First Mining's Joint Venture Partner Fulfils Stage 1 Expenditure Requirements for the Pickle Crow Gold Project, Ontario, Canada

First Mining Gold Corp. announced that Auteco Minerals Ltd has met its Stage 1 $5 million expenditure requirement for the Pickle Crow Gold Project. This completion allows Auteco to issue 100,000,000 shares to First Mining, granting it a 51% interest in PC Gold Inc. First Mining anticipates receiving these shares by the end of April 2021. A major drill program of 45,000 meters is ongoing at Pickle Crow, with promising early results. After completing further expenditures, Auteco has the option to acquire an additional stake in PC Gold.

- None.

- None.

Insights

Analyzing...

Webcast on March 30, 2021

VANCOUVER, BC, March 18, 2021 /PRNewswire/ - First Mining Gold Corp. ("First Mining" or the "Company") (TSX: FF) (OTCQX: FFMGF) (FRANKFURT: FMG) is pleased to report that it has received notice from Auteco Minerals Ltd ("Auteco") (ASX: AUT) that Auteco has fulfilled the Stage 1

"First Mining is delighted that Auteco has completed its

"The successful completion of the Stage 1 expenditures requirement at Pickle Crow marks a significant milestone in the development of this exciting project" commented Ray Shorrocks, Auteco's Executive Chairman. "The promising results from our initial drill program have truly motivated our team to continue to establish Pickle Crow as a large, high-grade deposit in a Tier-1 location."

Once the 100,000,000 Auteco shares have been issued to First Mining, Auteco will have earned a

A 45,000-metre drill program with five diamond drill rigs is underway at Pickle Crow, with the objective of updating the Project's mineral resource estimate by the mid-year 2021. To date, Auteco has completed 84 diamond drill holes for 19,400 metres, focusing exclusively on near mine extensions and mineralized structures outside of the resource area. Once the current drill program has been completed, Auteco plans to transition their drill program to infill drilling and resource definition in order to provide sufficient data density to update the current mineral resource estimate for Pickle Crow.

Auteco finished 2020 with A

Recent Pickle Crow Drill Results

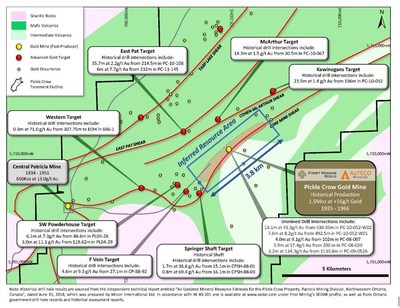

The current phase of drilling has successfully intersected extensions to known mineralized structures, in addition to the discovery of previously undefined mineralization. Recent drill highlights include:

- 5.6 m @ 33.4 g/t gold from 20.3 m in hole AUDD0078 (Shaft 3 Veins) – New Structure(includes 3.4 m @ 51.3 g/t gold from 20.3 m) with individual assay grades of up to 117 g/t gold and 109 g/t gold (0.4 m @ 117 g/t gold from 21.3 m and 0.3 m @ 109 g/t gold from 22.8 m)

- 1.6 m @ 16.9 g/t gold from 12.7 m in hole AUDD0077 (Shaft 3 Veins) – New Structure(includes 0.7 m @ 36.6 g/t gold from 13.6 m)

- 2 m @ 8.2 g/t gold from 396.5 m in hole AUDD0056 (Shaft 1 Veins) – Extension of Structure

- 4 m @ 5.9 g/t gold from 420 m in hole AUDD0056 (Shaft 1 Veins) – Extension of Structure

Notes:

|

Drill Hole Locations

Hole ID | Azimuth ⁰ | Dip ⁰ | Final Depth (m) | UTM East | UTM North |

AUDD0056 | 170 | -65 | 510 | 703910 | 5709647 |

AUDD0077 | 350 | -70 | 57 | 704898 | 5710715 |

AUDD0078 | 160 | -60 | 240 | 704871 | 5710794 |

Note: Collar coordinates in UTM NAD 83 z15 |

Drill results for all 2020 and 2021 holes completed to date will be reported in an upcoming news release.

Mineralization remains open in all directions on all target areas and work will now be focused on defining high-grade gold shoots within the mineralized envelopes and bringing them into the Inferred Resource category.

About Pickle Crow

The Pickle Crow Gold Deposit is a high-grade, shear-hosted, mesothermal Archean lode gold deposit. The deposit occurs primarily within mafic volcanics and banded iron formation (BIF) units in the Pickle Crow assemblage of the Pickle Lake Greenstone belt located in the Uchi Lake Sub-province of the Superior Craton of the Canadian Shield.

Mineralization is focused around steeply north-west dipping, regional scale shear zones. Multiple mineralization styles have been identified on the property, including Quartz-Gold-Tungsten (+/-Tourmaline) Shear Veins which are the focus of the current exploration, and banded iron formation mineralization (BIF-style), which comprises structurally controlled, sheeted vein arrays hosted within the BIF.

Pickle Crow was one of Canada's highest-grade historical gold mines. It operated from 1935 until 1966, during which time it reportedly produced almost 1.5 million ounces of gold at an average grade of 16.14 g/t. The property consists of ~190 km2 (19,000 hectares) of tenure covering a major gold province. Auteco recently increased its landholding near the Project by acquiring an additional 176 km2 (176,000 ha) of land contiguous to Pickle Crow, which, together with the 130 km2 acquired by Auteco in 2020 (see news release dated February 17, 2021) increases the combined property's land package to over 496 km2 (496,000 ha) (see news release dated January 28, 2021). First Mining acquired Pickle Crow Project in November 2015 through its acquisition of PC Gold Inc.

Auteco's development focus is on returning to first principles, completing a new geological review, and applying modern exploration technologies in their advancement of Pickle Crow. Auteco has a strong focus on discovering and developing new project scale, high-grade, near surface gold resources.

Webcast

Management of First Mining and Auteco will host a webcast on Tuesday, March 30th at 1pm Pacific Time (March 31st, at 7am Australian Eastern Standard Time) to discuss the merits of the Pickle Crow Earn-in agreement, Auteco's ongoing drill program and to answer any questions from shareholders. Hosting the call will be Mr. Dan Wilton, CEO of First Mining and Mr Ray Shorrocks, Executive Chairman of Auteco. Shareholders, analysts, investors, and media are invited to join the live webcast by registering using the link below.

Link: https://6ix.com/event/first-mining-gold-auteco-minerals-discuss-pickle-crow-drill-program/

After registering, you will receive a confirmation email containing details to access the webinar via conference call or webcast.

A replay of the webcast will be available on First Mining's website following the conclusion of the call.

About Auteco

Auteco Minerals Limited is a mineral exploration company currently focused on advancing high-grade gold resources at the Pickle Crow Gold Project in the world class Uchi Sub-province of Ontario, Canada. The Auteco Board of Directors and Technical Management team has a proven track record of discovering gold and creating wealth for shareholders and all stakeholders in recent years.

Qualified Person

Hazel Mullin, P.Geo., Director, Data Management and Technical Services of First Mining, is a "Qualified Person" for the purposes of National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101"), and she has reviewed and approved the scientific and technical disclosure contained in this news release.

About First Mining Gold Corp.

First Mining is a Canadian gold developer focused on the development and permitting of the Springpole Gold Project in northwestern Ontario. Springpole is one of the largest undeveloped gold projects in Canada. The results of a positive Pre-Feasibility Study for the Springpole Gold Project were announced by First Mining in January 2021, and permitting activities are on-going with submission of an Environmental Impact Statement for the project targeted for 2021. The Company also holds a large equity position in Treasury Metals Inc. who are advancing the Goliath-Goldlund gold projects towards construction. First Mining's portfolio of gold projects in eastern Canada also includes the Pickle Crow (being advanced in partnership with Auteco Minerals Ltd.), Cameron, Hope Brook, Duparquet, Duquesne, and Pitt gold projects.

First Mining was established in 2015 by Mr. Keith Neumeyer, founding President and CEO of First Majestic Silver Corp.

ON BEHALF OF FIRST MINING GOLD CORP.

Daniel W. Wilton

Chief Executive Officer and Director

Cautionary Note Regarding Forward-Looking Statements

This news release includes certain "forward-looking information" and "forward-looking statements" (collectively "forward-looking statements") within the meaning of applicable Canadian and United States securities legislation including the United States Private Securities Litigation Reform Act of 1995. These forward-looking statements are made as of the date of this news release. Forward-looking statements are frequently, but not always, identified by words such as "expects", "anticipates", "believes", "plans", "projects", "intends", "estimates", "envisages", "potential", "possible", "strategy", "goals", "objectives", or variations thereof or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved, or the negative of any of these terms and similar expressions.

Forward-looking statements in this news release relate to future events or future performance and reflect current estimates, predictions, expectations or beliefs regarding future events and include, but are not limited to, statements with respect to: (i) timing for the meeting of Auteco shareholders to approve the issuance of 100 million shares of Auteco to First Mining and the receipt by First Mining of such shares; (ii) timing for the completion of Stage 1 of the earn-in and the execution of the JV Agreement; (iii) timing for Auteco to incur the Additional Expenditures on the Pickle Crow Project; (iv) timing for Auteco to pay

First Mining cautions that the foregoing list of factors that may affect future results is not exhaustive. When relying on our forward-looking statements to make decisions with respect to First Mining, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. First Mining does not undertake to update any forward-looking statement, whether written or oral, that may be made from time to time by the Company or on our behalf, except as required by law.

Cautionary Note to United States Investors

This news release has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of U.S. securities laws. Unless otherwise indicated, all resource and reserve estimates included in this news release have been prepared in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy, and Petroleum 2014 Definition Standards on Mineral Resources and Mineral Reserves. NI 43-101 is a rule developed by the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Canadian standards, including NI 43-101, differ significantly from the requirements of the SEC, and mineral resource and reserve information contained herein may not be comparable to similar information disclosed by U.S. companies. In particular, and without limiting the generality of the foregoing, the term "resource" does not equate to the term "reserves". Under U.S. standards, mineralization may not be classified as a "reserve" unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. The SEC's disclosure standards normally do not permit the inclusion of information concerning "measured mineral resources", "indicated mineral resources" or "inferred mineral resources" or other descriptions of the amount of mineralization in mineral deposits that do not constitute "reserves" by U.S. standards in documents filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. U.S. investors should also understand that "inferred mineral resources" have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an "inferred mineral resource" will ever be upgraded to a higher category. Under Canadian rules, estimated "inferred mineral resources" may not form the basis of feasibility or pre-feasibility studies except in rare cases. Investors are cautioned not to assume that all or any part of an "inferred mineral resource" exists or is economically or legally mineable. Disclosure of "contained ounces" in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute "reserves" by SEC standards as in-place tonnage and grade without reference to unit measures. The requirements of NI 43-101 for identification of "reserves" are also not the same as those of the SEC, and reserves reported by the Company in compliance with NI 43-101 may not qualify as "reserves" under SEC standards. Accordingly, information concerning mineral deposits set forth herein may not be comparable with information made public by companies that report in accordance with U.S. standards.

![]() View original content to download multimedia:http://www.prnewswire.com/news-releases/first-minings-joint-venture-partner-fulfils-stage-1-expenditure-requirements-for-the-pickle-crow-gold-project-ontario-canada-301249885.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/first-minings-joint-venture-partner-fulfils-stage-1-expenditure-requirements-for-the-pickle-crow-gold-project-ontario-canada-301249885.html

SOURCE First Mining Gold Corp.