Foremost Lithium Announces Option Agreement with Denison on 10 Uranium Projects Spanning over 330,000 Acres in the Athabasca Basin, Saskatchewan

Foremost Lithium (NASDAQ: FMST) has announced a transformational option agreement with Denison Mines to acquire up to a 70% interest in 10 uranium exploration properties spanning over 330,000 acres in the Athabasca Basin, Saskatchewan. The deal includes cash, stock, and future exploration spending commitments. Key highlights:

1. Foremost to change its name to Foremost Clean Energy .

2. David Cates, Denison's President and CEO, expected to join Foremost's Board.

3. Properties include 7 in the Eastern Athabasca Basin and 3 'Blue Sky' properties in the northwest.

4. Three-phase option agreement to earn up to 70% interest.

5. Collaboration with Denison, a leading uranium company in the Athabasca Basin.

6. Transaction aims to capitalize on growing demand for uranium and clean energy.

The deal positions Foremost as a new player in uranium exploration in a top jurisdiction, with potential for significant discoveries and growth.

Foremost Lithium (NASDAQ: FMST) ha annunciato un accordo di opzione trasformativo con Denison Mines per acquisire fino a un 70% di interesse in 10 proprietà di esplorazione dell'uranio che si estendono per oltre 330.000 acri nella Basin di Athabasca, Saskatchewan. L'accordo include contante, azioni e impegni futuri di spesa per l'esplorazione. Ecco i punti salienti:

1. Foremost cambierà il suo nome in Foremost Clean Energy.

2. David Cates, Presidente e CEO di Denison, dovrebbe unirsi al Consiglio di Foremost.

3. Le proprietà includono 7 nella Basin di Athabasca orientale e 3 proprietà 'Blue Sky' nel nord-ovest.

4. Accordo di opzione in tre fasi per guadagnare fino al 70% di interesse.

5. Collaborazione con Denison, una delle principali aziende di uranio nella Basin di Athabasca.

6. La transazione mira a capitalizzare la crescente domanda di uranio e di energia pulita.

L'accordo posiziona Foremost come un nuovo attore nell'esplorazione dell'uranio in una giurisdizione di alto livello, con il potenziale per scoperte significative e crescita.

Foremost Lithium (NASDAQ: FMST) ha anunciado un acuerdo transformador de opción con Denison Mines para adquirir hasta un 70% de participación en 10 propiedades de exploración de uranio que abarcan más de 330,000 acres en la Cuenca de Athabasca, Saskatchewan. El acuerdo incluye efectivo, acciones y compromisos de gasto futuro en exploración. Puntos destacados:

1. Foremost cambiará su nombre a Foremost Clean Energy.

2. David Cates, Presidente y CEO de Denison, se espera que se una a la Junta de Foremost.

3. Las propiedades incluyen 7 en la Cuenca de Athabasca Oriental y 3 propiedades 'Blue Sky' en el noroeste.

4. Acuerdo de opción en tres fases para obtener hasta el 70% de interés.

5. Colaboración con Denison, una empresa líder en uranio en la Cuenca de Athabasca.

6. La transacción tiene como objetivo capitalizar la creciente demanda de uranio y energía limpia.

El acuerdo posiciona a Foremost como un nuevo jugador en la exploración de uranio en una jurisdicción de primer nivel, con potencial para descubrimientos significativos y crecimiento.

포어모스트 리튬(나스닥: FMST)은 데니슨 마인스와의 변혁적 옵션 계약을 발표하며 아타바스카 분지, 사스캐처원 전역에 걸쳐 33만 에이커 이상에 걸친 10개의 우라늄 탐사 속성에서 최대 70%의 지분을 인수하기로 했습니다. 이번 거래는 현금, 주식, 향후 탐사에 대한 지출 약속을 포함하고 있습니다. 주요 내용:

1. 포어모스트는 포어모스트 클린 에너지로 이름을 변경합니다.

2. 데니슨의 사장 겸 CEO인 데이비드 케이트가 포어모스트 이사회에 합류할 것으로 예상됩니다.

3. 물건은 동부 아타바스카 분지에 7개, 북서부에 3개의 '블루 스카이' 속성을 포함합니다.

4. 삼단계 옵션 계약으로 최대 70%의 지분을 얻습니다.

5. 아타바스카 분지의 선도적 우라늄 회사인 데니슨과의 협력.

6. 거래는 증가하는 우라늄 및 청정 에너지에 대한 수요를 활용하는 것을 목표로 합니다.

이번 계약은 포어모스트를 최고의 관할권인 우라늄 탐사의 새로운 참가자로 포지셔닝하며, 의미 있는 발견과 성장을 위한 잠재력을 보유하고 있습니다.

Foremost Lithium (NASDAQ: FMST) a annoncé un accord d'option transformateur avec Denison Mines pour acquérir jusqu'à 70 % d'intérêt dans 10 propriétés d'exploration d'uranium s'étendant sur plus de 330 000 acres dans le bassin d'Athabasca, Saskatchewan. L'accord comprend des paiements en espèces, des actions et des engagements futurs de dépenses d'exploration. Points clés :

1. Foremost changera son nom en Foremost Clean Energy.

2. David Cates, président et PDG de Denison, devrait rejoindre le conseil d'administration de Foremost.

3. Les propriétés comprennent 7 dans le bassin d'Athabasca oriental et 3 propriétés 'Blue Sky' au nord-ouest.

4. Accord d'option en trois phases pour acquérir jusqu'à 70 % d'intérêt.

5. Collaboration avec Denison, une entreprise leader en uranium dans le bassin d'Athabasca.

6. La transaction vise à tirer parti de la demande croissante d'uranium et d'énergie propre.

L'accord positionne Foremost comme un nouvel acteur dans l'exploration de l'uranium dans un secteur de premier plan, avec un potentiel pour des découvertes significatives et une croissance.

Foremost Lithium (NASDAQ: FMST) hat eine transformative Optionsvereinbarung mit Denison Mines angekündigt, um bis zu 70% Anteile an 10 Uran-Explorationsgebieten zu erwerben, die sich über mehr als 330.000 Acres im Athabasca-Becken in Saskatchewan erstrecken. Der Deal umfasst Bargeld, Aktien und zukünftige Ausgabenverpflichtungen für die Erkundung. Wichtige Highlights:

1. Foremost wird seinen Namen in Foremost Clean Energy ändern.

2. David Cates, Präsident und CEO von Denison, wird voraussichtlich dem Vorstand von Foremost beitreten.

3. Die Liegenschaften umfassen 7 im östlichen Athabasca-Becken und 3 'Blue Sky'-Liegenschaften im Nordwesten.

4. Dreiphasen-Optionsvereinbarung, um bis zu 70% Anteile zu erwerben.

5. Zusammenarbeit mit Denison, einem führenden Uranunternehmen im Athabasca-Becken.

6. Die Transaktion zielt darauf ab, von der wachsenden Nachfrage nach Uran und sauberer Energie zu profitieren.

Der Deal positioniert Foremost als neuen Akteur in der Uranexploration in einer erstklassigen Jurisdiktion mit Potenzial für bedeutende Entdeckungen und Wachstum.

- Option to acquire up to 70% interest in 10 uranium exploration properties in the Athabasca Basin

- Collaboration with Denison Mines, a leading uranium company

- David Cates, Denison's CEO, expected to join Foremost's Board

- Expansion into uranium exploration amid rising global demand for clean energy

- Access to high-potential properties in a prolific uranium-producing region

- Significant exploration expenditures required to earn full interest in properties

- Risk of forfeiting interests if exploration conditions not met

- Potential dilution for existing shareholders due to share issuances for the deal

Insights

This transaction marks a significant strategic shift for Foremost Lithium, diversifying into uranium exploration in the highly prospective Athabasca Basin. The deal with Denison Mines provides Foremost access to 10 uranium projects covering over 330,000 acres, with the option to acquire up to a 70% interest. This move is timely, given the recent surge in uranium prices and growing global demand for nuclear energy as a clean power source.

The phased structure of the agreement allows Foremost to manage its financial commitments while potentially gaining substantial exposure to uranium assets. The total exploration commitment of

The collaboration with Denison, including the addition of Denison's CEO to Foremost's board, brings valuable expertise and credibility to Foremost's uranium endeavors. However, investors should note that this represents a major pivot from the company's previous focus on lithium, which may carry execution risks as Foremost enters a new sector.

The global uranium market is experiencing a resurgence, driven by increasing demand for clean energy and supply constraints. Uranium prices have risen significantly, from a low of

Key market factors supporting this trend include:

- Growing global commitment to nuclear energy, with 22 countries targeting a tripling of nuclear capacity by 2050

- Projected increase in uranium demand from 65,650 tonnes in 2023 to 130,000 tonnes by 2040

- Supply constraints due to past mine closures and geopolitical factors affecting major producers

Foremost's entry into this market is well-timed, but success will depend on exploration results and the company's ability to effectively operate in a new sector. The partnership with Denison provides a strong foundation, but investors should monitor Foremost's progress in executing its new strategy and managing the financial commitments required by the option agreement.

Highlights

- Transformational opportunity to acquire up to a

70% interest in 10 highly-prospective uranium projects in the Athabasca Basin and collaborate with Denison Mines (TSX: DML, NYSE American: DNN) - Foremost Lithium to change its name to Foremost Clean Energy Ltd.

- David Cates, Denison’s President and CEO, is expected to join Foremost’s Board of Directors

VANCOUVER, British Columbia, Sept. 24, 2024 (GLOBE NEWSWIRE) -- Foremost Lithium Resource & Technology Ltd. (NASDAQ: FMST) (CSE: FAT) (“Foremost Lithium”, “Foremost” or the “Company”) is pleased to announce today that it has executed a property acquisition agreement (the “Option Agreement”) with Denison Mines Corp. (“Denison”), which grants Foremost an option to acquire up to

“We are pleased to announce a transformative transaction with Denison, a clear leader in the uranium sector. Uranium prices have seen significant strength in recent years driven by the global demand for clean energy, which has been reinforced by supportive government policies and geopolitical events underscoring the need for reliable western uranium supply. The Athabasca Basin is recognized as one of the world’s leading uranium jurisdictions, with numerous producing mines and high-profile development projects. This collaboration will advance significant near-term exploration and development efforts across numerous high-quality exploration projects to maximize the properties’ potential for the benefit of both Foremost and Denison shareholders,” stated Foremost’s President and CEO, Jason Barnard. Further, Barnard added, “On behalf of the entire team, I’d like to warmly welcome David Cates to our Board. As Denison’s current President and CEO, Mr. Cates will be an invaluable member adding his extensive experience and a proven track record in the Canadian uranium mining space. As a junior explorer, having the support of Mr. Cates and Denison will provide Foremost a competitive advantage. We are confident that Foremost is entering a new chapter of growth, and enhanced outcomes, for the benefit of both companies’ shareholders. We look forward to working with Mr. Cates as we steer and support our Company’s expansion towards its goal of being a new leading uranium explorer in the Athabasca Basin.”

David Cates, President and CEO, commented, “Denison is pleased to work with Foremost to enhance the potential for discovery on an excellent portfolio of uranium exploration properties that would otherwise receive little attention from Denison with our current focus on development and mining stage projects. We are impressed with Foremost’s leadership team and technical capabilities and are excited to see high-potential exploration work being carried out on these properties in the coming years.”

Transformational Transaction Covering High-Potential Uranium Properties

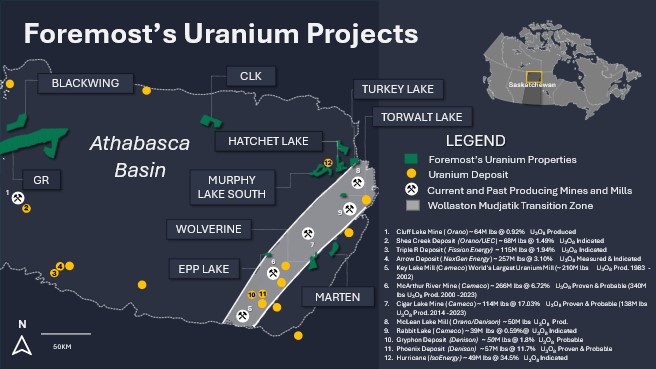

The project portfolio subject to the Option Agreement consists of 10 properties comprised of 45 claims covering an aggregate area of 332,378 acres (134,509 hectares) within the Athabasca Basin region of northern Saskatchewan (the “Exploration Properties”), which is known for its prolific history of large high-grade uranium discoveries and operating mines—currently producing ~

Generally, the most prospective exploration ground in the eastern portion of the Athabasca Basin is proximal to the Wollaston-Mudjatik Transition Zone (“WMTZ”) and has already been staked by existing uranium producers, developers, and explorers. As illustrated in Figure 1 below, the Transaction offers Foremost a unique opportunity to acquire a sizeable portfolio of well-situated properties (including several situated along the WMTZ) to facilitate a pivot towards a future focus on uranium exploration in a top jurisdiction.

Figure 1. Detailed Map of Exploration Properties being Acquired by Foremost

Eastern Properties

Seven (7) of the Exploration Properties are situated within the Eastern portion of the Athabasca Basin region, in proximity to significant existing regional infrastructure, including: Murphy Lake South, Hatchet Lake, Turkey Lake, Torwalt Lake, Marten, Wolverine and Epp Lake (collectively, the “Eastern Properties”). Several of the Eastern Properties host previously identified uranium mineralization in geological settings similar to other known uranium discoveries. Historical drilling has focused primarily on unconformity targets, which provides Foremost further opportunity for continued exploration of potential basement style mineralization. Hatchet Lake is currently undergoing an active summer drilling and evaluation program, while several of the projects contain drill-ready targets from previously conducted exploration programs. The Eastern Properties are highlighted by the following projects:

- Murphy Lake South: conductive corridors that host significant high-grade uranium mineralization may extend onto the property; unconformity depth of ~350m

- Hatchet Lake: historical mineralization has been identified along the Richardson trend; uranium and base metal enrichment has also been encountered on the property with untested areas identified for follow up

- Torwalt Lake: Adjacent to the McClean Lake Operation and within 5km of multiple uranium deposits; potential to identify Key Lake or Collins Bay analogues

Blue Sky Properties

Three (3) of the Exploration Properties are located in the northwestern portion of the Athabasca Basin region (the “Blue Sky Properties”), representing an area of comparative under-exploration and high potential for new discovery, including Blackwing, GR and CLK, which encompass ~250,000 acres (101,634 hectares). These three projects are virtually unexplored. Holes drilled to date at CLK have intersected uranium mineralization, and regional geological surveys compiled by the Government of Saskatchewan indicate the potential for favourable geological settings for uranium mineralization at each property. The Blue Sky Properties are highlighted by the following:

- Blackwing and GR: both projects are situated on regional structures; Black Bay Fault and Grease River Shear – the Black Bay Fault hosts multiple Beaverlodge-style deposits in the Uranium City area

- CLK: only two historic drill holes are known to have been completed on the property, each of which intersected uranium mineralization, including CLG-D1 (up to 8,600 ppm U) and CLG-D5 (up to 510 ppm U)

Collaboration with Denison

Denison (TSX: DML) (NYSE American: DNN) is a leading Athabasca Basin-focused uranium mining, development, and exploration company. Denison’s current focus is advancing the Wheeler River project, which represents the largest undeveloped uranium mining project in the infrastructure rich eastern portion of the Athabasca Basin. Denison has a significant team of technical experts based in its office in Saskatoon, Saskatchewan, and this best-in-class team is ideal for supporting Foremost with its technical, operating and corporate initiatives. Upon completion of Phase 1 of the Option Agreement, Denison will be the largest shareholder of Foremost, holding ~

Foremost expects to act as project operator during the term of the Option Agreement and will conduct the exploration programs with its geological team led by Dahrouge Geological Consulting, under the guidance of Jody Dahrouge. Mr. Dahrouge has a long history of uranium exploration and discovery, which includes the generation of several projects on behalf of Strathmore Minerals Corp. and its successors, including the J Zone (now the Tthe Heldeth Túé deposit) on the Waterbury Lake property, the JR Zone on the Patterson Lake North property and the Triple R Zone at the Patterson Lake South property. As a past President and COO of Fission Energy Corp. (“Fission Energy”), Jody played a key role in the acquisition and exploration of Fission Energy’s exploration property portfolio, which culminated with the eventual acquisition of Fission Energy by Denison in 2013.

Key Terms of the Transaction

Under the terms of the Option Agreement, Foremost may acquire up to

| Phase 1: | To earn an initial

|

| Phase 2: | To earn an additional

|

| Phase 3: | To earn an additional

|

Upon the successful completion of the Option Agreement, the parties would enter into a formal joint venture agreement in respect of the Exploration Properties where the initial ownership interests of Foremost and Denison will be determined based on satisfaction of conditions pursuant to the Option Agreement.

Uranium Overview

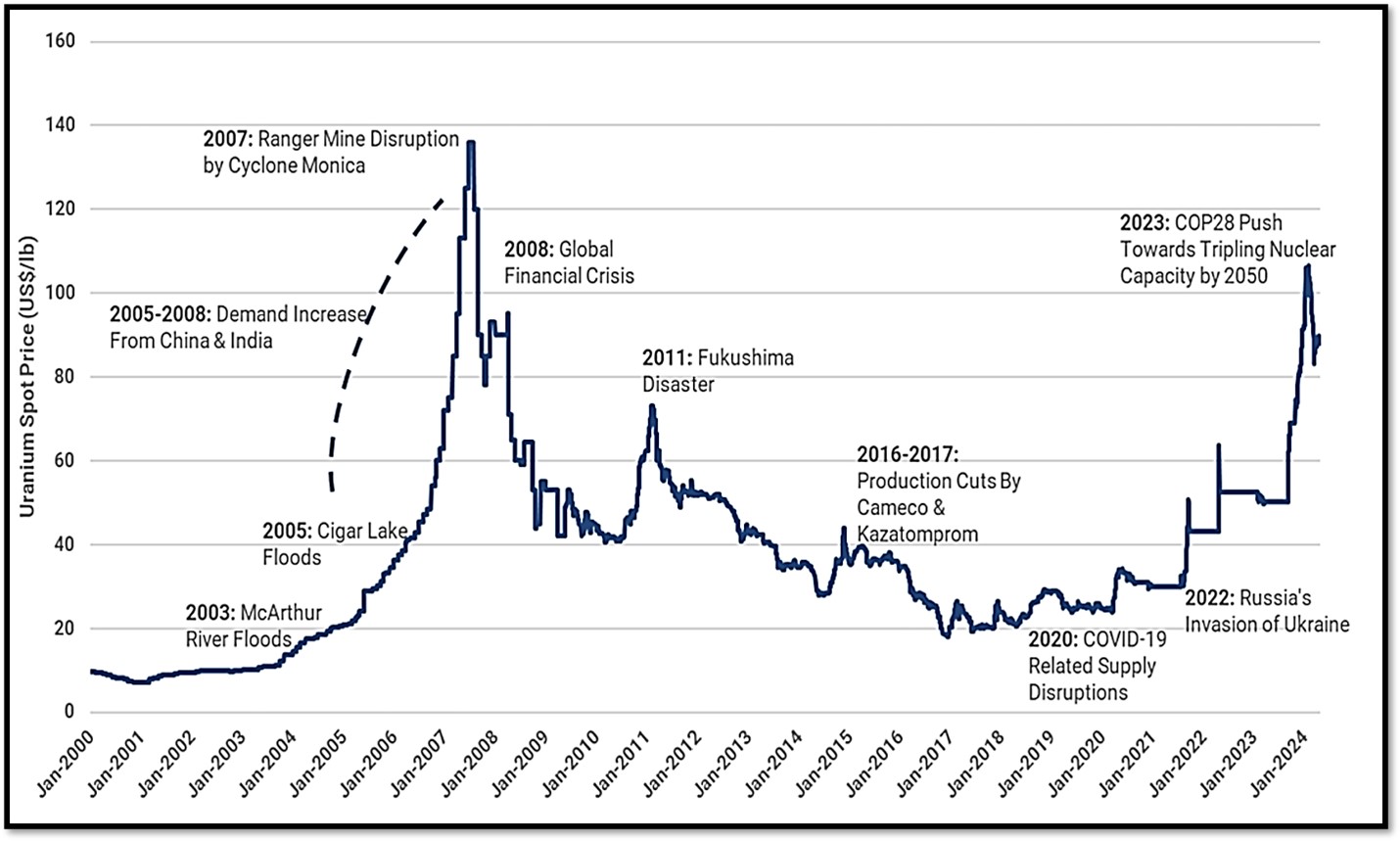

The global clean energy transition has increased the need for alternative fuel sources with nuclear power prevailing as a crucial component to meet the demand for a green economy. “Market sentiments on uranium are positive including equity markets, and particularly look favourable for uranium developers” wrote Sehaj Anand, a research analyst for FactSet (What’s Driving the Bull Run in Uranium, May 2024). The commodity price rose above US

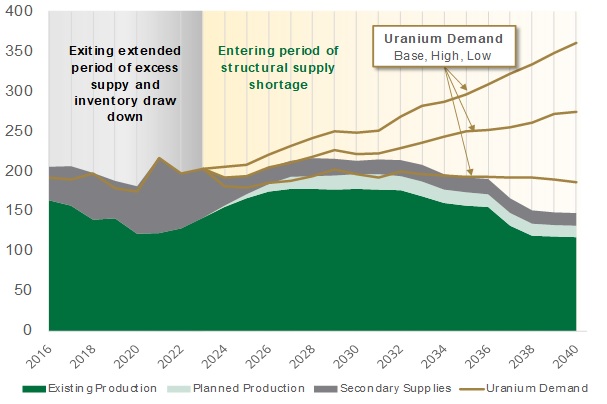

Uranium: Supply vs Demand

The supply side’s future outlook is forecasted to underserve the demand side. Some of the factors contributing to an increase in the demand for uranium globally include: the desire to phase out dependence on fossil fuels, depressed uranium prices over the past decade and mine closures and/or disruptions. Trade sanctions on Russia are affecting enriched uranium supply to the West and civil unrest in Niger have sparked a global urgency to secure reliable sources of uranium.

Figure 2. Uranium Spot Prices History with Key Events

Source: Factset UxC CME

Most recently, uranium producers, developers, and physical uranium holding companies have continued to buy physical uranium, putting a further strain on the uranium supply. With the scarcity of nuclear fuel, there is a growing sense of urgency to secure sufficient uranium supply, adding additional pressure on the overall uranium market 2.

Figure 3. Global Uranium Supply and Demand (million pounds U3O8 - per UxC Q3’24)

Note: Data in this slide has been derived from UxC’s Uranium Market Outlook dated Q3’2024, including supply & demand estimates and market balance figures. Source: Denison Investor Presentation – September 2024.

Market Outlook

Nuclear energy has the lowest carbon footprint for power generation compared to any other source and is the most reliable option for carbon-free baseload electricity generation3. At the 2023 United Nations Climate Change Conference or Conference of the Parties of the UNFCCC (more commonly known as COP 28), a total of 22 countries agreed to target tripling nuclear capacity by 2050 as countries focus on energy security and affordability. The biennial Nuclear Fuel Report said demand for uranium is expected to rise to 83,840 tonnes by 2030 and 130,000 tonnes by 2040, from 65,650 in 2023.4

Name Change

With Foremost’s business activities to be focused on exploration efforts to discover source fuel for clean energy solutions, including both uranium and lithium, the Board of Directors have unanimously agreed to change the Company’s name to “Foremost Clean Energy Ltd.” Foremost will continue trading under the same symbols, “FMST” as listed on the Nasdaq, and “FAT” as listed on the CSE, subject in each case to regulatory approval. The CUSIP number assigned to the Company’s shares following the name change will be CUSIP (34546R100) and ISIN (CA34546R1001).

The CSE will publish a bulletin announcing the effective date of the change in Foremost’s name. The Company’s common shares are anticipated to commence trading on both the CSE and Nasdaq under its new name and CUSIP number at market open on or about Sept 27, 2024. No action is required to be taken by shareholders with respect to the name change. Outstanding share certificates are not affected by the name change and do not need to be exchanged.

To see full details of the Option Agreement, Investor Rights Agreement, and other related documents in connection with the Transaction, please refer to the Company’s filings under its profile on Sedar+ at www.sedarplus.ca and on Edgar at www.sec.gov/edgar.shtm. The Company retained an arm’s-length financial advisor in connection with the Transaction which will be entitled to a transaction fee equal to

About Denison

Denison is a uranium mining, exploration and development company with interests focused in the Athabasca Basin region of northern Saskatchewan, Canada. Denison has an effective

Denison's interests in Saskatchewan also include a

Additionally, through its

Denison has a market capitalization of approximately ~

Qualified Person

Technical information in this news release has been reviewed and approved by Jody Dahrouge, B.Sc., Sp.C., P. Geo who is a Qualified Person as identified by Canadian National Instrument 43-101-Standards of Disclosure for Mineral Projects and as defined by the Securities and Exchange Commission’s Regulation S-K 1300 rules for resource deposit disclosure.

About Foremost

Foremost (NASDAQ: FMST) (CSE: FAT) (FSE: F0R0) (WKN: A3DCC8), assuming the effectiveness of the Transaction, will be an emerging North American uranium exploration company with interests in 10 prospective properties spanning over 330,000 acres in the prolific, uranium-rich Athabasca Basin. As global demand for decarbonization accelerates, the need for nuclear power is crucial. Foremost expects to be positioned to capitalize on the growing demand for uranium through discovery in a top jurisdiction with the objective to support the world’s energy transition goals. Alongside its exploration partner Denison, Foremost will be committed to a strategic and disciplined exploration strategy to identify resources by testing drill–ready targets with identified mineralization along strike of recent major discoveries.

Foremost also maintains a secondary portfolio of significant lithium projects at different stages of development spanning over 50,000 acres across Manitoba and Quebec. For further information please visit the company’s website at www.foremostcleanenergy.com.

Contact and Information

Company

Jason Barnard, President and CEO

+1 (604) 330-8067

info@foremostcleanenergy.com

Investor Relations

Lucas A. Zimmerman

Managing Director

MZ Group - MZ North America

(949) 259-4987

FMST@mzgroup.us

www.mzgroup.us

Follow us or contact us on social media:

Twitter: @[foremostcleanenergy]

Linkedin: https://www.linkedin.com/company/foremost-lithium-resource-technology

Facebook: https://www.facebook.com/ForemostLithium

Forward-Looking Statements

Except for the statements of historical fact contained herein, the information presented in this news release and oral statements made from time to time by representatives of the Company are or may constitute “forward-looking statements” as such term is used in applicable United States and Canadian laws and including, without limitation, within the meaning of the Private Securities Litigation Reform Act of 1995, for which the Company claims the protection of the safe harbor for forward-looking statements. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. Any other statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect,” “is expected,” “anticipates” or “does not anticipate,” “plans,” “estimates” or “intends,” or stating that certain actions, events or results “may,” “could,” “would,” “might” or “will” be taken, occur or be achieved) are not statements of historical fact and should be viewed as forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such risks and other factors include, among others, the availability of capital to fund programs and the resulting dilution caused by the raising of capital through the sale of shares, continuity of agreements with third parties and satisfaction of the conditions to the Transaction, risks and uncertainties associated with the environment, delays in obtaining governmental approvals, permits or financing. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Although the Company believes that the expectations reflected in such forward-looking statements are based upon reasonable assumptions, it can give no assurance that its expectations will be achieved. Forward-looking information is subject to certain risks, trends and uncertainties that could cause actual results to differ materially from those projected. Many of these factors are beyond the Company’s ability to control or predict. Important factors that may cause actual results to differ materially and that could impact the Company and the statements contained in this news release can be found in the Company’s filings with the Securities and Exchange Commission. The Company assumes no obligation to update or supplement any forward-looking statements whether as a result of new information, future events or otherwise. Accordingly, readers should not place undue reliance on forward-looking statements contained in this news release and in any document referred to in this news release. This news release shall not constitute an offer to sell or the solicitation of an offer to buy securities. and information. Please refer to the Company’s most recent filings under its profile at on Sedar+ at www.sedarplus.ca and on Edgar at www.sec.gov/edgar.shtm for further information respecting the risks affecting the Company and its business.

The Canadian Securities Exchange has neither approved nor disapproved the contents of this news release and accepts no responsibility for the adequacy or accuracy hereof.

___________________________________

1 https://investingnews.com/innspired/global-uranium-supply-athabasca-basin/

2 https://insight.factset.com/whats-driving-the-bull-run-in-uranium

3 https://www.energy.gov/ne/articles/nuclear-power-most-reliable-energy-source-and-its-not-even-close

4 https://www.nucnet.org/news/uranium-demand-expected-to-surge-by-28-by-2030-9-5-2023

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/8ab29c64-9b71-4214-b45c-5bf30775c661

https://www.globenewswire.com/NewsRoom/AttachmentNg/3edf9168-6456-473f-bb42-dd4c2c917b13

https://www.globenewswire.com/NewsRoom/AttachmentNg/03b19377-f5e5-4379-bf49-3567c0ca0c2b