General Dynamics Reports Second-Quarter 2023 Financial Results

- Q2 2023 net earnings of $744 million, up 10.5% YoY

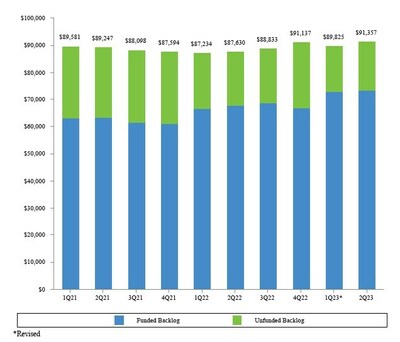

- Record-high backlog of $91.4 billion, a 4.3% increase from the year-ago quarter

- Cash flow of $731 million provided by operating activities in Q2

- Debt reduced by $1.7 billion in the past 12 months

- None.

- Revenue of

$10.2 billion 10.5% year-over-year, with growth in all four segments - Net earnings

$744 million $2.70 - Record-high backlog of

$91.4 billion

"Our businesses demonstrated solid momentum despite continued supply chain headwinds in several units, achieving the highest-ever revenue for a mid-year quarter, record-high backlog and very strong cash flow," said Phebe N. Novakovic, chairman and chief executive officer. "We are well positioned to continue to perform for the remainder of the year."

Cash

Net cash provided by operating activities in the quarter totaled

Backlog

Good order activity across the segments yielded a consolidated book-to-bill ratio, defined as orders divided by revenue, of 1.2-to-1 for the quarter. The company ended the quarter with record-high backlog of

The Aerospace segment booked

Significant awards in the quarter for the three defense segments included

About General Dynamics

Headquartered in

WEBCAST INFORMATION: General Dynamics will webcast its second-quarter 2023 financial results conference call at 9 a.m. EDT on Wednesday, July 26, 2023. The webcast will be a listen-only audio event available at www.gd.com. An on-demand replay of the webcast will be available by telephone two hours after the end of the call through August 2, 2023, at 800-770-2030 (international +1 647-362-9199), conference ID 4299949. Charts furnished to investors and securities analysts in connection with General Dynamics' announcement of its financial results are available at www.gd.com.

This press release contains forward-looking statements (FLS), including statements about the company's future operational and financial performance, which are based on management's expectations, estimates, projections and assumptions. Words such as "expects," "anticipates," "plans," "believes," "forecasts," "scheduled," "outlook," "estimates," "should" and variations of these words and similar expressions are intended to identify FLS. In making FLS, we rely on assumptions and analyses based on our experience and perception of historical trends; current conditions and expected future developments; and other factors, estimates and judgments we consider reasonable and appropriate based on information available to us at the time. FLS are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, as amended. FLS are not guarantees of future performance and involve factors, risks and uncertainties that are difficult to predict. Actual future results and trends may differ materially from what is forecast in the FLS. All FLS speak only as of the date they were made. We do not undertake any obligation to update or publicly release revisions to FLS to reflect events, circumstances or changes in expectations after the date of this press release. Additional information regarding these factors is contained in the company's filings with the SEC, and these factors may be revised or supplemented in future SEC filings. In addition, this press release contains some financial measures not prepared in accordance with

***

EXHIBIT A CONSOLIDATED STATEMENT OF EARNINGS - (UNAUDITED) DOLLARS IN MILLIONS, EXCEPT PER SHARE AMOUNTS | |||||||

Three Months Ended | Variance | ||||||

July 2, 2023 | July 3, 2022 | $ | % | ||||

Revenue | $ 10,152 | $ 9,189 | $ 963 | 10.5 % | |||

Operating costs and expenses | (9,190) | (8,211) | (979) | ||||

Operating earnings | 962 | 978 | (16) | (1.6) % | |||

Other, net | 13 | 40 | (27) | ||||

Interest, net | (89) | (95) | 6 | ||||

Earnings before income tax | 886 | 923 | (37) | (4.0) % | |||

Provision for income tax, net | (142) | (157) | 15 | ||||

Net earnings | $ 744 | $ 766 | $ (22) | (2.9) % | |||

Earnings per share—basic | $ 2.72 | $ 2.77 | $ (0.05) | (1.8) % | |||

Basic weighted average shares outstanding | 273.1 | 276.3 | |||||

Earnings per share—diluted | $ 2.70 | $ 2.75 | $ (0.05) | (1.8) % | |||

Diluted weighted average shares outstanding | 275.1 | 278.9 | |||||

EXHIBIT B CONSOLIDATED STATEMENT OF EARNINGS - (UNAUDITED) DOLLARS IN MILLIONS, EXCEPT PER SHARE AMOUNTS | |||||||

Six Months Ended | Variance | ||||||

July 2, 2023 | July 3, 2022 | $ | % | ||||

Revenue | $ 20,033 | $ 18,581 | $ 1,452 | 7.8 % | |||

Operating costs and expenses | (18,133) | (16,695) | (1,438) | ||||

Operating earnings | 1,900 | 1,886 | 14 | 0.7 % | |||

Other, net | 46 | 79 | (33) | ||||

Interest, net | (180) | (193) | 13 | ||||

Earnings before income tax | 1,766 | 1,772 | (6) | (0.3) % | |||

Provision for income tax, net | (292) | (276) | (16) | ||||

Net earnings | $ 1,474 | $ 1,496 | $ (22) | (1.5) % | |||

Earnings per share—basic | $ 5.39 | $ 5.41 | $ (0.02) | (0.4) % | |||

Basic weighted average shares outstanding | 273.6 | 276.7 | |||||

Earnings per share—diluted | $ 5.34 | $ 5.35 | $ (0.01) | (0.2) % | |||

Diluted weighted average shares outstanding | 275.8 | 279.4 | |||||

EXHIBIT C REVENUE AND OPERATING EARNINGS BY SEGMENT - (UNAUDITED) DOLLARS IN MILLIONS | |||||||

Three Months Ended | Variance | ||||||

July 2, 2023 | July 3, 2022 | $ | % | ||||

Revenue: | |||||||

Aerospace | $ 1,953 | $ 1,867 | $ 86 | 4.6 % | |||

Marine Systems | 3,059 | 2,651 | 408 | 15.4 % | |||

Combat Systems | 1,924 | 1,666 | 258 | 15.5 % | |||

Technologies | 3,216 | 3,005 | 211 | 7.0 % | |||

Total | $ 10,152 | $ 9,189 | $ 963 | 10.5 % | |||

Operating earnings: | |||||||

Aerospace | $ 236 | $ 238 | $ (2) | (0.8) % | |||

Marine Systems | 235 | 211 | 24 | 11.4 % | |||

Combat Systems | 251 | 245 | 6 | 2.4 % | |||

Technologies | 283 | 304 | (21) | (6.9) % | |||

Corporate | (43) | (20) | (23) | (115.0) % | |||

Total | $ 962 | $ 978 | $ (16) | (1.6) % | |||

Operating margin: | |||||||

Aerospace | 12.1 % | 12.7 % | |||||

Marine Systems | 7.7 % | 8.0 % | |||||

Combat Systems | 13.0 % | 14.7 % | |||||

Technologies | 8.8 % | 10.1 % | |||||

Total | 9.5 % | 10.6 % | |||||

EXHIBIT D REVENUE AND OPERATING EARNINGS BY SEGMENT - (UNAUDITED) DOLLARS IN MILLIONS | |||||||

Six Months Ended | Variance | ||||||

July 2, 2023 | July 3, 2022 | $ | % | ||||

Revenue: | |||||||

Aerospace | $ 3,845 | $ 3,770 | $ 75 | 2.0 % | |||

Marine Systems | 6,051 | 5,302 | 749 | 14.1 % | |||

Combat Systems | 3,680 | 3,341 | 339 | 10.1 % | |||

Technologies | 6,457 | 6,168 | 289 | 4.7 % | |||

Total | $ 20,033 | $ 18,581 | $ 1,452 | 7.8 % | |||

Operating earnings: | |||||||

Aerospace | $ 465 | $ 481 | $ (16) | (3.3) % | |||

Marine Systems | 446 | 422 | 24 | 5.7 % | |||

Combat Systems | 496 | 472 | 24 | 5.1 % | |||

Technologies | 582 | 602 | (20) | (3.3) % | |||

Corporate | (89) | (91) | 2 | 2.2 % | |||

Total | $ 1,900 | $ 1,886 | $ 14 | 0.7 % | |||

Operating margin: | |||||||

Aerospace | 12.1 % | 12.8 % | |||||

Marine Systems | 7.4 % | 8.0 % | |||||

Combat Systems | 13.5 % | 14.1 % | |||||

Technologies | 9.0 % | 9.8 % | |||||

Total | 9.5 % | 10.2 % | |||||

EXHIBIT E CONSOLIDATED BALANCE SHEET DOLLARS IN MILLIONS | |||

(Unaudited) | |||

July 2, 2023 | December 31, 2022 | ||

ASSETS | |||

Current assets: | |||

Cash and equivalents | $ 1,154 | $ 1,242 | |

Accounts receivable | 3,167 | 3,008 | |

Unbilled receivables | 8,291 | 8,795 | |

Inventories | 7,642 | 6,322 | |

Other current assets | 1,571 | 1,696 | |

Total current assets | 21,825 | 21,063 | |

Noncurrent assets: | |||

Property, plant and equipment, net | 5,947 | 5,900 | |

Intangible assets, net | 1,732 | 1,824 | |

Goodwill | 20,443 | 20,334 | |

Other assets | 2,609 | 2,464 | |

Total noncurrent assets | 30,731 | 30,522 | |

Total assets | $ 52,556 | $ 51,585 | |

LIABILITIES AND SHAREHOLDERS' EQUITY | |||

Current liabilities: | |||

Short-term debt and current portion of long-term debt | $ 508 | $ 1,253 | |

Accounts payable | 3,365 | 3,398 | |

Customer advances and deposits | 8,628 | 7,436 | |

Other current liabilities | 3,185 | 3,254 | |

Total current liabilities | 15,686 | 15,341 | |

Noncurrent liabilities: | |||

Long-term debt | 9,247 | 9,243 | |

Other liabilities | 8,145 | 8,433 | |

Total noncurrent liabilities | 17,392 | 17,676 | |

Shareholders' equity: | |||

Common stock | 482 | 482 | |

Surplus | 3,614 | 3,556 | |

Retained earnings | 38,154 | 37,403 | |

Treasury stock | (21,077) | (20,721) | |

Accumulated other comprehensive loss | (1,695) | (2,152) | |

Total shareholders' equity | 19,478 | 18,568 | |

Total liabilities and shareholders' equity | $ 52,556 | $ 51,585 | |

EXHIBIT F CONSOLIDATED STATEMENT OF CASH FLOWS - (UNAUDITED) DOLLARS IN MILLIONS | |||

Six Months Ended | |||

July 2, 2023 | July 3, 2022 | ||

Cash flows from operating activities—continuing operations: | |||

Net earnings | $ 1,474 | $ 1,496 | |

Adjustments to reconcile net earnings to net cash from operating activities: | |||

Depreciation of property, plant and equipment | 297 | 278 | |

Amortization of intangible and finance lease right-of-use assets | 136 | 147 | |

Equity-based compensation expense | 87 | 120 | |

Deferred income tax benefit | (154) | (218) | |

(Increase) decrease in assets, net of effects of business acquisitions: | |||

Accounts receivable | (159) | (172) | |

Unbilled receivables | 513 | 695 | |

Inventories | (1,264) | (816) | |

Increase (decrease) in liabilities, net of effects of business acquisitions: | |||

Accounts payable | (33) | (29) | |

Customer advances and deposits | 1,286 | 1,402 | |

Other, net | 10 | (276) | |

Net cash provided by operating activities | 2,193 | 2,627 | |

Cash flows from investing activities: | |||

Capital expenditures | (373) | (365) | |

Other, net | (31) | — | |

Net cash used by investing activities | (404) | (365) | |

Cash flows from financing activities: | |||

Repayment of fixed-rate notes | (750) | — | |

Dividends paid | (705) | (679) | |

Purchases of common stock | (378) | (1,094) | |

Other, net | (42) | 110 | |

Net cash used by financing activities | (1,875) | (1,663) | |

Net cash (used) provided by discontinued operations | (2) | 21 | |

Net (decrease) increase in cash and equivalents | (88) | 620 | |

Cash and equivalents at beginning of period | 1,242 | 1,603 | |

Cash and equivalents at end of period | $ 1,154 | $ 2,223 | |

EXHIBIT G ADDITIONAL FINANCIAL INFORMATION - (UNAUDITED) DOLLARS IN MILLIONS, EXCEPT PER SHARE AMOUNTS | |||||||

Other Financial Information: | |||||||

July 2, 2023 | December 31, 2022 | ||||||

Debt-to-equity (a) | 50.1 % | 56.5 % | |||||

Book value per share (b) | $ 71.34 | $ 67.66 | |||||

Shares outstanding | 273,042,571 | 274,411,106 | |||||

Second Quarter | Six Months | ||||||

2023 | 2022 | 2023 | 2022 | ||||

Income tax payments, net | $ 269 | $ 550 | $ 327 | $ 565 | |||

Company-sponsored research and development (c) | $ 145 | $ 130 | $ 255 | $ 237 | |||

Return on sales (d) | 7.3 % | 8.3 % | 7.4 % | 8.1 % | |||

Non-GAAP Financial Measures: | |||||||

Second Quarter | Six Months | ||||||

2023 | 2022 | 2023 | 2022 | ||||

Free cash flow: | |||||||

Net cash provided by operating activities | $ 731 | $ 659 | $ 2,193 | $ 2,627 | |||

Capital expenditures | (212) | (224) | (373) | (365) | |||

Free cash flow (e) | $ 519 | $ 435 | $ 1,820 | $ 2,262 | |||

July 2, 2023 | December 31, 2022 | ||||||

Net debt: | |||||||

Total debt | $ 9,755 | $ 10,496 | |||||

Less cash and equivalents | 1,154 | 1,242 | |||||

Net debt (f) | $ 8,601 | $ 9,254 | |||||

(a) Debt-to-equity ratio is calculated as total debt divided by total equity as of the end of the period. | |||||||

(b) Book value per share is calculated as total equity divided by total outstanding shares as of the end of the period. | |||||||

(c) Includes independent research and development and Aerospace product-development costs. | |||||||

(d) Return on sales is calculated as net earnings divided by revenue. | |||||||

(e) We define free cash flow as net cash provided by operating activities less capital expenditures. We believe free cash flow is a useful measure | |||||||

(f) We define net debt as short- and long-term debt (total debt) less cash and equivalents. We believe net debt is a useful measure for investors | |||||||

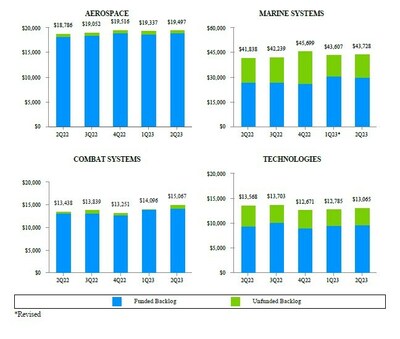

EXHIBIT H BACKLOG - (UNAUDITED) DOLLARS IN MILLIONS | ||||||||||

Funded | Unfunded | Total Backlog | Estimated Potential Contract Value** | Total Estimated Contract Value | ||||||

Second Quarter 2023: | ||||||||||

Aerospace | $ 19,050 | $ 447 | $ 19,497 | $ 888 | $ 20,385 | |||||

Marine Systems | 30,318 | 13,410 | 43,728 | 3,238 | 46,966 | |||||

Combat Systems | 14,349 | 718 | 15,067 | 6,196 | 21,263 | |||||

Technologies | 9,732 | 3,333 | 13,065 | 27,639 | 40,704 | |||||

Total | $ 73,449 | $ 17,908 | $ 91,357 | $ 37,961 | $ 129,318 | |||||

First Quarter 2023: | ||||||||||

Aerospace | $ 18,853 | $ 484 | $ 19,337 | $ 804 | $ 20,141 | |||||

Marine Systems | 30,722 | * | 12,885 | * | 43,607 | 3,499 | 47,106 | |||

Combat Systems | 13,953 | 143 | 14,096 | 5,599 | 19,695 | |||||

Technologies | 9,465 | 3,320 | 12,785 | 28,637 | 41,422 | |||||

Total | $ 72,993 | $ 16,832 | $ 89,825 | $ 38,539 | $ 128,364 | |||||

Second Quarter 2022: | ||||||||||

Aerospace | $ 18,237 | $ 549 | $ 18,786 | $ 877 | $ 19,663 | |||||

Marine Systems | 26,965 | 14,873 | 41,838 | 3,904 | 45,742 | |||||

Combat Systems | 13,236 | 202 | 13,438 | 6,939 | 20,377 | |||||

Technologies | 9,448 | 4,120 | 13,568 | 27,028 | 40,596 | |||||

Total | $ 67,886 | $ 19,744 | $ 87,630 | $ 38,748 | $ 126,378 | |||||

* Revised | ||||||||||

** The estimated potential contract value includes work awarded on unfunded indefinite delivery, indefinite quantity (IDIQ) contracts | ||||||||||

EXHIBIT H-1 |

BACKLOG - (UNAUDITED) |

DOLLARS IN MILLIONS |

EXHIBIT H-2 |

BACKLOG BY SEGMENT - (UNAUDITED) |

DOLLARS IN MILLIONS |

EXHIBIT I |

SECOND QUARTER 2023 SIGNIFICANT ORDERS - (UNAUDITED) |

DOLLARS IN MILLIONS |

We received the following significant contract awards during the second quarter of 2023:

Marine Systems:

$1.1 billion U.S. Navy for long-lead materials and advance construction for Block V Virginia-class submarines.

$735

$55 $220

$160

$75

$65

Combat Systems:

$340 U.S. Army for various munitions and ordnance with a maximum potential value of$1.4 billion

$695 $75

$710

$260

$140

$65

$60

Technologies:

$435 $935

$60 $325

$95 U.S. Department of State (DoS) to provide overseas consular services to support visa application and issuance atU.S. embassies and consulates throughout the world under the Global Support Strategy (GSS) program, and options totaling$265

$270

$15 U.S. Department of the Treasury. The contract has a maximum potential value of$190

$185

$160

$145

$60 $125

EXHIBIT J AEROSPACE SUPPLEMENTAL DATA - (UNAUDITED) DOLLARS IN MILLIONS | ||||||||

Second Quarter | Six Months | |||||||

2023 | 2022 | 2023 | 2022 | |||||

Gulfstream Aircraft Deliveries (units): | ||||||||

Large-cabin aircraft | 18 | 17 | 35 | 38 | ||||

Mid-cabin aircraft | 6 | 5 | 10 | 9 | ||||

Total | 24 | 22 | 45 | 47 | ||||

Aerospace Book-to-Bill: | ||||||||

Orders* | $ 2,476 | $ 3,652 | $ 4,203 | $ 6,895 | ||||

Revenue | 1,953 | 1,867 | 3,845 | 3,770 | ||||

Book-to-Bill Ratio | 1.27x | 1.96x | 1.09x | 1.83x | ||||

* Does not include customer defaults, liquidated damages, cancellations, foreign exchange fluctuations and other backlog adjustments. | ||||||||

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/general-dynamics-reports-second-quarter-2023-financial-results-301885651.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/general-dynamics-reports-second-quarter-2023-financial-results-301885651.html

SOURCE General Dynamics

FAQ

What were General Dynamics' Q2 2023 net earnings?

What is General Dynamics' backlog?