F&M Bank Corp. Reports Second Quarter 2024 Earnings and Quarterly Dividend

F&M Bank Corp. (OTCQX:FMBM) reported strong Q2 2024 results with net income of $3.0 million or $0.86 per share, up from $1.2 million in Q1 2024 and $241,000 in Q2 2023. For the first half of 2024, net income was $4.2 million or $1.21 per share. The company saw growth in total assets to $1.31 billion, total loans to $826.3 million, and total deposits to $1.19 billion. Key highlights include:

- Improved net interest margin of 2.72%

- Recovery of credit losses of $458,000

- Increased noninterest income to $3.0 million

- Reduced noninterest expenses

- Tangible book value per share increased to $22.621

The Board declared a Q2 dividend of $0.26 per share, yielding 6.03% annualized based on the recent share price of $17.25.

F&M Bank Corp. (OTCQX:FMBM) ha registrato risultati solidi per il secondo trimestre del 2024, con un utile netto di 3,0 milioni di dollari o 0,86 dollari per azione, in aumento rispetto a 1,2 milioni di dollari nel primo trimestre del 2024 e 241.000 dollari nel secondo trimestre del 2023. Per la prima metà del 2024, l'utile netto è stato di 4,2 milioni di dollari o 1,21 dollari per azione. L'azienda ha visto una crescita del totale degli attivi a 1,31 miliardi di dollari, dei prestiti totali a 826,3 milioni di dollari e dei depositi totali a 1,19 miliardi di dollari. I punti salienti includono:

- Miglioramento del margine di interesse netto al 2,72%

- Recupero delle perdite su crediti di 458.000 dollari

- Aumento del reddito non da interessi a 3,0 milioni di dollari

- Riduzione delle spese non da interessi

- Valore contabile tangibile per azione aumentato a 22,621 dollari

Il consiglio ha dichiarato un dividendo per il secondo trimestre di 0,26 dollari per azione, con un rendimento annualizzato del 6,03% basato sul recente prezzo delle azioni di 17,25 dollari.

F&M Bank Corp. (OTCQX:FMBM) reportó resultados sólidos para el segundo trimestre de 2024, con ingresos netos de 3.0 millones de dólares o 0.86 dólares por acción, un aumento respecto a 1.2 millones de dólares en el primer trimestre de 2024 y 241,000 dólares en el segundo trimestre de 2023. Para la primera mitad de 2024, los ingresos netos fueron 4.2 millones de dólares o 1.21 dólares por acción. La compañía experimentó un crecimiento en los activos totales a 1.31 mil millones de dólares, en préstamos totales a 826.3 millones de dólares y en depósitos totales a 1.19 mil millones de dólares. Los puntos destacados incluyen:

- Mejora en el margen de interés neto del 2.72%

- Recuperación de pérdidas crediticias de 458,000 dólares

- Aumento de los ingresos no por intereses a 3.0 millones de dólares

- Reducción de gastos no por intereses

- Valor contable tangible por acción aumentado a 22.621 dólares

La Junta declaró un dividendo del segundo trimestre de 0.26 dólares por acción, con un rendimiento anualizado del 6.03% basado en el reciente precio de las acciones de 17.25 dólares.

F&M Bank Corp. (OTCQX:FMBM)는 2024년 2분기 강력한 실적을 보고했으며, 순이익 300만 달러 또는 주당 0.86 달러를 기록했으며, 이는 2024년 1분기의 120만 달러와 2023년 2분기의 24만 1천 달러에서 증가한 수치입니다. 2024년 상반기 동안 순이익은 420만 달러 또는 주당 1.21 달러였습니다. 회사는 총 자산을 13억 1천만 달러, 총 대출을 8억 2천 6백만 달러, 총 예금을 11억 9천만 달러로 늘리며 성장하였습니다. 주요 하이라이트는 다음과 같습니다:

- 순이자 마진 개선 2.72%

- 458,000 달러의 신용 손실 회복

- 300만 달러로 증가한 비이자 수익

- 비이자 비용 감소

- 주당 tangible book value가 22.621 달러로 증가

이사회는 2분기 주당 0.26 달러의 배당금을 선언하며, 최근 주가인 17.25 달러를 기준으로 연율 6.03%의 수익률을 보입니다.

F&M Bank Corp. (OTCQX:FMBM) a annoncé des résultats solides pour le deuxième trimestre 2024, avec un revenu net de 3,0 millions de dollars ou 0,86 dollar par action, en hausse par rapport à 1,2 million de dollars au premier trimestre 2024 et 241 000 dollars au deuxième trimestre 2023. Pour le premier semestre 2024, le revenu net était de 4,2 millions de dollars ou 1,21 dollar par action. L'entreprise a connu une croissance de l'actif total à 1,31 milliard de dollars, des prêts totaux à 826,3 millions de dollars et des dépôts totaux à 1,19 milliard de dollars. Les points forts comprennent :

- Amélioration de la marge d'intérêt nette de 2,72%

- Récupération des pertes de crédit de 458 000 dollars

- Augmentation des revenus non liés aux intérêts à 3,0 millions de dollars

- Réduction des dépenses non liées aux intérêts

- Valeur comptable tangible par action augmentée à 22,621 dollars

Le conseil d'administration a déclaré un dividende de 0,26 dollar par action pour le deuxième trimestre, soit un rendement annualisé de 6,03% basé sur le récent prix de l'action de 17,25 dollars.

F&M Bank Corp. (OTCQX:FMBM) hat starke Ergebnisse für das zweite Quartal 2024 berichtet, mit einem Nettoergebnis von 3,0 Millionen Dollar oder 0,86 Dollar pro Aktie, im Vergleich zu 1,2 Millionen Dollar im ersten Quartal 2024 und 241.000 Dollar im zweiten Quartal 2023. Für die erste Hälfte 2024 betrug das Nettoergebnis 4,2 Millionen Dollar oder 1,21 Dollar pro Aktie. Das Unternehmen verzeichnete ein Wachstum der Gesamteigentümer auf 1,31 Milliarden Dollar, der Gesamtdarlehen auf 826,3 Millionen Dollar und der Gesamteinlagen auf 1,19 Milliarden Dollar. Wichtige Höhepunkte sind:

- Verbesserte Nettozinsmarge von 2,72%

- Rückgewinnung von Kreditverlusten in Höhe von 458.000 Dollar

- Erhöhtes Nichtzins Einkommen auf 3,0 Millionen Dollar

- Verminderte Nichtzinsausgaben

- Tangible Buchwert pro Aktie auf 22,621 Dollar gestiegen

Der Vorstand erklärte eine Dividende für das zweite Quartal von 0,26 Dollar pro Aktie, die bei einem aktuellen Aktienkurs von 17,25 Dollar eine annualisierte Rendite von 6,03% ergibt.

- Net income increased to $3.0 million in Q2 2024, up from $1.2 million in Q1 2024 and $241,000 in Q2 2023

- First half 2024 net income reached $4.2 million, significantly higher than $1.3 million in the same period of 2023

- Total assets grew to $1.31 billion, with loans increasing to $826.3 million and deposits to $1.19 billion

- Net interest margin improved to 2.72%, up 8 basis points from Q1 2024

- Noninterest income increased to $3.0 million, up $644,000 from Q1 2024

- Tangible book value per share rose to $22.621 from $21.551 at the end of 2023

- Declared a quarterly dividend of $0.26 per share, yielding 6.03% annualized

- Nonperforming loans as a percentage of total assets increased to 0.58% from 0.50% at the end of 2023

- Year-to-date net charge-offs for 2024 were 0.24% compared to 0.14% for the first six months of 2023

- 11.34% of the Bank's total deposits were uninsured as of June 30, 2024

F&M continues strong start to 2024 with solid second quarter results.

See associated, unaudited summary consolidated financial data for additional information.

TIMBERVILLE, VA / ACCESSWIRE / July 29, 2024 / F&M Bank Corp. (the "Company" or "F&M"), (OTCQX:FMBM), the parent company of Farmers & Merchants Bank ("F&M Bank" or the "Bank"), today reported results for the quarter and six months ended June 30, 2024.

Net income was

On June 30, 2024, the Company had total assets of

Also noteworthy, the Company's tangible book value per common share has increased to

"I am pleased to share F&M's financial results for second quarter and year-to-date 2024," said Mike Wilkerson, chief executive officer. "During the second quarter, we continued to achieve positive trends in increased revenue and interest income, controlled operational expenses, experienced solid growth in both deposits and loans, and benefited from strong asset quality.

"These results reflect our focus on generating ‘sufficient and sustainable profit,' which is our number one priority. They also show our focus on the Company's future, as the execution of our strategic plan continues and as the results from that plan are realized. Across the board, these outcomes and growth are a team effort, with each area and business line of F&M stepping up and contributing. It is through this team effort, for which we are all grateful, that we will continue to grow as a Company and in our ability to serve the people and businesses of the Shenandoah Valley."

SECOND QUARTER INCOME STATEMENT COMPARISON

Overview

Net income for second quarter 2024 was

Net income increased by

Net Interest Income and Net Interest Margin

For second quarter 2024, net interest income totaled

Compared to second quarter 2023, net interest margin increased by seven basis points as the earning asset mix shifted from cash and investments to loans. Loans as a percentage of earning assets increased to

Provision for (Recovery of) Credit Losses

During second quarter 2024, the Bank recorded a

Noninterest Income

Noninterest income, which includes gains and losses, totaled

Compared to second quarter 2023, noninterest income increased by

Noninterest Expenses

Noninterest expenses totaled

Compared to the same quarter in 2023, noninterest expenses declined

YEAR-TO-DATE INCOME STATEMENT COMPARISON

Overview

Net income for the six months ended June 30, 2024 was

Net Interest Income and Net Interest Margin

In the first half of 2024, net interest income totaled

Provision for Credit Losses

During the first six months of 2024, the Bank recorded a

Noninterest Income

Noninterest income, which includes gains and losses, totaled

Noninterest Expenses

Noninterest expenses totaled

BALANCE SHEET REVIEW

On June 30, 2024, assets totaled

Investment securities decreased by

Total deposits on June 30, 2024, were

Shareholders' equity increased by

LIQUIDITY

The Company's on-balance sheet asset liquidity includes cash and cash equivalents, unpledged investment securities, and loans held for sale, which totaled

The Bank had access to off-balance sheet liquidity through unsecured Federal funds lines totaling

The Bank is scheduled to receive

LOAN PORTFOLIO

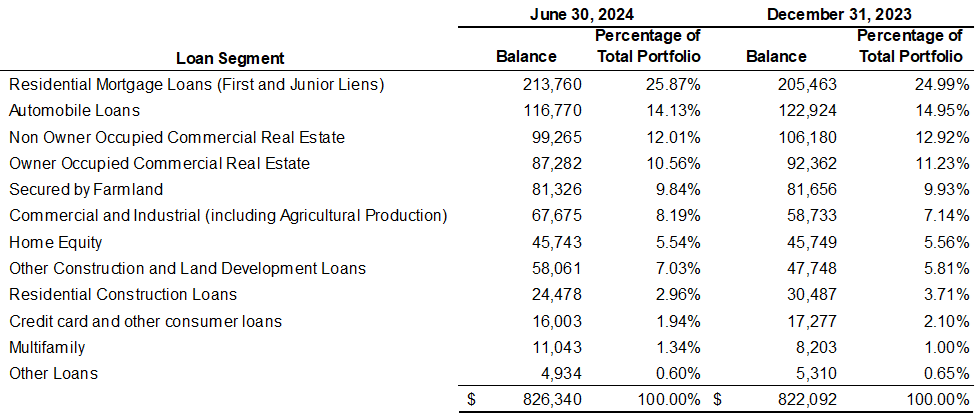

The Company's loan portfolio is diversified with its largest segment being residential mortgage loans originated through its subsidiary F&M Mortgage that represents

ASSET QUALITY AND ALLOWANCE FOR CREDIT LOSSES

Nonperforming loans (NPLs) as a percentage of total assets were

The current quarter recovery was the result of the release of

The reserve for unfunded commitments decreased from

DIVIDEND DECLARATION

On July 18, 2024, our Board of Directors declared a second quarter dividend of

###

ABOUT US

F&M Bank Corp. is an independent, locally owned, financial holding company offering a full range of financial services through our subsidiary, Farmers & Merchants Bank's (F&M Bank) fourteen banking offices in Rockingham, Shenandoah, and Augusta counties, Virginia, and the cities of Winchester and Waynesboro, Virginia. The Company also owns F&M Mortgage, a mortgage lending subsidiary, and VSTitle, a title company subsidiary. Founded in 1908 as a community venture to serve the farmers and merchants of the Shenandoah Valley, where both the Company and the Bank are headquartered, F&M Bank remains more committed than ever to the success of the agricultural industry, small business ventures, and the nonprofit sector. F&M's values, which are gregarious, resolute, original, and wholehearted (G.R.O.W.), combined with our brand pillars of sustenance, security, and enrichment, shape the Company's decision-making, philanthropy, and volunteerism. The only publicly traded organization based in Rockingham County, we offer a diverse suite of financial products and services and a strong team dedicated to living our mission of being the financial partner of choice in the Shenandoah Valley, both today and tomorrow, as we have been since 1908. Additional information may be found by visiting our website, fmbankva.com.

NON-GAAP FINANCIAL MEASURES

The accounting and reporting policies of the Company conform to U.S. generally accepted accounting principles ("GAAP") and prevailing practices in the banking industry. However, management uses certain non-GAAP measures, including tangible book value per share, to supplement the evaluation of the Company's financial condition and performance. Management believes presentation of these non-GAAP financial measures provides useful supplemental information that is essential to a proper understanding of the Company's operating results. These non-GAAP disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. A definition of GAAP to non-GAAP measures is included in the footnotes to the table accompanying this release.

FORWARD-LOOKING STATEMENTS

This press release may contain "forward-looking statements" as defined by federal securities laws, which are subject to significant risks and uncertainties. These include statements regarding future plans, strategies, results, or expectations that are not historical facts, and are generally identified by the use of words such as "believe," "expect," "intend," "anticipate," "will," "estimate," "project" or similar expressions. These statements are based on estimates and assumptions, and our ability to predict results, or the actual effect of future plans or strategies, is inherently uncertain. Our actual results could differ materially from those contemplated by these forward-looking statements. Factors that could have a material adverse effect on our operations and future prospects include, but are not limited to, changes in local and national economies or market conditions; changes in interest rates; regulations and accounting principles; changes in policies or guidelines; loan demand and asset quality, including values of real estate and other collateral; deposit flow; the impact of competition from traditional or new sources; and other factors. Readers should consider these risks and uncertainties in evaluating forward-looking statements and should not place undue reliance on such statements. We undertake no obligation to update these statements following the date of this press release.

F&M Bank Corp.

Summary Consolidated Financial Data (unaudited)

Dollars in Thousands, except for per share data

|

| Quarter to Date |

|

| Year-to-Date |

| ||||||||||||||||||||||

|

| 6/30/2024 |

|

| 3/31/2024 |

|

| 12/31/2023 (3) |

|

| 9/30/2023 (3) |

|

| 6/30/2023 (3) |

|

| 6/30/2024 |

|

| 6/30/2023 (3) |

| |||||||

Condensed Balance Sheet |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Cash and cash equivalents |

| $ | 50,459 |

|

| $ | 52,486 |

|

| $ | 23,717 |

|

| $ | 22,159 |

|

| $ | 36,505 |

|

| $ | 50,459 |

|

| $ | 36,505 |

|

Investment securities |

|

| 355,930 |

|

|

| 369,744 |

|

|

| 379,557 |

|

|

| 383,502 |

|

|

| 394,868 |

|

|

| 355,930 |

|

|

| 394,868 |

|

Loans held for sale |

|

| 3,958 |

|

|

| 1,385 |

|

|

| 1,119 |

|

|

| 2,028 |

|

|

| 881 |

|

|

| 3,958 |

|

|

| 881 |

|

Gross loans |

|

| 826,340 |

|

|

| 825,872 |

|

|

| 822,092 |

|

|

| 805,602 |

|

|

| 776,260 |

|

|

| 826,340 |

|

|

| 776,260 |

|

Allowance for credit losses |

|

| (7,815 | ) |

|

| (8,408 | ) |

|

| (8,321 | ) |

|

| (9,166 | ) |

|

| (8,769 | ) |

|

| (7,815 | ) |

|

| (8,769 | ) |

Goodwill |

|

| 3,082 |

|

|

| 3,082 |

|

|

| 3,082 |

|

|

| 3,082 |

|

|

| 3,082 |

|

|

| 3,082 |

|

|

| 3,082 |

|

Other assets |

|

| 77,691 |

|

|

| 72,053 |

|

|

| 73,350 |

|

|

| 75,212 |

|

|

| 75,543 |

|

|

| 77,691 |

|

|

| 75,543 |

|

Total Assets |

| $ | 1,309,645 |

|

| $ | 1,316,214 |

|

| $ | 1,294,596 |

|

| $ | 1,282,419 |

|

| $ | 1,278,370 |

|

| $ | 1,309,645 |

|

| $ | 1,278,370 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest bearing deposits |

| $ | 270,246 |

|

| $ | 267,106 |

|

| $ | 264,254 |

|

| $ | 277,219 |

|

| $ | 277,578 |

|

| $ | 270,246 |

|

| $ | 277,578 |

|

Interest bearing deposits |

|

| 915,011 |

|

|

| 889,237 |

|

|

| 868,982 |

|

|

| 856,691 |

|

|

| 859,534 |

|

|

| 915,011 |

|

|

| 859,534 |

|

Total Deposits |

|

| 1,185,257 |

|

|

| 1,156,343 |

|

|

| 1,133,236 |

|

|

| 1,133,910 |

|

|

| 1,137,112 |

|

|

| 1,185,257 |

|

|

| 1,137,112 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Short-term debt |

|

| 20,000 |

|

|

| 60,000 |

|

|

| 60,000 |

|

|

| 60,000 |

|

|

| 47,000 |

|

|

| 20,000 |

|

|

| 47,000 |

|

Long-term debt |

|

| 6,954 |

|

|

| 6,943 |

|

|

| 6,932 |

|

|

| 6,922 |

|

|

| 6,911 |

|

|

| 6,954 |

|

|

| 6,911 |

|

Other liabilities |

|

| 15,818 |

|

|

| 15,194 |

|

|

| 16,105 |

|

|

| 14,567 |

|

|

| 15,153 |

|

|

| 15,818 |

|

|

| 15,153 |

|

Total Liabilities |

|

| 1,228,029 |

|

|

| 1,238,480 |

|

|

| 1,216,273 |

|

|

| 1,215,399 |

|

|

| 1,206,176 |

|

|

| 1,228,029 |

|

|

| 1,206,176 |

|

Shareholders' equity |

|

| 81,616 |

|

|

| 77,734 |

|

|

| 78,323 |

|

|

| 67,020 |

|

|

| 72,194 |

|

|

| 81,616 |

|

|

| 72,194 |

|

Total Liabilities and Shareholders' Equity |

| $ | 1,309,645 |

|

| $ | 1,316,214 |

|

| $ | 1,294,596 |

|

| $ | 1,282,419 |

|

| $ | 1,278,370 |

|

| $ | 1,309,645 |

|

| $ | 1,278,370 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Condensed Income Statement |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income and fees on loans |

| $ | 13,494 |

|

| $ | 13,352 |

|

| $ | 13,061 |

|

| $ | 12,525 |

|

| $ | 11,517 |

|

| $ | 26,846 |

|

| $ | 22,371 |

|

Interest income and fees on loans held for sale |

|

| 46 |

|

|

| 18 |

|

|

| 22 |

|

|

| 19 |

|

|

| 25 |

|

|

| 64 |

|

|

| 47 |

|

Income on cash and securities |

|

| 2,180 |

|

|

| 2,207 |

|

|

| 2,074 |

|

|

| 2,028 |

|

|

| 2,092 |

|

|

| 4,387 |

|

|

| 4,198 |

|

Total Interest Income |

|

| 15,720 |

|

|

| 15,577 |

|

|

| 15,157 |

|

|

| 14,572 |

|

|

| 13,634 |

|

|

| 31,297 |

|

|

| 26,616 |

|

Interest expense on deposits |

|

| 6,951 |

|

|

| 6,337 |

|

|

| 6,108 |

|

|

| 5,811 |

|

|

| 5,218 |

|

|

| 13,288 |

|

|

| 9,255 |

|

Interest expense on short-term debt |

|

| 454 |

|

|

| 996 |

|

|

| 812 |

|

|

| 702 |

|

|

| 523 |

|

|

| 1,450 |

|

|

| 1,514 |

|

Interest expense on long-term debt |

|

| 116 |

|

|

| 115 |

|

|

| 116 |

|

|

| 115 |

|

|

| 116 |

|

|

| 231 |

|

|

| 228 |

|

Total Interest Expense |

|

| 7,521 |

|

|

| 7,448 |

|

|

| 7,036 |

|

|

| 6,628 |

|

|

| 5,857 |

|

|

| 14,969 |

|

|

| 10,997 |

|

Net Interest Income |

|

| 8,199 |

|

|

| 8,129 |

|

|

| 8,121 |

|

|

| 7,944 |

|

|

| 7,777 |

|

|

| 16,328 |

|

|

| 15,619 |

|

Provision for (recovery of) credit losses |

|

| (458 | ) |

|

| 824 |

|

|

| (134 | ) |

|

| 620 |

|

|

| 539 |

|

|

| 366 |

|

|

| 539 |

|

Noninterest income |

|

| 2,986 |

|

|

| 2,342 |

|

|

| 2,464 |

|

|

| 2,572 |

|

|

| 2,907 |

|

|

| 5,328 |

|

|

| 5,097 |

|

Noninterest expense |

|

| 8,156 |

|

|

| 8,431 |

|

|

| 10,482 |

|

|

| 8,922 |

|

|

| 10,335 |

|

|

| 16,587 |

|

|

| 19,364 |

|

Income tax expense (benefit) |

|

| 471 |

|

|

| (1 | ) |

|

| (220 | ) |

|

| (44 | ) |

|

| (431 | ) |

|

| 470 |

|

|

| (483 | ) |

Net Income |

| $ | 3,016 |

|

| $ | 1,217 |

|

| $ | 457 |

|

| $ | 1,018 |

|

| $ | 241 |

|

| $ | 4,233 |

|

| $ | 1,296 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Per Share Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per common share - basic |

| $ | 0.86 |

|

| $ | 0.35 |

|

| $ | 0.13 |

|

| $ | 0.29 |

|

| $ | 0.07 |

|

| $ | 1.21 |

|

| $ | 0.37 |

|

Book Value per Share |

|

| 23.54 |

|

|

| 22.11 |

|

|

| 22.47 |

|

|

| 19.43 |

|

|

| 20.75 |

|

|

| 23.54 |

|

|

| 20.75 |

|

Tangible Book Value per Share (1) |

|

| 22.62 |

|

|

| 21.20 |

|

|

| 21.55 |

|

|

| 18.50 |

|

|

| 19.82 |

|

|

| 22.62 |

|

|

| 19.82 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Key Performance Ratios |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return on Average Assets |

|

| 0.93 | % |

|

| 0.37 | % |

|

| 0.14 | % |

|

| 0.32 | % |

|

| 0.08 | % |

|

| 0.65 | % |

|

| 0.20 | % |

Return on Average Equity |

|

| 15.59 | % |

|

| 6.25 | % |

|

| 2.49 | % |

|

| 5.80 | % |

|

| 1.33 | % |

|

| 10.96 | % |

|

| 3.62 | % |

Noninterest Income / Average Assets |

|

| 0.92 | % |

|

| 0.71 | % |

|

| 0.76 | % |

|

| 0.80 | % |

|

| 0.92 | % |

|

| 0.82 | % |

|

| 0.80 | % |

Noninterest Expense / Average Assets |

|

| 2.52 | % |

|

| 2.54 | % |

|

| 3.23 | % |

|

| 2.76 | % |

|

| 3.28 | % |

|

| 2.56 | % |

|

| 3.05 | % |

Efficiency Ratio (2) |

|

| 71.23 | % |

|

| 78.67 | % |

|

| 96.79 | % |

|

| 82.81 | % |

|

| 94.35 | % |

|

| 74.77 | % |

|

| 91.14 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net Interest Margin |

|

| 2.72 | % |

|

| 2.64 | % |

|

| 2.66 | % |

|

| 2.67 | % |

|

| 2.65 | % |

|

| 2.71 | % |

|

| 2.69 | % |

Earning Asset Yield |

|

| 5.19 | % |

|

| 5.07 | % |

|

| 4.96 | % |

|

| 4.87 | % |

|

| 4.64 | % |

|

| 5.18 | % |

|

| 4.57 | % |

Cost of Interest Bearing Liabilities |

|

| 3.21 | % |

|

| 3.14 | % |

|

| 3.00 | % |

|

| 2.87 | % |

|

| 2.61 | % |

|

| 3.17 | % |

|

| 2.51 | % |

Cost of Funds |

|

| 2.51 | % |

|

| 2.45 | % |

|

| 2.37 | % |

|

| 2.26 | % |

|

| 1.75 | % |

|

| 2.49 | % |

|

| 1.91 | % |

Net Interest Spread |

|

| 2.68 | % |

|

| 2.62 | % |

|

| 2.59 | % |

|

| 2.61 | % |

|

| 2.89 | % |

|

| 2.69 | % |

|

| 2.66 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net Charge-offs |

| $ | 179 |

|

| $ | 807 |

|

| $ | 770 |

|

| $ | 193 |

|

| $ | 344 |

|

| $ | 986 |

|

| $ | 510 |

|

Net Charge-offs as a % of Avg Loans |

|

| 0.09 | % |

|

| 0.39 | % |

|

| 0.38 | % |

|

| 0.10 | % |

|

| 0.18 | % |

|

| 0.24 | % |

|

| 0.14 | % |

Non-Performing Loans |

| $ | 7,586 |

|

| $ | 6,246 |

|

| $ | 6,469 |

|

| $ | 3,586 |

|

| $ | 1,997 |

|

| $ | 7,586 |

|

| $ | 1,997 |

|

Non-Performing Loans to Total Assets |

|

| 0.58 | % |

|

| 0.47 | % |

|

| 0.50 | % |

|

| 0.28 | % |

|

| 0.16 | % |

|

| 0.58 | % |

|

| 0.16 | % |

Non-Performing Assets |

| $ | 7,586 |

|

| $ | 6,246 |

|

| $ | 6,524 |

|

| $ | 3,586 |

|

| $ | 1,997 |

|

| $ | 7,586 |

|

| $ | 1,997 |

|

Non-Performing Assets to Total Assets |

|

| 0.58 | % |

|

| 0.47 | % |

|

| 0.50 | % |

|

| 0.28 | % |

|

| 0.16 | % |

|

| 0.58 | % |

|

| 0.16 | % |

ACLL as a % of Total Loans |

|

| 0.95 | % |

|

| 1.02 | % |

|

| 1.01 | % |

|

| 1.14 | % |

|

| 1.13 | % |

|

| 0.95 | % |

|

| 1.13 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Loans to Deposits |

|

| 69.72 | % |

|

| 71.42 | % |

|

| 72.54 | % |

|

| 71.05 | % |

|

| 68.27 | % |

|

| 69.72 | % |

|

| 68.27 | % |

(1) Tangible book value per share is calculated by subtracting goodwill and other intangibles from total shareholders' equity and dividing the result by the common shares outstanding. Tangible book value per share is a non-GAAP financial measure that management believes provides investors with important information that may be related to the valuation of common stock.

(2) The Efficiency Ratio equals noninterest expenses divided by the sum of tax equivalent net interest income and noninterest income. Noninterest income excludes gains (losses) on securities transactions and low-income housing partnership losses. Noninterest expense excludes amortization of intangibles.

(3) Certain reclassifications have been made in the 2023 financial information to conform to reporting for the 2024. These reclassifications are not considered material and had no impact on prior year's net income, balance sheet or shareholders' equity.

FOR MORE INFORMATION, CONTACT

Lisa F. Campbell | EVP | Chief Financial Officer

540-896-1705

fmbankva.com

SOURCE: F&M Bank Corp

View the original press release on accesswire.com