Eos Energy Enterprises Achieves “Power On” Status of all Motion Systems on its First State-of-the-Art Manufacturing Line and Provides Preliminary Results

- None.

- None.

Insights

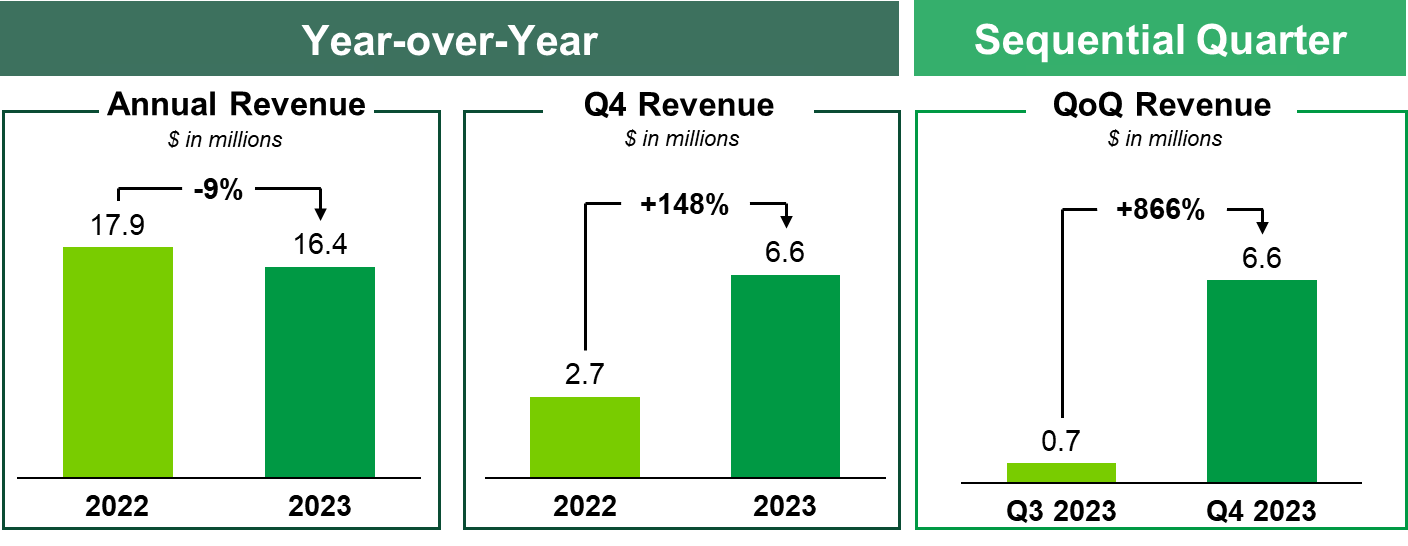

From a market research perspective, the announcement by Eos Energy Enterprises of achieving 'Power On' status for its manufacturing line and the reported revenue growth are indicative of operational progress and strategic execution. The 148% increase in Q4 revenue year-over-year and the 866% sequential growth from Q3 are particularly noteworthy as they signal a strong market demand for the Eos Z3 Cube and the company's ability to scale production to meet this demand.

However, the full-year revenue decline from $17.9 million in 2022 to $16.4 million in 2023 raises questions about the company's overall growth trajectory. This could be attributed to the transition phase from Gen 2.3 to the Eos Z3 Cube, which might have temporarily disrupted production. Investors would benefit from a deeper understanding of the market dynamics for energy storage systems and the competitive positioning of Eos's zinc-based solutions compared to lithium-ion and other emerging technologies.

From a financial standpoint, the expected improvement in gross margin by 30% to 50% over the previous year is a strong indicator of operational efficiency and cost management. The ending cash balance of $69.5 million provides the company with a solid liquidity position to support ongoing operations and strategic investments. Additionally, the substantial orders backlog of $534.8 million suggests a healthy pipeline of future revenue, albeit with the caveat that it reflects customer commitments that may be subject to change based on project timelines and execution.

The anticipated cost-reduction initiatives set to take effect in 2024 could further enhance margins and profitability. Investors should monitor the implementation of these initiatives and their impact on the company's financial performance, particularly in the fourth quarter when the majority of the benefits are expected to be realized.

The technical advancements in the Eos Z3 Cube, such as higher power density, fewer cells, reduced weight and significantly fewer welds, represent a leap forward in energy storage technology. The reduction in manufacturing cycle time from 90 to under 4 minutes is a testament to the efficiency gains achieved through the semi-automated production line. These improvements could position Eos as a leader in the zinc-based energy storage market, offering an alternative to traditional lithium-ion systems with potential advantages in safety, scalability and sustainability.

It's important to understand the broader implications of these advancements for the energy storage industry, including how they align with global trends towards renewable energy integration and grid stability. The strategic focus on a phased manufacturing approach demonstrates a commitment to capital efficiency and could set a precedent for the industry.

EDISON, N.J., Feb. 13, 2024 (GLOBE NEWSWIRE) -- Eos Energy Enterprises, Inc. (NASDAQ: EOSE) (“Eos” or the “Company”), a leading provider of safe, scalable, efficient, and sustainable zinc-based energy storage systems, today announced that it achieved “Power On” status of all motion systems on its first state-of-the-art manufacturing line and expects to record revenue of

The Company also provided further details on its first state-of-the-art manufacturing line and its preliminary fourth quarter and full year 2023 revenue.

State-of-the-Art Manufacturing Line Update

At the end of January, the Company, and its automation partner, ACRO Automation, achieved a significant milestone towards Factory Acceptance Testing in ACRO’s Wisconsin facility. ACRO recently fully powered on the core Eos Z3 battery assembly section of the state-of-the-art manufacturing line. This begins equipment commissioning, along with controls configuration and uploading software into programmable logic controllers (PLCs) to operate conveyors, indexers, robots, and pneumatic devices. During the week of February 5, the Company successfully powered on the second half of the line that performs final Eos Z3 battery module assembly and testing, achieving “Power On” of all motion systems on the line. The Company is on track for the first state-of-the-art manufacturing line to be installed and commissioned in Eos’s Turtle Creek facility in Q2 2024.

Fourth Quarter 2023 Revenue

Q4 2023 Revenue is expected to be

Full Year 2023 Revenue

Full year 2023 Revenue is expected to be

Expected Q4 and Full Year 2023 Revenue

Eos will provide further commentary on its fourth quarter performance in connection with the release of its full year and fourth quarter 2023 financial results in March with conference call timing and details to follow.

About Eos

Eos Energy Enterprises, Inc. is accelerating the shift to clean energy with positively ingenious solutions that transform how the world stores power. Our breakthrough Znyth™ aqueous zinc battery was designed to overcome the limitations of conventional lithium-ion technology. Safe, scalable, efficient, sustainable—and manufactured in the U.S—it's the core of our innovative systems that today provide utility, industrial, and commercial customers with a proven, reliable energy storage alternative for 3- to 12-hour applications. Eos was founded in 2008 and is headquartered in Edison, New Jersey. For more information about Eos (NASDAQ: EOSE), visit eose.com.

| Contacts | |

| Investors: | ir@eose.com |

| Media: | media@eose.com |

Forward-Looking Statements / Disclaimer

This press release includes certain statements that may constitute "forward-looking statements" within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include, but are not limited to, statements that refer to our expected revenue for the fourth quarter and full year 2023, expected margins for full year 2023, and cash balance and orders backlog as of December 31, 2023. The words "anticipate," "believe," "continue," "could," "estimate," "expect," "intends," "may," "might," "plan," "possible," "potential," "predict," "project," "should," "would" and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Factors which may cause actual results to differ materially from current expectations include, but are not limited to: the preliminary financial information remains subject to changes and finalization based upon management’s ongoing review of results for the fourth quarter and full year 2023 and the completion of all quarter closing procedures; changes adversely affecting the business in which we are engaged; our ability to forecast trends accurately; our ability to secure final approval of a loan from the Department of Energy or the final amount of any loan; our ability to generate cash, service indebtedness and incur additional indebtedness; our ability to secure financing to continue expansion; our customer’s ability to secure project financing; our ability to develop efficient manufacturing processes to scale and to forecast related costs and efficiencies accurately, and to secure labor; fluctuations in our revenue and operating results; competition from existing or new competitors; the failure to convert firm order backlog and pipeline to revenue; the failure to sufficiently reduce manufacturing costs, potential delays in the launch of our Eos Z3 battery; inefficient implementation of the Inflation Reduction Act of 2022; the amount of final tax credits available to our customers or to Eos pursuant to the Inflation Reduction Act; risks associated with security breaches in our information technology systems; risks related to legal proceedings or claims; risks associated with evolving energy policies in the United States and other countries and the potential costs of regulatory compliance; risks associated with changes in federal, state, or local laws; risks associated with potential costs of regulatory compliance; risks associated with changes to U.S. trade policies; risks resulting from the impact of global pandemics, including the novel coronavirus, Covid-19; our ability to maintain the listing of our shares of common stock on NASDAQ; our ability to grow our business and manage growth profitably, maintain relationships with customers and suppliers and retain our management and key employees; risks related to the adverse changes in general economic conditions, including inflationary pressures and increased interest rates; risk from supply chain disruptions and other impacts of geopolitical conflict; changes in applicable laws or regulation; the possibility that Eos may be adversely affected by other economic, business, and/or competitive factors; other factors beyond our control; and other risks and uncertainties. The forward-looking statements contained in this press release are also subject to additional risks, uncertainties, and factors, including those more fully described in Eos’s most recent filings with the Securities and Exchange Commission, including Eos’s most recent Annual Report on Form 10-K and subsequent reports on Forms 10-Q and 8-K. Further information on potential risks that could affect actual results will be included in the subsequent periodic and current reports and other filings that Eos makes with the Securities and Exchange Commission from time to time. Moreover, Eos operates in a very competitive and rapidly changing environment, and new risks and uncertainties may emerge that could have an impact on the forward-looking statements contained in this press release. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and, except as required by law, Eos assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise.

A photo accompanying this announcement is available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/bd40da2a-b2e9-4fc8-9f2d-f52e79f74529

FAQ

What is Eos Energy Enterprises, Inc.'s ticker symbol?

What was the revenue for Eos Energy Enterprises, Inc. in Q4 2023?

What is the full year 2023 revenue projection for Eos Energy Enterprises, Inc.?

What was the gross margin improvement expected for Eos Energy Enterprises, Inc. in full year 2023?