Gelesis Reports First Quarter 2022 Results

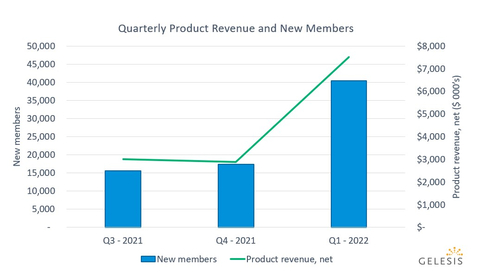

Gelesis (NYSE: GLS) reported a significant financial boost in Q1 2022, with net product revenue reaching $7.5 million, a 142% increase from Q1 2021, fueled by a national media campaign. Gross margin surged to 34.6%, up from 9.2% the previous year. The company acquired 40,400 new members, marking a 187% increase. Despite these gains, it reported a net loss of $(5.7) million. Looking ahead, Gelesis maintains a revenue guidance of $58 million for 2022, contingent on market dynamics and financing.

- 142% increase in net product revenue to $7.5 million year-over-year.

- Gross margin improved to 34.6%, up from 9.2% in Q1 2021.

- Acquired 40,400 new members, a 187% increase.

- Successful launch of national media campaign leading to high web traffic and prescription requests.

- Reported a net loss of $(5.7) million despite revenue growth.

- Adjusted EBITDA of $(26.9) million indicates ongoing financial strain.

Plenity product revenue increased

Q1 2022 gross margin increased

Company reiterates guidance of

“We saw all-time highs of people seeking and starting Plenity prescriptions. It’s no surprise: we offer a proven, nature-inspired, and FDA-cleared therapy that has the potential to help over 150 million people in

Gelesis CFO

Key Business Metrics

|

|

For the Three Months Ended |

|

|||||

|

|

2022 |

|

|

2021 |

|

||

New members acquired |

|

|

40,400 |

|

|

|

14,100 |

|

Units sold |

|

|

114,570 |

|

|

|

48,761 |

|

Product revenue, net |

|

$ |

7,514 |

|

|

$ |

3,101 |

|

Average selling price per unit, net |

|

$ |

65.58 |

|

|

$ |

63.60 |

|

Gross profit |

|

$ |

2,601 |

|

|

$ |

285 |

|

Gross margin |

|

|

34.6 |

% |

|

|

9.2 |

% |

First Quarter 2022 Results

-

Net product revenue was

$7.5 million 142% increase over the first quarter 2021, driven by the launch of the company’s first national broad awareness media campaign onJanuary 31 . -

Gross profit was

$2.6 million 276% over the first quarter 2021, attributable to increased sales volume and lower costs of goods sold. -

Net loss for the quarter was

$(5.7) million $(26.9) million -

Following the broad awareness media campaign launch, a total of 40,400 members joined during first quarter 2022, a

187% increase over first quarter 2021. In one quarter, with two months of broad awareness media, the company more than doubled the number of new members quarter over quarter.

A reconciliation of Adjusted EBITDA, a non-GAAP financial measure, to net loss, its most comparable financial measure under generally accepted accounting principles in

Recent Business Highlights

-

More than

80% of new member acquisition and product revenue occurred in February and March following the successful media launch. -

Quarter over quarter, web traffic increased

140% and the number of individuals seeking a new prescription increased140% . This conversion rate remained consistent with previous quarters, despite the large influx of new potential members, suggesting that the right message is reaching the appropriate target audience.-

90% of new members typically complete a treatment request within 24 hours of first visiting the website, indicating they are coming with the intention of seeking a prescription and do not require additional advertising investment. - The online visit takes about 15 minutes. On average, people find out whether they have been approved for a prescription within 24 hours. The product is shipped directly to their home and arrives within 2 days.

-

-

The company demonstrated its operational ability to scale to meet the significant increase in consumer demand. Manufacturing Plenity is a proprietary process to

Gelesis , and the company completed a manufacturing scale up at the end of 2021 which helped enable significant improvement in gross margin. -

Notable among growth with traditional healthcare provider (“HCP”) interaction prescriptions, 40

-50% of these prescriptions were requested by the consumer (the company’s baseline before the media campaign began was25% ).-

Of the prescriptions requests initiated by the patient,

40% of the time the patient specifically made an appointment with their HCP to seek out a prescription;60% of the time they brought it up during an already-scheduled visit.

-

Of the prescriptions requests initiated by the patient,

-

Plenity has the largest addressable market of any prescription weight management approach and 150 million American adults could qualify for treatment, including the tens of millions of Americans with a BMI between 25 and 30 who generally do not qualify for other prescription weight loss treatments. Unlike other available prescription treatments for obesity, Plenity does not contain any black box safety warnings.

-

About

70% of Plenity members had never tried a prescription weight management product before, indicating Plenity is bringing new people into the category of prescription weight management products.

-

About

-

During its limited time on the market, Plenity members are already ordering multiple units: three monthly kits on average within the first year. The company expects this number to increase over time as obesity and excess weight are chronic in nature, and

Gelesis intends to support members’ episodic and longer-term needs. There is no limit to how long a person can take Plenity and the company expects that those members who had success will seek Plenity out the next time they are looking to manage their weight. -

Gelesis presented results from the LIGHT-UP clinical trial at theEuropean Congress on Obesity 2022. The study looked at adults with overweight or obesity who have prediabetes or type 2 diabetes and were treated with either GS200 (one of the company’s clinical stage hydrogels) or placebo. Approximately 6 out of 10 adults treated with GS200 achieved clinically meaningful response to treatment (achieving at least5% body weight loss), losing on average11% of their body weight (~23 pounds) and an average reduction of 5.5 inches off their waist circumference in only 24 weeks. Approximately 1 out of 3 GS200-treated adults were “super responders,” losing at least10% of their body weight and on average losing13% (~30 pounds), or 7 inches off their waist circumference. The overall incidence of adverse events (AEs) in adults treated with GS200 was similar to the incidence of AEs in the placebo group. -

Gelesis completed its business combination with Capstar SPAC onJanuary 13, 2022 , resulting in gross proceeds of$105 million

Financial Outlook for Fiscal Year 2022

Based on current market conditions, results of the first quarter of 2022, and expectations for the remainder of the year,

The guidance provided above constitutes forward-looking statements which are subject to uncertainty. Actual results may differ materially and we cannot anticipate the effect of changes in marketing investment on our results from operations. Refer to the "Forward-Looking Statements" safe harbor section below for information on the factors that could cause our actual results to differ materially from these forward-looking statements.

Q1 2022 Conference Call and Webcast Information

A live webcast will also be available here, or on the company’s investor relations website at https://ir.gelesis.com/. A replay of the webcast will be available shortly afterwards.

About

Plenity® is indicated to aid weight management in adults with excess weight or obesity, a Body Mass Index (BMI) of 25–40 kg/m², when used in conjunction with diet and exercise.

Important Safety Information about Plenity

- Patients who are pregnant or are allergic to cellulose, citric acid, sodium stearyl fumarate, gelatin, or titanium dioxide should not take Plenity.

-

To avoid impact on the absorption of medications:

- For all medications that should be taken with food, take them after starting a meal.

- For all medications that should be taken without food (on an empty stomach), continue taking on an empty stomach or as recommended by your physician.

- The overall incidence of side effects with Plenity was no different than placebo. The most common side effects were diarrhea, distended abdomen, infrequent bowel movements, and flatulence.

- Contact a doctor right away if problems occur. If you have a severe allergic reaction, severe stomach pain, or severe diarrhea, stop using Plenity until you can speak to your doctor.

Rx Only. For the safe and proper use of Plenity or more information, talk to a healthcare professional, read the Patient Instructions for Use, or call 1-844-PLENITY.

Forward-Looking Statements

Certain statements, estimates, targets and projections in this press release may constitute “forward-looking statements” within the meaning of the federal securities laws. The words “anticipate,” “believe,” continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “strive,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that statement is not forward looking. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Forward-looking statements include, but are not limited to, statements regarding our or our management team’s expectations, hopes, beliefs, intentions or strategies regarding the future, including those relating to Gelesis’ business combination with

Disclaimer

Key Business Metrics

We monitor the following key metrics to help us evaluate our business, identify trends affecting our business, formulate business plans and make strategic decisions. We believe the following metrics are useful in evaluating our business:

New members acquired

We define new members acquired as the number of consumers in

Units sold

Units sold is defined as the number of 28-day supply units of Plenity sold to consumers based on prescriptions, through our strategic partnerships with online pharmacies and telehealth providers as well as the units sold to our strategic partners outside

Product revenue, net

We recognize product revenue in accordance with Accounting Standards Codification Topic 606, Revenue from Contracts with Customers, when we transfer promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services.

Our product revenue is derived from product sales of Plenity, net of estimates of variable consideration for which reserves are established for expected product returns, shipping charges to end-users, pharmacy dispensing and platform fees, merchant and processing fees, and promotional discounts offered to end-users.

Average selling price per unit, net

Average selling price per unit, net is the gross price per unit sold during the period net of estimates of per unit variable consideration for which reserves are established for expected product returns, shipping charges to end-users, pharmacy dispensing and platform fees, merchant and processing fees, and promotional discounts offered to end-users.

Gross profit and gross margin

Our gross profit represents product revenue, net, less our total cost of goods sold, and our gross margin is our gross profit expressed as a percentage of our product revenue, net. Our gross profit and gross margin have been and will continue to be affected by a number of factors, including the prices we charge for our product, the costs we incur from our vendors for certain components of our cost of goods sold, the mix of channel sales in a period, and our ability to sell our inventory.

Non-GAAP Financial Measures

In addition to our financial results determined in accordance with GAAP, we believe that Adjusted EBITDA, a non-GAAP measure, is useful in evaluating our operating performance. We define “Adjusted EBITDA” as net (loss) income before depreciation and amortization expenses, provision for (benefit from) income taxes, interest expense, net, stock-based compensation and (gains) and losses related to changes in fair value of our warrant liability, our convertible promissory note liability, our tranche rights liability and the One S.r.l. call option. We use Adjusted EBITDA to evaluate our ongoing operations and for internal planning and forecasting purposes because it facilitates internal comparisons of our historical operating performance. We believe that this non-GAAP financial measure, when taken together with the corresponding GAAP financial measure, net loss, provides meaningful supplemental information regarding our performance by excluding certain items that may not be indicative of our business, results of operations, or outlook. We consider Adjusted EBITDA to be an important measure because it helps illustrate underlying trends in our business and our historical operating performance on a more consistent basis. We believe that Adjusted EBITDA is helpful to our investors as it is a metric used by management in assessing the health of our business and our operating performance.

However, non-GAAP financial information is presented for supplemental informational purposes only, has limitations as an analytical tool and should not be considered in isolation or as a substitute for financial information presented in accordance with GAAP. In addition, other companies, including companies in our industry, may calculate similarly-titled non-GAAP financial measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of Adjusted EBITDA as a tool for comparison. A reconciliation is provided below for Adjusted EBITDA to the most directly comparable financial measure stated in accordance with GAAP. Investors are encouraged to review the related GAAP financial measure and the reconciliation of this non-GAAP financial measure to its most directly comparable GAAP financial measure, and not to rely on any single financial measure to evaluate our business.

SELECTED UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS (In thousands) |

||||||||

|

|

|

|

|

|

|

||

|

|

2022 |

|

|

2021 |

|

||

ASSETS |

|

|

|

|

|

|

||

Cash and cash equivalents |

|

$ |

33,985 |

|

|

$ |

28,397 |

|

Accounts receivable and grants receivable |

|

|

9,762 |

|

|

|

9,903 |

|

Inventories |

|

|

16,276 |

|

|

|

13,503 |

|

Property and equipment, net |

|

|

58,321 |

|

|

|

58,515 |

|

All other current and non-current assets |

|

|

34,535 |

|

|

|

35,983 |

|

Total assets |

|

$ |

152,879 |

|

|

$ |

146,301 |

|

LIABILITIES, REDEEMABLE CONVERTIBLE PREFERRED STOCK AND STOCKHOLDERS’ EQUITY (DEFICIT) |

|

|

|

|

|

|

||

Accounts payable |

|

$ |

13,241 |

|

|

$ |

10,066 |

|

Accrued expenses and other current liabilities |

|

|

10,124 |

|

|

|

13,660 |

|

Deferred income, current portion |

|

|

25,533 |

|

|

|

32,370 |

|

Notes and convertible notes payable, current portion |

|

|

2,001 |

|

|

|

29,078 |

|

Warrant liabilities |

|

|

3,730 |

|

|

|

15,821 |

|

Earnout liability |

|

|

25,002 |

|

|

|

— |

|

Deferred income, non-current portion |

|

|

9,984 |

|

|

|

8,914 |

|

Notes payable, non-current portion |

|

|

33,958 |

|

|

|

35,131 |

|

All other current and non-current liabilities |

|

|

7,565 |

|

|

|

7,648 |

|

Total liabilities |

|

|

131,138 |

|

|

|

152,688 |

|

Noncontrolling interest |

|

|

11,704 |

|

|

|

11,855 |

|

Redeemable convertible preferred stock |

|

|

— |

|

|

|

311,594 |

|

Total stockholders’ equity (deficit) |

|

|

10,037 |

|

|

|

(329,836 |

) |

Total liabilities, noncontrolling interest, redeemable convertible preferred stock and stockholders’ equity (deficit) |

|

$ |

152,879 |

|

|

$ |

146,301 |

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands) |

||||||||

|

|

Three Months Ended |

|

|||||

|

|

2022 |

|

|

2021 |

|

||

Revenue: |

|

|

|

|

|

|

||

Product revenue, net |

|

$ |

7,514 |

|

|

$ |

3,101 |

|

Total revenue, net |

|

|

7,514 |

|

|

|

3,101 |

|

Operating expenses: |

|

|

|

|

|

|

||

Costs of goods sold |

|

|

4,913 |

|

|

|

2,816 |

|

Selling, general and administrative |

|

|

37,706 |

|

|

|

11,945 |

|

Research and development |

|

|

7,410 |

|

|

|

4,376 |

|

Amortization of intangible assets |

|

|

567 |

|

|

|

567 |

|

Total operating expenses |

|

|

50,596 |

|

|

|

19,704 |

|

Loss from operations |

|

|

(43,082 |

) |

|

|

(16,603 |

) |

Change in the fair value of earnout liability |

|

|

33,869 |

|

|

|

— |

|

Change in the fair value of convertible promissory notes |

|

|

(156 |

) |

|

|

— |

|

Change in the fair value of warrants |

|

|

3,484 |

|

|

|

(2,074 |

) |

Interest expense, net |

|

|

(135 |

) |

|

|

(361 |

) |

Other income, net |

|

|

317 |

|

|

|

469 |

|

Loss before income taxes |

|

|

(5,703 |

) |

|

|

(18,569 |

) |

Provision for income taxes |

|

|

— |

|

|

|

17 |

|

Net loss |

|

|

(5,703 |

) |

|

|

(18,586 |

) |

Accretion of senior preferred stock to redemption value |

|

|

(37,934 |

) |

|

|

(33,761 |

) |

Accretion of noncontrolling interest put option to redemption value |

|

|

(88 |

) |

|

|

(94 |

) |

Net loss attributable to common stockholders |

|

$ |

(43,725 |

) |

|

$ |

(52,441 |

) |

Net loss per share attributable to common stockholders—basic and diluted |

|

$ |

(0.70 |

) |

|

$ |

(9.38 |

) |

Weighted average common shares outstanding—basic and diluted |

|

|

62,743,154 |

|

|

|

5,589,290 |

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (In thousands) |

||||||||

|

|

Three Months Ended |

|

|||||

|

|

2022 |

|

|

2021 |

|

||

Cash flows from operating activities: |

|

|

|

|

|

|

||

Net loss |

|

$ |

(5,703 |

) |

|

$ |

(18,586 |

) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

. |

|

||

Amortization of intangible assets |

|

|

567 |

|

|

|

567 |

|

Reduction in carrying amount of right-of-use assets |

|

|

132 |

|

|

|

41 |

|

Depreciation |

|

|

1,019 |

|

|

|

174 |

|

Stock-based compensation |

|

|

13,989 |

|

|

|

1,455 |

|

Unrealized loss on foreign currency transactions |

|

|

65 |

|

|

|

143 |

|

Noncash interest expense |

|

|

40 |

|

|

|

19 |

|

Accretion on marketable securities |

|

|

— |

|

|

|

(1 |

) |

Change in the fair value of earnout liability |

|

|

(33,869 |

) |

|

|

— |

|

Change in the fair value of warrants |

|

|

(3,484 |

) |

|

|

2,074 |

|

Change in the fair value of convertible promissory notes |

|

|

156 |

|

|

|

— |

|

Change in fair value of One S.r.l. call option |

|

|

258 |

|

|

|

48 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

||

Account receivables |

|

|

(1,177 |

) |

|

|

(169 |

) |

Grants receivable |

|

|

(198 |

) |

|

|

(1,273 |

) |

Prepaid expenses and other current assets |

|

|

(2,010 |

) |

|

|

318 |

|

Inventories |

|

|

(2,888 |

) |

|

|

846 |

|

Other assets |

|

|

— |

|

|

|

(1,222 |

) |

Accounts payable |

|

|

3,502 |

|

|

|

(1,192 |

) |

Accrued expenses and other current liabilities |

|

|

528 |

|

|

|

200 |

|

Operating lease liabilities |

|

|

(134 |

) |

|

|

(37 |

) |

Deferred income |

|

|

(5,550 |

) |

|

|

8,459 |

|

Other long-term liabilities |

|

|

(426 |

) |

|

|

(158 |

) |

Net cash used in operating activities |

|

|

(35,183 |

) |

|

|

(8,294 |

) |

Cash flows from investing activities: |

|

|

|

|

|

|

||

Purchases of property and equipment |

|

|

(1,963 |

) |

|

|

(6,354 |

) |

Maturities of marketable securities |

|

|

— |

|

|

|

24,000 |

|

Net cash (used in) provided by investing activities |

|

|

(1,963 |

) |

|

|

17,646 |

|

Cash flows from financing activities: |

|

|

|

|

|

|

||

Proceeds from Business Combination, net of transaction costs |

|

|

70,478 |

|

|

|

— |

|

Principal repayment of notes payable |

|

|

(418 |

) |

|

|

(186 |

) |

Repayment of convertible promissory notes due to related party, held at fair value |

|

|

(27,284 |

) |

|

|

— |

|

Proceeds from issuance of promissory notes (net of issuance costs of |

|

|

— |

|

|

|

3,506 |

|

Proceeds from the exercise of warrants |

|

|

4 |

|

|

|

10 |

|

Proceeds from exercise of share-based awards |

|

|

— |

|

|

|

4 |

|

Net cash provided by financing activities |

|

|

42,780 |

|

|

|

3,334 |

|

Effect of exchange rates on cash |

|

|

(46 |

) |

|

|

(973 |

) |

Net increase in cash |

|

|

5,588 |

|

|

|

11,713 |

|

Cash and cash equivalents at beginning of year |

|

|

28,397 |

|

|

|

48,144 |

|

Cash and cash equivalents at end of period |

|

$ |

33,985 |

|

|

$ |

59,857 |

|

Noncash investing and financing activities: |

|

|

|

|

|

|

||

Purchases of property and equipment included in accounts payable and accrued expense |

|

$ |

1,721 |

|

|

$ |

889 |

|

Recognition of earnout liability |

|

$ |

58,871 |

|

|

|

— |

|

Recognition of private placement warrant liability |

|

$ |

8,140 |

|

|

|

— |

|

Supplemental cash flow information: |

|

|

|

|

|

|

||

Interest paid on notes payable |

|

$ |

95 |

|

|

$ |

43 |

|

NET LOSS TO ADJUSTED EBITDA RECONCILIATION (In thousands, Unaudited) |

||||||||

|

|

For the Three Months Ended |

|

|||||

|

|

2022 |

|

|

2021 |

|

||

Adjusted EBITDA |

|

|

|

|

|

|

||

Net loss |

|

$ |

(5,703 |

) |

|

$ |

(18,586 |

) |

Provision for income taxes |

|

|

— |

|

|

|

17 |

|

Depreciation and amortization |

|

|

1,586 |

|

|

|

741 |

|

Stock based compensation expense |

|

|

13,989 |

|

|

|

1,455 |

|

Change in fair value of earnout liability |

|

|

(33,869 |

) |

|

|

— |

|

Change in fair value of warrants |

|

|

(3,484 |

) |

|

|

2,074 |

|

Change in fair value of convertible promissory notes |

|

|

156 |

|

|

|

— |

|

Change in fair value of One S.r.l. call option |

|

|

258 |

|

|

|

48 |

|

Interest expense, net |

|

|

135 |

|

|

|

361 |

|

Adjusted EBITDA |

|

$ |

(26,932 |

) |

|

$ |

(13,890 |

) |

View source version on businesswire.com: https://www.businesswire.com/news/home/20220512005826/en/

Media & Investor Relations

ksullivan@gelesis.com

Source:

FAQ

What was Gelesis' product revenue for Q1 2022?

How much did Gelesis increase its net product revenue year-over-year?

What was the gross profit margin for Gelesis in Q1 2022?

How many new members did Gelesis acquire in Q1 2022?

What is Gelesis' revenue guidance for 2022?