Energy Transfer Announces Pipeline Project Connecting Permian Basin Production Supplies to Multiple Markets

Energy Transfer LP (NYSE: ET) has announced a final investment decision to construct the Hugh Brinson Pipeline, a major natural gas pipeline project connecting the Permian Basin to multiple markets. The project will be developed in two phases:

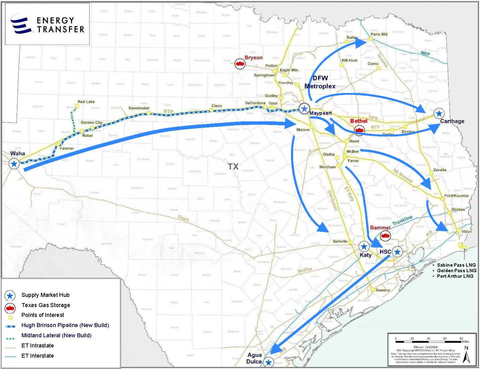

Phase I includes construction of a 400-mile, 42-inch pipeline with 1.5 Bcf/d capacity from Waha to Maypearl, Texas, plus a 42-mile Midland Lateral. Phase II would increase capacity to 2.2 Bcf/d through additional compression. The combined cost is estimated at $2.7 billion, supported by long-term, fee-based commitments from investment-grade counterparties.

The pipeline will connect to Energy Transfer's existing infrastructure and provide access to major Texas markets and trading hubs. Phase I completion is expected by end of 2026.

Energy Transfer LP (NYSE: ET) ha annunciato una decisione finale di investimento per la costruzione del Hugh Brinson Pipeline, un importante progetto di gasdotto che collega il Bacino del Permiano a diversi mercati. Il progetto sarà sviluppato in due fasi:

La Fase I prevede la costruzione di un gasdotto di 400 miglia e 42 pollici con una capacità di 1,5 Bcf/d da Waha a Maypearl, in Texas, oltre a un Lateral di Midland di 42 miglia. La Fase II aumenterebbe la capacità a 2,2 Bcf/d attraverso compressione aggiuntiva. Il costo complessivo è stimato in $2,7 miliardi, supportato da impegni a lungo termine basati su commissioni da controparti con rating di investimento.

Il gasdotto si collegherà alle infrastrutture esistenti di Energy Transfer e fornirà accesso ai principali mercati e hub di trading del Texas. Il completamento della Fase I è previsto entro la fine del 2026.

Energy Transfer LP (NYSE: ET) ha anunciado una decisión final de inversión para construir el Hugh Brinson Pipeline, un importante proyecto de gasoducto que conecta la Cuenca del Pérmico con múltiples mercados. El proyecto se desarrollará en dos fases:

La Fase I incluye la construcción de un gasoducto de 400 millas y 42 pulgadas con una capacidad de 1.5 Bcf/d desde Waha hasta Maypearl, Texas, además de un Lateral de Midland de 42 millas. La Fase II aumentará la capacidad a 2.2 Bcf/d mediante compresión adicional. El costo total se estima en $2.7 mil millones, respaldado por compromisos a largo plazo basados en tarifas de contrapartes de grado de inversión.

El gasoducto se conectará a la infraestructura existente de Energy Transfer y proporcionará acceso a los principales mercados y centros de comercio de Texas. Se espera que la finalización de la Fase I ocurra a fines de 2026.

Energy Transfer LP (NYSE: ET)는 Hugh Brinson Pipeline 건설을 위한 최종 투자 결정을 발표했습니다. 이는 퍼미안 분지를 여러 시장과 연결하는 주요 천연 가스 파이프라인 프로젝트입니다. 이 프로젝트는 두 단계로 개발됩니다:

1단계는 Waha에서 Texas의 Maypearl까지 400마일, 42인치 파이프라인과 1.5 Bcf/d 용량을 포함하며, 42마일 길이의 Midland Lateral이 포함됩니다. 2단계는 추가 압축을 통해 용량을 2.2 Bcf/d로 늘립니다. 총 비용은 27억 달러로 추정되며, 투자 등급의 상대방으로부터 장기적인 수수료 기반의 약속을 지원합니다.

이 파이프라인은 Energy Transfer의 기존 인프라와 연결되어 주요 텍사스 시장 및 거래 허브에 접근할 수 있게 될 것입니다. 1단계 완료는 2026년 말로 예상됩니다.

Energy Transfer LP (NYSE: ET) a annoncé une décision finale d'investissement pour la construction du Hugh Brinson Pipeline, un grand projet de pipeline de gaz naturel reliant le bassin permien à plusieurs marchés. Le projet sera développé en deux phases :

La Phase I comprend la construction d'un pipeline de 400 miles et 42 pouces avec une capacité de 1,5 Bcf/d de Waha à Maypearl, au Texas, ainsi qu'un latéral Midland de 42 miles. La Phase II augmenterait la capacité à 2,2 Bcf/d grâce à une compression supplémentaire. Le coût total est estimé à 2,7 milliards de dollars, soutenu par des engagements à long terme basés sur des frais provenant de contreparties de qualité investissement.

Le pipeline se connectera à l'infrastructure existante d'Energy Transfer et offrira un accès aux principaux marchés et hubs de négociation du Texas. L'achèvement de la Phase I est prévu d'ici fin 2026.

Energy Transfer LP (NYSE: ET) hat eine endgültige Investitionsentscheidung für den Bau des Hugh Brinson Pipeline bekannt gegeben, einem wichtigen Erdgasleitungprojekt, das das Permian Basin mit mehreren Märkten verbindet. Das Projekt wird in zwei Phasen entwickelt:

Phase I umfasst den Bau einer 400 Meilen langen, 42-Zoll-Leitung mit einer Kapazität von 1,5 Bcf/d von Waha nach Maypearl, Texas, sowie eine 42 Meilen lange Midland Lateral. Phase II würde die Kapazität auf 2,2 Bcf/d durch zusätzliche Verdichtung erhöhen. Die Gesamtkosten werden auf 2,7 Milliarden US-Dollar geschätzt, unterstützt durch langfristige, gebührenbasierte Verpflichtungen von Gegenparteien mit Investment-Grade-Rating.

Die Leitung wird an die bestehende Infrastruktur von Energy Transfer angeschlossen und bietet Zugang zu wichtigen Märkten und Handelszentren in Texas. Der Abschluss der Phase I wird bis Ende 2026 erwartet.

- Secured long-term, fee-based commitments from investment-grade counterparties

- Project will expand capacity by 1.5-2.2 Bcf/d, increasing revenue potential

- Strategic expansion into high-demand Permian Basin market

- Integration with existing infrastructure enhances network value

- Large capital expenditure of $2.7 billion required

- Extended timeline to completion (end of 2026) delays revenue generation

Insights

Will Provide Additional Natural Gas Capacity to Serve Growing Market Needs

Hugh Brinson Pipeline (Graphic: Business Wire)

The Hugh Brinson Pipeline is expected to be constructed in two phases with the first phase including the construction of approximately 400 miles of 42-inch pipeline with a capacity of 1.5 billion cubic feet per day (Bcf/d). It will extend from Waha to

As part of Phase I, Energy Transfer will also construct the Midland Lateral, which is expected to be a 42-mile, 36-inch lateral to connect Energy Transfer and third-party processing plants in

Phase II of the project would include the addition of compression to increase the capacity of the new pipeline to approximately 2.2 Bcf/d. Depending on shipper demand, Phase II could be constructed concurrently with Phase I.

Combined costs of Phase I and Phase II are expected to be approximately

The Hugh Brinson Pipeline will connect shippers to Energy Transfer’s existing intrastate natural gas pipeline network and other downstream pipelines. In addition, it will provide shippers with the optionality to access prolific markets and trading hubs throughout

Energy Transfer LP (NYSE: ET) owns and operates one of the largest and most diversified portfolios of energy assets in

Forward-Looking Statements

This news release may include certain statements concerning expectations for the future that are forward-looking statements as defined by federal law. Such forward-looking statements are subject to a variety of known and unknown risks, uncertainties, and other factors that are difficult to predict and many of which are beyond management’s control. An extensive list of factors that can affect future results, are discussed in the Partnership’s Annual Report on Form 10-K and other documents filed from time to time with the Securities and Exchange Commission. The Partnership undertakes no obligation to update or revise any forward-looking statement to reflect new information or events.

The information contained in this press release is available on our website at www.energytransfer.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20241206711495/en/

Investor Relations:

Bill Baerg

Brent Ratliff

Lyndsay Hannah

214-981-0795

Media Relations:

Vicki Granado

214-840-5820

Source: Energy Transfer LP