GOLDMINING COMMENCES DRILLING AT THE SÃO JORGE GOLD PROJECT, BRAZIL

GoldMining has commenced drilling at its São Jorge Gold Project in Brazil, spanning 45,997 hectares. The project includes 1,000 meters of diamond core drilling and 3,000 meters of power auger drilling. Objectives include confirming structural controls on high-grade mineralization and exploring new targets along a NW-SE high-strain corridor. The drilling will test surficial geochemical anomalies within a 12 km x 7 km area, comprising gold, copper, and molybdenum. The project sits within the Tapajos Gold District, noted for producing over 20 million ounces of gold. A new geological model may optimize mineral resource estimates, potentially leading to new discoveries.

- Commencement of drilling at the São Jorge Gold Project after more than ten years.

- Exploration designed to confirm a new geological model for optimizing mineral resource estimates.

- Drilling program includes 1,000 meters of diamond core and 3,000 meters of power auger drilling.

- São Jorge project spans a large 45,997-hectare area in a prolific gold district.

- Potential new discoveries along a multi-kilometer NW-SE striking high-strain corridor.

- Testing surficial geochemical anomalies in a 12 km x 7 km area with gold, copper, and molybdenum.

- Use of power auger drilling expedites target definition for deeper drilling.

- São Jorge is located along the Tocantinzinho - São Jorge Trend, a significant mining corridor.

- Enhanced infrastructure, including proximity to a highway and powerline corridor.

- No specific financial data provided on the cost or funding of the drilling program.

- Uncertainty regarding the success of the reinterpretation of structural controls on high-grade mineralization.

- Possible risks associated with new geological models not yet proven through drilling.

- The project remains relatively underexplored, indicating potential unknown challenges.

Insights

The initiation of drilling at the São Jorge Gold Project is a significant step forward for GoldMining Inc. This project, located in the highly productive Tapajos Gold District, is characterized by its large-scale operations and favorable geological conditions. The use of both diamond core and power auger drilling methods is strategic. Diamond core drilling will allow the company to obtain precise and high-quality core samples, essential for confirming the geological model and high-grade mineralization. Power auger drilling, on the other hand, is efficient for initial exploration as it can quickly cover extensive areas to identify potential new bedrock mineralization targets.

One critical aspect to monitor is the reinterpretation of the structural controls on high-grade mineralization. If successful, it could lead to a more accurate mineral resource estimate, thereby enhancing the project's economic viability. The high-strain corridor and its associated geochemical footprint suggest the potential presence of significant gold and possibly copper and molybdenum deposits, which adds to the project's attractiveness.

The strategic location of São Jorge, with its proximity to infrastructure such as the Cuiabá-Santarém Highway and a 138 kV powerline, further bolsters its development potential. These logistical advantages could reduce operational costs and facilitate the movement of materials and personnel. Overall, this program could substantially de-risk the project and provide valuable data for future development decisions.

From a financial perspective, GoldMining Inc.'s commencement of the drilling program at the São Jorge Gold Project is a noteworthy development. This initiative indicates ongoing progress and commitment to enhancing the value of their asset portfolio. The timing aligns with a broader trend of increasing investment in gold exploration, driven by sustained high gold prices. If the drilling program confirms new high-grade mineralization and enhances the existing resource estimates, it could significantly increase the project's net present value (NPV) and make it more attractive to potential investors and partners.

However, investors should be aware of the inherent risks associated with exploration activities. There is never a guarantee that drilling will result in economically viable resources. Moreover, the capital expenditure required for such drilling programs can be substantial, impacting short-term financial performance. Investors should closely monitor subsequent updates on the drilling results to gauge the potential impact on GoldMining's financial health and long-term growth prospects.

Highlights:

- The drilling program (the "Program") at the Project consists of approximately 1,000 metres (m) of proposed diamond core drilling and 3,000 m of power auger drilling.

- The Program has the following objectives:

- Confirmatory drilling within and near the margins of the existing São Jorge gold deposit* (the "Deposit"), to test a reinterpretation of the structural controls on high-grade mineralization; and

- Testing targets for potential new discovery along the broader multi-kilometre NW-SE striking high strain corridor that hosts the Deposit.

- The Program includes a mobile power auger drill rig to test for bedrock sources of surficial soil geochemical anomalies and to define targets for deeper core drilling.

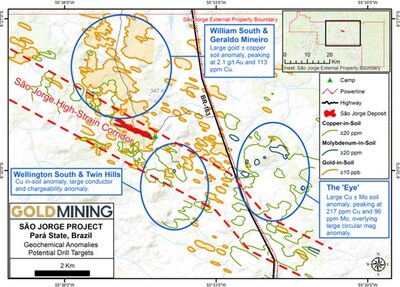

- Auger drilling will focus on the broad surficial soil geochemical footprint, expanded over the past 12 months, which comprises a large 12 km x 7 km area of elevated gold ± copper ± molybdenum.

- Auger drilling is designed to penetrate through the soil profile into the underlying saprolite zone, and vector into potential bedrock hosted mineralization targets.

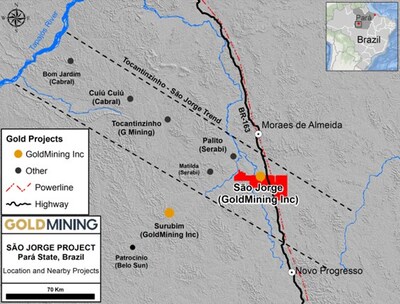

- São Jorge is located in the Tapajos Gold District, which hosts multiple gold projects including producing mines, development projects and exploration properties over approximately 200 km along the Tocantinzinho - São Jorge Trend (see Figure 1).

* Please see the technical report titled "São Jorge Gold Project, Pará State, |

Tim Smith, Vice President of Exploration of GoldMining, commented: "We are excited to commence the first drilling program at the São Jorge Project in more than ten years. We expect the Program will build upon our recent exploration work that has expanded a regional scale gold and copper footprint. The Program aims to confirm a new geological model for the São Jorge deposit, which may help to optimize and improve confidence in our mineral resource estimate. The proposed drilling also tests a number of new target areas defined from our extensive geochemical and geophysical datasets. The mobile mechanized auger drill program is designed to expedite target definition by allowing us to rapidly test beneath broad high-tenor gold ± copper soil anomalies surrounding the São Jorge deposit, enabling us to vector into bedrock targets for follow-up core drilling. Overall, we're optimistic about the potential for new discoveries at São Jorge given it remains currently relatively underexplored, yet boasts indications of a significant mineral system located within a prolific gold mining district."

Tapajos Gold District

São Jorge sits within the active and rapidly developing Tapajos Gold District. This region is estimated to have produced over 20 million ounces of gold from artisanal mining of surface deposits, according to the Brazil National Mining Agency. The paved Cuiabá-Santarém Highway (Hwy BR-163) has reduced hurdles for more traditional bedrock mine development in the region, including Serabi Gold Plc.'s producing high-grade underground Palito Mine and G Mining Ventures Corp.'s ("G Mining") Tocantinzinho open pit mine which is nearing completion of construction and remains on track for commercial production in H2-2024 (see G Mining news release May 27, 2024).

São Jorge straddles Hwy BR-163 which includes a 138 kV powerline corridor tied into the district electrical grid that was recently constructed for Tocantinzinho. Exploration activities at São Jorge are operated from a permanent camp located adjacent to the existing Deposit and just 3 km from the highway.

Update on Activities

The Company has commenced the Program with the goal of confirming a new structural interpretation which may help to optimize modelling of the mineral resource. Structural analysis of historic mapping and oriented core from drilling by previous operators, has identified two principal vein/fracture orientations, the intersection of which produces a steeply plunging high-grade 'shoot' geometry. Infill confirmatory oriented core drilling is underway within the Deposit and near its margins to test this interpretation which could provide evidence for a better understanding of the controls on high-grade mineralization and optimization of the resource modelling methodology.

The Company also plans to conduct core drilling along the broad northwest-southeast striking São Jorge high-strain corridor (see Figure 2), which has previously been drill tested over a strike length of approximately 1.4 km in the area of the currently defined Deposit, but which remains open and largely untested along strike.

The São Jorge high-strain corridor occurs within a broader 12 km x 7 km surface geochemical footprint defined by elevated gold ± copper ± molybdenum, and the Company is conducting systematic follow-up exploration activities over several high priority target areas (see Figure 2), including ongoing soil sampling and geological mapping, with a view to define and prioritize new bedrock diamond core drilling targets. A mobile power auger drill rig has recently been added to the Program to expedite the testing of several high-tenor surficial geochemical targets. Auger drilling can reach depths of around 10 - 20 metres vertical to effectively penetrate through the colluvial/alluvial soil profile and into the underlying saprolite zone. This efficient method of shallow geochemical drilling can cover large areas rapidly and cost effectively, and may ultimately allow the Company's exploration team to vector into new potential bedrock mineralization occurrences for follow-up diamond core drilling.

Qualified Person

Paulo Pereira, P. Geo., President of GoldMining, has supervised the preparation of and approved the scientific and technical information contained herein. Mr. Pereira is a qualified person defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101").

About GoldMining Inc.

The Company is a public mineral exploration company focused on the acquisition and development of gold assets in the

Notice to Readers

Technical disclosure regarding São Jorge has been prepared by the Company in accordance with NI 43-101. NI 43-101 is a rule of the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. These standards differ from the requirements of the

Cautionary Statement on Forward-looking Statements

Certain of the information contained in this news release constitutes "forward-looking information" and "forward-looking statements" within the meaning of applicable Canadian and

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/goldmining-commences-drilling-at-the-sao-jorge-gold-project-brazil-302157426.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/goldmining-commences-drilling-at-the-sao-jorge-gold-project-brazil-302157426.html

SOURCE GoldMining Inc.