Genius Group Announces Updated Investor Presentation and Compliance with NYSE Guidelines on Audit Opinion

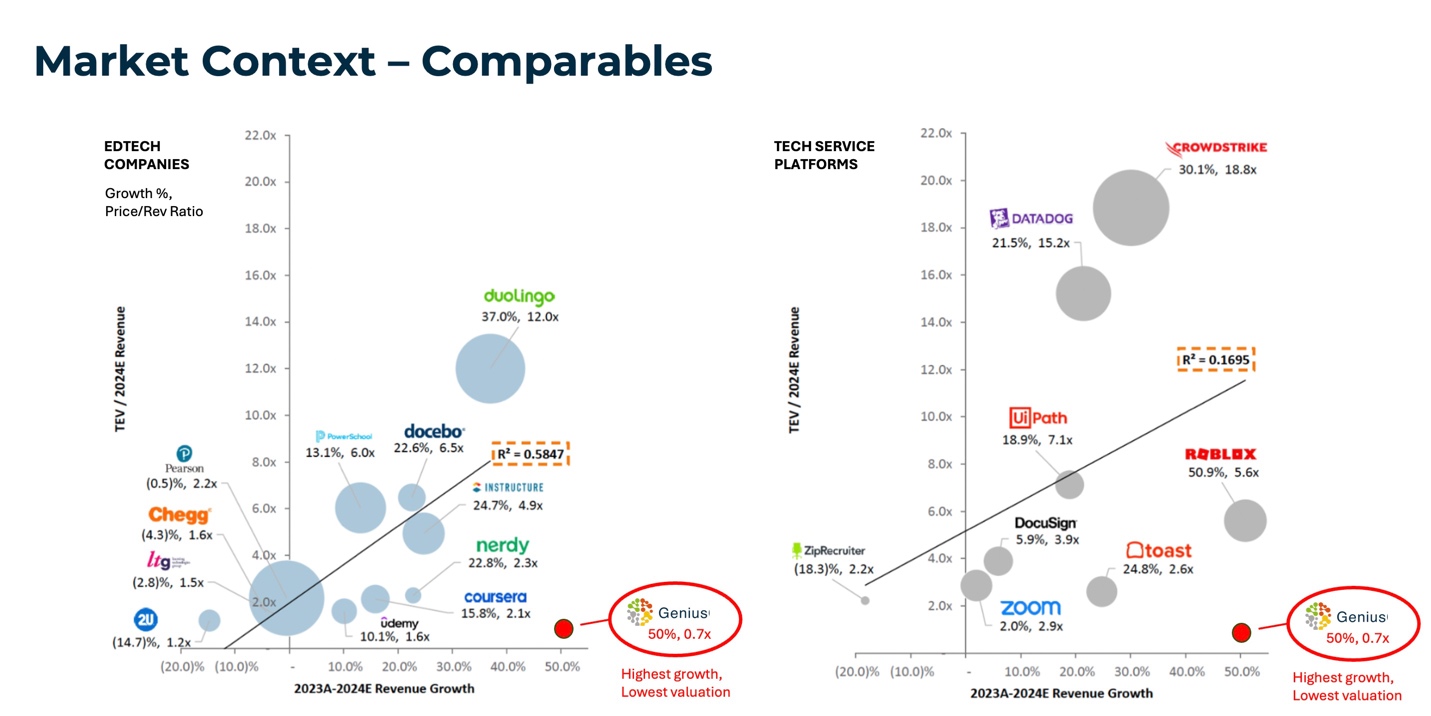

Genius Group, a leading AI-powered education company listed on NYSE American under GNS, released an updated investor presentation at the MicroCap Rodeo Spring Into Summer Investor Conference. The presentation highlighted a $70 million pro forma revenue for 2023, 150% revenue growth, and a 52% gross margin. The company aims to achieve $1 billion revenue and 100 million students through its freemium-to-premium edtech model. Additionally, Genius Group forecasts a 50% revenue growth for 2024, outperforming the 14% industry average. Despite a 'going concern' audit opinion, the company has improved its balance sheet by clearing liabilities and completing successful financing initiatives.

- Pro forma revenue of $70 million in 2023.

- 150% pro forma revenue growth in 2023.

- 52% gross margin reported.

- 10x revenue growth over the past three years.

- Projected $1 billion revenue target.

- 2024 revenue growth forecast of 50%.

- Gross margin target of $10 million per Genius City within three years.

- ROAS of 10x annually with a freemium to premium model.

- Audit opinion includes a 'going concern' paragraph.

- High operational risks associated with ambitious growth targets.

- Revenue growth heavily reliant on continued scalability of the freemium model.

Insights

Genius Group's financial performance and growth forecast are noteworthy. The pro forma revenue of

The

The mention of a going concern in the audit opinion is a red flag, indicating potential financial instability. Although the company claims to have improved its cash management and balance sheet, this aspect needs continuous monitoring. The recent payment of convertible notes and successful financing efforts are positives, but their long-term effects remain to be seen.

Genius Group's strategy to develop Genius City learning ecosystems in collaboration with various partners appears innovative. Each Genius City aims to generate

The company's claim of a

However, the ambitious targets and rapid expansion plans carry risks, including operational challenges and potential disparities in execution across different regions. Investors should consider these factors while evaluating the company's future prospects.

As an AI-powered education group, Genius Group is positioned well within the burgeoning edtech sector. The integration of AI in education can offer personalized learning experiences and improve student outcomes. The shift from a freemium to premium model leverages AI to identify high-value opportunities and optimize acquisition costs.

The company's participation in the AI revolution and their tech-driven approach are significant competitive advantages. However, the rapid technological changes in the AI and edtech sectors mean that the company must continuously innovate to maintain its edge. Investors should look into the company's ongoing R&D investments and partnerships to gauge its future readiness.

The long-term success of their AI initiatives will depend on their ability to scale these technologies effectively and address the diverse educational needs across different regions.

SINGAPORE, June 06, 2024 (GLOBE NEWSWIRE) -- Genius Group Limited (NYSE American: GNS) (“Genius Group” or the “Company”), a leading AI-powered education group, today announced the issuance of an updated investor presentation for their attendance at the MicroCap Rodeo Spring Into Summer Investor Conference.

Specific highlights included within the Investor Presentation

- 2023 results including

$70 million pro forma revenue,150% pro forma revenue growth,52% gross margin and 5.5 million students. - 10x revenue growth in the last 3 years and plan to 10x again, with its target plan to reach 100 million students, 100 Genius Cities and

$1 billion revenue. - Freemium to premium edtech model with target KPIs of under

$1 cost per student leading to$10 revenue per student per year, delivering a ROAS (Return on Acquisition Spend) of 10x annually. - Genius City learning ecosystems in partnership with schools, startups, businesses and government - each with a target of

$10 million in revenue within three years. - 2024 revenue growth forecast of

50% in comparison to the14% average of its Edtech peers, and its 0.7x price / revenue ratio in comparison to the 4.7x average of its peers.

Compliance with NYSE Guidelines on Audit Opinion

As previously disclosed in its Annual Report on Form 20-F for the year ended December 31, 2023, which was filed on May 15, 2024 with the Securities and Exchange Commission, the audited financial statements contained an unqualified audit opinion from its independent registered public accounting firm that included an explanatory paragraph related to the Company’s ability to continue as a going concern. See further discussion in the footnotes to the Company’s financial statements included in the Company’s Annual Report on Form 20-F. This announcement is being made solely to comply with the NYSE American LLC Company Guide Section 610(b), which requires public announcement of the receipt of an audit opinion containing a going concern paragraph. This announcement does not represent any change or amendment to the Company’s financial statements or to its Annual Report on Form 20-F for the year ended December 31, 2023.

Stronger Balance Sheet

Following the filing of the Company’s 20-F and the recently announced warrant exercise, Genius Group management believes the Company’s cash management balance sheet improvement efforts are proving successful. Adrian Reese, Genius Group’s Chief Financial Officer, said “In the last six months, the company has been successful in paying in full its convertible note, completing a series of successful financing initiatives and clearing a considerable amount of contingent liabilities.”

Genius Group’s CEO, Roger Hamilton, added “As we execute our growth plan, we are increasing our communication and outreach to institutional investors, family offices and investment funds. With 2024 guidance of over

The Company’s new Investor Presentation can be viewed at: https://ir.geniusgroup.net/

About Genius Group

Genius Group (NYSE: GNS) is a leading provider of AI-powered, digital-first education solutions, disrupting the highly standardized system of traditional education with a personalized, flexible and life-long learning curriculum for the modern student. Genius Group services 5.4 million users in over 100 countries, providing personalized curriculums for individuals, enterprises and governments. The comprehensive, AI-powered platform offers programs for K-12 education, accredited university courses and skills-based courses for entrepreneurs. To learn more, please visit https://www.geniusgroup.net/.

Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of the U.S. federal securities laws, including (without limitation) statements regarding our or our management’s expectations, hopes, beliefs, intentions or strategies regarding the future and other statements that are other than statements of historical fact. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Forward-looking statements are generally identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result” and similar expressions, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties.

Many factors could cause actual future events to differ materially from the forward-looking statements in this press release, including but not limited to: the Company’s goals and strategies; the Company’s future business development; changes in demand for online learning; changes in technology; fluctuations in economic conditions; the growth of the online learning industry the United States and the other markets the Company serves or plans to serve; reputation and brand; the impact of competition and pricing; government regulations; and assumptions underlying or related to any of the foregoing and other risks contained in reports filed by the Company with the Securities and Exchange Commission (the “SEC”). For these reasons, among others, investors are cautioned not to place undue reliance upon any forward-looking statements in this press release. Additional factors are discussed in the Company’s filings with the SEC, which are available for review at www.sec.gov. The Company undertakes no obligation to publicly update these forward-looking statements to reflect events or circumstances that arise after the date hereof.

Investor Relations

MZ Group - MZ North America

(949) 259-4987

GNS@mzgroup.us

www.mzgroup.us