Falcon Restates Its Announcement of Its Agreement for Esperanza Gold/Silver/Copper Project in La Rioja, Argentina

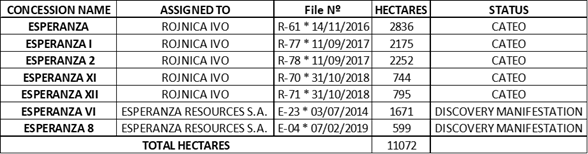

Falcon Gold Corp (FGLDF) announced a restated agreement to acquire up to a 100% interest in the ERSA mineral concessions in La Rioja, Argentina, currently owned by Esperanza Resources S.A. The property, covering 11,072 hectares, is near historical gold and silver mines. Under the new option agreement, Falcon will initially earn 80% interest by making payments of 500,000 shares and warrants over four years, along with a minimum expenditure of $350,000. Following completion, Falcon can acquire the remaining 20% for an additional 2 million shares and $1.5 million.

- Acquisition of 100% interest in ERSA concessions could enhance Falcon's asset base.

- High-grade gold intercepts reported from previous drilling in the area.

- Opportunity to capitalize on historical mining successes in the region.

- Regulatory approval for the agreement is still pending, which introduces uncertainty.

- Future share dilution risk due to the issuance of new shares and warrants.

VANCOUVER, BC / ACCESSWIRE / February 10, 2021 / FALCON GOLD CORP. (TSXV:FG)(FRA:3FA)(OTC PINK:FGLDF); ("Falcon" or the "Company") is restating its announcement respecting the new agreement to acquire up to a

The Property

The ERSA Property comprises seven (7) mineral concessions covering an aggregate area of 11,072 hectares ("ha"). The concessions are road accessible, located about 20 kilometres ("km") south-southeast of the town of Chepes within the renowned Sierra de Las Minas District of southern La Rioja province. The District is reported to host several past producing gold and silver mines. The city of San Juan is about 250 km by paved highway to the west-southwest.

High-grade gold mineralization was reportedly first discovered within the District around 1865 at the Callanas occurrences followed by limited mining conducted on a gold, silver, and copper zone. Other sites of historical small-scale mining within the ERSA concessions include the El Espinillo, Callanas East and West, El Abrita, Cerro Alto, Las Lajas and San Isidro gold mineralized zones.

The Japanese agency, JICA completed 900 metres ("m") of diamond drilling in the Callanas area during the 1990's. Two of the holes returned encouraging intercepts assaying 1m at 9.11 grams per tonne gold ("g/t Au"), 28.59 grams per tonne silver ("g/t Ag") and 0.42m @ 24.3 g/t Au, 61.10 g/t Ag. More recently, Esperanza Resources has reported that the Callanas West zone has been mapped along a northwest-southeast strike for approximately 4,000 m.

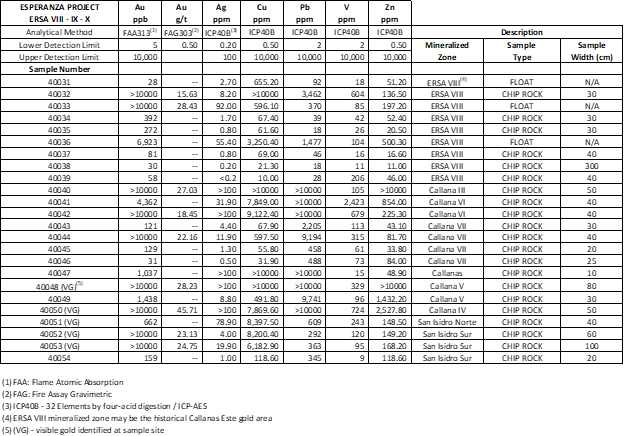

In 2018 the Company completed a limited sampling program as part of its initial due diligence. From the Callanas East trenches results included a 1m sample that returned 5,619 ppb gold. A 2.5m continuous chip sample from the north end of the Callanas West exposure showed 5,905 ppb Au, 20.6 ppm Ag and

- from Callana III vein of 27.03 g/t Au across 50 cm; and

- from the Callana IV vein across a 50 cm width where visible gold was identified, that assayed 45.71 g/t Au with Ag content greater than 100 ppm and Cu analyses of 7,869.60 ppm

Table 1: Summary of the sampling and analyses results for the 2018 exploration program on concessions, ERSA VIII, IX & X. Note the high-grade gold beyond the analytical detection limit of 10,000 ppb Au were assayed for better upper grade results (from Falcon News Release dated, January 7, 2019).

The New Option Agreement

Under the renegotiated Agreement to earn its initial

Upon completion of payments and expenditures, Falcon will own

Table 2: List of the ESRA mineral concessions in La Rioja province, Argentina

Qualified Person

Dr. Daniel Rubiolo, P. Geo., who is a Qualified Person as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects has reviewed and approved the technical content of this news release.

About Falcon Gold Corp.

Falcon is a Canadian mineral exploration company focused on generating, acquiring, and exploring opportunities in the Americas. Falcon's flagship project, the Central Canada Gold Mine, is approximately 20 km south east of Agnico Eagle's Hammond Reef Gold Deposit which has Measured & Indicated estimated resources of 208 million tonnes containing 4.5 million ounces of gold. The Hammond Reef gold property lies on the Hammond fault which is a splay off of the Quetico Fault Zone ("QFZ") and may be the control for the gold deposit. The Central Gold property lies on a similar major splay of the QFZ.

The history of the Central Canada gold mine spans more than 120 years;

1901 to 1907 - Shaft constructed to a depth of 12 m and 27 oz of gold from 18 tons using a stamp mill.

1930 to 1934 - Central Canada Mines Ltd. installed a 75 ton per day gold mill. Development work included 1,829 m of drilling and a vertical shaft to a depth of 45 m with about 42 m of crosscuts and drifts on the 100-foot level. In December, 1934 the mine had reportedly outlined approximately 230,000 ounces of gold with an average grade of 9.9 g/t Au.

1935 - With the on-going financial crisis of the Great Depression, the Central Canada Mines was unable to fund operations and the mine ceased operations.

1965 - Anjamin Mines completed diamond drilling and in hole S2 returned a 2 ft section of 37.0 g/t Au and hole S3 assayed 44.0 g/t Au across 7 ft.

1985 - Interquest Resources Corp. drilled 13 diamond holes totaling 1,840 m in which a 3.8 ft intersection showed 30.0 g/t Au.

2010 to 2012 - TerraX Minerals Inc. conducted programs that included line cutting, geological surveys and 363 m of drilling.

2020 - Falcon completed its inaugural 17-hole program totaling 2,942.5m of core. In addition, the Company acquired by staking an additional 7,477 ha of mineral claims consisting of 369 units in 2 separate properties immediately south and northwest of Agnico Eagle Mines Ltd.'s Hammond Reef property.

The Company also holds 4 additional projects. The Camping Lake Gold property in the world-renowned Red Lake mining camp; a

CONTACT INFORMATION:

Falcon Gold Corp.

"Karim Rayani"

Karim Rayani

Chief Executive Officer, Director

Telephone: (604) 716-0551

Email: info@falcongold.ca

Cautionary Language and Forward-Looking Statements

This news release may contain forward looking statements including but not limited to comments regarding the timing and content of upcoming work programs, geological interpretations, receipt of property titles, etc. Forward looking statements address future events and conditions and therefore, involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Falcon Gold Corp

View source version on accesswire.com:

https://www.accesswire.com/629205/Falcon-Restates-Its-Announcement-of-Its-Agreement-for-Esperanza-GoldSilverCopper-Project-in-La-Rioja-Argentina

FAQ

What is Falcon Gold Corp's recent acquisition announcement regarding FGLDF?

How many mineral concessions are included in the ERSA Property acquisition?

What payments are involved in the new option agreement for the ERSA concessions?

What minimum expenditure is required by Falcon during the option period for the ERSA concessions?