GGX Gold Closes Financing - Historic Mining District - Greenwood BC

GGX Gold Corp. has successfully closed its non-brokered private placement, raising a total of $110,000 by issuing 1,375,000 flow-through units at $0.08 per unit. Each unit consists of one common share and a warrant for an additional share at $0.10 for 24 months. The funds will support ongoing exploration activities at the Gold Drop Property in British Columbia. All securities issued will be subject to a hold period expiring on April 29, 2023, with no commissions paid on the financing.

This completion marks the end of the targeted amount raised in this financing.

- Raised $110,000 through a successful private placement.

- Funds allocated for continued exploration at the Gold Drop Property.

- None.

VANCOUVER, BC / ACCESSWIRE / February 15, 2023 / GGX Gold Corp. (TSXV:GGX)(OTCQB:GGXXF)(FRA:3SR2) (the "Company" or "GGX") is pleased to announce that it has closed the non-brokered private placement previously announced on December 16, 2022, and December 30, 2022 by issuing 1,375,000 flow through units at a price of

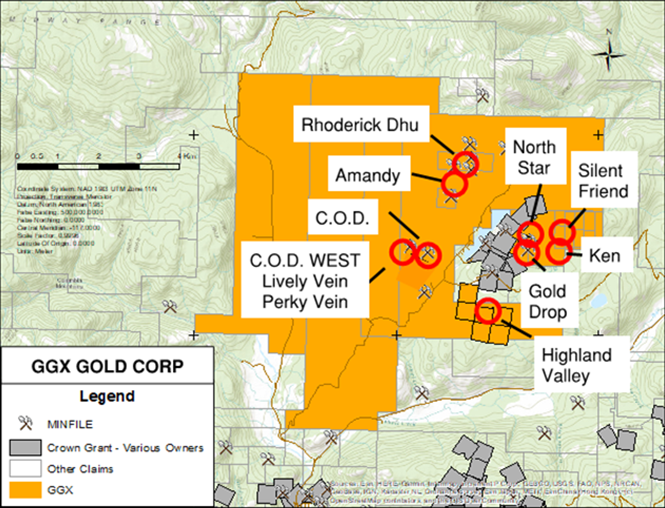

Proceeds from the private placement will be used for the continued exploration work on the Gold Drop Property in the Greenwood mining camp of south-central British Columbia.

This is the final amount to raised and the placement is now closed.

All securities issued in connection with the Offering will be subject to a hold period expiring

April 29, 2023. The Company paid no commission for this financing.

On Behalf of the Board of Directors

Quinn Field - Dyte, President

604-488-3900

Office@GGXgold.com

Investor Relations: IR@GGXgold.com

Forward Looking Statement

This News Release may contain forward-looking statements including but not limited to comments regarding the acquisition of certain mineral claims. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements and Revolver undertakes no obligation to update such statements, except as required by law.

Forward-looking statements are based on the then-current expectations, beliefs, assumptions, estimates and forecasts about the business and the industry and markets in which the Company operates, including that: the current price of and demand for minerals being targeted by the Company will be sustained or will improve; the Company will be able to obtain required exploration licences and other permits; general business and economic conditions will not change in a material adverse manner; financing will be available if and when needed on reasonable terms; the Company will not experience any material accident; and the Company will be able to identify and acquire additional mineral interests on reasonable terms or at all. Forward-looking statements are not guarantees of future performance and involve risks, uncertainties and assumptions which are difficult to predict. Investors are cautioned that all forward-looking statements involve risks and uncertainties, including: that resource exploration and development is a speculative business; that environmental laws and regulations may become more onerous; that the Company may not be able to raise additional funds when necessary; fluctuations in currency exchange rates; fluctuating prices of commodities; operating hazards and risks; competition; potential inability to find suitable acquisition opportunities and/or complete the same; and other risks and uncertainties listed in the Company's public filings. These risks, as well as others, could cause actual results and events to vary significantly. Accordingly, readers should not place undue reliance on forward-looking statements and information, which are qualified in their entirety by this cautionary statement. There can be no assurance that forward-looking information, or the material factors or assumptions used to develop such forward-looking information, will prove to be accurate. The Company does not undertake any obligations to release publicly any revisions for updating any voluntary forward-looking statements, except as required by applicable securities law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release

SOURCE: GGX Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/739536/GGX-Gold-Closes-Financing--Historic-Mining-District--Greenwood-BC

FAQ

What amount did GGXXF raise in the recent private placement?

What will the proceeds from GGX Gold's financing be used for?

When does the hold period for the newly issued securities expire?