Fake Texts From the Boss, Bogus Job Postings and Frankenstein Shoppers — Oh My!

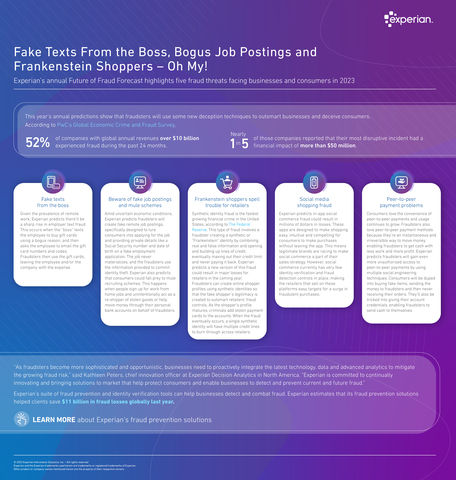

Experian’s annual Future of Fraud Forecast highlights five fraud threats facing businesses and consumers in 2023

(Graphic: Experian)

According to PwC’s

- Fake texts from the boss: Given the prevalence of remote work, Experian predicts there’ll be a sharp rise in employer text fraud. This occurs when the “boss” texts the employee to buy gift cards using a bogus reason, and then asks the employee to email the gift card numbers and codes. Fraudsters then use the gift cards, leaving the employee and/or the company with the expense.

- Beware of fake job postings and mule schemes: Amid uncertain economic conditions, Experian predicts fraudsters will create fake remote job postings, specifically designed to lure consumers into applying for the job and providing private details like a social security number and date of birth on a fake employment application. The job never materializes, and the fraudsters use the information provided to commit identity theft. Experian also predicts that consumers could fall prey to mule recruiting schemes. This happens when people sign up for work from home jobs and unintentionally act as a re-shipper of stolen goods or help move money through their personal bank accounts on behalf of fraudsters.

-

Frankenstein shoppers spell trouble for retailers: Synthetic identity fraud is the fastest growing financial crime in

the United States , according to TheFederal Reserve . This type of fraud involves a fraudster creating a synthetic or “Frankenstein” identity by combining real and false information and opening and building up lines of credit, eventually maxing out their credit limit and never paying it back. Experian predicts a new version of this fraud could result in major losses for retailers in the coming year. Fraudsters can create online shopper profiles using synthetic identities so that the fake shopper’s legitimacy is created to outsmart retailers’ fraud controls. As the shopper’s profile matures, criminals add stolen payment cards to the accounts. When the fraud eventually occurs, a single synthetic identity will have multiple credit lines to burn through across retailers. - Social media shopping fraud: Experian predicts in-app social commerce fraud could result in millions of dollars in losses. These apps are designed to make shopping easy, intuitive and compelling for consumers to make purchases without leaving the app. This means legitimate brands are racing to make social commerce a part of their sales strategy. However, social commerce currently has very few identity verification and fraud detection controls in place, making the retailers that sell on these platforms easy targets for a surge in fraudulent purchases.

- Peer-to-peer payment problems: Consumers love the convenience of peer-to-peer payments and usage continues to grow. Fraudsters also love peer-to-peer payment methods because they’re an instantaneous and irreversible way to move money, enabling fraudsters to get cash with less work and more profit. Experian predicts fraudsters will gain even more unauthorized access to peer-to-peer payments by using multiple social engineering techniques. Consumers will be duped into buying fake items, sending the money to fraudsters and then never receiving their orders. They’ll also be tricked into giving their account credentials, enabling fraudsters to send cash to themselves.

“As fraudsters become more sophisticated and opportunistic, businesses need to proactively integrate the latest technology, data and advanced analytics to mitigate the growing fraud risk,” said

Experian’s suite of fraud prevention and identity verification tools can help businesses detect and combat fraud. Experian estimates that its fraud prevention solutions helped clients save

About Experian

Experian is the world’s leading global information services company. During life’s big moments — from buying a home or a car to sending a child to college to growing a business by connecting with new customers — we empower consumers and our clients to manage their data with confidence. We help individuals to take financial control and access financial services, businesses to make smarter decisions and thrive, lenders to lend more responsibly, and organizations to prevent identity fraud and crime.

We have 21,700 people operating across 30 countries, and every day we’re investing in new technologies, talented people and innovation to help all our clients maximize every opportunity. We are listed on the

Learn more at www.experianplc.com or visit our global content hub at our global news blog for the latest news and insights from the Group.

Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates. Other product and company names mentioned herein are the property of their respective owners.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230126005322/en/

Experian

949 683 5243

annie.russell@experian.com

Source: Experian