Electric Royalties Provides Update on Royalty Portfolio

Electric Royalties Ltd. (TSXV:ELEC)(OTCQB:ELECF) provided an update on its lithium royalty portfolio, highlighting rapid advancements in key projects. Sayona Mining's North American Lithium operation is projected to become Canada's only producing lithium mine by early 2023, with lithium prices soaring from under $500 to over $7,500 per tonne. The Authier project is nearing production, and significant progresses have been reported at Cancet and Battery Hill projects. The company maintains a focus on acquiring royalties in stable jurisdictions to capitalize on the demand for clean energy metals.

- Sayona Mining's North American Lithium operation is projected to begin production in early 2023, enhancing cash flow potential for Electric Royalties.

- Lithium prices have surged over 1,400% since the acquisition of royalty rights, indicating strong revenue growth potential.

- Electric Royalties is advancing its portfolio with several projects nearing critical stages, including Authier, Cancet, and Battery Hill.

- None.

Insights

Analyzing...

VANCOUVER, BC / ACCESSWIRE / October 13, 2022 / Electric Royalties Ltd. (TSXV:ELEC)(OTCQB:ELECF) ("Electric Royalties" or the "Company") is pleased to provide an asset update on its current royalty portfolio.

Brendan Yurik, CEO of Electric Royalties, commented: "We are seeing rapid progress across many of our lithium royalty interests, and we are confident that our commitment to clean energy metal royalties remains a solid business proposition. As an example, Sayona Mining is steadily advancing its North American Lithium (NAL) operation and the planned integration of the Authier project. NAL is projected to be the only producing lithium mine in Canada by early next year, and will potentially be a steady and long-life cashflow generator for Electric Royalties at such time as it commences production. All of our lithium royalties to date are on hard rock lithium spodumene deposits in Eastern Canada and were acquired when lithium spodumene prices were less than

Highlights since the Company's previous update on August 23, 2022:

- Authier Lithium Project (

0.5% Gross Metal Royalty) - Sayona Mining Limited (ASX:SYA) ("Sayona") announced on September 16, 2022 that it has further advanced its planned restart of spodumene (lithium) production at the North American Lithium (NAL) operation in Québec, Canada, with permitting applications95% complete and procurement at94% , with most major procurement items already on‐site. Construction activities have also ramped up, with the installation of cone crushers underway, among other items.

Additionally, Sayona announced on September 27, 2022 that Québec company L. Fournier & Fils was awarded an approximately C

Sayona announced on October 4, 2022 that it has launched a pre-feasibility study (PFS) to examine the option of producing lithium carbonate from spodumene produced at NAL, where production of spodumene concentrate is scheduled to commence in Q1 2023. According to Sayona, the potential move downstream could enhance the long‐term value and profitability of the NAL operation. Major engineering firm Hatch will undertake the lithium carbonate PFS, targeting completion by March 2023.

Sayona plans to combine mineralized material produced from Authier with mineralized material at the nearby NAL site, with a goal to facilitate improvement in plant performance and economics. A PFS for NAL integrates Authier, on which Electric Royalties holds a

- Cancet Lithium Project (

1.0% Net Smelter Royalty) - Winsome Resources Limited (ASX:WR1) ("Winsome") announced on September 26, 2022 that it has completed Stage 1 environmental studies of the Cancet lithium project in Québec, Canada. Completion of environmental studies marks a step towards progressing ongoing exploration activity and the mining approval process. The survey and field work carried out by First Nations-led consultancy Niigaan helps to inform an environmental map database covering the Cancet property. Winsome expects the full environmental dataset to be completed in 2023.

On October 5, 2022, Winsome announced that one of the approximately 15 pegmatite outcrops identified during previous field exploration work will be targeted in drilling to begin in October. This reverse circulation drilling program is due to conclude at Cancet in December, and based on results of the campaign, one or more diamond drill rigs will be brought to site to conduct more thorough drilling of the new targets, as well as to infill and extend drilling on the main mineralized body.

- Battery Hill Manganese Project (

2.0% Gross Metal Royalty) - Manganese X Energy Corp. (TSXV:MN) ("Manganese X") announced on October 4, 2022 that has filed a provisional patent on the manganese purification process in preparation for its upcoming pilot project at the Battery Hill manganese project in New Brunswick, Canada. As the next step to fast track the development of Battery Hill, Manganese X has started the development of the field pilot plant with the goal of demonstrating its proprietary process for treating Battery Hill mineralization under near commercial-scale operating conditions that incorporates a modular design.

On October 11, 2022, Manganese X announced plans to commence the Battery Hill pre-feasibility study in-fill and step-out drilling program. Tendering for the proposed drilling program is underway with commencement tentatively scheduled for late October 2022. The goal of the drill program is to in-fill and expand the measured and indicated resources in preparation for the pre-feasibility study by upgrading the inferred category resource included in the mine plan in the preliminary economic assessment.

In addition to this drilling program, Manganese X is scoping the engineering, environmental and social studies to support the PFS work program. Geotechnical and hydrogeological drilling is planned for early 2023 for open-pit mine design and to advance the understanding of ground conditions in proposed infrastructure sites. Additional environmental baseline data will continue to be collected through 2022 and 2023.

- Mont Sorcier Iron and Vanadium Project (

1.0% Gross Metal Royalty) - Voyager Metals Inc. (TSXV:VONE) ("Voyager") announced on September 27, 2022 that it has retained DRA Americas Inc. to act as project integrator for the NI 43-101 feasibility study of the Mont Sorcier iron and vanadium project located near Chibougamau, Québec, Canada, along with the responsibility for future mineral resource and mineral reserve estimates. All other key consultants remain unchanged. Voyager also revised its timeline for the feasibility study to the end of Q2 2023. - Seymour Lake Lithium Project (

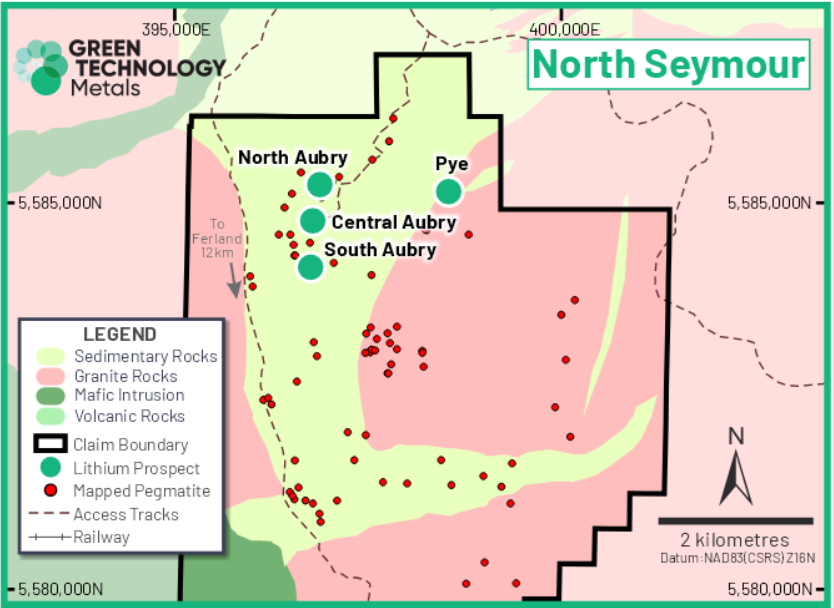

1.5% Net Smelter Royalty) - On August 22, 2022, Green Technology Metals Limited (ASX: GT1) ("Green Technology Metals") provided an update on diamond drilling activity at the Seymour Lake lithium project in Ontario, Canada.

The drilling focus at Seymour Lake now moves to testing for lateral repeats of the North Aubry deposit to the north and drilling the multiple mapped pegmatite targets across the Pye Complex.

Figure 1: Location map of northern area of the Seymour Lake project showing North and South Aubry deposits, Central Aubry zone and Pye prospect. Source: Green Technology Metals.

- Chubb Lithium Project (

2.0% Gross Metal Royalty) - Newfoundland Discovery Corp. (CSE:NEWD) ("Newfoundland Discovery") announced on October 4, 2022 that it has entered into a binding letter of intent whereby it has granted Mining Equities Pty Ltd. ("Mining Equities"), an Australian company, the right to acquire a100% interest in the Chubb property, consisting of thirty-five mineral claims comprising approximately 15 km2, located in Québec, Canada.

Newfoundland Discovery has granted Mining Equities an exclusive due diligence period of forty-five days in consideration of a non-refundable payment of C

David Gaunt, P.Geo., a qualified person who is not independent of Electric Royalties, has reviewed and approved the technical information in this release.

1 https://tradingeconomics.com/commodities

About Electric Royalties Ltd.

Electric Royalties is a royalty company established to take advantage of the demand for a wide range of commodities (lithium, vanadium, manganese, tin, graphite, cobalt, nickel, zinc and copper) that will benefit from the drive toward electrification of a variety of consumer products: cars, rechargeable batteries, large scale energy storage, renewable energy generation and other applications.

Electric vehicle sales, battery production capacity and renewable energy generation are slated to increase significantly over the next several years and with it, the demand for these targeted commodities. This creates a unique opportunity to invest in and acquire royalties over the mines and projects that will supply the materials needed to fuel the electric revolution.

Electric Royalties has a growing portfolio of 20 royalties, including one royalty that currently generates revenue. The Company is focused predominantly on acquiring royalties on advanced stage and operating projects to build a diversified portfolio located in jurisdictions with low geopolitical risk, which offers investors exposure to the clean energy transition via the underlying commodities required to rebuild the global infrastructure over the next several decades towards a decarbonized global economy.

For further information, please contact:

Brendan Yurik

CEO, Electric Royalties Ltd.

Phone: (604) 364‐3540

Email: Brendan.yurik@electricroyalties.com

www.electricroyalties.com

Scott Logan

Renmark Financial Communications Inc.

Phone: (416) 644-2020 or (212) 812-7680

Email: slogan@renmarkfinancial.com

www.renmarkfinancial.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange), nor any other regulatory body or securities exchange platform, accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements Regarding Forward-Looking Information and Other Company Information

This news release includes forward-looking information and forward-looking statements (collectively, "forward-looking information") with respect to the Company within the meaning of Canadian securities laws. This news release includes information regarding other companies and projects owned by such other companies in which the Company holds a royalty interest, based on previously disclosed public information disclosed by those companies and the Company is not responsible for the accuracy of that information, and that all information provided herein is subject to this Cautionary Statement Regarding Forward-Looking Information and Other Company Information. Forward looking information is typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate and similar expressions, or are those, which, by their nature, refer to future events. This information represents predictions and actual events or results may differ materially. Forward-looking information may relate to the Company's future outlook and anticipated events and may include statements regarding the financial results, future financial position, expected growth of cash flows, business strategy, budgets, projected costs, projected capital expenditures, taxes, plans, objectives, industry trends and growth opportunities of the Company and the projects in which it holds royalty interests.

While management considers these assumptions to be reasonable, based on information available, they may prove to be incorrect. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company or these projects to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. These risks, uncertainties and other factors include, but are not limited to risks associated with general economic conditions; adverse industry events; marketing costs; loss of markets; future legislative and regulatory developments involving the renewable energy industry; inability to access sufficient capital from internal and external sources, and/or inability to access sufficient capital on favourable terms; the mining industry generally, the Covid-19 pandemic, recent market volatility, income tax and regulatory matters; the ability of the Company or the owners of these projects to implement their business strategies including expansion plans; competition; currency and interest rate fluctuations, and the other risks.

The reader is referred to the Company's most recent filings on SEDAR as well as other information filed with the OTC Markets for a more complete discussion of all applicable risk factors and their potential effects, copies of which may be accessed through the Company's profile page at www.sedar.com and at otcmarkets.com.

SOURCE: Electric Royalties Ltd.

View source version on accesswire.com:

https://www.accesswire.com/720261/Electric-Royalties-Provides-Update-on-Royalty-Portfolio