Envela Reports Fourth Quarter and Fiscal Year 2023 Results

- None.

- None.

Insights

The reported financial results from Envela Corporation, with annual revenue of $171.7 million and earnings per share of $0.27, are indicative of a stable financial performance despite the noted decline in global bullion demand. The company's strategy to invest in store expansions and staff training, even as operating expenses rise, suggests a forward-looking approach aimed at capturing more market share in the re-commerce space. The expansion plan, which includes doubling the store footprint, is an aggressive growth strategy that could potentially increase revenue streams and customer base.

Furthermore, the emphasis on customer loyalty through transparency and value could resonate well with consumers, especially in the luxury pre-owned market where trust is a significant factor. This approach could lead to a virtuous cycle of repeat business and referrals, which are vital in retail. However, investors should be attentive to the execution risks associated with rapid expansion and the ability of the company to maintain profitability during this growth phase.

Envela's performance in a declining bullion market underscores its operational resilience and adaptability. The earnings per share (EPS) of $0.27 for the year and $0.05 for the quarter reflect a company that is managing to maintain profitability in challenging conditions. The planned store expansion is a capital-intensive move that could impact short-term profitability due to increased operating expenses. However, if the expansion captures additional market share and drives sales volume, it could be accretive to earnings in the long run.

Investors should monitor the company's debt levels and liquidity position as they embark on this expansion. The retail environment is highly competitive and Envela will need to ensure that its new stores are strategically located and that the staff is well-trained to differentiate their customer service. The company's focus on the re-commerce sector, which is gaining traction as consumers become more environmentally conscious, could be a growth catalyst.

Envela's strategic decision to expand in the midst of a global bullion demand decline can be seen as a counter-cyclical investment, which may pay off if the economy rebounds and consumer spending increases. The re-commerce market is growing as sustainability becomes a more significant factor in consumer purchasing decisions. The company's plan to double its retail footprint could position it well to take advantage of this trend.

However, the broader economic context cannot be ignored. If consumer confidence wanes or if there is an economic downturn, luxury and discretionary spending are typically among the first to be cut, which could impact Envela's growth projections. The success of the expansion will depend on the company's ability to navigate these macroeconomic factors while executing its strategy effectively.

DALLAS, TX / ACCESSWIRE / March 20, 2024 / Envela Corporation (NYSE American:ELA) ("Envela" or the "Company"), today reported financial results for its fourth quarter and full year ended December 31, 2023. The Company reported annual revenue of

Management Commentary

Consumer Division

"Despite a significant decline in global bullion demand in the latter half of 2023, our performance was exceptional, highlighting Envela's capability to adjust swiftly to a changing market landscape. The Company's results demonstrate the strength of our business model and the adaptability of our operating entities in managing a fluctuating market, enabling us to remain profitable in slower market conditions," said John Loftus, Envela's CEO.

"In 2023, we made considerable progress strengthening Envela's position as a leading provider of re-commerce solutions to both businesses and consumers. During the year, we further invested in our business in anticipation of our 2024 store expansion. As a result, operating expenses increased, including for recruiting and training specialized staff for upcoming store launches. Demand for jewelry continues to be strong, and we anticipate our Consumer Division will see an improved bottom line in 2024, driven by the opening of new stores," Loftus added.

"As we move into 2024, our excitement builds as we anticipate connecting with new customers through the Company's strategic retail expansion. Announced last year, we planned to open at least 3 new retail locations in at least 2 new metro areas and double our current footprint from 7 to 14 stores by the end of 2024. The opening of three new Arizona stores marks the launch of this strategy and keeps us on track for 7 new stores by year's end," Loftus remarked.

"We believe in great value and providing our customers with comprehensive information and complete transparency. This engenders loyalty, which is key to our business success. And our expansion underscores Envela's commitment to providing a next-level experience to our customers, recognizing that many prefer visiting a physical store for personalized advice before selling their luxury preowned items," concluded Loftus.

Commercial Division

"In 2023, we maintained our close partnerships with some of the world's largest multinational corporations and many of America's leading retailers and technology companies to meet their re-commerce requirements. With our focus on building lasting customer relationships, we are optimistic about Envela's role as an essential partner for our clients as their needs evolve. Our dedication to the circular economy-prioritizing the reuse, repair, refurbishment, and recycling of materials and products-guides our mission. By extending products' lives, we not only aid the environment but also enable consumers to purchase goods at more affordable prices," said Loftus.

"Envela is actively exploring investment opportunities to expand its geographical footprint and market penetration. We believe the Company is well positioned to take advantage of rising trends that are fueling demand for preowned goods," added Loftus.

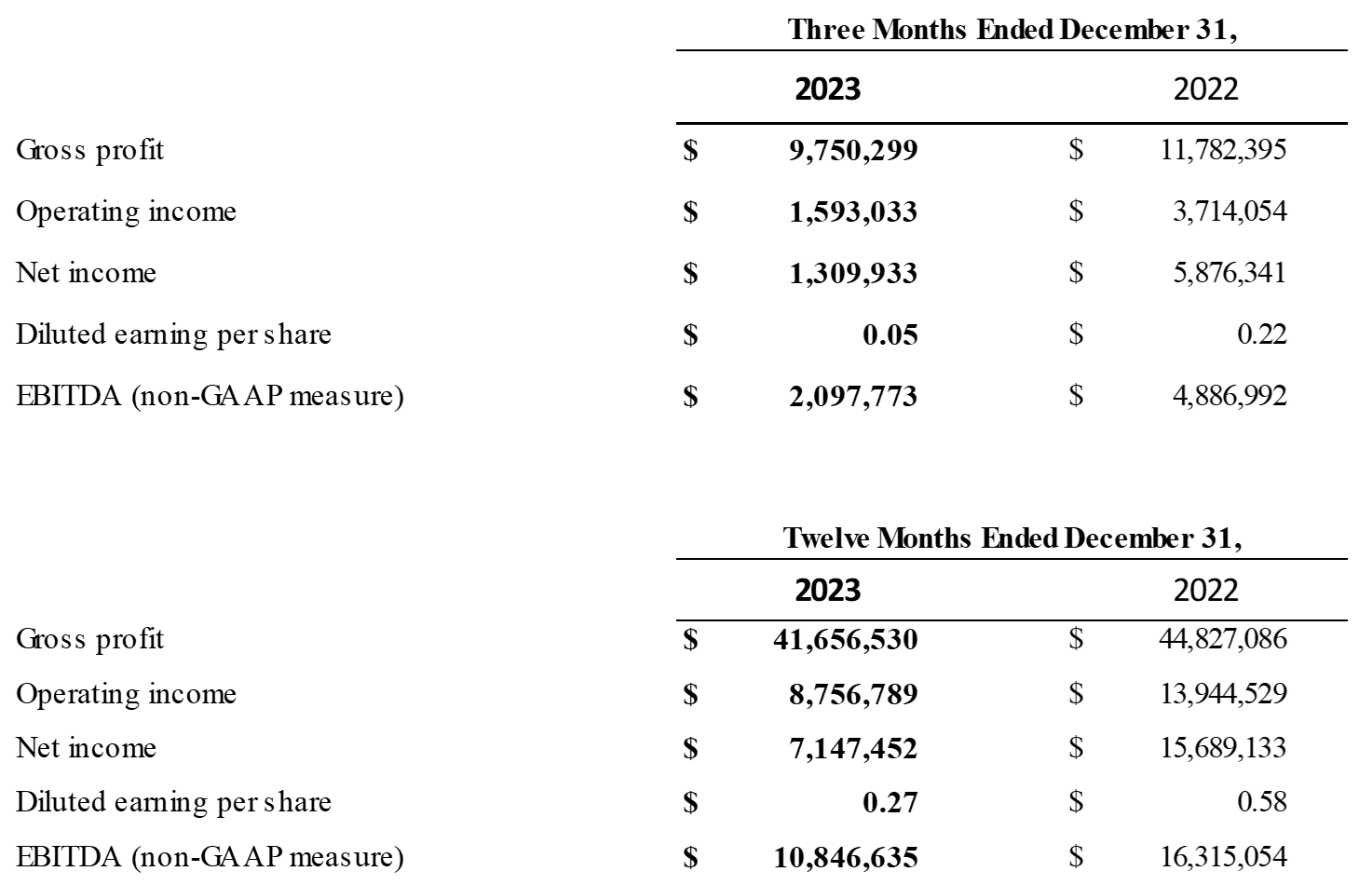

Fourth Quarter and Full Year 2023 Financial Highlights

Envela will report more complete earnings in its Form 10-K

Fourth Quarter and Full Year 2023 Consolidated Operating Highlights

- Full year revenue was

$171.7 million compared to$182.7 million in 2022. Fourth quarter revenue was$36.7 million compared to$47.4 million in the fourth quarter of 2022. - In spite of the decreased revenue, full year gross profit margin was

24.3% of revenue, compared to24.5% of revenue for 2022. Fourth quarter gross profit margin improved to26.6% of quarterly revenue, compared to24.8% in the fourth quarter last year. - Full year selling, general and administrative expenses as a percentage of sales increased to

18.4% or$31.5 million . Fourth quarter selling, general and administrative expenses as a percentage of sales increased to21.3% or$7.8 million , primarily due to increased investments in the Consumer segment of the business to support its anticipated growth. - Full year operating income decreased to

$8.8 million , or5.1% of revenue, compared to$13.9 million , or7.6% of revenue for 2022. Fourth quarter operating income decreased to$1.6 million , or4.3% of revenue, compared to$3.7 million , or7.8% of revenue for the fourth quarter of 2022. - Full year net income was

$7.1 million , or$0.27 per basic and diluted share, compared to$15.7 million , or$0.58 per basic and diluted share in 2022. Fourth quarter net income was$1.3 million , or$0.05 per basic and diluted share, compared to$5.9 million or$0.22 per basic and diluted shared in the fourth quarter of 2022. Last year, the company did not pay taxes due to a valuation allowance associated with the deferred tax asset reflecting net operating losses brought over from prior years. Due to the strong profitability of the business, the valuation allowance was written off as of December 31, 2022. In the fourth quarter of 2023, the Company paid federal income taxes of$340 thousand compared to an income tax credit of$1.5 million in the fourth quarter of last year. - Full year 2023 EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) was

$10.8 million , or6.3% of revenue, compared to$16.3 million , or8.9% of revenue in the 2022. Fourth quarter EBITDA was$2.1 million or5.7% of revenue, compared to$4.9 million or10.3% of revenue in the fourth quarter of 2022. - Cash and cash equivalents grew to

$17.9 million at December 31, 2023, compared to$17.2 million at December 31, 2022. - Total stockholders' equity grew to

$48.3 million at December 31, 2023, compared to$43.3 million at December 31, 2022.

Fourth Quarter Consumer Division Operating Highlights

- New store openings remain on track as Envela looks to open 3 retail stores in the Phoenix area. The company continues to target 7 new stores by the end of 2024.

- Consumer Division revenue was

$26.2 million for the fourth quarter of 2023, a decrease of24.2% compared to revenue of$34.6 million in the prior-year quarter primarily due to weakness in the global bullion market. - Consumer Division gross margins increased to

15.2% in the fourth quarter of 2023 compared to11.8% in the prior-year quarter, reflecting product mix and a focus on higher margin sales. - Operating expenses increased

58.1% to$3.3 million in the fourth quarter of 2023 compared to$2.1 million in the prior-year quarter, primarily reflecting increased personnel to support the long-term growth of the business. - Consumer Division pre-tax operating income in the fourth quarter of 2023 was

$725 thousand , a decrease of64% compared to$2 million in the prior-year quarter. The resulting consumer pre-tax operating margin was2.8% for the fourth quarter of 2023, decreasing from the5.8% margin for the prior-year quarter.

Fourth Quarter Commercial Division Operating Highlights

- Commercial Division revenue was

$10.5 million for the fourth quarter of 2023, a decrease from revenue of$12.9 million in the prior-year quarter. Revenues increased sequentially from the third quarter of 2023, reflecting Envela's growing partnerships with leading technology and electronics companies, as well as a range of local businesses. - Commercial Division gross margins decreased to

54.8% in the fourth quarter of 2023 compared to59.9% in the prior-year quarter. - Operating expenses increased

10.5% to$4.6 million in the fourth quarter of 2023 compared to$6.0 million in the prior-year quarter. - Commercial Division pre-tax operating income in the fourth quarter of 2023 was

$868 thousand , a decrease of48.9% compared to$1.7 million in the prior-year quarter. The resulting pre-tax operating margin was8.2% for the fourth quarter of 2023, decreasing from13.2% margin for the prior-year quarter.

Balance Sheet, Cash Flow and Liquidity

- Cash and cash equivalents increased to

$17.9 million from$17.2 million at December 31, 2022 - The Company reduced its long-term debt to

$13.6 million at December 31, 2023 compared to$14.7 million at December 31, 2022 - Total shareholders' equity increased to

$48.3 million at December 31, 2023 compared to$43.3 million at December 31, 2022 - For the year ended December 31, 2023, consolidated operating cash flows totaled

$5.8 million - Working capital at December 31, 2023 increased to

$48.3 million from$36.9 million at December 31, 2022

Share Repurchase Program

During the quarter ended December 31, 2023, the Company repurchased 191,342 shares of common stock at a cost of

About Envela

Envela a leading provider of re-commerce services at the forefront of the circular economy. The company is comprised of primarily two key business segments: Consumer and Commercial. The Consumer segment operates retail stores and online sites that offer premium brands and luxury hard assets, while the Commercial segment provides personalized re-commerce solutions to meet the needs of various clients, including Fortune 500 companies. We execute with passion and meticulous attention to detail, focusing on our strengths rather than trying to be everything to everyone.

At Envela, we Reuse, Recycle, and Reimagine. To learn more, visit Envela.com and follow our social media channels on Twitter, Instagram, Facebook, and LinkedIn.

Cautionary Statement Regarding Forward-Looking Information

This press release contains statements that may constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995's safe harbor provisions, including statements regarding future events and developments; potential expansions, purchases and acquisitions; potential future success of business lines and strategies; and management's expectations, beliefs, plans, estimates and projections relating to the future. Words such as "believes," "anticipates," "plans," "may," "intends," "will," "should," "expects" and similar expressions are intended to identify forward-looking statements. Forward-looking statements are based on management's then current views and assumptions and, as a result, are subject to certain risks and uncertainties, which could cause the Company's actual results to differ materially from those projected. These risks and uncertainties include, but are not limited to, risks described more fully in Item 1A in the Company's Annual Report on Form 10-K, which are expressly incorporated herein by reference, and other factors as may periodically be described in the Company's filings with the SEC. By making these statements, the Company undertakes no obligation to update these statements for revisions or changes after the date of this release except as required by law.

Investor Relations Contact:

John Nesbett/ Jennifer Belodeau

ir@envelacorp.com

972-587-4030

SOURCE: Envela Corporation

View the original press release on accesswire.com