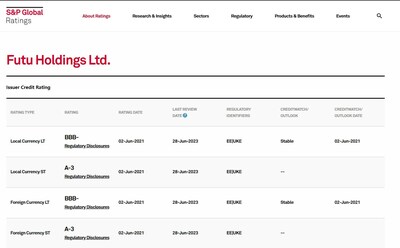

S&P Expects A Steady Increase in Futu's Overseas Client Base, Reaffirms Its BBB- Rating

- Futu received a positive long-term issuer credit rating from S&P for the third consecutive year, indicating confidence in the company's growth potential and client retention. The expansion into Canada and other markets is expected to provide lucrative opportunities for investors, especially in the US stock market.

- None.

Insights

Analyzing...

In S&P's report, Futu was expected to steadily grow its client base over the next two years, particularly in overseas markets.

S&P believes that Futu will be able to continue serving its existing mainland client base. Futu continues to offer quality trading services to its existing mainland

Meanwhile, S&P underscored Futu's good track record of client retention in the last few years. According to Futu' financial reports, the company's paying client retention rate has maintained at approximately

S&P also mentioned that the expansion of Futu's product offering and services will enhance clients' engagement and retention, and bring more stable recurring income streams for the next two to three years.

The rating agency reiterated Futu's good share in

Futu announced its overseas subsidiaries expanded footprints into

About Futu

Futu Holdings Limited ("Futu") (Nasdaq: FUTU) is an advanced fintech company upgrading the investing experience by offering fully digitalized financial services in multiple markets. Futu was listed on Nasdaq on March 8, 2019. Futu offers market data, financial news, interactive social features, and investor education on its proprietary one-stop digital platforms Futubull and moomoo. Its subsidiaries provide clients with investing services including trading and clearing services for

Contact - futupr@futunn.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/sp-expects-a-steady-increase-in-futus-overseas-client-base-reaffirms-its-bbb--rating-301899671.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/sp-expects-a-steady-increase-in-futus-overseas-client-base-reaffirms-its-bbb--rating-301899671.html

SOURCE Futu Holdings