Green Bridge Metals Highlights Milestones of 2024 and Provides 2025 Outlook for South Contact Zone and Chrome-Puddy Projects

Green Bridge Metals (GBMCF) has announced key achievements from 2024 and outlined its 2025 plans for the South Contact Zone and Chrome-Puddy projects. In 2024, the company reported significant prospecting results from Chrome-Puddy, revealing widespread iron-nickel oxide mineralization with samples returning up to 0.38% Ni. The company also acquired an 80% earn-in option for the South Contact Zone in Minnesota's Duluth Complex.

The South Contact Zone includes four prospects: Titac (with an Inferred Mineral Resource of 46.6M tonnes at 15% TiO₂), Skibo (currently undergoing core sampling), Wyman-Siphon (historical resource of ~47M short tonnes at 0.29% Cu, 0.11% Ni), and Boulder. For 2025, the company plans drilling programs at Chrome-Puddy and Titac, with a 5000-meter program scheduled for Titac North and South in H2 2025.

The company strengthened its management team in 2024, adding expertise in technical, financial, and sustainability areas, including Robert G. Krause, Dr. George J. Hudak, Christopher Gulka, and Dr. Ajeet Milliard.

Green Bridge Metals (GBMCF) ha annunciato importanti risultati del 2024 e delineato i suoi piani per il 2025 per la Zona di Contatto Sud e i progetti Chrome-Puddy. Nel 2024, l'azienda ha riportato risultati significativi di prospezione da Chrome-Puddy, rivelando una diffusa mineralizzazione di ossido di ferro-nickel con campioni che restituiscono fino allo 0,38% di Ni. L'azienda ha anche acquisito un'opzione di guadagno dell'80% per la Zona di Contatto Sud nel Duluth Complex del Minnesota.

La Zona di Contatto Sud include quattro prospetti: Titac (con una Risorsa Minerale Indicata di 46,6 milioni di tonnellate a 15% TiO₂), Skibo (attualmente in fase di campionamento del nucleo), Wyman-Siphon (risorsa storica di ~47 milioni di tonnellate corte a 0,29% Cu, 0,11% Ni) e Boulder. Per il 2025, l'azienda prevede programmi di perforazione a Chrome-Puddy e Titac, con un programma di 5000 metri programmato per Titac Nord e Sud nel secondo semestre del 2025.

L'azienda ha rafforzato il suo team di gestione nel 2024, aggiungendo competenze nei settori tecnico, finanziario e della sostenibilità, tra cui Robert G. Krause, Dr. George J. Hudak, Christopher Gulka e Dr. Ajeet Milliard.

Green Bridge Metals (GBMCF) ha anunciado logros clave de 2024 y ha delineado sus planes para 2025 para la Zona de Contacto Sur y los proyectos Chrome-Puddy. En 2024, la empresa informó sobre resultados significativos de prospección de Chrome-Puddy, revelando una amplia mineralización de óxido de hierro-níquel con muestras que devolvieron hasta el 0.38% de Ni. La empresa también adquirió una opción de ganancia del 80% para la Zona de Contacto Sur en el Duluth Complex de Minnesota.

La Zona de Contacto Sur incluye cuatro prospectos: Titac (con un Recurso Mineral Inferido de 46.6 millones de toneladas al 15% de TiO₂), Skibo (actualmente en muestreo de núcleo), Wyman-Siphon (recurso histórico de ~47 millones de toneladas cortas al 0.29% de Cu, 0.11% de Ni) y Boulder. Para 2025, la empresa planea programas de perforación en Chrome-Puddy y Titac, con un programa de 5000 metros programado para Titac Norte y Sur en la segunda mitad de 2025.

La empresa fortaleció su equipo de gestión en 2024, añadiendo experiencia en áreas técnicas, financieras y de sostenibilidad, incluyendo a Robert G. Krause, Dr. George J. Hudak, Christopher Gulka y Dr. Ajeet Milliard.

그린 브리지 메탈스 (GBMCF)는 2024년 주요 성과를 발표하고 2025년 남부 접촉 지대 및 크롬-퍼디 프로젝트에 대한 계획을 개요했습니다. 2024년에 이 회사는 크롬-퍼디에서 중요한 탐사 결과를 보고했으며, 샘플에서 최대 0.38% Ni을 반환하는 광범위한 철-니켈 산화물 광물화를 밝혔습니다. 이 회사는 또한 미네소타의 둘루스 복합체에서 남부 접촉 지대에 대한 80% 수익 옵션을 인수했습니다.

남부 접촉 지대에는 네 개의 전망이 포함됩니다: 티탁 (15% TiO₂의 추정 광물 자원 4660만 톤), 스키보 (현재 코어 샘플링 진행 중), 와이먼-사이폰 (역사적 자원 약 4700만 단톤, 0.29% Cu, 0.11% Ni) 및 볼더. 2025년에는 크롬-퍼디와 티탁에서 드릴링 프로그램을 계획하고 있으며, 2025년 하반기에는 티탁 북부와 남부에서 5000미터 프로그램이 예정되어 있습니다.

회사는 2024년에 기술, 재무 및 지속 가능성 분야의 전문성을 추가하여 관리 팀을 강화했으며, 여기에는 로버트 G. 크라우스, 조지 J. 후닥 박사, 크리스토퍼 굴카 및 아지트 밀리어드 박사가 포함됩니다.

Green Bridge Metals (GBMCF) a annoncé des réalisations clés de 2024 et a esquissé ses plans pour 2025 concernant la Zone de Contact Sud et les projets Chrome-Puddy. En 2024, l'entreprise a rapporté des résultats de prospection significatifs de Chrome-Puddy, révélant une large minéralisation en oxyde de fer-nickel avec des échantillons retournant jusqu'à 0,38 % de Ni. L'entreprise a également acquis une option de gain de 80 % pour la Zone de Contact Sud dans le Duluth Complex du Minnesota.

La Zone de Contact Sud comprend quatre perspectives : Titac (avec une Ressource Minérale Indiquée de 46,6 millions de tonnes à 15 % TiO₂), Skibo (actuellement en cours d'échantillonnage de carottes), Wyman-Siphon (ressource historique d'environ 47 millions de tonnes courtes à 0,29 % Cu, 0,11 % Ni) et Boulder. Pour 2025, l'entreprise prévoit des programmes de forage à Chrome-Puddy et Titac, avec un programme de 5000 mètres prévu pour Titac Nord et Sud au second semestre 2025.

L'entreprise a renforcé son équipe de direction en 2024, ajoutant une expertise dans les domaines technique, financier et de durabilité, notamment Robert G. Krause, Dr. George J. Hudak, Christopher Gulka et Dr. Ajeet Milliard.

Green Bridge Metals (GBMCF) hat wichtige Errungenschaften aus 2024 bekannt gegeben und seine Pläne für 2025 für die South Contact Zone und die Chrome-Puddy-Projekte skizziert. Im Jahr 2024 berichtete das Unternehmen über bedeutende Prospektionsergebnisse von Chrome-Puddy, die eine weit verbreitete Mineralisierung von Eisen-Nickel-Oxid mit Proben zeigten, die bis zu 0,38% Ni zurückgaben. Das Unternehmen erwarb außerdem eine 80%ige Earn-in-Option für die South Contact Zone im Duluth-Komplex in Minnesota.

Die South Contact Zone umfasst vier Prospekte: Titac (mit einer geschätzten Mineralressource von 46,6 Millionen Tonnen bei 15% TiO₂), Skibo (derzeit in der Kernprobenahme), Wyman-Siphon (historische Ressource von ~47 Millionen Short Tonnen bei 0,29% Cu, 0,11% Ni) und Boulder. Für 2025 plant das Unternehmen Bohrprogramme in Chrome-Puddy und Titac, mit einem 5000-Meter-Programm, das für den Norden und Süden von Titac im zweiten Halbjahr 2025 angesetzt ist.

Das Unternehmen hat sein Management-Team im Jahr 2024 verstärkt und Fachwissen in den Bereichen Technik, Finanzen und Nachhaltigkeit hinzugefügt, darunter Robert G. Krause, Dr. George J. Hudak, Christopher Gulka und Dr. Ajeet Milliard.

- Acquired 80% earn-in option for South Contact Zone with significant mineral resources

- Titac property shows Inferred Mineral Resource of 46.6M tonnes at 15% TiO₂

- Chrome-Puddy prospecting revealed high-grade samples up to 0.38% Ni

- Planned 5000-meter drill program for Titac North and South in H2 2025

- Strengthened management team with industry experts

- Historical Wyman-Siphon resource estimate not compliant with current NI 43-101 standards

- Significant portions of core samples (up to 65%) were previously left unsampled at Skibo

VANCOUVER, BC / ACCESS Newswire / February 21, 2025 / Green Bridge Metals Corporation (CSE:GRBM)(OTCQB:GBMCF)(FWB:J48, WKN:A3EW4S) ("Green Bridge" or the "Company") is pleased to announce an outline of key achievements in 2024 and provide an update on its South Contact Zone (Duluth, Minnesota, U.S.) and Chrome-Puddy (Ontario, Canada) projects as it advances exploration and development initiatives for 2025.

Message from David Suda CEO:

"We are pleased to highlight achievements from 2024 as a strong platform to create value for shareholders in 2025. In an increasingly complex geopolitical climate, we note the importance of critical metals and an urgent need to re-shore production for strategic and security reasons. Uncertainty in the geopolitical landscape between Canada and the United States, has created a backdrop bringing opportunity to investors. As investors seek shelter from potential tariff impacts around the world, Green Bridge provides value driven access to American metals on American soil."

2024 Highlights:

2024 was a transformative year for Green Bridge Metals, marked by significant exploration success and corporate milestones across its portfolio. In May, the Company announced prospecting results from the Chrome-Puddy project, revealing widespread iron-nickel oxide mineralization with the potential for bulk-tonnage nickel resources.

In June, Green Bridge acquired an

1. Chrome Puddy: Prospecting Results Highlight Bulk Tonnage Nickel Potential:

Results from prospecting at the Chrome-Puddy ultramafic intrusion revealed widespread iron-nickel oxide mineralization.

Fifty-two grab samples collected over a 2.5-kilometre strike length returned up to

0.38% Ni, averaging0.20% Ni.Channel sampling revealed consistent bulk-tonnage nickel mineralization with oxide alteration.

Included 110.4m at

0.23% Ni,11.8% Fe, and 119 ppm Co at Commerce East and 55.5m at0.25% Ni and4.6% Fe at Commerce West. Mineralization within the channel samples remains open.

Disseminated Ni mineralization lines up on the edges of two prominent conductors that are 2000m x 500m and 1000m x 200m dimensions that remain largely untested by drilling. These conductors define large scale drill targets defined by the VTEM Plus survey conducted in 2024.

2. Acquisition of Option on South Contact Zone in Duluth Complex, Minnesota:

The Company secured an

Titac: Inferred Mineral Resource Estimate (MRE) at Titac South of 46.6 million tonnes grading

Titac South also contains significant copper and vanadium that has not been included in the MRE:

571m of

0.19% Cu,0.18% Ni,0.08% V2O5462m of

0.37% Cu,0.07% V2O5145m of

0.39% Cu,0.08% V2O5

Titac North contains mineralization on order with Titac South but has not been as extensively drilled nor has a MRE been produced for the occurrence.

36m

17.7% TiO2,0.34% Cu,0.06% V2O5

Titac 2025 Drill Plan:

5000 meter drill program scheduled for Titac North and South H2 2025

Targeting for Titac East H2 2025

Entire property underexplored with respect to copper and vanadium mineralization.

VTEM survey flown over the property in 2024 expected to generate additional drill targets

Skibo: Represents a large property that is underexplored and has the potential for a significant copper and nickel discovery. At the Skibo prospect a core sampling campaign is currently underway to test previously unsampled sections of core for critical mineral content including; copper, nickel, vanadium, and titanium. Up to

Unsampled, historically drilled core is being processed and assayed to account for all potential mineralization: copper, nickel, TiO2, and vanadium.

515m of 2000m of drill core have been resampled, results anticipated Q1 2025.

Wyman-Siphon: Property on-trend with world-class copper-nickel deposits; NorthMet, Mesaba, and Maturi.

Historical inferred mineral resource estimate of ~47 million-short tonnes grading

0.29% Cu,0.11% Ni.*

Boulder: Historical drilling indicates potential for TiO2, V2O5, Cu, and minor Ni mineralization.

57m of

23.2% TiO2,0.4% V2O5,0.22% Cu,0.03% Ni37m of

26.8% TiO2,0.5% V2O5,0.19% Cu

3. Completion of Geophysical Study at South Contact Zone Properties:

Analysis of historical data revealed the geophysical signature of additional oxidized ultra mafic intrusions that are associated with copper-nickel-titanium-vanadium mineralization within the project area that have not been explored - providing key drill targets.

New VTEM survey flown over the entire Titac property at the end of 2024 - results in Q1 2025.

* As noted in the Company's 43-101 Report dated September 24, 2024 prepared by Apex Geoscience, this historical Wyman MRE was not prepared in accordance with NI 43-101 Canadian Institute of Mining Definition Standards for Mineral Resources and Mineral Reserves (May 2014) and CIM Estimation of Mineral Resources & Mineral Reserves Best Practices Guidelines (November 2019). The Company is treating the Wyman MRE as an "historical resource" and the reader is cautioned not to treat or rely on it, or any part of it, as a current mineral resource. A qualified person has not done sufficient work to classify the historical Wyman MRE as a current mineral resource. The Company would need to complete additional exploration, including twinning of historical drillholes, to verify the historical estimate as a current mineral resource. Further details on the Wyman MRE (including parameters and assumptions) can be found in the Company's 43-101 Report dated September 24, 2024 prepared by Apex Geoscience.

4. Management and Board Bolstered:

Green Bridge expanded its management and board to align with project demands, adding expertise in technical, financial, and sustainability areas.

Robert G. Krause, with four decades of mineral exploration expertise, joined the board of directors.

Dr. George J. Hudak became the Company's technical adviser for mineral development, leveraging his deep knowledge of Neoarchean-age VMS deposits.

Christopher Gulka was appointed CFO and corporate secretary, contributing over 30 years of experience in capital markets and public company leadership.

Dr. Ajeet Milliard joined as chief geologist, bringing over 14 years of experience in exploration.

2025 Outlook:

Ontario - Chrome Puddy Exploration: Drill program aimed at further defining and expanding the historical resource. Drill targets are based on nickel mineralization encountered within channel samples that coincide with large scale conductors identified from the recently completed VTEM airborne geophysical survey. Program specifics to follow in Q1 2025.

Minnesota - Skibo Exploration: Sampling and assaying of previously unrecognized disseminated copper-nickel mineralization in historical core to determine the extent of the mineralized system and to provide clear exploration vectors. Assay results are expected in Q1.

Minnesota - Titac Exploration: Drilling and metallurgical studies to expand the Titac resource and advance toward a Preliminary Economic Assessment (PEA). Titac North - the potential to significantly increase the current resources based on historical drilling not included in the 2024 MRE. In addition, new targets will be defined during Q1 from the VTEM survey flown in 2024.

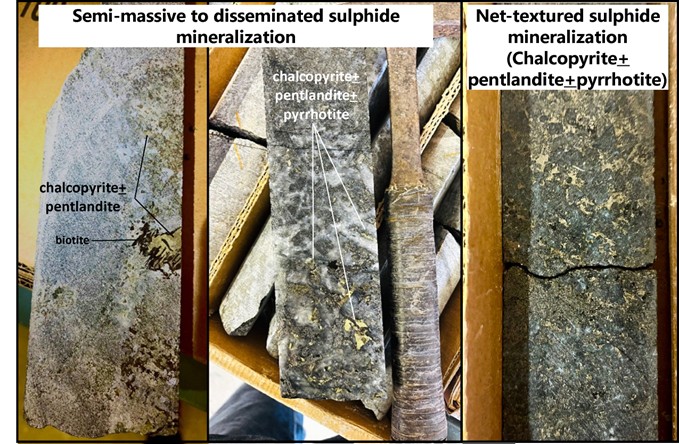

Figure 1. Photo of Skibo core sampled and shipped for assay.

US Mining Landscape in 2025: Impacts of the 2024 US Election:

The 2024 presidential election ushered in a significant shift in U.S. policy as Donald Trump secured victory, leading to a Republican-controlled government across the executive and legislative branches. This united government is poised to prioritize domestic resource development, with a strong focus on critical minerals essential for industries ranging from electric vehicles to national defence.

Early indications of policy direction suggest the Trump administration aims to accelerate mining projects by waiving environmental reviews for federally funded initiatives. This approach, according to a December 18 report by Reuters, seeks to boost domestic production of critical minerals, thereby reducing U.S. reliance on China for lithium, cobalt, and other key materials. The strategy reflects a major shift in how federal lands are managed and aligns with Trump's broader agenda of resource independence. (source: Reuters)

Analysts anticipate a continuation of trends from Trump's first term, where he invoked the Defense Production Act in 2020 to address foreign mineral reliance. However, unlike the Biden administration, which emphasized partnerships with allied nations like Australia, Trump's approach is expected to prioritize reshoring projects, focusing on the development of domestic mining operations. This strategy could further bolster funding initiatives through the Departments of Energy and Defense, building on efforts to secure a stable supply of critical materials. (source: The Oregon Group)

Adding to this, Trump has proposed sweeping tariffs of

The National Mining Association (NMA) was among the first industry groups to congratulate President-elect Trump, emphasizing the mining sector's readiness to support America's economic and strategic goals. In its statement, the NMA highlighted: "Across the country 500,000 miners stand ready to do what they have always done: deliver for our country. Together with the next Trump administration and Congress, we can increase America's competitive standing on the global stage, ensuring that made in America also means mined in America…" (source: National Mining Association)

As 2025 unfolds, the mining landscape is set to experience transformative changes driven by a renewed focus on domestic production, strategic tariffs, and deregulatory measures. These shifts are likely to redefine the U.S.'s role in the global critical minerals market, positioning the country as a leading producer and reducing reliance on foreign sources.

All scientific and technical information, and written disclosure in this news release has been prepared by, or approved by Ajeet Milliard, Ph.D., CPG, Chief Geologist for Green Bridge Metals and a qualified person (QP) for the purposes of National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

About Green Bridge Metals

Green Bridge Metals Corporation is a Canadian based exploration company focused on acquiring ‘battery metal' rich mineral assets and the development of the South Contact Zone (the "Property") along the basal contact of the Duluth Intrusion, north of Duluth, Minnesota. The South Contact Zone contains bulk-tonnage copper-nickel and titanium-vanadium in ilmenite hosted in ultramafic to oxide ultramafic intrusions. The Property has exploration targets for bulk-tonnage Ni mineralization, high grade Ni-Cu-PGE magmatic sulfide mineralization and titanium.

ON BEHALF OF GREEN BRIDGE METALS,

"David Suda"

President and Chief Executive Officer

For more information, please contact:

David Suda

President and Chief Executive Officer

Tel: 604.928-3101

investors@greenbridgemetals.com

Forward Looking Information

Certain statements and information herein, including all statements that are not historical facts, contain forward-looking statements and forward-looking information within the meaning of applicable securities laws. Such forward-looking statements or information include but are not limited to statements or information with respect to: the exploration and development of the South Contact Zone and Chrome-Puddy Properties; the timing and results (drill targets) of an upcoming VTEM airborne geophysical survey; new and evolving American/Trump administration policies with respect to the exploration and development of critical metal resources, and the effects thereon; and the Company's ability to identify any new potential mineral deposits within North America or otherwise.

Although management of the Company believe that the assumptions made and the expectations represented by such statements or information are reasonable, there can be no assurance that forward-looking statements or information herein will prove to be accurate. Forward-looking statements and information by their nature are based on assumptions and involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. These risk factors include, but are not limited to: locating mineral deposits is inherently risky; the proposed expansion drilling programs and upcoming VTEM airborne geophysical survey may not occur as currently contemplated, or at all; the exploration and development of the South Contact Zone and Chrome-Puddy Properties may not result in any commercially successful outcome for the Company; risks associated with the business of the Company; business and economic conditions in the mining industry generally; changes in general economic conditions or conditions in the financial markets; changes in laws (including regulations respecting mining concessions); and other risk factors as detailed from time to time.

The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Certain figures and references contain information supported by public and corporate references that may have been updated, changed, or modified since their referenced date.

The CSE has not approved or disapproved the contents of this news release.

SOURCE: Green Bridge Metals Corporation

View the original press release on ACCESS Newswire