GoldMining Issues Letter to Shareholders

GoldMining Inc. updates shareholders on the successful IPO of Gold Royalty Corp. (GRC), achieving a market cap of approximately US$200 million and tripling its initial offering to US$90 million. GoldMining retains a 49% equity stake in GRC, valued at about C$120 million, reflecting strong confidence in its assets. Future plans include acquiring opportunities and advancing projects such as La Mina and Yellowknife, with preliminary economic assessments anticipated in H2 2021. The firm aims to leverage its substantial resources of 14.3 million ounces gold equivalent in Measured and Indicated Resources.

- Successful IPO of Gold Royalty Corp. raised US$90 million, tripling initial size.

- GoldMining retains 20 million GRC shares, valued at approximately C$120 million.

- Plans for preliminary economic assessments on La Mina and Yellowknife projects expected in H2 2021.

- None.

Insights

Analyzing...

VANCOUVER, BC, March 18, 2021 /PRNewswire/ - GoldMining Inc. (the "Company" or "GoldMining") (TSX: GOLD; NYSE American: GLDG) is pleased to issue the following letter from its Chairman, Amir Adnani, updating shareholders on the recent successful launch of Gold Royalty Corp. ("GRC" or "Gold Royalty") (NYSE American: GROY) and plans for project advancement:

Dear Fellow Shareholders,

Since going public a decade ago, we entered the first phase of GoldMining's strategy, which was to acquire resource stage projects in stable jurisdictions in the Americas at opportune prices during low points in the gold and copper cycle. In 2020, we embarked on the second phase of our strategic plan with a view to unlock the intrinsic value from our vast project portfolio. To this end we created Gold Royalty Corp. to expose existing shareholders to a new and distinct form of value enhancement.

Last week, Gold Royalty completed its successful initial public offering (the "IPO") and listing on the NYSE American, achieving a market capitalization of approximately US

As a result of this transformative event, GoldMining holds 20,000,000 GRC shares on its balance sheet. Importantly, GoldMining shareholders have continued indirect ownership of our

As such, we view the IPO as an important value-crystallizing event for the Company and a strong vote of confidence in our team and assets. I would like to take this opportunity to thank the GoldMining and Gold Royalty teams for all their hard work and effort to transform Gold Royalty from a concept into a highly successful IPO launch in less than 9 months.

Since the IPO, the GRC team has hit the ground running. Just yesterday, Gold Royalty announced an agreement to acquire a

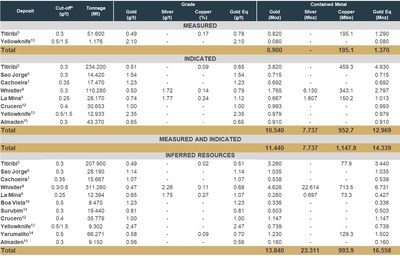

Moving forward, we remain focused on identifying accretive acquisition opportunities, evaluating joint ventures with potential industry partners, and increasing our efforts to daylight value from our projects. We control one of the largest global resource holdings amongst our peers, with an aggregate total of approximately 14.3 million ounces gold equivalent Measured and Indicated Resources and 16.5 million ounces gold equivalent Inferred Mineral Resources (see Table below for further information).

While our technical team continues to review key projects for advancement, we are initiating preliminary economic assessments ("PEAs") at the La Mina gold-copper project in Colombia and the high-grade Yellowknife gold project in Canada. We expect these studies to be completed in H2 2021. In addition, diamond drilling programs to test geological targets and to better define, and potentially expand, existing mineral resources at the Titiribi and La Mina projects in Colombia are currently planned to commence in H2 2021. Details will be announced as the studies progress and as program details are refined and finalized. These programs will be funded with existing cash-on-hand and are subject to permitting and potential restrictions related to COVID-19.

We look forward to an exciting 2021 for GoldMining, Gold Royalty and all our stakeholders. We thank our shareholders for their continued support and look forward to reporting further progress as we execute our strategy.

___________________________ | |

1 | Based on the closing price of the GRC Shares on the NYSE American and the applicable exchange rate on March 17, 2021. |

About GoldMining Inc.

GoldMining Inc. is a public mineral exploration company focused on the acquisition and development of gold assets in the Americas. Through its disciplined acquisition strategy, GoldMining now controls a diversified portfolio of resource-stage gold and gold-copper projects in Canada, U.S.A., Brazil, Colombia, and Peru.

Technical Information

Paulo Pereira, P. Geo., President of GoldMining, has reviewed and approved the technical information contained in this news release. Mr. Pereira is a Qualified Person as defined in National Instrument 43-101 ("NI 43-101").

Disclosure regarding Mineral Resource estimates included herein have been prepared by the Company in accordance with NI 43-101. NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for public disclosure by issuer of scientific and technical information concerning mineral projects. NI 43-101 differs significantly from the disclosure requirements of the United States Securities and Exchange Commission ("SEC") generally applicable to U.S. companies subject to the SEC's disclosure requirements. For example, the terms "Measured Mineral Resource", "Indicated Mineral Resource" and "Inferred Mineral Resource" are defined in NI 43-101 by reference to the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum CIM Definition Standards on Mineral Resources and Mineral Reserves. These definitions differ from the definitions in the disclosure requirements promulgated by the SEC. Accordingly, information contained herein or in the Company's descriptions of its projects may not be comparable to similar information made public by U.S. companies reporting pursuant to SEC disclosure requirements.

"Inferred Mineral Resources" have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that part or all of an inferred resource exists, or is economically or legally mineable.

Please refer to the Company's Technical Reports, which are available under its profile at www.sedar.com, for further information regarding Mineral Resource estimates for the Company's projects and other important information regarding such projects, including classification, reporting parameters, key assumptions and risks for each of the Company's projects.

Table 1: GoldMining's Aggregated Mineral Resource Statement across all its Projects1,2,3.

1. | Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the mineral resources will be converted into mineral reserves. The estimate of mineral resources may be materially affected by environmental permitting, legal, title, taxation, sociopolitical, marketing or other relevant issues. | ||

2. | The above global resource estimate table is provided for informational purposes only and is not intended to represent the viability of any project on a standalone or global basis. The exploration and development of each project, project geology and the assumptions and other factors underlying each estimate, are not uniform and will vary from project to project. Please refer to the technical report for each respective project, as referenced herein, for detailed information respecting each individual project. | ||

3. | All quantities are rounded to the appropriate number of significant figures; consequently, sums may not add up due to rounding. | ||

4. | Gold cut-off for all projects except for Whistler, which is gold equivalent cut-off. | ||

5. | Notes for Titiribi: | ||

• | Based on technical report titled "Technical Report on the Titiribi Project Department of Antioquia, Colombia" with an effective date of September 14, 2016, which is available under GoldMiningꞌs SEDAR profile. | ||

• | Gold equivalent estimated for the Titiribi deposit assumes metal prices of US | ||

6. | Notes for Sao Jorge: | ||

• | Based on technical report titled "Technical Report and Resource Estimate on the São Jorge Gold Project, Pará State, Brazil" with an effective date of November 22, 2013, which is available under GoldMiningꞌs SEDAR profile. | ||

7. | Notes for Cachoeira: | ||

• | Based on technical report titled "Technical Report and Resource Estimate on the Cachoeira Property, Pará State, Brazil" with an effective date of April 17, 2013 and amended and re-stated October 2, 2013, which is available under GoldMiningꞌs SEDAR profile. | ||

8. | Notes for Whistler: | ||

• | Based on technical report titled "Technical Report on the Whistler Project" with an effective date of March 24, 2016, which is available under GoldMiningꞌs SEDAR profile. | ||

• | The Whistler Project is comprised of three deposits: Whistler, Raintree West and Island Mountain. | ||

• | Gold equivalent estimated for the Whistler deposit assumes metal prices of US | ||

• | Gold equivalent estimated for the Raintree West deposit assumes metal prices of US | ||

• | Gold equivalent estimated for the Island Mountain deposit assumes metal prices of US | ||

• | A gold equivalent cut-off of 0.3 g/t was highlighted in the estimate as a possible open pit cut-off (Whistler, Raintree-shallow and Island Mountain), and a gold equivalent cut-off of 0.6 g/t was highlighted in the estimate as a possible underground cut-off (Raintree-deep). | ||

9. | Notes for La Mina: | ||

• | Based on technical report titled "Technical Report on the La Mina Project" with an effective date of October 24, 2016, which is available under Bellhaven Copper and Gold Inc.ꞌs SEDAR profile. | ||

• | Gold equivalent estimated for the La Mina project assumes metal prices of US | ||

10. | Notes for Boa Vista: | ||

• | Based on technical report titled "Technical Report on the Boa Vista Project and Resource Estimate on the VG1 Prospect, Tapajos Area, Para State, Northern Brazil" with an effective date of November 22, 2013, which is available under GoldMiningꞌs SEDAR profile. | ||

11. | Notes for Rio Novo/Surubim: | ||

• | Based on technical report titled "Technical Report on the Rio Novo Gold Project and Resource Estimate on the Jau Prospect, Tapajos Area, Para State, Northern Brazil" ("Surubim Project") with an effective date of November 22, 2013, which is available under GoldMiningꞌs SEDAR profile. | ||

12. | Notes for Crucero: | ||

• | Based on technical report titled "Technical Report on the Crucero Property, Carabaya Province, Peru" with an effective date of December 20, 2017, which is available under GoldMining's SEDAR profile. | ||

13. | Notes for Yellowknife: | ||

• | Open pit resources stated as contained within a potentially economically minable open pit above a 0.50 g/t Au cut-off. | ||

• | Pit optimization is based on an assumed gold price of US | ||

• | Underground resources stated as contained within potentially economically minable gold grade shapes above a 1.50 g/t Au cut-off. | ||

• | Mineral resource tonnage and grade are reported as undiluted and reflect a potentially minable bench height of 3.0 m. | ||

• | Based on technical report titled "Independent Technical Report Yellowknife Gold Project Northwest Territories, Canada" with an effective date of March 1, 2019, which is available under GoldMining's SEDAR profile. | ||

14. | Notes for Yarumalito: | ||

• | Pit constrained resources with reasonable prospects of eventual economic extraction reported above a 0.50 g/t AuEq cut-off. | ||

• | Pit constrained resource estimate and gold equivalency are based on US | ||

• | Based on a technical report titled "Technical Report: Yarumalito Gold-Copper Property, Departments of Antioquia and Caldas, Republic of Colombia" with an effective date of April 1, 2020, which is available under GoldMining's SEDAR profile. | ||

15. | Notes for Almaden: | ||

• | Pit constrained resources with reasonable prospects of eventual economic extraction reported above a 0.30 g/t Au cut-off. | ||

• | Pit constrained resource estimate based on US | ||

• | Based on technical report titled "Technical Report: Almaden Gold Property, Washington County, Idaho, USA" with an effective date of April 1, 2020, which is available under GoldMining's SEDAR profile. | ||

Forward-looking Statements

This document contains certain forward-looking statements that reflect the current views and/or expectations of GoldMining with respect to its long-term strategy, proposed work and other plans and expected timing of PEAs and proposed drililng and its expectations for GRC and its proposed acquisitions. Forward-looking statements are based on the then-current expectations, beliefs, assumptions, estimates and forecasts about the business and the markets in which GoldMining and GRC operate. Investors are cautioned that all forward-looking statements involve risks and uncertainties, including: delays to plans caused by restrictions and other future impacts of COVID-19 or any other inability of the Company to meet expected timelines for planned project activities, including the proposed PEAs and drilling programs; the inherent risks involved in the exploration and development of mineral properties, fluctuating metal prices, proposed studies may not confirm GoldMining's expectations for its projects, risks generally facing companies in GRC's sector, the ability of GRC to complete and satisfy the conditions to its proposed acquisition, unanticipated costs and expenses and the availability and costs of financing needed in the future. These risks, as well as others, including those set forth in GoldMiningꞌs Annual Information Form for the year ended November 30, 2020, and other filings with Canadian securities regulators and the U.S. Securities and Exchange Commission, could cause actual results and events to vary significantly. Accordingly, readers should not place undue reliance on forward-looking statements and information. There can be no assurance that forward-looking information, or the material factors or assumptions used to develop such forward looking information, will prove to be accurate. The Company does not undertake any obligations to release publicly any revisions for updating any voluntary forward-looking statements, except as required by applicable securities law.

![]() View original content to download multimedia:http://www.prnewswire.com/news-releases/goldmining-issues-letter-to-shareholders-301249795.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/goldmining-issues-letter-to-shareholders-301249795.html

SOURCE GoldMining Inc.