Enerplus Agrees to Acquire Williston Basin Operator, Enhancing Value for Shareholders and Accelerating Free Cash Flow Generation; Provides Preliminary 2020 Results and 2021 Guidance

Enerplus Corporation (TSX & NYSE: ERF) announced the acquisition of Bruin E&P HoldCo, LLC for US$465 million. This acquisition enhances Enerplus's position in the Williston Basin, adding 151,000 net acres and approximately 24,000 BOE per day of production. Expected synergies include a 30% increase in adjusted funds flow per share and an 80% increase in free cash flow per share within the first year. The deal is projected to generate over $200 million in free cash flow for 2021, maintaining a robust financial position with a net debt to adjusted funds flow ratio below 1.3x.

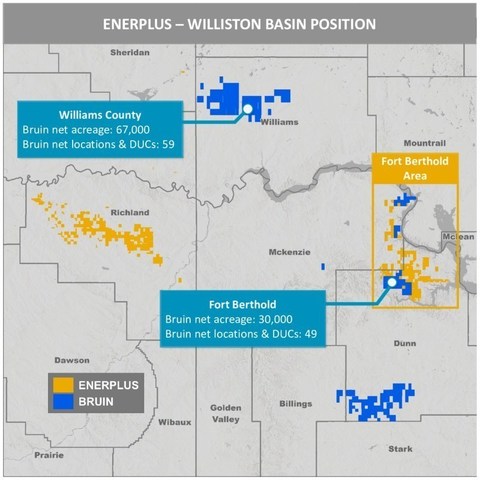

- Acquiring 151,000 net acres in the Williston Basin, including 30,000 net acres adjacent to existing operations.

- Immediately accretive to per share metrics, with an estimated 30% increase in adjusted funds flow per share and 80% in free cash flow per share within the first year.

- The acquisition price represents less than 3.0 times Bruin's 2021 forecast EBITDA, indicating a good value purchase.

- Expected to generate over $200 million in free cash flow in 2021 based on commodity pricing assumptions.

- Pro forma balance sheet strength with net debt to adjusted funds flow ratio estimated at or below 1.3x.

- The acquisition will be funded partly through a new US$400 million term loan, which could add financial strain.

- Potential integration challenges with Bruin's assets could affect operational efficiency.

Insights

Analyzing...

CALGARY, AB, Jan. 25, 2021 /PRNewswire/ - Enerplus Corporation ("Enerplus" or the "Company") (TSX & NYSE: ERF) today announced that it has entered into a definitive agreement to acquire all of the shares of Bruin E&P HoldCo, LLC ("Bruin"), a pure play Williston Basin private company, for total cash consideration of US

KEY HIGHLIGHTS

- Core area acquisition improving scale – Acquiring 151,000 net acres in the Williston Basin, including 30,000 net acres contiguous with Enerplus' tier 1 acreage position. The acquisition includes approximately 24,000 BOE per day of existing production (working interest(1)), 84 MMBOE of proved plus probable reserves (working interest(1)), and an inventory of 149 (111 net) drilling locations (including drilled uncompleted wells). After the Acquisition, Enerplus estimates it will hold more than a decade of drilling inventory capable of sustaining production at 2021 levels, with additional drilling inventory upside on Bruin's acreage if commodity prices strengthen.

- Immediately accretive to per share metrics – Expected to be materially accretive to per share metrics in the first year, including adjusted funds flow and free cash flow. Accretion to adjusted funds flow per share and free cash flow per share is expected to be approximately

30% and80% , respectively, in the 12-month period following closing of the Acquisition, inclusive of the bought deal equity financing described below. - Enhanced value capture and free cash flow acceleration – The purchase price represents less than 3.0 times Bruin's 2021 forecast EBITDA using a US

$50 per barrel WTI oil price – a discount to Enerplus' current trading metrics. Bruin's lower decline production base is expected to support strong free cash flow generation. Pro forma and based on a ten-month contribution from Bruin's assets in 2021, Enerplus expects to generate over$200 million of free cash flow in 2021 based on US$50 per barrel WTI crude oil and US$2.75 per Mcf NYMEX natural gas prices. - Maintains strong balance sheet – The pro forma business retains a solid financial position with an estimated year-end 2021 net debt to adjusted funds flow ratio at or below 1.3x on a trailing 12-month basis (inclusive of the bought deal equity financing described below), with a target of less than 1.0x over the longer term. The business will continue to have excellent liquidity and expects to be undrawn on its US

$600 million bank credit facility upon the Acquisition closing. - Drives cost synergies – The enhanced operating scale and asset synergies resulting from the Acquisition are expected to drive continued efficiency gains and cost reductions supporting further cash flow improvements beyond Enerplus' current forecast. Additionally, there are no incremental general and administrative costs associated with the Acquisition.

- Commitment to strong ESG performance – Enerplus will continue to pursue ESG excellence while integrating Bruin's assets and operations into its ESG initiatives. The Company will continue to work towards its longer-term goals, including a

50% reduction in GHG emissions intensity by 2030 and a50% reduction in freshwater use per well completion by 2025.

"This acquisition demonstrates our disciplined returns-oriented focus and commitment to value creation for our shareholders," said Ian C. Dundas, President and CEO of Enerplus. "With immediately adjacent acreage offering strong operational synergies, Bruin's assets are highly complementary to our existing tier 1 position in the Bakken and will enable us to accelerate free cash flow growth and further support our focus on providing long term sustainable shareholder returns."

(1) | Production and reserves are stated on a working interest basis before deduction of royalties. |

TRANSACTION DETAILS

Enerplus has agreed to acquire all of the outstanding shares of Bruin for total cash consideration of US

In connection with the Acquisition, Enerplus has entered into a binding agreement with RBC Capital Markets and BMO Capital Markets, who are acting as Joint Bookrunners, to provide Enerplus with a new three year, US

Bruin's properties are all located in North Dakota with significant production and development inventory concentrated in the Fort Berthold area near Enerplus' primary property. Bruin's current production rate is approximately 24,000 BOE per day (

2020 UPDATE AND PRO FORMA 2021 OUTLOOK

Enerplus delivered fourth quarter 2020 production at the higher end of its guidance ranges with total production of approximately 86,200 BOE per day, including liquids production of 49,200 barrels per day, based on preliminary estimates. Full year 2020 production averaged approximately 90,700 BOE per day, with liquids production of 51,100 barrels per day, also at the high end of the Company's guidance. Capital spending in the fourth quarter of 2020 was approximately

Enerplus' Fourth Quarter and Full-Year 2020 Production Summary

Light & medium crude oil (bbl/d) | Tight oil | Heavy oil | NGL | Natural gas | Total | |

Fourth quarter 2020 | 3,190 | 36,000 | 4,220 | 5,790 | 222 | 86,200 |

Full year 2020 | 3,280 | 38,240 | 3,900 | 5,630 | 238 | 90,700 |

Enerplus' stand-alone 2021 preliminary outlook (provided with its third quarter 2020 results on November 6, 2020) contemplated 2021 production volumes approximately flat to the Company's fourth quarter 2020 production guidance of 86,000 BOE per day, including 48,000 barrels per day of liquids (based on the guidance mid-points). The capital spending associated with this outlook was approximately

Assuming completion of the Acquisition and a ten-month contribution from the Bruin assets to Enerplus' 2021 results, Enerplus expects to deliver 2021 production of 103,500 to 108,500 BOE per day, including 63,000 to 67,000 barrels per day of liquids. Capital spending in 2021 is expected to be

Assuming a ten-month contribution from Bruin, Enerplus expects to generate over

Pro forma for the Acquisition, the Company expects to realize a Bakken oil price differential of

Detailed guidance for 2021 will be provided following closing of the Acquisition.

2021 OUTLOOK SUMMARY

Enerplus 2021 Preliminary | Pro forma 2021 Outlook | Increase (based on a ten-month | |

Total production (BOE/d)(1) | 86,000 | 103,500 to 108,500 | +17,500 to 22,500 |

Liquids production (bbl/d)(1) | 48,000 | 63,000 to 67,000 | +15,000 to 19,000 |

Capital spending ($MM) | + |

(1) | Production is stated on a working interest basis before the deduction of royalties. |

COMMODITY HEDGING UPDATE

Pro forma for the Acquisition, Enerplus has approximately

For natural gas, Enerplus has hedges in place for its summer 2021 volumes representing approximately

ADVISORS

Stifel FirstEnergy acted as financial advisor to Enerplus on the Acquisition. Tudor, Pickering, Holt & Co. and TD Securities acted as strategic advisors to Enerplus on the Acquisition. Vinson & Elkins LLP acted as U.S. legal advisor to Enerplus for the Acquisition and financings, and Blake, Cassels & Graydon LLP acted as legal advisor to Enerplus on the Acquisition and financings.

ABOUT ENERPLUS

Enerplus is an independent North American oil and gas exploration and production company focused on creating long-term value for its shareholders through a disciplined, returns-based capital allocation strategy and a commitment to safe, responsible operations.

Currency and Accounting Principles

All amounts in this news release are stated in Canadian dollars unless otherwise specified.

Barrels of Oil Equivalent

This news release also contains references to "BOE" (barrels of oil equivalent). Enerplus has adopted the standard of six thousand cubic feet of gas to one barrel of oil (6 Mcf: 1 bbl) when converting natural gas to BOEs. BOEs may be misleading, particularly if used in isolation. The foregoing conversion ratios are based on an energy equivalency conversion method primarily applicable at the burner tip and do not represent a value equivalency at the wellhead. Given that the value ratio based on the current price of oil as compared to natural gas is significantly different from the energy equivalent of 6:1, utilizing a conversion on a 6:1 basis may be misleading.

Presentation of Production Information and Reserves Information

Under U.S. GAAP oil and gas sales are generally presented net of royalties and U.S. industry protocol is to present production volumes net of royalties. Under Canadian industry protocol oil and gas sales and production volumes are required to be presented on a gross basis before deduction of royalties. In order to continue to be comparable with its Canadian peer companies, unless otherwise stated, the information contained within this news release presents Enerplus' production and BOE measures on a before royalty "company interest" basis. All production volumes presented herein are reported on a "company interest" basis, before deduction of Crown and other royalties, plus Enerplus' royalty interest. This news release also contains references to the percentage of the Company's production that is hedged under commodity derivatives contracts, this percentage being based upon the Company's net of royalty production volumes. All reserves volumes in this news release (and all information derived therefrom) are based on "gross reserves" using forecast prices and costs. "Gross reserves" (as defined in NI 51-101), are Enerplus' working interest before deduction of any royalties. Information about reserves on Bruin's properties contained in this press release is derived from a report on Bruin's properties effective as of December 31, 2020 prepared by McDaniel & Associates Ltd., an independent reserves evaluator. The drilling locations identified in this news release are comprised of 65 gross (50.0 net) proved plus probable undeveloped reserves locations identified by McDaniel & Associates Ltd., of which 14 gross (9.9 net) are drilled and uncompleted, and 84 gross (60.9 net) unbooked future drilling locations not associated with any reserves of Bruin, and have been identified by internal qualified reserves evaluators.

FORWARD-LOOKING INFORMATION AND STATEMENTS

This news release contains certain forward-looking information and statements ("forward-looking information") within the meaning of applicable securities laws. The use of any of the words "expect", "anticipate", "continue", "estimate", "guidance", "ongoing", "may", "will", "project", "plans", "budget", "strategy" and similar expressions are intended to identify forward-looking information. In particular, but without limiting the foregoing, this news release contains forward-looking information pertaining to the following: anticipated completion of the Acquisition and financings, including expected size, terms, timing and completion thereof; expected benefits of the Acquisition; expected impacted of the Acquisition on Enerplus' operations and financial results, including inventory of drilling locations, expected accretion to Enerplus' metrics (including expected free cash flow in 2021 and year-end net debt to adjusted funds flow ratio) and minimum rates of return; Enerplus' expected 2020 and 2021 average production volumes and expected capital levels to support such production; anticipated production mix and Enerplus' expected source of funding thereof; the proportion of Enerplus' anticipated oil and gas production that is hedged; our operating plans; oil and natural gas prices and differentials and our commodity risk management programs; and anticipated impact of the Acquisition on Enerplus' future costs and expenses; plans for excess cash flow; and Enerplus' ESG targets, including reduction in GHG emissions intensity and in freshwater use.

The forward-looking information contained in this news release reflects several material factors and expectations and assumptions of Enerplus including, without limitation: that the Acquisition will be completed substantially on the terms and within the timeline described in this press release; that Enerplus will realize expected benefits of the Acquisition described in this press release; that Enerplus will conduct its operations and achieve results of operations as anticipated; that Enerplus' development plans will achieve the expected results; current commodity price and cost assumptions; the general continuance of current or, where applicable, assumed industry conditions, including expectations regarding the duration and overall impact of COVID-19; the continuation of assumed tax, royalty and regulatory regimes; the accuracy of the estimates of Enerplus' reserves and resources volumes; the continued availability of adequate debt and/or equity financing, cash flow and other sources to fund Enerplus' capital and operating requirements, and dividend payments as needed; availability of third party services; and the extent of its liabilities. In addition, Enerplus' 2021 outlook contained in this news release is based on the following: a WTI price of between US

The forward-looking information included in this news release is not a guarantee of future performance and should not be unduly relied upon. Such information involves known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking information including, without limitation: failure to complete the Acquisition, at all or on terms or within the timeline described in this press release; failure by Enerplus to realize anticipated benefits of the Acquisition; changes, including future decline, in commodity prices, including as a result of continued COVID-19 pandemic; changes in realized prices for Enerplus' products; changes in the demand for or supply of Enerplus' products; unanticipated operating results, results from Enerplus' capital spending activities or production declines; curtailment of Enerplus' production due to low realized prices or lack of adequate infrastructure; changes in tax or environmental laws, royalty rates or other regulatory matters; changes in development plans by Enerplus or by third party operators of Enerplus' properties; increased debt levels or debt service requirements; changes in estimates of Enerplus' oil and gas reserves and resources volumes; limited, unfavourable or a lack of access to capital markets; increased costs; a lack of adequate insurance coverage; the impact of competitors; reliance on industry partners; failure to complete any anticipated acquisitions or divestitures; changes in law or government programs or policies in Canada or the United States; and certain other risks detailed from time to time in Enerplus' public disclosure documents (including, without limitation, those risks identified in its AIF, management's discussion and analysis ("MD&A"), and Form 40-F at December 31, 2019 and management's discussion and analysis for the third quarter of 2020) as it may be updated from time to time by current reports on Form 6-K, all of which are available, as applicable, on SEDAR website at www.sedar.com, on the SEC's website at http://www.sec.gov and on Enerplus' website).

The purpose of our estimated free cash flow disclosure, is to assist readers in understanding our expected and targeted financial results, and this information may not be appropriate for other purposes. Information in this press release is provided as of the date hereof and Enerplus assumes no obligation to update any forward-looking statements, unless otherwise required by law.

NON-GAAP MEASURES

In this news release, Enerplus uses the terms "free cash flow" and "adjusted funds flow" (including per share measures) as measures to analyze operating and financial performance. "Free cash flow" is defined as "Adjusted funds flow less exploration and development capital spending". "Adjusted funds flow" is calculated as net cash generated from operating activities but before changes in non-cash operating working capital and asset retirement obligation expenditures.

Enerplus believes that, in addition to net earnings and other measures prescribed by U.S. GAAP, the terms "adjusted funds flow" and "free cash flow" are useful supplemental measures as such provide an indication of the results generated by Enerplus' principal business activities. However, these measures are not recognized by U.S. GAAP and do not have a standardized meaning prescribed by U.S. GAAP. Therefore, these measures, as defined by Enerplus, may not be comparable to similar measures presented by other issuers.

![]() View original content to download multimedia:http://www.prnewswire.com/news-releases/enerplus-agrees-to-acquire-williston-basin-operator-enhancing-value-for-shareholders-and-accelerating-free-cash-flow-generation-provides-preliminary-2020-results-and-2021-guidance-301214430.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/enerplus-agrees-to-acquire-williston-basin-operator-enhancing-value-for-shareholders-and-accelerating-free-cash-flow-generation-provides-preliminary-2020-results-and-2021-guidance-301214430.html

SOURCE Enerplus Corporation