Electrovaya Reports Second Quarter FY2024 Financial Results

Electrovaya has reported its financial results for Q2 FY2024, showing a significant improvement in profitability and margins despite delays in revenue growth caused by customer issues. The company achieved $10.7 million in revenue, a 26% year-over-year increase, and improved gross margins by 1240 basis points to 35%. Operating profit was $0.7 million, and Adjusted EBITDA was $1.5 million. Highlights include a new supply agreement with Sumitomo , increased interest in various sectors including defense and electric buses, and an expanded credit facility to support growth. The company anticipates revenue of $65-75 million for FY 2024, though some revenue may be deferred due to customer site delays. Electrovaya is also progressing with technology developments and project financing for its Jamestown gigafactory.

- Revenue increased by 26% year-over-year to $10.7 million.

- Gross margin improved by 1240 basis points year-over-year to 35%.

- Operating profit reached $0.7 million, up from a loss of $0.6 million.

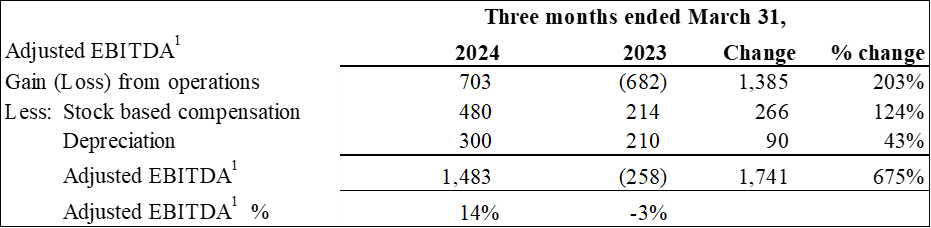

- Adjusted EBITDA was $1.5 million for the quarter.

- Trailing 12-month Adjusted EBITDA stands at $5.8 million.

- Expanded credit facility to C$22 million, with potential increase to C$26 million.

- New supply agreement with Sumitomo for Japanese construction equipment manufacturers.

- Significant progress in research and development, including solid-state batteries and wireless charging capabilities.

- Positive cash flow from operations.

- Anticipated revenue of $65-75 million for FY 2024.

- Revenue growth was less than anticipated due to customer-driven delays.

- Approximately $20 million of FY 2024 anticipated revenue is dependent on customers' new distribution center sites.

- Uncertainty in delivery dates of battery systems due to customer site construction delays.

- Notice to reader disclaimer due to incomplete review engagement.

Insights

Electrovaya’s latest financial results show a clear improvement in several key metrics. The company reported

Investors should particularly note the

In summary, Electrovaya’s financial health appears to be improving, but investors should remain attentive to the external dependencies associated with its revenue forecasts. The company's ability to manage these risks will be important for maintaining its positive financial trajectory.

Electrovaya’s strategic movements, including the deal with Sumitomo Corporation Power and Mobility, highlight the company’s effort to solidify its market position in the battery technology sector. This partnership could open doors to substantial new market opportunities, particularly in the heavy-duty and mission-critical applications segment. The integration and successful testing of wireless charging capabilities also position Electrovaya at the forefront of innovation in the battery sector.

The company’s expansion into the defense sector and its ongoing R&D projects with major OEMs in the electric bus and truck industries signal a diversified approach to market penetration. This diversification can mitigate sector-specific risks and tap into various growth avenues. Particularly, the move towards mass production for a Japanese OEM by 2026 through SCPM shows potential long-term growth.

Electrovaya’s business model seems to be leveraging both technological advancements and strategic partnerships to carve out a competitive edge. This multi-faceted growth strategy is promising, but market adoption and execution will be key factors to watch.

Electrovaya's ongoing advancements in battery technology, especially their Infinity Battery Technology, appear to be tailored for high-demand applications such as material handling, robotics and now extending into defense and construction equipment. The claim that their technology stands as the best for heavy-duty applications underscores their focus on durability and performance.

The recent successful integration of their battery systems with wireless chargers is noteworthy. Wireless charging can significantly enhance the usability and efficiency of battery systems in logistics and industrial environments, reducing downtime and manual intervention. This technological edge could be a significant differentiator in the market.

Furthermore, their ongoing R&D in solid-state batteries, which are known for higher energy densities and safety features, indicates a forward-looking approach in keeping pace with industry trends. This could position Electrovaya well as the market evolves towards more advanced battery technologies.

Overall, the technology developments signal Electrovaya's commitment to innovation, which is critical for maintaining competitive advantage in the battery sector. However, actual market performance and customer adoption will ultimately determine the success of these technologies.

Revenue of

Operating profit of

TORONTO, ON / ACCESSWIRE / May 14, 2024 / Electrovaya Inc. ("Electrovaya" or the "Company") (Nasdaq:ELVA)(TSX:ELVA), a leading lithium-ion battery technology and manufacturing company, today reported its financial results for the second quarter fiscal year ended March 31, 2024 ("Q2 FY2024"). All dollar amounts are in U.S. dollars unless otherwise noted.

"Electrovaya continues to make great strides in strengthening our business, including a new supply agreement with Sumitomo Corporation Power and Mobility ("SCPM"), a

"The Infinity Battery Technology stands, in my opinion, as the best battery technology for heavy duty and mission critical applications. While we continue to see strong growth opportunities in our core material handling and robotics verticals, we are also seeing increased interest in other sectors. During the last few months, we have engaged in multiple projects in the defense sector and are seeding new interest in construction and mining equipment applications. With regards to construction equipment OEMs, we have been selected by one Japanese OEM, through our agreement with SCPM, to supply a mass production start in 2026. We also continue to see interest from the electric bus and truck sectors and are in two research and development programs with major OEMs."

John Gibson, Electrovaya's CFO commented, "Q2 FY2024 demonstrated a significant improvement to our margins leading to an adjusted EBITDA1 of

1 Non-IFRS Measure: Adjusted EBITDA is defined as profit/(loss) from operations , plus finance costs, stock based compensation and depreciation. Adjusted EBITDA does not have a standardized meaning under IFRS. Therefore it is unlikely to be comparable to similar measures presented by other issuers. Management believes that certain investors and analysts use adjusted EBITDA to measure the performance of the business and is an accepted measure of financial performance in our industry. It is not a measure of financial performance under IFRS, and may not be defined and calculated in the same manner by other companies and should not be considered in isolation or as an alternative to Income (loss) from operations.

The Company included with its financial results a notice to reader disclaimer due to the review engagement not being completed in time to meet the filing deadline. The reviewer identified an opening balance currency translation adjustment from fiscal year 2022 pertaining to the change in functional currency that requires further analysis. The Company expects to complete the review over the next few days.

Financial Highlights:

Revenue increased to

Gross margin increased to

Operating profit increased to

For the quarter ended March 31, 2024, the Adjusted EBITDA1 was

For the trailing 12 months, Adjusted EBITDA1 is

Business Highlights:

On February 14, 2024, the Company announced that it had increased its credit facility from C

On March 11, 2024, the Company announced that its latest generation of battery systems had been integrated and tested with two leading providers of wireless chargers and had successfully demonstrated wireless charging capabilities that achieve performance metrics similar to that of wired chargers.

On April 29, 2024, the Company announced that it had established a supply agreement with SCPM, a

In May 2024, the Company signed a Contribution Agreement with a Canadian Federal Government funding agency, for C

The Company is continuing negotiations with both government and private lenders to support planned investments in Jamestown, New York.

During the quarter, the Company commenced research and development efforts with two major bus manufacturers for next generation electric bus applications.

The Company continued to make progress with research and development activities relating to its solid-state battery efforts and plans to provide a further update during its Battery Technology and Investor day on June 12, 2024.

Positive Financial Outlook & Fiscal 2024 Guidance:

The Company continues to anticipate revenue of approximately

The annual revenue forecast takes into consideration revenue from already delivered orders, the Company's current purchase order backlog, which as of May 13, 2024 is over

Selected Annual Financial Information for the Quarter ended March 31, 2024 and 2023

Results of Operations

(Expressed in thousands of U.S. dollars)

Adjusted EBITDA1

(Expressed in thousands of U.S. dollars)

1 Non-IFRS Measure: Adjusted EBITDA is defined as loss from operations, plus finance costs, stock-based compensation costs and depreciation. Adjusted EBITDA does not have a standardized meaning under IFRS. We believe that certain investors and analysts use Adjusted EBITDA to measure the performance of the business and is an accepted measure of financial performance in our industry. It is not a measure of financial performance under IFRS, and may not be defined and calculated in the same manner by other companies and should not be considered in isolation or as an alternative to Income (loss) from operations.

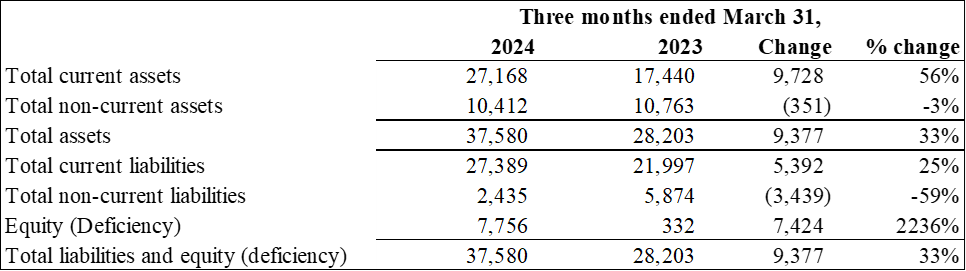

Summary Financial Position

(Expressed in thousands of U.S. dollars)

The Company's complete Financial Statements, Management Discussion and Analysis and Annual Information Form for the fourth quarter and fiscal year ended September 30, 2023 are available at www.sedarplus.ca or on the Company's website at www.electrovaya.com.

Conference Call details:

Date: Monday, May 14, 2024

Time: 8:am Eastern Time (ET)

Toll Free: 888-506-0062

International: 973-528-0011

Participant Access Code: 427679

Webcast URL: https://www.webcaster4.com/Webcast/Page/2975/50573

To help ensure that the conference begins in a timely manner, please dial in 10 minutes prior to the start of the call.

For those unable to participate in the conference call, a replay will be available for two weeks beginning on May 13, 2024 through May 27, 2024. To access the replay, the dial-in number is 877-481-4010 and 919-882-2331. The replay access ID is 50573.

Investor and Media Contact:

Jason Roy

VP, Corporate Development and Investor Relations

Electrovaya Inc.

jroy@electrovaya.com

905-855-4618

Brett Maas

Hayden IR

elva@haydenir.com

646-536-7331

About Electrovaya Inc.

Electrovaya Inc. (NASDAQ:ELVA)(TSX:ELVA) is a pioneering leader in the global energy transformation, focused on contributing to the prevention of climate change by supplying safe and long-lasting lithium-ion batteries. The Company has extensive IP and designs, develops and manufactures proprietary lithium-ion batteries and battery systems for energy storage and heavy duty electric vehicles based on its Infinity Battery Technology Platform. This technology offers enhanced safety and industry leading battery longevity. The Company is also developing next generation solid state battery technology at its Labs division. Headquartered in Ontario, Canada, Electrovaya has two operating sites in Canada and has acquired a 52-acre site with a 135,000 square foot manufacturing facility in New York state for its planned gigafactory. To learn more about Electrovaya, please explore www.electrovaya.com.

Forward-Looking Statements

This press release contains forward-looking statements including statements relating to FY 2024 revenue and growth expectations, refinancing existing debt, the satisfaction of filing obligations in the United States, new product lines, new OEM partners, and an increased order backlog in FY 2024, business opportunities in 2025, progress on the development of the Company's Jamestown assets, the deployment of the Company's products by the Company's customers and the timing for delivery thereof, and can generally be identified by the use of words such as "may", "will", "could", "should", "would", "likely", "possible", "expect", "intend", "estimate", "anticipate", "believe", "plan", "objective" and "continue" (or the negative thereof) and words and expressions of similar import. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, such statements involve risks and uncertainties, and undue reliance should not be placed on such statements. Certain material factors and assumptions are applied in making forward-looking statements, and actual results may differ materially from those expressed or implied in such statements. Without limitation, statements with respect to the FY2024 guidance, to the purchase and deployment of the Company's products by the Company's customers and users, and the timing for delivery thereof, customer delivery expectation changes, levels of expected sales and expected further purchases and demand growth, and development of facilities are based on an assumption that the Company's customers and users will deploy its products in accordance with communicated and contracted intentions and in accordance with trends observed by management, that the Company will be able to deliver the ordered products on a basis consistent with past deliveries, that future gross margins will reflect expected gross margins based on historical sales, the ability to increase prices to help maintain gross margins, ability to have production ramps of the Infinity Battery Technology Products in FY2024 to meet demand. Statements with respect to the ability to refinance debt are based on assumptions extrapolated from discussions with alternative lenders to the Company's existing lender. Important factors that could cause actual results to differ materially from expectations include but are not limited to macroeconomic effects on the Company and its business and on the Company's customers, economic conditions generally and their effect on consumer demand, labor shortages, inflation, supply chain constraints, and other factors which may cause disruptions in the Company's supply chain and Company's capability to deliver the products. Additional information about material factors that could cause actual results to differ materially from expectations and about material factors or assumptions applied in making forward-looking statements may be found in the Company's Annual Information Form for the year ended September 30, 2023 under "Risk Factors", and in the Company's most recent annual Management's Discussion and Analysis under "Qualitative And Quantitative Disclosures about Risk and Uncertainties" as well as in other public disclosure documents filed with Canadian securities regulatory authorities. The Company does not undertake any obligation to update publicly or to revise any of the forward-looking statements contained in this document, whether as a result of new information, future events or otherwise, except as required by law.

The expected revenue for FY 2024 described in this release constitutes future‐oriented financial information ("FOFI"), and is generally, without limitation, based on the assumptions and subject to the risks set out above under "Forward‐Looking Statements". Although management believes such assumptions to be reasonable, a number of such assumptions are beyond the Company's control and there can be no assurance that the assumptions made in preparing the FOFI will prove accurate. FOFI is provided for the purpose of providing information about management's current expectations and plans relating to the Company's future performance, and may not be appropriate for other purposes.

The FOFI does not purport to present the Company's financial condition in accordance with IFRS, and it is expected that there may be differences between expected results and actual results, and the differences may be material. The inclusion of the FOFI in this news release should not be regarded as an indication that the Company considers the FOFI to be a reliable prediction of future events, and the FOFI should not be relied upon as such.

SOURCE: Electrovaya, Inc.

View the original press release on accesswire.com