Electric Royalties Closes Acquisition of Lithium Royalty and Option Portfolio in Ontario, Canada

Electric Royalties (ELECF) closed the acquisition of a significant lithium royalty and option portfolio in Ontario, Canada. The company acquired 18 royalty agreements and 32 lithium properties, doubling its overall royalty portfolio. This strategic move enhances the company's growth opportunities, considering the potential lithium price rebound. The properties are strategically located near major lithium discoveries and are expected to revert into royalty interests for Electric Royalties upon exercise of option agreements. The acquisition aligns with the increasing demand for battery metals, especially lithium, driven by the shift towards clean energy systems.

Electric Royalties acquired a portfolio of 18 royalty agreements and 32 lithium properties in Ontario, Canada, doubling its overall royalty portfolio.

The acquisition strategically positions the company for growth opportunities, as forecasts suggest lithium prices will rebound in the longer term.

The properties are located near major lithium discoveries, with potential to revert into royalty interests for Electric Royalties upon exercise of option agreements.

The completion of the acquisition involved a net cash payment of C$1,689,000, which reflects a total cash consideration of C$1,875,000.

The company issued 2,250,000 common shares to the vendors as part of the transaction, potentially diluting shareholder ownership.

VANCOUVER, BC / ACCESSWIRE / May 1, 2024 / Electric Royalties Ltd. (TSXV:ELEC)(OTCQB:ELECF) ("Electric Royalties" or the "Company") is pleased to announce the closing of the previously announced transaction (the "Transaction") to acquire a portfolio of 18 royalty agreements and 32 lithium properties in Ontario, Canada (the "Ontario Lithium Projects" or the "OLP"). Pursuant to the Asset Purchase Agreement between the Company and 1544230 Ontario Inc., MK Exploration Services Inc. and Gravel Ridge Resources Ltd. (together, the "Vendors") dated April 8, 2024, the Company has issued 2,250,000 common shares of the Company to the Vendors and made a net cash payment of C

Brendan Yurik, CEO of Electric Royalties, commented: "Northwestern Ontario is known for its lithium potential; thus we are very pleased to complete the acquisition of these prospective lithium royalties and optioned properties in that region. We have strategically selected these royalties and projects from an initial 126 projects, based on our assessment of their prospective geology and greater proximity to prospects with reported lithium resources and exploration activity.

"Current lithium market conditions have allowed us to acquire this portfolio at a relatively low cost, while doubling the size of our overall royalty portfolio. The acquisition represents a significant opportunity for Electric Royalties to grow in an accretive manner, as forecasts suggest lithium prices will rebound in the longer term."

Overview of the Ontario Lithium Projects (OLP)

The OLP portfolio consists of 18 royalties (Table 1) and 32 lithium properties (Table 2) located in the province of Ontario, Canada. 31 of the 32 properties are currently being explored by third parties pursuant to option agreements and, to the extent that the applicable option payments (yielding the Company up to

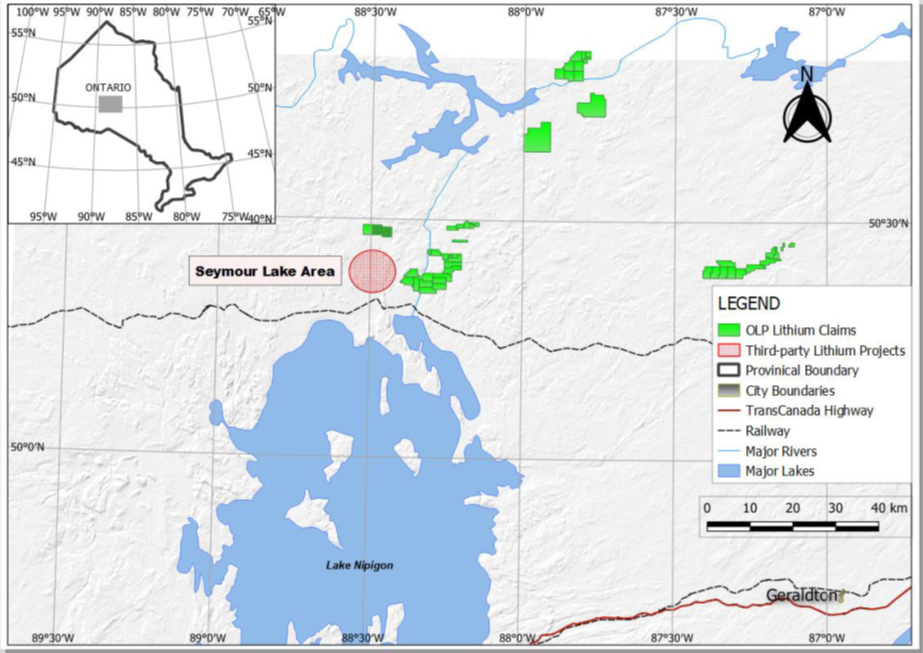

The properties cover prospective land on the same geological trends of, and surrounding, major lithium discoveries in Ontario. Six of 24 developed lithium prospects in Ontario with reported reserves or resources are located in the vicinity of these properties1. Several of these properties are adjacent to Green Technology Metals' Seymour Lake Lithium Project (on which Electric Royalties holds a

Table 1: OLP Royalties

| Operator | Operator Stock Exchange Listing | Property underlying Royalty | |

1 | Maple Minerals (acquired by Cohiba Minerals) | n/a (private) | Rogers Creek / McCluskey |

2 | Maple Minerals (acquired by Cohiba Minerals) | n/a (private) | Big Rock / Ottertail River SW |

3 | Maple Minerals (acquired by Cohiba Minerals) | n/a (private) | Ottertail / Ottertail River NE / Mahamo |

4 | Maple Minerals (acquired by Cohiba Minerals) | n/a (private) | Gathering Lake |

5 | FE Battery Metals | CSE | Cosgrave |

6 | Musk Metals | CSE | Allison Lake |

7 | Electrification and Decarbonization AIE LP | n/a (private) | Jubilee, Campus Creek, Crescent |

8 | Lithium Triangle Resources | n/a (private) | Root Bay |

9 | Portofino Resources | TSX-V | Birkett |

10 | Double O Seven Mining | n/a (private) | Separation Rapids Lithium |

11 | Private BC Company | n/a (private) | Arrel |

12 | Lithium One Metals | TSX-V | Otatakan Township |

13 | Fifty St George | n/a (private) | Lauri |

14 | Sultan Resources | ASX | Kember / Pakeageama |

15 | Sultan Resources | ASX | Allison Lake / Ruddy |

16 | Lithos Minerals | n/a (private) | Peggy Lithium |

17 | Private BC Company | n/a (private) | Margot Lithium |

18 | Private BC Company | n/a (private) | Barbara Lake |

Table 2: OLP Properties

| Operator | Operator Stock Exchange Listing | Property | |

1 | Lithium Triangle Resources | n/a (private) | Allison Lake North and South |

2 | Mosam Ventures | n/a (private) | Pakwan Lithium |

3 | Mosam Ventures | n/a (private) | Margot Lake |

4 | Tearlach Resources | TSX-V | Wesley Lake |

5 | Tearlach Resources | TSX-V | Ferland Station |

6 | Tearlach Resources | TSX-V | Margot South |

7 | Tearlach Resources | TSX-V | McCluskey |

8 | Private BC Company | n/a (private) | Jeanette 1 |

9 | Forza Lithium | CSE | Jeanette 2 |

10 | Planet Green Metals | CSE | Harrison Road |

11 | Xplore Resources | TSX-V | Raggy / Aerial / Cathy Creek |

12 | Xplore Resources | TSX-V | Falls / Joseph / Root Bay |

13 | Xplore Resources | TSX-V | Root Bay North / Root Bay |

14 | Xplore Resources | TSX-V | Root Lake |

15 | EEE Exploration | CSE | Barbara |

16 | Bastion Minerals | ASX | Pakwan |

17 | Austek Resources | n/a (private) | McCombe |

18 | LiCan Exploration | CSE | Crescent |

19 | LiCan Exploration | CSE | Wakeman East |

20 | Private BC Company | n/a (private) | Maskerine / Lynxpaw / Bingo |

21 | Mosam Ventures | n/a (private) | Sharp Lake |

22 | Lithium One Metals | TSX-V | Adamhay |

23 | Lithium One Metals | TSX-V | Dagny |

24 | Altari Capital | n/a (private) | Rosyln Lithium |

25 | Westmount Minerals | CSE | Kaba |

26 | Redstone Resources | ASX | Greenside Lake / Witchwood |

27 | Manning Ventures | OTC | Kaba Cu-Li |

28 | GoldOn Resources | TSX-V | Hagarty Creek |

29 | Solstice Gold | TSX-V | Purdom |

30 | Solstice Gold | TSX-V | Kamuck |

31 | Private BC Company | n/a (private) | Falcon Lake |

32 | Electric Royalties (recently terminated by Maverick Minerals) | TSX-V | Sollas Lake / Muriel |

Figure 1: Map showing claim groups comprising the OLP in the Seymour Lake area

Currently, Canada hosts the sixth-highest lithium reserves of any country, yet 2022 production totaled an estimated 500 tonnes - an amount dwarfed by global lithium powerhouses such as Chile and Australia3. The hard-rock lithium deposits in Canada are hosted in pegmatites containing a lithium-bearing mineral known as spodumene. Lithium hosted in spodumene provides producers with greater flexibility as it can be processed into either lithium hydroxide (mainly used in high-density electric vehicle (EV) batteries) or lithium carbonate4. It also offers faster processing times and is higher quality than lithium extracted from brine as spodumene typically contains higher lithium content4. Spodumene-bearing pegmatites are often hosted in metavolcanic or metasedimentary rocks adjacent to granitic intrusions5. Many of the world's largest hard-rock lithium occurrences are found in Archean or Paleoproterozoic orogens - geological environments underlying approximately two-thirds of Ontario6.

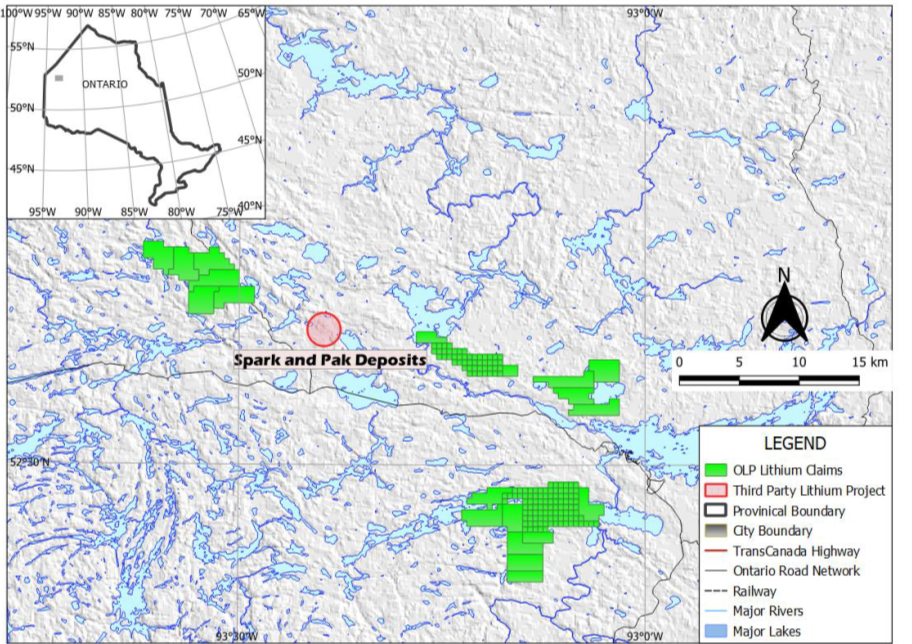

One of the most advanced and high-grade lithium projects in Ontario is Frontier Lithium's ("Frontier") PAK and Spark deposits on which a positive pre-feasibility study was recently announced7. PAK contains one of North America's highest-grade lithium resources and is one of the largest known deposits of its subtype in North America8. Further, Frontier has recently received a grant from the Ontario government to advance its understanding of the processing of lithium into battery metal products. Electric Royalties' OLP acquisition includes two large unexplored, optioned claim groupings located less than 10 kilometres from the Frontier projects and adjacent to terrane hosting geologically favourable two-mica granitic rocks (see Figure 2).

Figure 2: Map showing claim groups comprising the OLP, and Frontier Lithium's Spark and PAK deposits

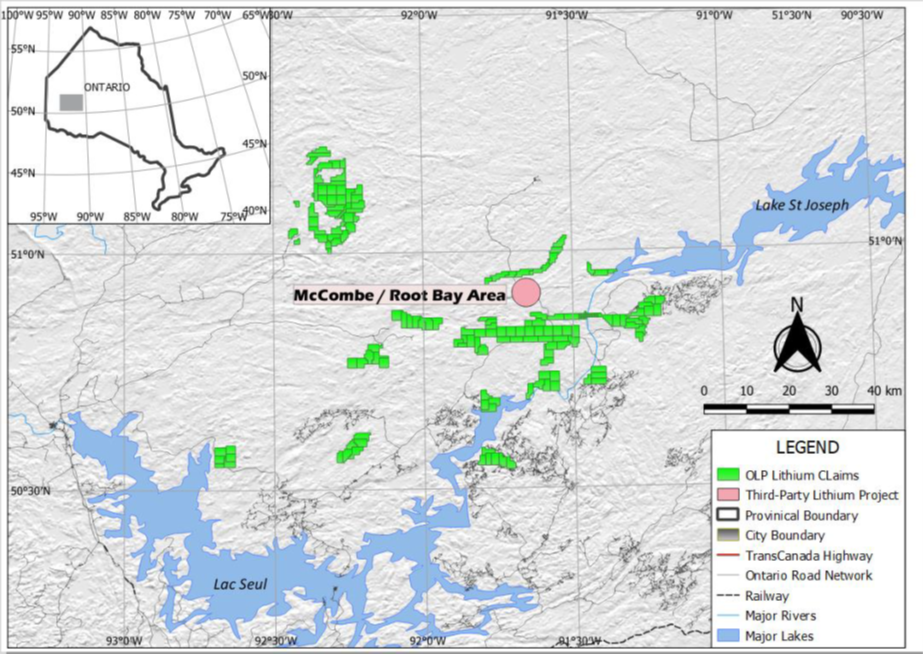

One of the most exciting new lithium exploration stories in Ontario is the emerging Root Bay project being advanced by Green Technology Metals. Drilling programs completed in the last year and a half resulted in the announcement of a 9.4 million-tonne (Mt) indicated resource grading

Figure 3: Map showing OLP claim extents in the Root Bay area

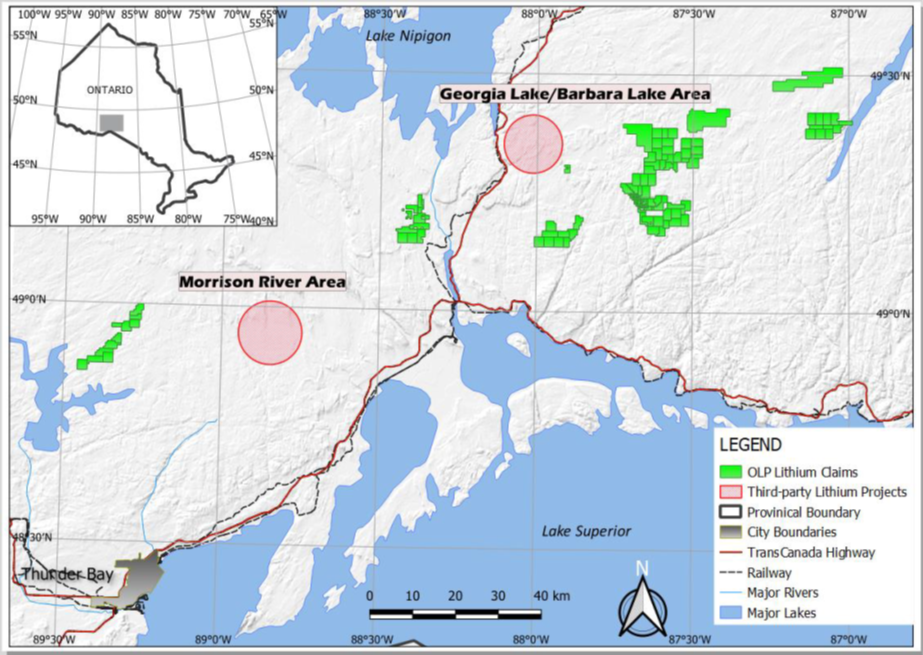

Rock Tech Lithium's Georgia Lake Project is also one of the more advanced integrated lithium development projects in Ontario. Rock Tech Lithium is, reportedly, pursuing a vertically integrated strategy which not only includes development of the Georgia Lake deposit, but also the construction of a lithium processing plant. The plan is to build a facility that is capable of processing material from various sources and is adaptable to the region's growing lithium industry13. There is tremendous exploration potential in the Georgia Lake area as it has been described as the largest concentration of rare-element mineralization in the Superior Province of Ontario14. Other companies have reported interesting results from work in the Georgia Lake district. Tearlach Resources recently announced the results of channel sampling which ranged from

The OLP includes the largest land position in the Georgia Lake lithium district (see Figure 4). One of the properties, the Arrel Lithium Property, is 20 kilometres east of the Rock Tech pegmatites, and not only is underlain by a muscovite-bearing peraluminous granite but is also in contact with metasediments which make excellent hosts for pegmatites.

Figure 4: Map showing claim groups comprising the OLP in the vicinity of the Georgia Lake projects

Lithium Development in Ontario

Ontario is a province with a deep-rooted mining tradition, abundant clean hydroelectric and nuclear power, and a skilled mining workforce. The permitting environment in Ontario is rigorous, fair, and process-based, and both the federal and provincial governments are supportive of battery metal projects as shown in their recent investments and initiatives16,17.

Access to sustainable power, abundant water, and skilled personnel makes mine development and permitting easier, and it is one of the compelling reasons for Electric Royalties' interest in the OLP acquisition. The properties cover a collective area of over 1 million acres and are adjacent to some of the most prominent lithium exploration and development plays in North America.

Lithium Outlook

The shift to clean energy systems is forecast to drive a significant increase in the demand for battery metals, and this is particularly true in the case of lithium. Lithium is a key component in current and anticipated battery chemistries. According to the International Energy Agency (IEA)'s Sustainable Development Scenario (SDS), clean energy technologies will ultimately account for

New sources of lithium will need to be developed and, equally important, new processing facilities will need to be built to meet long-term demand. Finding new lithium deposits in proximity to where the metal is processed into products suitable for battery production is imperative to secure supply chains. Complex supply chains and foreign sources of supply increase the risk of exposure to physical disruption and trade restrictions, while increasing the carbon footprint of the process.

Completion of Drawdown under Convertible Credit Facility

Further to the Company's news release on April 9, 2024, it has completed the C

Loans drawn under the Credit Facility bear interest ("Interest") at a floating rate (United States Secured Overnight Financing Rate as published by the New York Federal Reserve ("SOFR") +

The Conversion Price for the Drawdown is C

The Credit Facility is a "related party transaction" within the meaning of Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions ("MI 61-101"). The Credit Facility is exempt from the valuation requirement of MI 61-101 by virtue of the exemption contained in section 5.5(b) as the Company's common shares are not listed on a specified market. The Company received disinterested shareholder approval of the Credit Facility at the Company's special meeting of shareholders held on March 19, 2024 in accordance with MI 61-101.

David Gaunt, P.Geo., a qualified person who is not independent of Electric Royalties, has reviewed and approved the technical information in this release.

________________

1 https://mndm.maps.arcgis.com/apps/webappviewer/index.html?id=66ee0efe4d3c4816963737dbdb890708

2 Green Technology Metals news release dated October 9, 2023

3 https://www.cbc.ca/news/climate/lithium-in-the-world-1.6841339

4 https://elements.visualcapitalist.com/visualizing-the-worlds-largest-lithium-producers/

5 USGS Mineral-Deposit Model for Lithium-Cesium- Tantalum Pegmatites; Scientific Investigations Report 2010-5070-O; By Dwight C. Bradley, Andrew D. McCauley, and Lisa M. Stillings

6 https://www.ontario.ca/page/about-ontario

7 NI 43-101 Technical Report Pre-Feasibility Study for the PAK Project, effective date May 31, 2023, filed under Frontier Lithium's profile at sedarplus.ca

8 Frontier Lithium news release dated September 25, 2023

9 Green Technology Metals Limited news release titled "SIGNIFICANT RESOURCE AND CONFIDENCE LEVEL INCREASE AT ROOT, GLOBAL RESOURCE INVENTORY NOW AT 24.5MT" dated October 17, 2023, Appendix A: JORC Code 2012, Table 1. The Mineral Resources are reported using open-pit mining constraints. The open-pit Mineral Resource is only the portion of the resource that is constrained within a US

10 OGS Open File Report 6099; F.W. Breaks, J.B. Selway and A.G. Tindle; 2003

11 https://www.bastionminerals.com/projects/canadian-lithium-project/

12 https://www.geologyontario.mndm.gov.on.ca/mndmfiles/pub/data/records/LakeGeochemON.html

14 Breaks, F.W., Selway, J.B. and Tindle, A.G. 2008. The Georgia Lake rare-element pegmatite field and related S-type, peraluminous granites, Quetico Subprovince, north-central Ontario; Ontario Geological Survey, Open File Report 6199, 176p

15 https://www.accesswire.com/viewarticle.aspx?id=810467&token=82fito391y0i58fbeufi

18 https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions

About Electric Royalties Ltd.

Electric Royalties is a royalty company established to take advantage of the demand for a wide range of commodities (lithium, vanadium, manganese, tin, graphite, cobalt, nickel, zinc and copper) that will benefit from the drive toward electrification of a variety of consumer products: cars, rechargeable batteries, large scale energy storage, renewable energy generation and other applications.

Electric vehicle sales, battery production capacity and renewable energy generation are slated to increase significantly over the next several years and with it, the demand for these targeted commodities. This creates a unique opportunity to invest in and acquire royalties over the mines and projects that will supply the materials needed to fuel the electric revolution.

Electric Royalties has a growing portfolio of 40 royalties across the world and 32 lithium properties in Ontario, Canada. The Company is focused predominantly on acquiring royalties on advanced stage and operating projects to build a diversified portfolio located in jurisdictions with low geopolitical risk, which offers investors exposure to the clean energy transition via the underlying commodities required to rebuild the global infrastructure over the next several decades toward a decarbonized global economy.

For further information, please contact:

Brendan Yurik

CEO, Electric Royalties Ltd.

Phone: (604) 364‐3540

Email: Brendan.yurik@electricroyalties.com

https://www.electricroyalties.com/

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange), nor any other regulatory body or securities exchange platform, accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements Regarding Forward-Looking Information and Other Company Information

This news release includes forward-looking information and forward-looking statements (collectively, "forward-looking information") with respect to the Company within the meaning of Canadian securities laws. This news release includes information regarding other companies and projects owned by such other companies, based on previously disclosed public information disclosed by those companies and the Company is not responsible for the accuracy of that information, and that all information provided herein is subject to this Cautionary Statement Regarding Forward-Looking Information and Other Company Information. Forward looking information is typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate and similar expressions, or are those, which, by their nature, refer to future events. This information represents predictions and actual events or results may differ materially. Forward-looking information may relate to the Company's future outlook and anticipated events and may include statements regarding the financial results, future financial position, expected growth of cash flows, business strategy, budgets, projected costs, projected capital expenditures, taxes, plans, objectives, industry trends and growth opportunities of the Company and the properties in which it holds interests.

While management considers these assumptions to be reasonable, based on information available, they may prove to be incorrect. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company or these properties to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. These risks, uncertainties and other factors include, but are not limited to risks associated with general economic conditions; adverse industry events; marketing costs; loss of markets; future legislative and regulatory developments involving the renewable energy industry; inability to access sufficient capital from internal and external sources, and/or inability to access sufficient capital on favourable terms; the mining industry generally, recent market volatility, income tax and regulatory matters; the ability of the Company or the owners of these properties to implement their business strategies including expansion plans; the optioned properties remaining under option; the optionees making option payments as and when due under the relevant option agreements; the lithium properties not being successfully explored and developed; competition; currency and interest rate fluctuations, and the other risks.

The reader is referred to the Company's most recent filings on SEDAR+ as well as other information filed with the OTC Markets for a more complete discussion of all applicable risk factors and their potential effects, copies of which may be accessed through the Company's profile page at sedarplus.ca and at otcmarkets.com.

SOURCE: Electric Royalties Ltd.

View the original press release on accesswire.com