E3 Lithium Outlines 2024 Corporate Guidance and its Plans to Advance the Clearwater Project

- E3 Lithium is poised for growth in 2024 with a focus on advancing the Clearwater Project.

- The company made substantial progress in 2023 towards commercial lithium production in Alberta.

- E3 Lithium's financial position remains strong, enabling it to accelerate commercial lithium production.

- The company aims to establish the Clearwater Project as a leading lithium development in Canada and North America.

- E3 Lithium is actively exploring additional resource areas beyond the Clearwater Project.

- The company has been building relationships with potential customers in automotive and manufacturing sectors.

- E3 Lithium has raised significant capital in 2023 and has a strong balance sheet to support its 2024 plans.

- The long-term outlook for EV uptake and lithium demand bodes well for E3 Lithium's future.

- E3 Lithium's commercial production is expected to coincide with rising lithium demand, creating favorable pricing environments.

- The company benefits from Alberta's efficient permitting regime, supporting its regulatory work in 2024.

- None.

Highlights:

- E3 Lithium is looking forward to another significant year of growth in 2024 as it advances its Clearwater Project towards commercial operations and revenue generation

- With the commercial viability of Direct Lithium Extraction Technology and E3 Lithium’s brines-to-battery flow sheet demonstrated in 2023, achieving the milestones set for 2024 marks a fundamental shift in E3 Lithium’s business and sets it on a clear and demonstrated pathway to commercial operations

- E3 Lithium looks forward to discussing its 2024 guidance during its February 22 webinar at 10 a.m. MST / 12 p.m. EST – details to join are provided below

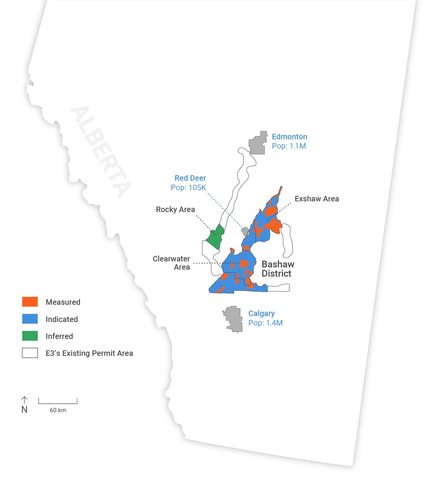

E3 Lithium's Alberta Assets (Graphic: Business Wire)

Going into 2024, E3 Lithium maintains a strong financial position. In the current market conditions, E3 Lithium has positioned itself to continue accelerating a path forward to producing first commercial lithium from its significant resources in South-Central Alberta.

“E3 Lithium had a very successful 2023 by progressing all core aspects of our business, putting us in position to deliver ambitious targets in 2024 moving us closer to first commercial lithium,” said Chris Doornbos, President and CEO of E3 Lithium. “The achievement of this year’s goals will mark a fundamental shift in our business, one that sees us move from a technology and resource developer to a commercialization company on a clear and demonstrated pathway to operations.”

E3 Lithium is focusing on the following goals in 2024.

Progressing the Clearwater Project Towards Commercial Operations

E3 Lithium’s Clearwater Project is the Company’s primary focus for its first commercial lithium facility, located in South-Central Alberta. The milestones the Company will achieve in advancing its development this year, including progressing engineering studies and commercial permitting, will establish the Clearwater Project as one of the few advanced stage lithium projects in

To move towards commercial operations in the Clearwater Project, the Company looks forward to completing the PFS and releasing the NI 43-101 report, aiming for late Q2 2024. E3 Lithium is working diligently to deliver the PFS report in Q2; the critical path to be able to do so is receiving engineering packages from external vendors. If delivery is delayed, the public report may be delayed as well. The Company will update the market on its progress and delivery times as they become firm.

The PFS is designed to a level of detail that will enable the Company to move directly into Feasibility Study (FS) and includes the full design of the first commercial facility, along with an updated cost estimate and development schedule. With the publication of the PFS NI 43-101 report, E3 Lithium will book Canada’s first lithium-in-brine reserves in the Clearwater Project area, a significant milestone for the Canadian lithium brine industry. E3 Lithium has initiated the permitting process for the commercial facility and will look to advance this throughout 2024. The milestones E3 Lithium looks forward to completing include publishing the PFS NI 43-101 report, selecting the EPC for and kicking off the FS, completing environmental and wildlife surveys and public consultation for its commercial facility, and preparing regulatory applications for approval.

While the PFS will outline details of the first commercial facility, the

Developing E3 Lithium’s Other Significant Resource Areas

In addition to its

In the Northern part of the

Rocky Area

In the Western trend of the Leduc Aquifer lies the Rocky area. This portion of the aquifer is largely disconnected from the

Nisku Aquifer across E3 Lithium’s Alberta Resource Areas

Recent sampling results indicate that the Nisku Aquifer, located above the Leduc Aquifer, has similar concentrations of lithium to the

E3 Lithium holds a strategic land position in the heart of the Estevan lithium belt in

Advancing Commercial Development and Offtake

E3 Lithium has been developing strong relationships with potential customers that include companies in the automotive, cell and cathode manufacturing sectors. The completion of the PFS is a major milestone for these discussions to mature towards sale contracts. E3 Lithium has been working to grow its commercial team to support this effort and will continue to prioritize identifying mutually beneficial arrangements with offtakers.

E3 Lithium’s Strengths Going into 2024

Balance sheet strength supports ability to execute 2024 plans: E3 Lithium raised more than

Long-term outlook for EV uptake and lithium demand: The long-term outlook for EV uptake and demand remains strong, with North American policy objectives in full alignment with a comprehensive shift to EVs into the 2030s. According to Benchmark Mineral Intelligence, entering 2024,

Commercial production to coincide with rising demand: E3 Lithium’s initial commercial production is likely to be timed in to coincide with the increase in demand for and shortfall of supply of lithium, which may create favourable pricing environments for E3 Lithium’s offtake.

Lithium offtake sold in long-term contracts: Most lithium today is sold in long-term offtake arrangements that contain negotiated sales prices. The best gauge for these prices is long term price forecasts provided by reputable research firms, which are outlining prices much higher than current spot prices. The price forecasts provided by reputable research firms will be relied upon for the PFS.

Efficient and well-known permitting regime:

Join us at our Upcoming Webinar

E3 Lithium will be hosting a webinar for investors and other interested parties to share more information about its 2024 Corporate Guidance and the progress made to-date. Details for this virtual webinar are below and questions can be submitted in advance to investor@e3lithium.ca.

- Date: Thursday, February 22, 2024

- Time: 10 a.m. MST / 12 p.m. EST / 9 a.m. PST

- Log in details: Zoom (click here to log in at the time of the webinar; no need to register in advance)

ON BEHALF OF THE BOARD OF DIRECTORS

Chris Doornbos, President & CEO

E3 Lithium Ltd.

About E3 Lithium

E3 Lithium is a development company with a total of 16.0 million tonnes of lithium carbonate equivalent (LCE) Measured and Indicated and 0.9 million tonnes LCE Inferred mineral resources1 in

1: The Preliminary Economic Assessment (PEA) for the Clearwater Lithium Project NI 43-101 technical report is amended Sept 17, 2021. Gordon MacMillan, P.Geol, QP, Fluid Domains Inc. and Grahame Binks, MAusIMM, QP (Metallurgy), formerly of Sedgman Canada Limited (Report Date: June 15, 2018, Effective Date: June 4, 2018 Amended Date: September 17, 2021). The mineral resource NI 43-101 Technical Report for the North Rocky Property, effective October 27, 2017, identified 0.9Mt LCE (inferred). The mineral resource NI 43-101 Technical Report for the Bashaw District Project, effective March 21, 2023, identified 16.0Mt LCE (measured & indicated). All reports are available on the E3 Lithium’s website (e3lithium.ca/technical-reports) and SEDAR+ (www.sedarplus.ca).

Forward-Looking and Cautionary Statements

This news release includes certain forward-looking statements as well as management’s objectives, strategies, beliefs and intentions. Forward looking statements are frequently identified by such words as “may”, “will”, “plan”, “expect”, “anticipate”, “estimate”, “intend” and similar words referring to future events and results. Forward-looking statements are based on the current opinions and expectations of management. All forward-looking information is inherently uncertain and subject to a variety of assumptions, risks and uncertainties, including the speculative nature of mineral exploration and development, fluctuating commodity prices, the effectiveness and feasibility of emerging lithium extraction technologies which have not yet been tested or proven on a commercial scale or on the Company’s brine, competitive risks and the availability of financing, as described in more detail in our recent securities filings available at www.sedarplus.ca. Actual events or results may differ materially from those projected in the forward-looking statements and we caution against placing undue reliance thereon. We assume no obligation to revise or update these forward-looking statements except as required by applicable law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

___________________________________

1 Based on a typical 68 kg EV battery.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240221541557/en/

E3 Lithium - Investor and Media Relations

Robin Boschman

Director, Investor Relations and Corporate Communications

investor@e3lithium.ca

587-324-2775

Source: E3 Lithium Ltd.

FAQ

What is E3 Lithium's (EEMMF) primary focus in 2024?

When will E3 Lithium discuss its 2024 guidance?

What financial milestone did E3 Lithium achieve in 2023?

What are E3 Lithium's strengths going into 2024?