GoGold Announces NPV of US$413M for Los Ricos North Initial PEA

Shares Outstanding: 326,138,511

Trading Symbols: TSX: GGD

OTCQX: GLGDF

Highlights of the PEA, with a base case silver price of

- After-Tax NPV (using a discount rate of

5% ) of$413 Million 29% (Base Case); - 13-year mine life producing a total of 110.3 Million payable silver equivalent ounces ("AgEq"), consisting of 68.0 Million silver ounces, 221,700 gold ounces, 22.8 Million pounds of copper, 144.1 Million pounds of lead and 242.2 Million pounds of zinc;

- Initial capital costs of

$221 Million $29 Million $137 Million $6 Million - Average LOM operating cash costs of

$9.50 $9.68 - Average annual production of 8.8 Million AgEq oz in years one through twelve;

- Approximately 3/4 of LOM production is from four open pits containing oxide mineralization and approximately 1/4 is from a separate open pit which contains only sulphide mineralization.

"This is a first look at the strong economics around our Los Ricos North Mineral Resource with average annual production of 8.8 Million AgEq oz at a first quartile AISC of

The PEA was prepared by independent consultants P&E Mining Consultants Inc ("P&E"), with metallurgical test work completed by SGS Canada Inc.'s

Table 1 below shows the key economic assumptions and results of the PEA, with Table 2 showing the physical attributes, Table 3 showing a sensitivity analysis based on varying metal prices and assumptions, and Table 4 showing a sensitivity analysis based on changes to operating and capital costs.

Table 1 – Los Ricos North PEA Key Economic Assumptions and Results

Assumption / Result | Unit | Value | Assumption / Result | Unit | Value | |

Total Oxide Feed Mined | kt | 25,557 | Net Revenue | US$M | 2,307 | |

Total Sulphide Feed Mined | kt | 9,964 | Initial Capital Costs | US$M | 221 | |

Total Plant Feed Mined | kt | 35,521 | Sustaining Capital Costs | US$M | 143 | |

Total Strip Ratio | 6.0 | Mining Costs | $/t Mined | 2.07 | ||

Mine Life | Yrs | 13 | Mining Costs | $/t Plant Feed | 12.28 | |

Average process rate | t/day | 8,000 | Operating Cash Cost | US$/oz AgEq | 9.50 | |

Silver Price | US$/oz | 23.00 | All in Sustaining Cost | US$/oz AgEq | 9.68 | |

Gold Price | US$/oz | 1,800 | After-Tax NPV ( | US$M | 413 | |

Copper Price | US$/lb | 4.00 | Pre-Tax NPV ( | US$M | 645 | |

Lead Price | US$/lb | 1.00 | After-Tax IRR | % | 29.1 | |

Zinc Price | US$/lb | 1.40 | Pre-Tax IRR | % | 39.8 | |

Payable AgEq | Moz | 110.3 | After-Tax Payback Period | Yrs | 3.0 |

Table 2 – Los Ricos North PEA Summary of Physical Attributes

Attribute | Unit | Oxide | Sulphide | Total |

Plant Feed Mined | kt | 25,557 | 9,964 | 35,521 |

Silver Grade1 | g/t | 83.2 | 30.1 | 68.3 |

Gold Grade1 | g/t | 0.29 | 0.07 | 0.23 |

Copper Grade1 | % | - | 0.12 | 0.12 |

Lead Grade | % | - | 0.87 | 0.87 |

Zinc Grade | % | - | 1.24 | 1.24 |

Silver Recovery | % | 87 | 88 | 87 |

Gold Recovery | % | 87 | 76 | 86 |

Copper Recovery | % | - | 89 | 89 |

Lead Recovery | % | - | 75 | 75 |

Zinc Recovery | % | - | 89 | 89 |

Payable Silver | Moz | 59.5 | 8.5 | 68.0 |

Payable Gold | koz | 205.2 | 16.5 | 221.7 |

Payable Copper | Mlb | - | 22.8 | 22.8 |

Payable Lead | Mlb | - | 144.1 | 144.1 |

Payable Zinc | Mlb | - | 242.2 | 242.2 |

Payable AgEq | Moz | 75.5 | 34.8 | 110.3 |

1. | Grades shown are LOM average plant feed grades. Dilution of approximately |

Table 3 – Los Ricos North PEA Metal Price Sensitivities

Sensitivity | Base | ||||||

Silver Price (US$/oz) | 17 | 19 | 21 | 23 | 25 | 27 | 30 |

Gold Price (US$/oz) | 1330 | 1487 | 1643 | 1800 | 1957 | 2113 | 2348 |

Copper Price (US$/lb) | 2.96 | 3.30 | 3.65 | 4.00 | 4.35 | 4.70 | 5.22 |

Lead Price (US$/lb) | 0.74 | 0.83 | 0.91 | 1.00 | 1.09 | 1.17 | 1.30 |

Zinc Price (US$/lb) | 1.03 | 1.16 | 1.28 | 1.40 | 1.52 | 1.64 | 1.83 |

After-Tax NPV ( | 120 | 222 | 318 | 413 | 508 | 603 | 746 |

After-Tax IRR (%) | 13.3 | 19.2 | 24.3 | 29.1 | 33.6 | 37.9 | 44.0 |

After-Tax Payback (years) | 5.4 | 4.4 | 3.6 | 3.0 | 2.5 | 2.1 | 1.8 |

Table 4 – Los Ricos North Operating Expense and Capital Expense Sensitivities

Sensitivity | -20 % | -10 % | Base | 10 % | 20 % |

Operating Costs – NPV (US$M) | 503 | 458 | 413 | 368 | 323 |

Operating Costs – IRR (%) | 33.4 | 31.2 | 29.1 | 26.8 | 24.5 |

Capital Costs – NPV (US$M) | 457 | 435 | 413 | 392 | 370 |

Capital Costs – IRR (%) | 36.3 | 32.2 | 28.8 | 25.9 | 23.4 |

The Los Ricos North Project has been envisioned as an open pit mining operation, with contract mining comprising five open pits. The first four pits contain oxide mineralization and will be mined over years one to nine of the Project, with the final pit containing sulphide mineralization which will be mined in years 10 to 13.

The processing plant is comprised of conventional crushing, grinding, cyanide tank leaching, tailings filtration (dry stack), and Merrill Crowe precipitation for the oxide mineralization. For the sulphide mineralization, processing will be completed through a flotation circuit which is included in sustaining capital and will be constructed in year eight of the Project.

Water supply to the process plant will be provided by a nearby surface water source and high voltage grid power will be provided by the local utility.

Key components of the capital cost estimate are provided in Table 5 and operating costs are provided in Table 6.

Table 5 – Capital Cost Estimate

Type | Initial (US$K) | Expansion (US$K)1 | Sustaining (US$K) | Total (US$K) |

Process plant direct costs | 141,020 | 25,864 | 5,000 | 171,884 |

Pre-stripping and haul roads | 10,268 | 88,090 | 98,358 | |

Project indirect costs | 19,108 | 2,870 | 21,978 | |

EPCM | 13,792 | 2,328 | 16,120 | |

Infrastructure | 7,680 | 7,680 | ||

Total | 191,869 | 119,151 | 5,000 | 316,020 |

Contingency ( | 28,780 | 17,873 | 750 | 47,403 |

Total | 220,649 | 137,024 | 5,750 | 363,423 |

1. Expansion capital is not included in AISC calculations |

Table 6 – Operating Costs (Average LOM)

Operating Costs (Average LOM) | US$/tonne Plant Feed | US$/tonne |

Mining | 12.28 | 2.07 |

Processing | 13.81 | |

General and admin | 1.02 | |

Total | 27.12 |

The open pit mining will be contracted and carried out by drilling and blasting followed by conventional loading and truck haulage to the waste rock storage facilities and the process plant.

A preliminary metallurgical test program was carried out by SGS Lakefield of

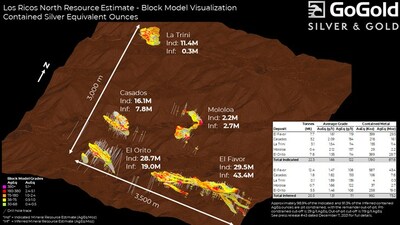

The basis for the PEA is the Mineral Resource Estimate completed by P&E in the National Instrument 43-101 Technical Report on the Initial Mineral Resource Estimate for the Los Ricos North Project located in Jalisco State,

Table 7: Los Ricos North Mineral Resource Estimate (1-11)

Deposit | Tonnes | Average Grade | Contained Metal | ||||||||||||

Au | Ag | Cu | Pb | Zn | AuEq | AgEq | Au | Ag | Cu | Pb | Zn | AuEq | AgEq | ||

(Mt) | (g/t) | (g/t) | ( %) | ( %) | ( %) | (g/t) | (g/t) | (koz) | (koz) | (Mlb) | (Mlb) | (Mlb) | (koz) | (koz) | |

Indicated: | |||||||||||||||

El Favor | 7.7 | 0.27 | 98 | - | - | - | 1.61 | 119 | 68 | 24,413 | - | - | - | 399 | 29,454 |

Casados | 3.2 | 0.42 | 124 | - | - | - | 2.09 | 154 | 43 | 12,871 | - | - | - | 218 | 16,061 |

La Trini | 3.1 | 0.54 | 74 | - | - | - | 1.54 | 114 | 54 | 7,428 | - | - | - | 155 | 11,424 |

Mololoa | 0.4 | 0.36 | 130 | - | - | - | 2.12 | 157 | 5 | 1,788 | - | - | - | 29 | 2,161 |

Silver-Gold | 14.5 | 0.37 | 100 | - | - | - | 1.71 | 127 | 171 | 46,500 | - | - | - | 801 | 59,100 |

El Orito Sulphide | 7.8 | 0.06 | 28 | 0.11 | 0.88 | 1.33 | 1.55 | 114 | 15 | 7,011 | 19 | 151 | 229 | 389 | 28,708 |

Total Indicated | 22.3 | 1.66 | 122 | 186 | 53,510 | 1,190 | 87,808 | ||||||||

Inferred: | |||||||||||||||

El Favor | 12.4 | 0.27 | 89 | - | - | - | 1.47 | 108 | 106 | 35,505 | - | - | - | 587 | 43,350 |

Casados | 1.8 | 0.35 | 108 | - | - | - | 1.82 | 135 | 21 | 6,323 | - | - | - | 106 | 7,843 |

La Trini | 0.1 | 0.43 | 108 | - | - | - | 1.89 | 139 | 1 | 201 | - | - | - | 4 | 260 |

Mololoa | 0.7 | 0.39 | 94 | - | - | - | 1.66 | 122 | 9 | 2,102 | - | - | - | 37 | 2,739 |

Silver-Gold | 15.0 | 0.28 | 91 | - | - | - | 1.52 | 112 | 136 | 44,131 | - | - | - | 734 | 54,191 |

El Orito Sulphide | 5.5 | 0.06 | 28 | 0.12 | 0.74 | 1.20 | 1.46 | 108 | 11 | 4,888 | 15 | 90 | 146 | 258 | 19,007 |

Total Inferred | 20.5 | 1.51 | 111 | 148 | 49,019 | 992 | 73,198 | ||||||||

1. | El Orito is a silver-base metal sulphide zone, all other deposits are silver-gold oxide zones. |

2. | Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues. |

3. | The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration. |

4. | The Mineral Resources in this news release were estimated in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines (2014) prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council and CIM Best Practices (2019). |

5. | Historically mined areas were depleted from the Mineral Resource model. |

6. | Approximately |

7. | The pit constrained AgEq cut-off grade of 29 g/t Ag was derived from |

8. | The out-of-pit AuEq cut-off grade of 119 g/t Ag was derived from |

9. | No Mineral Resources are classified as Measured. |

10. | AgEq and AuEq calculated at an Ag/Au ratio of 73.8:1. |

11. | Totals may not agree due to rounding |

The Preliminary Economic Assessment Technical Report will be filed on SEDAR within 45 days of this news release.

Robert Harris, P.Eng. and David Duncan, P.Geo. are the GoGold Qualified Persons and Eugene Puritch, P.Eng., FEC, CET, President of P&E Mining Consultants Inc. and David Salari, P. Eng., DENM Engineering Ltd. are Independent Qualified Persons all as defined by National Instrument 43-101 and whom are responsible for the technical information in this press release.

VRIFY is a platform being used by companies to communicate with investors using 360° virtual tours of remote mining assets, 3D models and interactive presentations. VRIFY can be accessed by website and with the VRIFY iOS and Android apps.

The VRIFY 3D Slide Deck for GoGold can be viewed at: https://vrify.com/companies/gogold-resources-inc and on the Company's website at: www.gogoldresources.com.

The Company's two exploration projects at its Los Ricos Property are in

The Los Ricos North Project was launched in March 2020 and an initial Mineral Resource Estimate was announced on December 7, 2021, which disclosed an Indicated Mineral Resource of 87.8 Million ounces AgEq grading 122 g/t AgEq contained in 22.3 Million tonnes, and an Inferred Mineral Resource of 73.2 Million ounces AgEq grading 111 g/t AgEq contained in 20.5 Million tonnes.

GoGold Resources (TSX: GGD) is a Canadian-based silver and gold producer focused on operating, developing, exploring and acquiring high quality projects in

CAUTIONARY STATEMENT:

The securities described herein have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the "

This news release may contain "forward-looking information" as defined in applicable Canadian securities legislation. All statements other than statements of historical fact, included in this release, including, without limitation, statements regarding the Los Ricos South and North projects, and future plans and objectives of GoGold, including the NPV, IRR, initial and sustaining capital costs, operating costs, and LOM production of Los Ricos South, constitute forward looking information that involve various risks and uncertainties. Forward-looking information is based on a number of factors and assumptions which have been used to develop such information but which may prove to be incorrect, including, but not limited to, assumptions in connection with the continuance of GoGold and its subsidiaries as a going concern, general economic and market conditions, mineral prices, the accuracy of Mineral Resource Estimates, and the performance of the Parral project. There can be no assurance that such information will prove to be accurate and actual results and future events could differ materially from those anticipated in such forward-looking information.

Important factors that could cause actual results to differ materially from GoGold's expectations include exploration and development risks associated with GoGold's projects, the failure to establish estimated Mineral Resources or Mineral Reserves, volatility of commodity prices, variations of recovery rates, and global economic conditions. For additional information with respect to risk factors applicable to GoGold, reference should be made to GoGold's continuous disclosure materials filed from time to time with securities regulators, including, but not limited to, GoGold's Annual Information Form. The forward-looking information contained in this release is made as of the date of this release.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/gogold-announces-npv-of-us413m-for-los-ricos-north-initial-pea-301827066.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/gogold-announces-npv-of-us413m-for-los-ricos-north-initial-pea-301827066.html

SOURCE GoGold Resources Inc.