GGX Gold, Silver and Tellurium Assay Results, 880 g/t Silver and 660 ppm Tellurium over 0.53 Meters Perky Vein Historic Gold Mining Camp Greenwood BC

GGX Gold Corp. announced positive silver and tellurium assay results from its 2020 diamond drilling program at the Gold Drop property in British Columbia. The most notable result includes 235 g/t gold, 880 g/t silver, and 660 ppm tellurium from the Perky vein. The company plans to continue drilling to delineate high-grade mineralization. Additionally, GGX granted 800,000 stock options to its directors and employees at an exercise price of $0.16, which are valid for five years.

- Significant assay results from the Perky vein include 235 g/t gold, 880 g/t silver, and 660 ppm tellurium.

- Plans for continued diamond drilling to further delineate high-grade gold, silver, and tellurium mineralization.

- None.

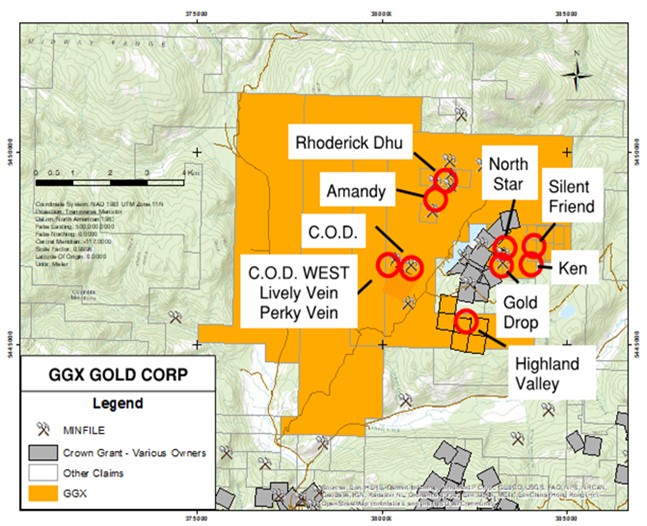

VANCOUVER, BC / ACCESSWIRE / June 17, 2021 / GGX Gold Corp. (TSXV:GGX)(OTCQB:GGXXF)(FRA:3SR2) (the "Company" or "GGX") is pleased to announce the silver and tellurium assay results for the Perky and C.O.D veins from the 2020 diamond drilling program at the Company's

Silver and Tellurium assay results were recently received for all the C.O.D (COD20-01 to COD20-019) and Perky (PKY20-01 to PKY20-17) veins drilled in 2020. Gold assay results were reported in the April 7, 2021 News Release.

The Perky vein located approximately 200 metres west of the C.O.D vein reported the most significant result of 235 g/t gold, 880 g/t silver, and 660 ppm tellurium over 0.53 metre core interval from drillhole PYK20-08. The Company plans to continue diamond drilling at the Perky vein in 2021 to continue delineation of high-grade gold, silver, and tellurium mineralization.

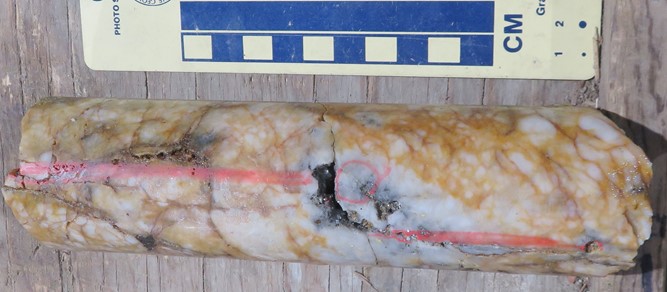

Drill core from PKY20-08: quartz vein

The following lists the drill intercepts over 1.0 grams per tonne gold for the C.O.D and Perky veins. Gold assays above 20.0 grams per tonne gold are bolded.

Hole | From (m) | To (m) | Interval Length (m) | Gold (g/t) | Silver (g/t) | Tellurium (ppm) | Description | ||

| PKY20-01 | 60.48 | 60.93 | 0.45 | 1.66 | 6.64 | 5.86 | Quartz veinlet, pyrite in granodiorite | ||

| PKY20-04 | 27.91 | 28.41 | 0.5 | 4.72 | 37.6 | 21 | Quartz veinlet, pyrite in granodiorite | ||

| PKY20-07 | 0.96 | 1.85 | 0.89 | 26.7 | 66.5 | 40.8 | Quartz vein, visible gold | ||

| PKY20-07 | 1.85 | 2.3 | 0.45 | 119.5 | 250 | 122 | Quartz vein, pyrite | ||

| PKY20-08 | 0.7 | 1.31 | 0.61 | 2.07 | 3.36 | 3.2 | Quartz vein, rusty | ||

| PKY20-08 | 1.31 | 1.73 | 0.42 | 9.63 | 64.6 | 43.2 | Quartz vein, rusty | ||

| PKY20-08 | 1.73 | 2.26 | 0.53 | 235 | 880 | 660 | Quartz vein, visible gold | ||

| PKY20-08 | 2.26 | 2.87 | 0.61 | 81.4 | 471 | 229 | Quartz vein, visible gold | ||

| PKY20-09 | 10.44 | 10.97 | 0.53 | 7.47 | 53 | 41.5 | Quartz vein, pyrite | ||

| PKY20-09 | 10.97 | 11.47 | 0.5 | 2.73 | 16.6 | 9.63 | Quartz vein, rusty, pyrite | ||

| PKY20-12 | 9.2 | 10.06 | 0.86 | 26.9 | 163 | 109.5 | Quartz vein | ||

| PKY20-13 | 3.38 | 3.88 | 0.5 | 2.46 | 16.55 | 10.75 | Quartz vein, pyrite | ||

| PKY20-13 | 4.59 | 5.09 | 0.5 | 3.72 | 28.4 | 26.1 | Quartz vein, pyrite | ||

| PKY20-13 | 5.09 | 5.62 | 0.53 | 7.26 | 54.6 | 34 | Quartz vein, pyrite | ||

| PKY20-13 | 5.62 | 6.19 | 0.57 | 20.4 | 107 | 59 | Quartz vein, pyrite | ||

| PKY20-14 | 36.76 | 37.32 | 0.56 | 1.4 | 13.2 | 8.26 | Qtz stringers, pyrite | ||

| PKY20-15 | 2.66 | 3.26 | 0.6 | 3.54 | 14.75 | 12.5 | Quartz vein | ||

| PKY20-15 | 8.75 | 9.23 | 0.48 | 2.44 | 19.2 | 10.8 | Quartz vein, pyrite | ||

| PKY20-15 | 9.23 | 9.66 | 0.43 | 3.81 | 19.45 | 11.3 | Quartz vein | ||

| COD20-09 | 15.61 | 16.28 | 0.67 | 2.22 | 9.74 | 7.72 | Quartz vein, pyrite | ||

| COD20-09 | 16.28 | 16.6 | 0.32 | 1.75 | 31.4 | 191 | Quartz vein | ||

| COD20-09 | 18.2 | 18.79 | 0.59 | 11.95 | 123 | 94.9 | Quartz vein, pyrite | ||

| COD20-10 | 17.57 | 17.97 | 0.4 | 2.44 | 29.2 | 17.1 | Quartz vein | ||

| COD20-10 | 19.67 | 20.62 | 0.95 | 2.45 | 17.3 | 16.8 | Quartz veinlet, pyrite | ||

| COD20-10 | 20.62 | 21.8 | 1.18 | 27.7 | 114 | 135.5 | Quartz vein | ||

| COD20-11 | 18.03 | 18.43 | 0.4 | 9.14 | 30.8 | 43.6 | Quartz vein | ||

| COD20-11 | 20.24 | 20.74 | 0.5 | 9.66 | 22.1 | 25.6 | Quartz veinlet, pyrite | ||

| COD20-11 | 21.4 | 22.49 | 1.09 | 3.34 | 16.8 | 14.45 | Quartz veinlet, pyrite |

Note that the intercept lengths are drill core lengths and are not true widths. Due to lack of information on the geometry of the and C.O.D and Perky veins, true widths cannot be determined at this time.

Analyses disclosed in this release were conducted by ALS Global - Geochemistry Analytical Lab in North Vancouver, BC, Canada. ALS is an independent, fully accredited commercial laboratory. All mineralized vein samples were analyzed by the metallics sieve method (ALS Code Au-SCR24) with gold determination by fire assay. For other samples, gold was determined by the fire assay method using a 50-gram sample weight and AA finish. Over-limits were re-analyzed by fire assay using a gravimetric finish. Other metals were analyzed as part of a 48-element package using a four-acid digestion and determination by ICP-MS.

The Company also announces that it has granted 800,000 stock options at an exercise price of

Sebastien Ah Fat, P.Geo., a Qualified Person as defined by National Instrument 43-101 and consultant to the Company, approved the technical information in this release.

On Behalf of the Board of Directors

Barry Brown, CEO

604-488-3900

Office@GGXgold.com

Investor Relations:

IR@GGXgold.com

Forward Looking Statement

This News Release may contain forward-looking statements including but not limited to comments regarding the acquisition of certain mineral claims. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements and Revolver undertakes no obligation to update such statements, except as required by law.

Forward-looking statements are based on the then-current expectations, beliefs, assumptions, estimates and forecasts about the business and the industry and markets in which the Company operates, including that: the current price of and demand for minerals being targeted by the Company will be sustained or will improve; the Company will be able to obtain required exploration licences and other permits; general business and economic conditions will not change in a material adverse manner; financing will be available if and when needed on reasonable terms; the Company will not experience any material accident; and the Company will be able to identify and acquire additional mineral interests on reasonable terms or at all. Forward-looking statements are not guarantees of future performance and involve risks, uncertainties and assumptions which are difficult to predict. Investors are cautioned that all forward-looking statements involve risks and uncertainties, including: that resource exploration and development is a speculative business; that environmental laws and regulations may become more onerous; that the Company may not be able to raise additional funds when necessary; fluctuations in currency exchange rates; fluctuating prices of commodities; operating hazards and risks; competition; potential inability to find suitable acquisition opportunities and/or complete the same; and other risks and uncertainties listed in the Company's public filings. These risks, as well as others, could cause actual results and events to vary significantly. Accordingly, readers should not place undue reliance on forward-looking statements and information, which are qualified in their entirety by this cautionary statement. There can be no assurance that forward-looking information, or the material factors or assumptions used to develop such forward looking information, will prove to be accurate. The Company does not undertake any obligations to release publicly any revisions for updating any voluntary forward-looking statements, except as required by applicable securities law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: GGX Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/652110/GGX-Gold-Silver-and-Tellurium-Assay-Results-880-gt-Silver-and-660-ppm-Tellurium-over-053-Meters-Perky-Vein-Historic-Gold-Mining-Camp-Greenwood-BC

FAQ

What are the latest assay results for GGX Gold Corp. (GGXXF) from the 2020 drilling program?

When will GGX Gold Corp. continue drilling at the Gold Drop property?

How many stock options has GGX Gold Corp. granted recently?