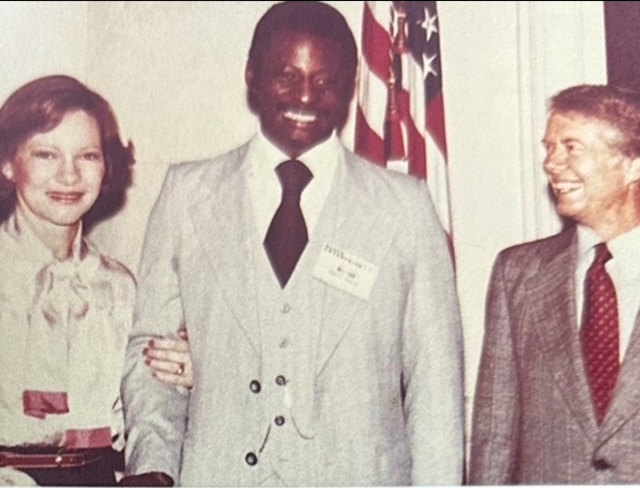

PawnTrust Inc. Reflects on Patriarch Mel Farr, Sr.'s Relationship with President Jimmy Carter and the Fight for Equity

Rhea-AI Summary

PawnTrust Inc. (OTC PINK: DWIS) reflects on the historical relationship between its patriarch Mel Farr, Sr. and President Jimmy Carter during the automotive industry crisis of the early 1980s. When Farr's automotive business faced severe challenges, with sales dropping from $15 million to $8 million between 1978 and 1980, President Carter responded to his appeal by pledging $400 million in low-interest SBA loans to support minority-owned businesses.

Farr received $200,000 through this program, matched by Ford Motor Company with another $200,000. This support helped stabilize his business, which later grew to become the largest African-American-owned business in the United States by the 1990s, achieving annual sales exceeding $500 million.

Positive

- None.

Negative

- None.

ATLANTA, GA, Jan. 13, 2025 (GLOBE NEWSWIRE) -- Dinewise, Inc (OTC PINK-DWIS) (referred to as "Dinewise", "we", "us", "our" or the "Company") a fintech company operating as PawnTrust Inc., providing solutions to the pawn shop industry reflects on its Patriarch Mel Farr, Sr's relationship with President Jimmy Carter.

As the nation mourns the passing of President Jimmy Carter, PawnTrust acknowledges his tireless commitment to racial equity and economic empowerment, which profoundly impacted the lives of countless individuals, including Mel Farr, Sr.

In the early 1980s, the automotive industry faced unprecedented challenges, with sales plummeting to half their 1979 levels. Mel Farr, Sr., a former NFL star turned automotive entrepreneur, was not immune to the downturn. Between 1978 and 1980, his sales dropped from

"We all stand on the shoulders of others, and we can never forget the sacrifices of those who came before us. My father’s success would not have been possible without President Carter’s vision and dedication to equity. We at PawnTrust honor his legacy and commitment to minority owned businesses.” Michael Farr Chief Executive Officer.

PawnTrust Inc., a fintech leader providing innovative solutions to the pawn shop industry, draws inspiration from the legacy of trailblazers like Mel Farr, Sr., and the advocacy of leaders like President Jimmy Carter.

About PawnTrust

PawnTrust is an exclusively tailored marketplace for the estimated 11,000 pawn shops nationwide. The online marketplace (www.pawntrust.com) digitizes the inventory using advanced image recognition algorithms to automate item descriptions of the participating pawn shops and markets them on a national scale. The marketplace contains cutting-edge technology that streamlines the borrowing, buying, and bartering transactions typically found at a pawn shop. The platform plans to leverage Artificial Intelligence (AI) to optimize pricing, reduce fraud, and create personalized search recommendations to enhance the customer's experience. These enhancements let consumers experience a frictionless shopping experience on their mobile app that gives them instant access to this nationwide inventory of pawn shops. Not only does this provide a more efficient way for consumers to shop, eliminating the need to visit multiple stores, but it also amplifies the reach of individual pawn shop owners. By joining the PawnTrust- 'Pawn Partners' network, shop owners gain access to a broader audience, enhancing their visibility and sales opportunities. This innovative approach aligns customer convenience with business growth, reshaping how people interact with the pawn industry. Consumers that purchase items outside of their local area will have their items conveniently shipped to them. As the intermediary in each transaction, PawnTrust earns a fee on every item sold in the marketplace. Many of these local pawn shops lack an online presence or the capital to market their inventory on a national scale. By bridging this gap, PawnTrust opens up opportunities for incremental sales from a wider buying base, effectively transforming the pawn shop and micro-lending industries. This model not only supports local businesses but also extends their reach, driving growth and innovation within the market."

Forward-Looking Information

This release includes statements that may constitute ''forward-looking'' statements, usually containing the words ''believe,'' ''estimate,'' ''project,'' ''expect'' or similar expressions. These statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. While the Company believes the expectations reflected in forward-looking statements are reasonable, there can be no assurances such expectations will prove to be accurate. Security holders are cautioned such forward-looking statements involve risks and uncertainties. Certain factors may cause results to differ materially from those anticipated by the forward-looking statements made in this release. Factors that would cause or contribute to such differences include, but are not limited to, acceptance of the Company's current and future products and services in the marketplace, the ability of the Company to develop effective new products and receive regulatory approvals of such products, competitive factors, dependence upon third-party vendors, risks and uncertainties related to the current unknown duration and severity of the COVID-19 pandemic and other risks detailed in the Company's periodic report filings with the Securities and Exchange Commission. By making these forward-looking statements, the Company undertakes no obligation to update these statements for revisions or changes after the date of this release.

Investor Relations:

Resources Unlimited

718-269-3366

mike@resourcesunlimitedllc.com

Attachment