Green Bridge Metals Corporation Outlines Strategic Plan

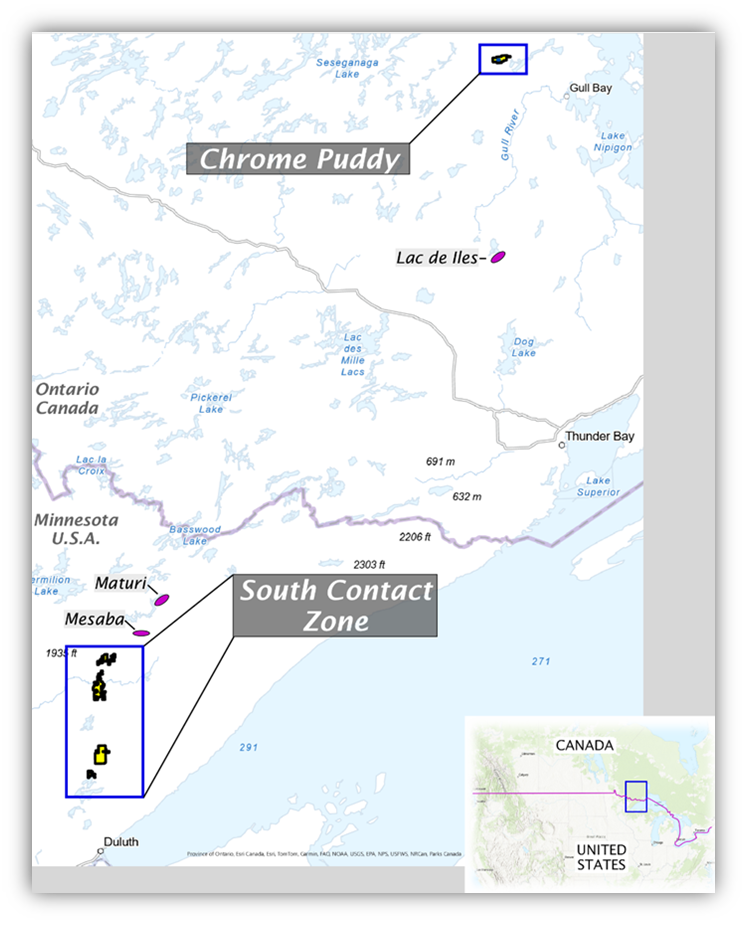

Green Bridge Metals (CNSX:GRBM, OTCQB:GBMCF) has announced a comprehensive 12-month exploration plan for its South Contact Zone (SCZ) and Chrome Puddy projects in Minnesota and Ontario, respectively. The SCZ plan will include extensive drilling and geophysical surveys to expand known mineralized systems, focusing on the Titac, Skibo, and Boulder properties. In Chrome Puddy, efforts will target historical nickel resources using state-of-the-art airborne geophysical surveys. The company aims to enhance resource estimates and identify new exploration targets. CEO David Suda emphasized the significant potential for copper, nickel, titanium, and vanadium mineralization and expects a catalyst-rich year for shareholders.

- Green Bridge Metals plans extensive exploration over the next 12 months, potentially increasing resource estimates.

- The exploration plan includes state-of-the-art geophysical surveys, enhancing the quality and precision of data.

- Focus on copper, nickel, titanium, and vanadium—metals with strong market demand.

- Historical data suggests significant resource potential in the targeted properties.

- Projects are fully funded, reducing financial risk.

- CEO David Suda highlights the experienced technical team overseeing the exploration.

- Historical resource estimates are not current, requiring verification through extensive exploration and drilling.

- No guarantee that the historical estimates can be upgraded to current mineral resources or reserves.

- Potential risk if the exploration does not yield expected results, impacting shareholder value.

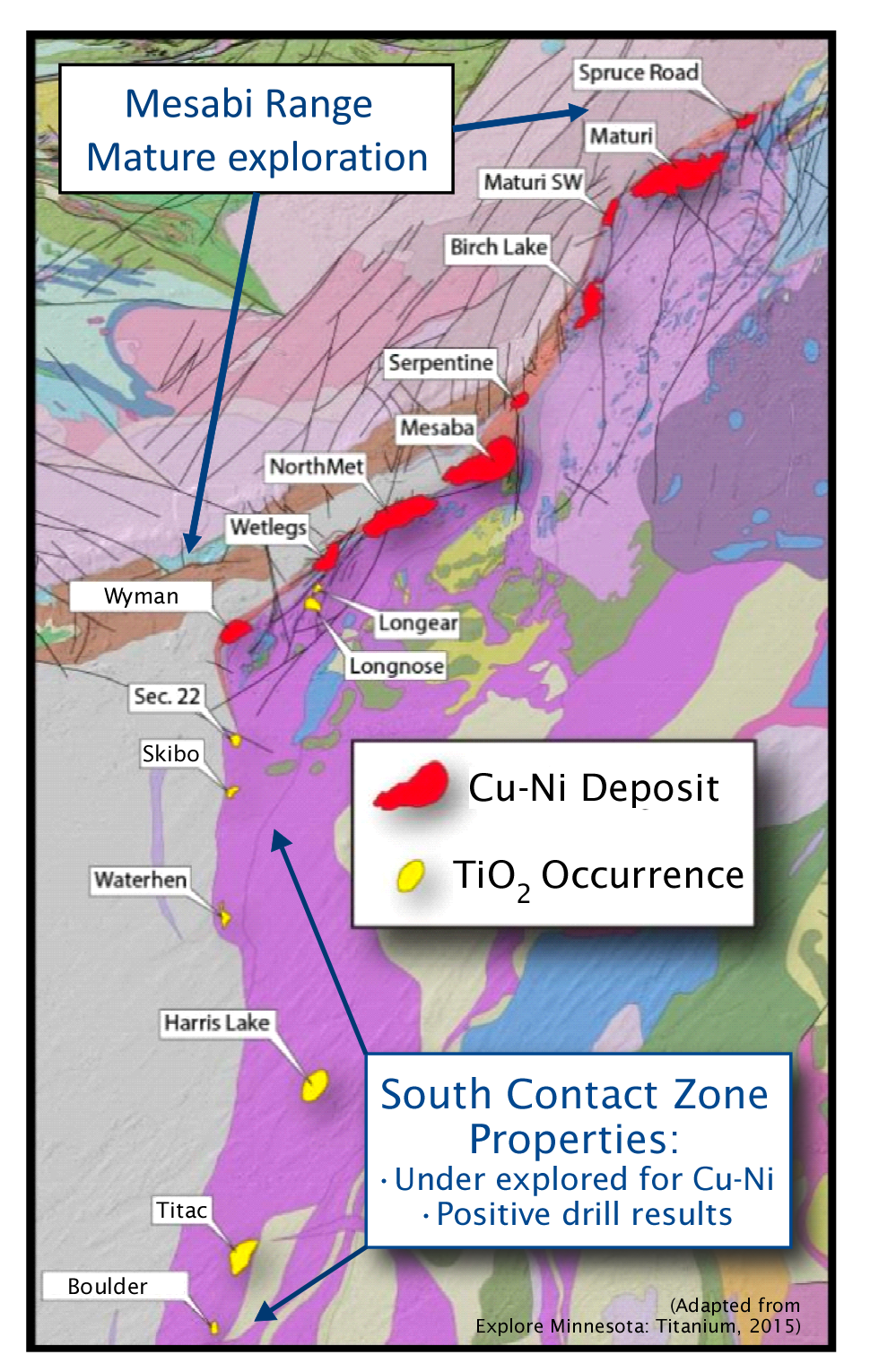

VANCOUVER, BC / ACCESSWIRE / June 25, 2024 / Green Bridge Metals Corporation (CNSX:GRBM)(OTCQB:GBMCF)(FWB:J48, WKN:A3EW4S) ("Green Bridge" or the "Company") is pleased to announce its exploration plan at its South Contact Zone ("SCZ") and Chrome Puddy ("Puddy") projects in Minnesota and Ontario respectively for the next 12 months (Figure 1). The focus of the work will be to expand upon the known mineralized systems and realize the exceptional exploration potential on both projects. The primary focus of the Company will be on the South Contact Zone group of properties (Figure 2); to prioritize drill ready, and permit additional, target areas, and broaden airborne geophysical coverage. At Chrome Puddy, targeting will focus on enhancing targeting near the historical resource through the acquisition of high quality electromagnetic airborne geophysical survey (Figure 3).

A Message from David Suda, CEO of Green Bridge Metals

"As capital markets re-awaken to the prospect of value creation in the mining space and in particular for the "critical metals" of copper and nickel, Green Bridge provides several highly prospective opportunities in North America in mining jurisdictions with proven world class endowment. We feel our timing is excellent with the imminent start-up of fully funded field programs in both Minnesota and Ontario. Our shareholders will see a catalyst rich set of work programs through for the next 12 months as plans tabled today have been designed by a seasoned, successful technical team. We are excited to have the opportunity to build on projects that have clear and demonstrated mineralization in copper, nickel, titanium, vanadium and look forward to executing on the Company's growth plans for each of the projects in our portfolio. We look forward to updating our shareholders with additional details of the strategic work plan with programs beginning this summer."

12 Month Exploration Plan

Exploration Growth South Contact Zone:

- The Company believes that the presence of Oxidized Ultramafic Intrusions (OUIs) that are associated with copper-titanium±nickel mineralization represent a new style of exploration target that has been underexplored. Disseminated copper and/or nickel mineralized OUIs are present at the Skibo, Titac, and Boulder properties and will represent the primary target of the Company's exploration plans.

- The Company's initial efforts will be at the Titac property that has a NI43-101 Inferred Resource of 45.1Mt of

15% TiO2 (Cardero Resources Corp., 2012) hosted within an OUI that also contains significant disseminated copper mineralization. Historical intercepts from surface including 462m of0.4% copper and 571.5m of0.2% copper (including 145m of0.4% Cu). - Green Bridge plans to initially drill into Titac's mineralized system to expand upon the known resource and realize the full potential for copper mineralization.

- The Company will conduct a Versatile Time Domain Electromagnetics (VTEM) geophysical survey over the Titac-Boulder property to fingerprint the signature of Titac mineralization and apply that to Boulder, which has recognized titanium and copper mineralization within an OUI similar to Titac.

- The Company will also prioritize drill ready targets in the Wyman/Siphon property that has a historical Ni-Cu resource characterized by disseminated mineralization similar to that of the world class Mesaba and Maturi deposits.

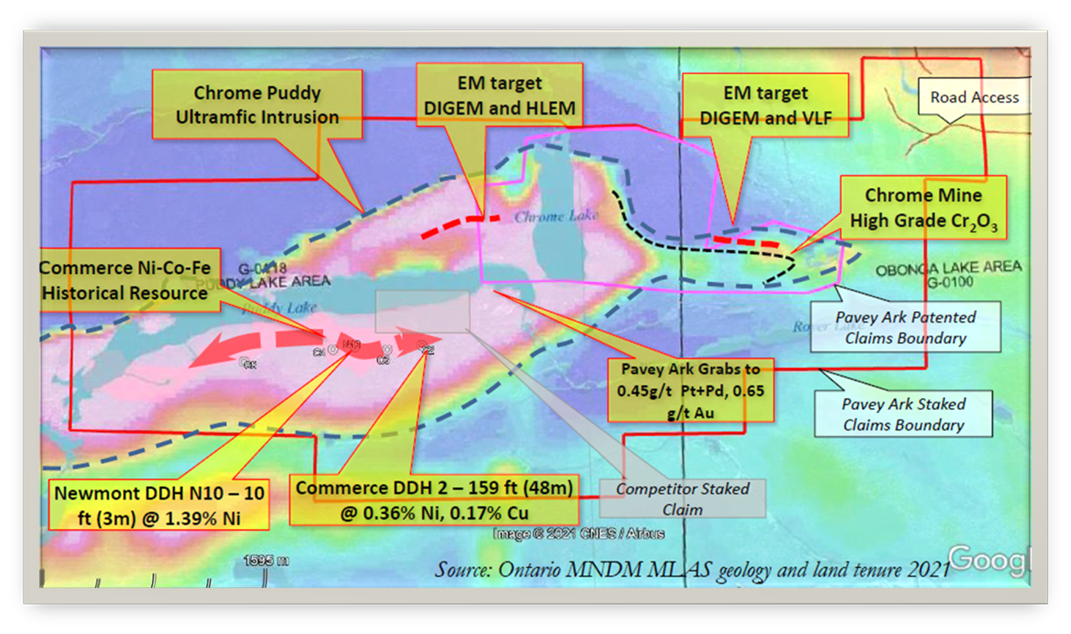

Exploration Growth Chrome Puddy:

- The Company plans to fly an airborne VTEM geophysical survey over the entire property to fingerprint the signature of the historical resource of 30Mt of

0.27% Ni (Commerce Nickel Mines Ltd., 1966) over a known mineralized trend over 2km; - The Company believes there is potential for a 100Mt exploration target within the 2km trend that will be the primary focus of the first drill campaign at the project;

- The VTEM survey will help prioritize future drill targets based on the presence of conductors.

The Chrome Puddy mineral resource estimate is not current and should be considered "historical estimates" under National Instrument 43-101 -Standards of Disclosure for Mineral Projects ("NI 43-101"). A Qualified Person has not done sufficient work to classify the historical estimate as a current mineral resource or reserve, and the Company is not treating these historical estimates as current mineral resources or reserves. The Company would need to conduct an exploration program (including drilling) in order to verify these historical estimates as current in accordance with NI 43-101. There can be no certainty, following further evaluation and/or exploration work, that these historical estimates can be upgraded or verified as mineral resources or mineral reserves in accordance with NI 43-101. As such, these historical estimates should not be relied upon.

All scientific and technical information, and written disclosure in this news release has been prepared by, or approved by Ajeet Milliard, Ph.D., CPG, Ajeet Milliard is and independent consultant and a qualified person for the purposes of National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

ON BEHALF OF GREEN BRIDGE METALS,

"David Suda"

President and Chief Executive Officer

For more information, please contact:

David Suda

President and Chief Executive Officer

Tel: 604.928-3101

investors@greenbridgemetals.com

About Green Bridge Metals

Green Bridge Metals Corporation (formerly Mich Resources Ltd.) is a Canadian based exploration company focused on acquiring ‘battery metal' rich mineral assets and the development of the South Contact Zone (the "Property") along the basal contact of the Duluth Intrusion, north of Duluth, Minnesota. The South Contact Zone contains bulk-tonnage copper-nickel and titanium-vanadium in ilmenite hosted in ultramafic to oxide ultramafic intrusions. The Property has exploration targets for bulk-tonnage Ni mineralization, high grade Ni-Cu-PGE magmatic sulfide mineralization and titanium.

Forward Looking Information

Certain statements and information herein, including all statements that are not historical facts, contain forward-looking statements and forward-looking information within the meaning of applicable securities laws. Such forward-looking statements or information include but are not limited to statements or information with respect to: the exploration and development of the South Contact Zone Properties.

Although management of the Company believe that the assumptions made and the expectations represented by such statements or information are reasonable, there can be no assurance that forward-looking statements or information herein will prove to be accurate. Forward-looking statements and information by their nature are based on assumptions and involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. These risk factors include, but are not limited to: the exploration and development of the South Contact Zone Properties may not result in any commercially successful outcome for the Company; risks associated with the business of the Company; business and economic conditions in the mining industry generally; changes in general economic conditions or conditions in the financial markets; changes in laws (including regulations respecting mining concessions); and other risk factors as detailed from time to time.

The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Certain figures and references contain information supported by public and corporate references that may have been updated, changed, or modified since their referenced date. The Company has not reviewed any resources and cannot comment on their accuracy.

References

Farrow, D., Johnson, M., (2012), January 2012 National Instrument 43-101Technical Report on the Titac Ilmenite Exploration Project, Minnesota, USA. SRK Consulting (Canada) Inc. SRK Project Number 2CC031.004. Cardero Resources Corp.

SOURCE: Green Bridge Metals Corporation

View the original press release on accesswire.com