Indigenous Communities and Enbridge Announce Landmark Equity Partnership

Enbridge Inc. has announced a landmark agreement with 23 First Nation and Métis communities to acquire an 11.57% non-operating interest in seven pipelines in Alberta for $1.12 billion. This investment, facilitated by Athabasca Indigenous Investments (Aii), represents the largest Indigenous energy partnership in North America. The transaction aims to promote economic sovereignty and environmental stewardship among Indigenous communities. The closing is expected within a month, with long-term contracts supporting predictable cash flows from the pipeline assets.

- Partnership represents the largest Indigenous energy investment in North America.

- Transaction aligns with Enbridge's goals to recycle capital and fund growth opportunities.

- Long-life resources and contracts underpin predictable cash flows from pipeline assets.

- None.

EDMONTON, AB, Sept. 28, 2022 /PRNewswire/ - Enbridge Inc. (Enbridge or the Company) (TSX: ENB) (NYSE: ENB) and 23 First Nation and Métis communities today announced an agreement whereby the communities will acquire, collectively, an

A newly created entity, Athabasca Indigenous Investments (Aii), will steward this investment, which represents the largest energy-related Indigenous economic partnership transaction in North America to date.

"We are very pleased to be joining our Indigenous partners in this landmark collaboration," said Al Monaco, President and Chief Executive Officer of Enbridge. "We believe this partnership exemplifies how Enbridge and Indigenous communities can work together, not only in stewarding the environment, but also in owning and operating critical energy infrastructure. We are looking forward to working with the Aii and deepening our relationship well into the future. This also fully aligns with our priority to recycle capital at attractive valuations, which can be used to fund numerous growth opportunities within our conventional and low carbon platforms."

This investment by Aii also fits well with commitments Enbridge made in its recently released Indigenous Reconciliation Action Plan (IRAP), building on a growing track record of engagement with Indigenous communities and employees. The IRAP incorporates advice into facility siting, environmental and cultural monitoring, employment, training and procurement opportunities and, most recently, financial partnerships such as the proposed Wabamun Carbon Hub.

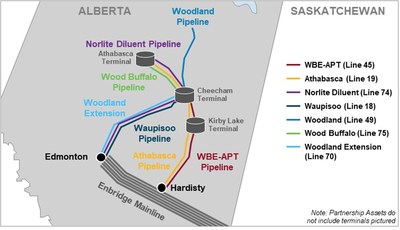

Pipelines included in the transaction are the Athabasca, Wood Buffalo/Athabasca Twin and associated tanks; Norlite Diluent; Waupisoo; Wood Buffalo; Woodland; and the Woodland extension. These assets are underpinned by long-life resources and long-term contracts, which provide highly predictable cash flows.

"On behalf of the Indigenous partners, we are proud to become equity owners in these high-quality assets which contribute to North American energy supply and security," said Justin Bourque, President of Athabasca Indigenous Investments. "Our partner logo theme – Seven Pipelines, Seven Generations – speaks to the long-term value potential of these assets, which will help enhance quality of life in our communities for many years to come."

"This is a truly historic day for our communities in the Athabasca region," added Chief Greg Desjarlais of Frog Lake First Nation. "In addition to an opportunity to generate wealth for our people, this investment supports economic sovereignty for our communities. We look forward to working with a leading energy company like Enbridge, which shares Indigenous values of water, land and environmental stewardship."

"To be involved in an Indigenous partnership that will bring ongoing benefits to our communities is very important to the Métis people of Alberta," says Stan Delorme, Chairperson, Buffalo Lake Métis Settlement. "Today's announcement marks a next step in our relationship with Enbridge and our neighbors in the Athabasca region."

Closing of the transaction is expected to occur within the next month. BMO Capital Markets acted as financial advisor to Enbridge and Torys LLP as legal counsel. RBC Capital Markets acted as financial advisor to Athabasca Indigenous Investments and Boughton Law as legal counsel.

JOINT VENTURE ASSETS

About Athabasca Indigenous Investments

Athabasca Indigenous Investments is a newly created limited partnership of 23 diverse Treaty 6 and Treaty 8 First Nations and Métis communities located in northern Alberta, that will steward the communities' investment in seven Enbridge-operated pipelines. Participating communities include:

Athabasca Chipewyan First Nation | Fishing Lake Métis Settlement | Kikino Métis Settlement |

Beaver Lake Cree Nation | Frog Lake First Nation | McMurray Métis Local 1935 |

Buffalo Lake Métis Settlement | Fort Chipewyan Métis Local 125 | Mikisew Cree First Nation |

Chard Métis Nation | Fort McKay First Nation | Onion Lake Cree Nation |

Chipewyan Prairie First Nation | Fort McKay Métis Nation | Saddle Lake Cree Nation |

Conklin Métis Local 193 | Fort McMurray 468 First Nation | Willow Lake Métis Nation |

Cold Lake First Nations | Heart Lake First Nation | Whitefish Lake First Nation (Goodfish) |

Elizabeth Métis Settlement | Kehewin Cree Nation |

About Enbridge

At Enbridge, we safely connect millions of people to the energy they rely on every day, fueling quality of life through our North American natural gas, oil or renewable power networks and our growing European offshore wind portfolio. We're investing in modern energy delivery infrastructure to sustain access to secure, affordable energy and building on two decades of experience in renewable energy to advance new technologies including wind and solar power, hydrogen, renewable natural gas and carbon capture and storage. We're committed to reducing the carbon footprint of the energy we deliver, and to achieving net zero greenhouse gas emissions by 2050.

Headquartered in Calgary, Alta., Enbridge's common shares trade under the symbol ENB on the Toronto (TSX) and New York (NYSE) stock exchanges. To learn more, visit us at Enbridge.com

Press Conference

The press conference will include remarks from key stakeholders followed by a Q&A. Media can join in-person or via teleconference. The event will be livestreamed at alberta.ca/news.

When: | Wednesday, September 28, 11 a.m.to 12:15 p.m. MT |

Where: | Enbridge Centre - 10175 101 St NW Suite 1800, Edmonton, AB |

Who: | Al Monaco, President and Chief Executive Officer, Enbridge |

Colin Gruending, Executive Vice President & President, Liquids Pipelines, Enbridge Justin Bourque, President, Athabasca Indigenous Investments | |

Chief Greg Desjarlais, Frog Lake First Nation Stan Delorme, Chairperson, Buffalo Lake Métis Settlement | |

Jason Kenney, Premier of Alberta | |

Chana Martineau, Chief Executive Officer, Alberta Indigenous Opportunity Corporation |

Teleconference information:

Calgary media dial-in: | 1-587-333-0001 |

Edmonton media dial-in: | 1-825-500-5007 |

Toll-free media dial-in: | 1-800-578-9520 |

Passcode: | 850474 |

- Reporters must provide their conference ID, name, affiliation, and telephone number to the conference operator

- Reporters are encouraged to dial in 15 minutes early to ensure participation

- Participants will be able to hear all questions and responses

- To ask a question: Press *1

- To exit question queue: Press *2

Forward-Looking Information

Forward-looking information, or forward-looking statements, have been included in this news release to provide information about Enbridge and its subsidiaries and affiliates, including management's assessment of Enbridge and its subsidiaries' and affiliates' future plans and operations. This information may not be appropriate for other purposes. Forward looking statements are typically identified by words such as ''anticipate'', ''expect'', ''project'', 'estimate'', ''forecast'', ''plan'', ''intend'', ''target'', ''believe'', "likely" and similar words suggesting future outcomes or statements regarding an outlook. Forward-looking information or statements included or incorporated by reference in this document include, but are not limited to, statements with respect to the sale by Enbridge of an equity interest in certain pipelines and the establishment of a partnership with Athabasca Indigenous Investments (the "Transaction"); capital to fund future growth opportunities; resources and contracts underpinning the pipeline assets; predictability of cash flows; and expected timing of closing. In addition, completion of the Transaction is subject to customary closing conditions.

Although Enbridge believes these forward-looking statements are reasonable based on the information available on the date such statements are made and processes used to prepare the information, such statements are not guarantees of future performance and readers are cautioned against placing undue reliance on forward-looking statements. By their nature, these statements involve a variety of assumptions, known and unknown risks and uncertainties and other factors, which may cause actual results, levels of activity and achievements to differ materially from those expressed or implied by such statements. Material assumptions include assumptions about the following: energy transition, including the drivers and pace thereof; the COVID-19 pandemic and the duration and impact thereof; global economic growth and trade; the expected supply of and demand for crude oil, natural gas, natural gas liquids ("NGL"), liquified natural gas ("LNG") and renewable energy; prices of crude oil, natural gas, NGL, LNG and renewable energy; anticipated utilization of our assets; anticipated cost savings; exchange rates; inflation; interest rates; availability and price of labour and construction materials; the stability of our supply chain; operational reliability and performance; customer, regulatory and stakeholder support and approvals; anticipated construction and in-service dates; weather; announced and potential acquisition, disposition and other corporate transactions and projects and the timing and impact thereof, including the Transaction; expectations about our partners' ability to complete and finance proposed transactions and projects; governmental legislation; litigation; credit ratings; hedging program; expected EBITDA and expected adjusted EBITDA; expected earnings/(loss) and adjusted earnings/(loss); expected earnings/(loss) or adjusted earnings/(loss) per share; expected future cash flows and expected future distributable cash flow ("DCF") and DCF per share; estimated future dividends; financial strength and flexibility; debt and equity market conditions; and general economic and competitive conditions. Assumptions regarding the expected supply of and demand for crude oil, natural gas, NGL, LNG and renewable energy and the prices of these commodities are material to and underlie all forward-looking statements, as they may impact current and future levels of demand for the Company's services. Similarly, exchange rates, inflation, interest rates and the COVID-19 pandemic impact the economies and business environments in which the Company operates and may impact levels of demand for the Company's services and cost of inputs and are, therefore, inherent in all forward-looking statements. Due to the interdependencies and correlation of these macroeconomic factors, the impact of any one assumption on a forward-looking statement cannot be determined with certainty, particularly with respect to expected DCF and DCF per share amounts.

Enbridge's forward-looking statements are subject to risks and uncertainties pertaining to the realization of anticipated benefits and synergies of projects and transactions, including the Transaction, successful execution of our strategic priorities, operating performance, the Company's dividend policy, regulatory parameters, changes in regulations applicable to the Company's business, litigation, acquisitions and dispositions and other transactions, project approval and support, renewals of rights-of-way, weather, economic and competitive conditions, public opinion, changes in tax laws and tax rates, changes in trade agreements, political decisions, exchange rates, interest rates, commodity prices, supply of and demand for commodities and the COVID-19 pandemic, including but not limited to those risks and uncertainties discussed in this and in the Company's other filings with Canadian and U.S. securities regulators. The impact of any one risk, uncertainty or factor on a particular forward-looking statement is not determinable with certainty, as these are interdependent and Enbridge's future course of action depends on management's assessment of all information available at the relevant time. Except to the extent required by applicable law, Enbridge assumes no obligation to publicly update or revise any forward-looking statements made in this news release or otherwise, whether as a result of new information, future events or otherwise. All forward-looking statements, whether written or oral, attributable to Enbridge or persons acting on the Company's behalf, are expressly qualified in their entirety by these cautionary statements.

Athabasca Indigenous Investments | Enbridge |

Media | Media |

Peter Pilarski | Toll Free: (888) 992-0997 |

President, CIPR Communications Inc. | Email:media@enbridge.com |

Phone: (403) 462-1160 | |

Email: peter@ciprcommunications.com | Investment Community |

Jonathan Morgan | |

Toll Free: (800) 481-2804 | |

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/indigenous-communities-and-enbridge-announce-landmark-equity-partnership-301634930.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/indigenous-communities-and-enbridge-announce-landmark-equity-partnership-301634930.html

SOURCE Enbridge Inc.

FAQ

What is the recent investment agreement involving Enbridge and Indigenous communities?

What percentage of interest in the pipelines is acquired by the Indigenous communities?

What is the value of the investment in the pipelines?

When is the closing of the Enbridge Indigenous partnership expected?

What does the partnership with Indigenous communities signify for Enbridge?