Galiano Gold Provides Nkran Exploration Update

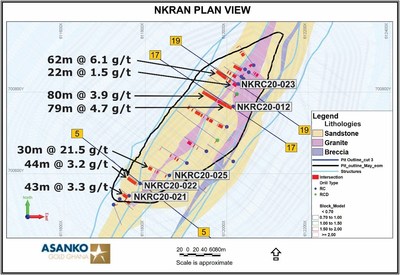

Galiano Gold Inc. (TSX: GAU, NYSE: GAU) has provided an update on its exploration program at the Asanko Gold Mine in Ghana. The completed 33-hole drilling program at the Nkran pit has confirmed and improved confidence in the Mineral Reserve Estimate for the upcoming Cut 3 phase, with significant gold intercepts reported.

Highlights include Hole 025 yielding 30 meters at 21.5 g/t gold. The current focus includes evaluating a transition to underground mining. The second phase of drilling is underway to test mineralization in planned waste pushbacks. An updated Mineral Resource and Reserve Estimate is expected by Q1 2021.

- 33-hole drilling program completed at Nkran pit confirming and enhancing Mineral Reserve Estimate.

- Significant gold intercepts reported, including 30 meters at 21.5 g/t gold.

- Improved confidence in Nkran's third Cut mine planning with potential for underground transition.

- Further drilling and engineering required to finalize Cut 3 design and potential underground transition.

VANCOUVER, BC, Sept. 8, 2020 /PRNewswire/ - Galiano Gold Inc. ("Galiano" or the "Company") (TSX: GAU) (NYSE: GAU) (formerly Asanko Gold Inc.) is pleased to announce an update from its 2020 exploration program underway at the Asanko Gold Mine ("AGM"), located in Ghana, West Africa. The AGM is a 50:50 joint venture ("JV") with Gold Fields Ltd (JSE, NYSE: GFI), which is managed and operated by Galiano. In addition to the previously announced 2020 exploration program at the AGM (see news release dated May 5, 2020) consisting of approximately 36,000m of Diamond (DD) and Reverse Circulation (RC) drilling, the Company has completed a 33 hole drilling program at the AGM's Nkran pit. The program was designed to both confirm and improve confidence in the Mineral Reserve Estimate for the third phase of mining at Nkran as well as test the extent of mineralization below the proposed Cut 3 pit shell. Mining of Cut 3 is contemplated to start in late 2022.

Highlights

- Drilling highlights (see Table 1 for details):

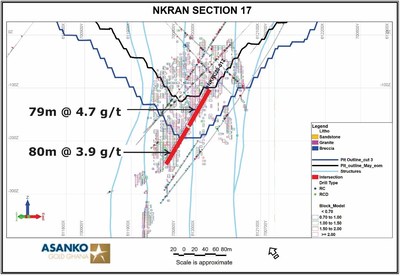

- Hole 012: 79 meters @ 4.7 g/t gold (from 1m to 80m) and

80 meters @ 3.9 g/t gold (from 84m to 164m) - Hole 021: 43 meters @ 3.3 g/t gold (from 1m to 44m)

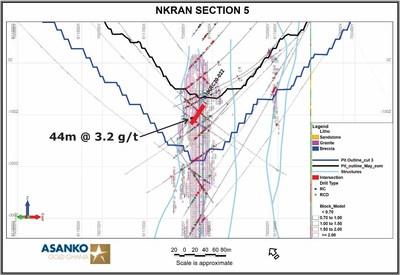

- Hole 022: 44 meters @ 3.2 g/t gold (from 14m to 58m)

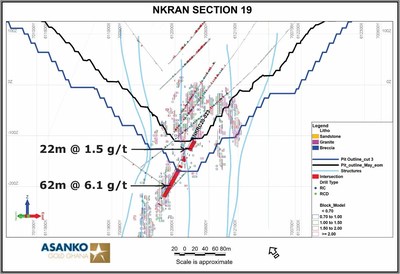

- Hole 023: 62 meters @ 6.1 g/t gold (from 65m to 127m)

- Hole 025: 30 meters @ 21.5 g/t gold (from 128m to 158m)

- Hole 026: 27 meters @ 4.9 g/t gold (from 137m to 164m)

- Hole 028: 27 meters @ 3.7 g/t gold (from 93m to 120m)

- Improved confidence in estimated Indicated Mineral Resources for Cut 3 mine planning

- Identification of mineralization continuing below the currently planned Cut 3

- Further work required to evaluate a potential transition of Nkran to an underground mine

- All core logging and sampling has been completed and all results have been received

"Our in-pit drilling program has indicated that the Nkran mineralized system is continuing to depth," said Greg McCunn, Chief Executive Officer. "While the drilling has improved our confidence in the third cut of the open pit that was envisioned in our life of mine plan, the results indicate that further drilling and engineering is required to determine if Nkran Cut 3 can be expanded or should be transitioned from an open pit to an underground mine."

Nkran Cut 3 Ongoing Work

The Nkran pit is located immediately adjacent to the 5.4 million tonne per annum processing plant and has been the main source of ore at the AGM since commercial production commenced in 2016. Cut 2 of the open pit operations was depleted at the end of Q2 2020 and in-pit drilling commenced in early July. Cut 3 is envisioned to commence waste stripping operations in late 2022 as part of the life of mine plan. Mineral Resources and Reserves1 estimated at Nkran as at December 31, 2019 were as follows:

- 8.5 Mt of Indicated Mineral Resources at 2.14 g/t gold (586 koz contained gold), including

- 10.9 Mt of Probable Mineral Reserves at 1.64 g/t gold (577koz contained gold)

______________________ |

1 Refer to the Company's NI 43-101 Technical Report (amended and restated) for the Asanko Gold Mine dated June 9, 2020 for further information on Mineral Reserves and Resources stated as at December 31, 2020, including the key assumptions, parameters and methods used to estimate the Mineral Resources and Reserves and risks associated with the Mineral Resource and Reserve estimate. The estimated Mineral Resources are reported inclusive of estimated Mineral Reserves. Generally for the Asanko Gold Mine, Mineral Resources were estimated using a |

The July 2020 drill program was designed to improve confidence in the Cut 3 Resource Estimate for continued open pit operation. In total, 4,591 meters of RC and DD drilling were completed with key intercepts shown in Table 1. Estimates of the contribution of this material to the Mineral Resources and Reserves at the AGM is expected to be included in the end-of-year updated Mineral Resource and Reserve Estimate expected to be dated December 31, 2020 and published in Q1 2021.

A second phase of drilling was initiated in August 2020 and is currently underway with one drill rig operating. The second phase drill program consists of 26 RC holes which will be drilled from surface around the existing pit rim, testing for mineralization in push-back zones for the proposed Cut 3 waste material.

In addition, a geotechnical drilling and engineering campaign has been initiated targeting the proposed new west wall location for Cut 3. Previous instability in the west wall of the Nkran pit has largely been attributed to the presence of a small waste dump created in the early 2000's by prior oxide mining operations. Cut 3 development envisions removing all of this waste dump, potentially improving the geotechnical conditions in the new west wall.

Upon completion of the current drilling and geotechnical work, it is expected that the design of Cut 3 will be finalized and a definitive mine plan and capital cost estimate completed in early 2021.

Table 1. Key intercepts in Current Nkran Drill Holes

Hole_ID | From | To | Grade | Intercept Description |

NKRC20-012 | 1 | 80 | 4.7 | 79m @ 4.7 g/t |

NKRC20-012 | 84 | 164 | 3.9 | 80m @ 3.9 g/t |

NKRC20-013 | 0 | 2 | 0.6 | 2m @ 0.6 g/t |

NKRC20-013 | 35 | 49 | 0.6 | 14m @ 0.6 g/t |

NKRC20-014 | 12 | 49 | 1.3 | 37m @ 1.3 g/t |

NKRC20-015 | 25 | 28 | 1.8 | 3m @ 1.8 g/t |

NKRC20-015 | 34 | 41 | 1.8 | 7m @ 1.8 g/t |

NKRC20-015 | 46 | 60 | 1 | 14m @ 1.0 g/t |

NKRC20-016 | 1 | 10 | 0.7 | 9m @ 0.7 g/t |

NKRC20-016 | 50 | 62 | 2.1 | 12m @ 2.1 g/t |

NKRC20-016 | 66 | 70 | 1.3 | 4m @ 1.3 g/t |

NKRC20-016 | 88 | 90 | 0.9 | 2m @ 0.9 g/t |

NKRC20-017 | 19 | 23 | 4.9 | 4m @ 4.9 g/t |

NKRC20-017 | 32 | 44 | 1.4 | 12m @ 1.4 g/t |

NKPC20-018 | 0 | 5.86 | 2.2 | 5.86m @ 2.2 g/t |

NKPC20-018 | 9 | 20 | 0.6 | 11m @ 0.6 g/t |

NKPC20-018 | 40 | 44.75 | 6.7 | 4.75m @ 6.7 g/t |

NKPC20-018 | 50.1 | 57 | 1.3 | 6.9m @ 1.3 g/t |

NKPC20-018 | 81 | 86 | 0.8 | 5m @ 0.8 g/t |

NKPC20-018 | 91.14 | 97 | 0.5 | 5.86m @ 0.5 g/t |

NKPC20-018 | 101 | 133.15 | 3.9 | 32.15m @ 3.9 g/t |

NKRC20-019 | 27 | 41 | 1 | 14m @ 1.0 g/t |

NKRC20-019 | 49 | 54 | 0.8 | 5m @ 0.8 g/t |

NKRC20-019 | 59 | 63 | 0.7 | 4m @ 0.7 g/t |

NKRC20-020 | 3 | 5 | 1.5 | 2m @ 1.5 g/t |

NKRC20-021 | 1 | 44 | 3.3 | 43m @ 3.3 g/t |

NKRC20-021 | 48 | 51 | 1.1 | 3m @ 1.1 g/t |

NKRC20-021 | 62 | 69 | 1.2 | 7m @ 1.2 g/t |

NKRC20-022 | 8 | 10 | 2.6 | 2m @ 2.6 g/t |

NKRC20-022 | 14 | 58 | 3.2 | 44m @ 3.2 g/t |

NKRC20-023 | 1 | 23 | 1.5 | 22m @ 1.5 g/t |

NKRC20-023 | 37 | 48 | 1.3 | 11m @ 1.3 g/t |

NKRC20-023 | 57 | 61 | 0.6 | 4m @ 0.6 g/t |

NKRC20-023 | 65 | 127 | 6.1 | 62m @ 6.1 g/t |

NKRC20-023 | 143 | 145 | 1.2 | 2m @ 1.2 g/t |

NKPC20-024 | 2 | 18 | 1.5 | 16m @ 1.5 g/t |

NKPC20-024 | 60 | 63 | 0.5 | 3m @ 0.5 g/t |

NKPC20-024 | 87.1 | 97 | 2 | 9.9m @ 2.0 g/t |

NKPC20-024 | 103.9 | 109 | 1.2 | 5.1m @ 1.2 g/t |

NKPC20-024 | 117 | 136 | 4.2 | 19m @ 4.2 g/t |

NKPC20-024 | 149 | 151 | 3.8 | 2m @ 3.8 g/t |

NKPC20-024 | 216 | 219.14 | 0.9 | 3.14m @ 0.9 g/t |

NKRC20-025 | 15 | 22 | 1.5 | 7m @ 1.5 g/t |

NKRC20-025 | 71 | 73 | 2.4 | 2m @ 2.4 g/t |

NKRC20-025 | 79 | 86 | 2.6 | 7m @ 2.6 g/t |

NKRC20-025 | 98 | 102 | 1.8 | 4m @ 1.8 g/t |

NKRC20-025 | 128 | 158 | 21.5 | 30m @ 21.5 g/t |

NKRC20-026 | 1 | 2 | 0.7 | 1m @ 0.7 g/t |

NKRC20-026 | 15 | 36 | 2.5 | 21m @ 2.5 g/t |

NKRC20-026 | 40 | 42 | 2.4 | 2m @ 2.4 g/t |

NKRC20-026 | 68 | 85 | 1.7 | 17m @ 1.7 g/t |

NKRC20-026 | 89 | 99 | 2.1 | 10m @ 2.1 g/t |

NKRC20-026 | 114 | 117 | 3.1 | 3m @ 3.1 g/t |

NKRC20-026 | 124 | 133 | 2.1 | 9m @ 2.1 g/t |

NKRC20-026 | 137 | 164 | 4.9 | 27m @ 4.9 g/t |

NKRC20-026 | 179 | 184 | 0.6 | 5m @ 0.6 g/t |

NKRC20-026 | 199 | 209 | 3.3 | 10m @ 3.3 g/t |

NKRC20-027 | 46 | 49 | 1.7 | 3m @ 1.7 g/t |

NKRC20-028 | 48 | 51 | 0.8 | 3m @ 0.8 g/t |

NKRC20-028 | 72 | 77 | 0.9 | 5m @ 0.9 g/t |

NKRC20-028 | 93 | 120 | 3.7 | 27m @ 3.7 g/t |

NKRC20-029 | 14 | 30 | 5.2 | 16m @ 5.2 g/t |

NKRC20-029 | 35 | 69 | 1.3 | 34m @ 1.3 g/t |

NKRC20-029 | 74 | 81 | 0.5 | 7m @ 0.5 g/t |

NKRC20-029 | 120 | 125 | 1.1 | 5m @ 1.1 g/t |

NKRC20-029 | 162 | 166 | 2.4 | 4m @ 2.4 g/t |

NKRC20-030 | 46 | 53 | 1.6 | 7m @ 1.6 g/t |

NKRC20-030 | 60 | 66 | 1 | 6m @ 1.0 g/t |

NKRC20-030 | 89 | 94 | 1.7 | 5m @ 1.7 g/t |

NKRC20-030 | 153 | 155 | 0.7 | 2m @ 0.7 g/t |

NKPC20-031 | 59 | 62.6 | 3 | 3.6m @ 3.0 g/t |

NKPC20-031 | 75.2 | 87.25 | 1.1 | 12.05m @ 1.1 g/t |

NKPC20-031 | 93 | 97.27 | 0.6 | 4.27m @ 0.6 g/t |

NKPC20-031 | 106 | 111 | 1.6 | 5m @ 1.6 g/t |

NKPC20-031 | 127 | 129 | 1.6 | 2m @ 1.6 g/t |

NKPC20-031 | 133 | 136.98 | 1.3 | 3.98m @ 1.3 g/t |

NKPC20-031 | 151.1 | 155 | 25.3 | 3.9m @ 25.3 g/t |

NKRC20-032 | 1 | 7 | 1.9 | 6m @ 1.9 g/t |

NKRC20-032 | 12 | 52 | 2.9 | 40m @ 2.9 g/t |

NKRC20-033 | 22 | 24 | 0.6 | 2m @ 0.6 g/t |

NKRC20-033 | 54 | 58 | 2.4 | 4m @ 2.4 g/t |

NKRC20-033 | 71 | 73 | 0.9 | 2m @ 0.9 g/t |

NKRC20-033 | 78 | 90 | 2.7 | 12m @ 2.7 g/t |

NKRC20-033 | 102 | 105 | 0.8 | 3m @ 0.8 g/t |

NKRC20-033 | 112 | 158 | 2.5 | 46m @ 2.5 g/t |

NKRC20-033 | 164 | 170 | 1.3 | 6m @ 1.3 g/t |

NKRC20-034 | 46 | 49 | 2.7 | 3m @ 2.7 g/t |

NKRC20-034 | 85 | 89 | 7.9 | 4m @ 7.9 g/t |

NKPC20-035 | 2 | 5 | 0.7 | 3m @ 0.7 g/t |

NKPC20-035 | 38.7 | 42 | 9.7 | 3.3m @ 9.7 g/t |

NKPC20-035 | 120 | 125 | 0.7 | 5m @ 0.7 g/t |

NKPC20-035 | 130 | 144 | 2 | 14m @ 2.0 g/t |

NKPC20-035 | 147.66 | 157.9 | 4.2 | 10.24m @ 4.2 g/t |

NKPC20-035 | 164 | 167.94 | 1 | 3.94m @ 1.0 g/t |

NKRC20-036 | 63 | 68 | 1.2 | 5m @ 1.2 g/t |

NKRC20-036 | 78 | 88 | 2.3 | 10m @ 2.3 g/t |

NKRC20-037 | 64 | 68 | 0.9 | 4m @ 0.9 g/t |

NKRC20-037 | 79 | 83 | 1.2 | 4m @ 1.2 g/t |

NKRC20-038 | 41 | 44 | 1.8 | 3m @ 1.8 g/t |

NKPC20-039 | 80 | 82.04 | 0.8 | 2.04m @ 0.8 g/t |

NKPC20-039 | 93.13 | 120 | 3.4 | 26.87m @ 3.4 g/t |

NKPC20-039 | 124 | 136.2 | 4 | 12.2m @ 4.0 g/t |

NKPC20-039 | 150.85 | 153 | 12.2 | 2.15m @ 12.2 g/t |

NKRC20-040 | 64 | 71 | 0.8 | 7m @ 0.8 g/t |

NKRC20-041 | 45 | 48 | 1.7 | 3m @ 1.7 g/t |

NKRC20-043 | 46 | 59 | 0.8 | 13m @ 0.8 g/t |

NKRC20-043 | 64 | 104 | 5.5 | 40m @ 5.5 g/t |

Note: Intervals indicated are not true widths as there is insufficient geologic information to calculate true widths. However, drill holes have been drilled to cross interpreted mineralized zones as close to perpendicular as possible. Intercepts in bold are those listed in the Highlights.

Nkran Underground Potential

In parallel to the Cut 3 drilling and engineering work underway for Nkran, the Company is evaluating the potential to transition Nkran to an underground mine, either prior to or following the completion of Cut 3. Planned work over the coming months will include planning for an underground exploration decline, development of a drilling program to follow-up on testing the extent of the mineralized system at depth and completing a conceptual study to investigate the potential of transitioning Nkran to an underground mine.

Nkran Geology and Cross Sections

The Nkran geological setting is typical of the Asankrangwa belt with a sedimentary sequence of interlayered shale, siltstone, and sandstone. Two granitic bodies intrude along shear zones that control mineralization which dips steeply to the northwest along with the sheared host stratigraphy. The mineralization indicated by the Company's drilling program and reported in this press release lies within and below the currently planned Cut 3 pushback of the Nkran pit. The grade and continuity of the mineralization indicated by the Company's drilling program are sufficient to warrant evaluation of this mineralization for potential underground mining.

Figure 1 shows the location of drill holes and intercepts. Cross sections (Figures 2, 3, and 4) demonstrate the location of intercepts with current block model and Cut 3 plans. Review and reassessment of the current block model is planned in light of these new results.

Qualified Person and QA/QC

Dr. Paul Klipfel, CPG, Senior Vice President Exploration of Galiano Gold Inc., is a Qualified Person as defined by Canadian NI 43-101 and has supervised the preparation of the scientific and technical information that forms the basis for this news release. Dr. Klipfel is responsible for all aspects of the work including the Quality Control/Quality Assurance programs and has verified the data disclosed. Dr. Klipfel is not independent of Galiano Gold Inc.

Certified Reference Materials and Blanks are inserted by Galiano Gold into the sample stream at the rate of 1:14 samples. Field duplicates are collected at the rate of 1:30 samples. All samples have been analysed by Intertek Minerals Ltd. in Tarkwa, Ghana with standard preparation methods and 50g fire assay with atomic absorption finish. Intertek Minerals Ltd. does their own introduction of QA/QC samples into the sample stream and reports them to Galiano for double checking. Higher grade samples are re-analysed from pulp or reject material or both. Intertek is an international company operating in 100 countries and is independent of Galiano. It provides testing for a wide range of industries including the mining, metals, and oil sectors.

About Galiano Gold Inc.

Galiano is focused on creating a sustainable business capable of long-term value creation for its stakeholders through exploration and disciplined deployment of its financial resources. The company currently operates and manages the Asanko Gold Mine, located in Ghana, West Africa which is jointly owned with Gold Fields Ltd. The Company is strongly committed to the highest standards for environmental management, social responsibility, and health and safety for its employees and neighbouring communities. For more information, please visit www.galianogold.com.

Cautionary Note Regarding Forward-Looking Statements

Certain statements and information contained in this news release constitute "forward-looking statements" within the meaning of applicable U.S. securities laws and "forward-looking information" within the meaning of applicable Canadian securities laws, which we refer to collectively as "forward-looking statements". Forward-looking statements are statements and information regarding possible events, conditions or results of operations that are based upon assumptions about future conditions and courses of action. All statements and information other than statements of historical fact may be forward looking statements. In some cases, forward-looking statements can be identified by the use of words such as "seek", "expect", "anticipate", "budget", "plan", "estimate", "continue", "forecast", "intend", "believe", "predict", "potential", "target", "may", "could", "would", "might", "will" and similar words or phrases (including negative variations) suggesting future outcomes or statements regarding an outlook.

Forward-looking statements in this news release include, but are not limited to: statements regarding future mining at the Nkran pit, including with respect to the nature and extent of the Cut 3 pushback at the Nkran pit and the commencement of further mining at the Nkran pit commencing in late 2022; the ability of future mining operations at the Nkran pit to improve geotechnical condition of the west wall of the Nkran pit; the nature and extent of indicated system of mineralization at the Nkran pit; the presence of Mineral Resources and Reserves at the Nkran pit; statements regarding the completion and timing of an updated definitive mine plan and capital cost estimate; statements with respect to the Company's exploration program, including the expected results of the exploration program (including its ability to delineate further mineralization at the Nkran pit) and the nature and timing of future exploration programs; information regarding planned future exploration, drilling and mining; statements regarding the potential to transition Nkran from an open-pit mine to an underground mine and the work planned by the Company in connection with exploring the viability of this potential transition; and the anticipated inclusion of drill results, and the mineralization defined thereby, if any, in the AGM's planned annual Mineral Reserve update as at December 31, 2020. Such forward-looking statements are based on a number of material factors and assumptions, including, but not limited to: the exploration program proceeding as anticipated; the exploration program achieving the targets and milestones included therein in the manner and on the timelines anticipated therein; the nature of drilling and exploration targets conforming to current expectations; mining at the Nkran pit proceeding as currently anticipated; the Company proceeding with further exploration programs as currently anticipated;; the ability of the AGM to continue to operate during the COVID-19 pandemic; that gold production and other activities will not be curtailed as a result of the COVID-19 pandemic; that the AGM will be able to continue to ship doré from the AGM site to be refined; that the doré produced by the AGM will continue to be able to be refined at similar rates and costs to the AGM, or at all; that the other current or potential future effects of the COVID-19 pandemic on the Company's business, operations and financial position, including restrictions on the movement of persons (and in particular, the AGM's workforce), restrictions on business activities, including access to the AGM, restrictions on the transport of goods, trade restrictions, increases in the cost of necessary inputs, reductions in the availability of necessary inputs and productivity and operational constraints, will not impact its 2020 production and cost guidance; that the Company's and the AGM's responses to the COVID-19 pandemic will be effective in continuing its operations in the ordinary course; the accuracy of the estimates and assumptions underlying Mineral Resource and Mineral Reserve estimates and prior exploration results, including future gold prices, cut-off grades and production and processing estimates; the successful completion of development and exploration projects, planned expansions or other projects within the timelines anticipated and at anticipated production levels; that mineral resources can be developed as planned; that the Company's relationship with joint venture partners will continue to be positive and beneficial to the Company; interest and exchange rates; that required financing and permits will be obtained; general economic conditions; that labour disputes or disruptions, flooding, ground instability, geotechnical failure, fire, failure of plant, equipment or processes to operate are as anticipated and other risks of the mining industry will not be encountered; that contracted parties provide goods or services in a timely manner; that there is no material adverse change in the price of gold or other metals; competitive conditions in the mining industry; title to mineral properties; costs; taxes; the retention of the Company's key personnel; and changes in laws, rules and regulations applicable to Galiano.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements to differ materially from those anticipated in such forward-looking statements. The Company believes the expectations reflected in such forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct and you are cautioned not to place undue reliance on forward-looking statements contained herein. Some of the risks and other factors which could cause actual results to differ materially from those expressed in the forward-looking statements contained in this news release, include, but are not limited to: the Company's and/or the AGM's operations may be curtailed or halted entirely as a result of the COVID-19 pandemic, whether as a result of governmental or regulatory law or pronouncement, or otherwise; that the doré produced at the AGM may not be able to be refined at expected levels, on expected terms or at all; that the Company and/or the AGM will experience increased operating costs as a result of the COVID-19 pandemic; that the AGM may not be able to source necessary inputs on commercially reasonable terms, or at all; the Company's and the AGM's responses to the COVID-19 pandemic may not be successful in continuing its operations in the ordinary course; mineral reserve and resource estimates may change and may prove to be inaccurate; life of mine estimates are based on a number of factors and assumptions and may prove to be incorrect; AGM has a limited operating history and is subject to risks associated with establishing new mining operations; sustained increases in costs, or decreases in the availability, of commodities consumed or otherwise used by the Company may adversely affect the Company; actual production, costs, returns and other economic and financial performance may vary from the Company's estimates in response to a variety of factors, many of which are not within the Company's control; adverse geotechnical and geological conditions (including geotechnical failures) may result in operating delays and lower throughput or recovery, closures or damage to mine infrastructure; the ability of the Company to treat the number of tonnes planned, recover valuable materials, remove deleterious materials and process ore, concentrate and tailings as planned is dependent on a number of factors and assumptions which may not be present or occur as expected; the Company's operations may encounter delays in or losses of production due to equipment delays or the availability of equipment; the Company's operations are subject to continuously evolving legislation, compliance with which may be difficult, uneconomic or require significant expenditures; the Company may be unsuccessful in attracting and retaining key personnel; labour disruptions could adversely affect the Company's operations; the Company's business is subject to risks associated with operating in a foreign country; risks related to the Company's use of contractors; the hazards and risks normally encountered in the exploration, development and production of gold; the Company's operations are subject to environmental hazards and compliance with applicable environmental laws and regulations; the Company's operations and workforce are exposed to health and safety risks; unexpected costs and delays related to, or the failure of the Company to obtain, necessary permits could impede the Company's operations; the Company's title to exploration, development and mining interests can be uncertain and may be contested; the Company's properties may be subject to claims by various community stakeholders; risks related to limited access to infrastructure and water; the Company's exploration programs may not successfully expand its current mineral reserves or replace them with new reserves; the Company's common shares may experience price and trading volume volatility; the Company's revenues are dependent on the market prices for gold, which have experienced significant recent fluctuations; the Company may not be able to secure additional financing when needed or on acceptable terms; Company shareholders may be subject to future dilution; risks related to changes in interest rates and foreign currency exchange rates; changes to taxation laws applicable to the Company may affect the Company's profitability and ability to repatriate funds; the Company's primary asset is held through a joint venture, which exposes the Company to risks inherent to joint ventures, including disagreements with joint venture partners and similar risks; risks related to the Company's internal controls over financial reporting and compliance with applicable accounting regulations and securities laws; the carrying value of the Company's assets may change and these assets may be subject to impairment charges; the Company may be liable for uninsured or partially insured losses; the Company may be subject to litigation; the Company may be unsuccessful in identifying targets for acquisition or completing suitable corporate transactions, and any such transactions may not be beneficial to the Company or its shareholders; the Company must compete with other mining companies and individuals for mining interests; and risks related to information systems security threats.

Although the Company has attempted to identify important factors that could cause actual results or events to differ materially from those described in the forward-looking statements, you are cautioned that this list is not exhaustive and there may be other factors that the Company has not identified. Furthermore, the Company undertakes no obligation to update or revise any forward-looking statements included in, or incorporated by reference in, this news release if these beliefs, estimates and opinions or other circumstances should change, except as otherwise required by applicable law.

Cautionary Note to US Investors Regarding Mineral Reporting Standards:

As a British Columbia corporation and a "reporting issuer" under Canadian securities laws, the Company is required to provide disclosure regarding its mineral properties, including the AGM, in accordance with Canadian National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101"). NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. In accordance with NI 43-101, the Company uses the terms mineral reserves and resources as they are defined in accordance with the CIM Definition Standards on mineral reserves and resources (the "CIM Definition Standards") adopted by the Canadian Institute of Mining, Metallurgy and Petroleum. In particular, the terms "mineral reserve", "proven mineral reserve", "probable mineral reserve", "mineral resource", "measured mineral resource", "indicated mineral resource" and "inferred mineral resource" used in this press release are Canadian mining terms defined in accordance with CIM Definition Standards. These definitions differ from the definitions in the disclosure requirements promulgated by the SEC. Accordingly, information contained in this press release may not be comparable to similar information made public by U.S. companies reporting pursuant to SEC disclosure requirements.

United States investors are also cautioned that while the SEC will now recognize "measured mineral resources", "indicated mineral resources" and "inferred mineral resources", investors should not to assume that any part or all of the mineralization in these categories will ever be converted into a higher category of mineral resources or into mineral reserves. Mineralization described using these terms has a greater amount of uncertainty as to their existence and feasibility than mineralization that has been characterized as reserves. Accordingly, investors are cautioned not to assume that any "measured mineral resources", "indicated mineral resources", or "inferred mineral resources" that the Company reports are or will be economically or legally mineable.

Further, "inferred resources" have a greater amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Therefore, United States investors are also cautioned not to assume that all or any part of the inferred resources exist. In accordance with Canadian rules, estimates of "inferred mineral resources" cannot form the basis of feasibility or other economic studies, except in limited circumstances where permitted under NI 43-101.

Neither Toronto Stock Exchange nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release.

![]() View original content to download multimedia:http://www.prnewswire.com/news-releases/galiano-gold-provides-nkran-exploration-update-301125195.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/galiano-gold-provides-nkran-exploration-update-301125195.html

SOURCE Galiano Gold Inc.

FAQ

What is the latest update on Galiano Gold Inc. (GAU) exploration program?

What were the highlights from Galiano Gold's drilling program at Nkran pit?

When is the updated Mineral Resource and Reserve Estimate expected for Galiano Gold (GAU)?