Dril-Quip, Inc. Announces Second Quarter 2024 Results

Dril-Quip (NYSE:DRQ) announced Q2 2024 results with a revenue of $120.3 million, up 9.1% sequentially and 34.3% YoY. Subsea Products saw orders of $54.1 million, a 25% sequential increase. However, including a $39.6 million cancellation, bookings were $12.8 million.

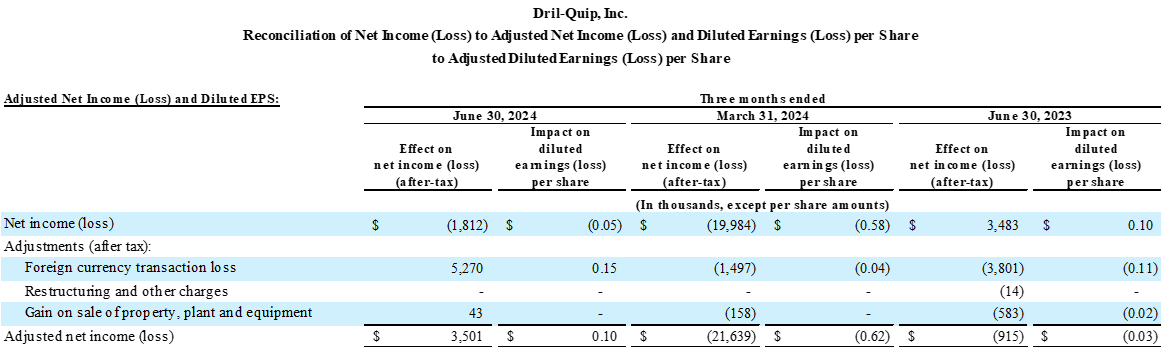

The net loss reduced to $1.8 million from $20 million in Q1 2024. Adjusted EBITDA improved to $16.5 million, up $6.3 million sequentially. Gross margin rose to 30.8%.

The company highlighted successful strategic partnerships and acquisitions, notably in Subsea Products and Well Construction. Revenue growth was driven by increased subsea wellhead deliveries and the acquisition of Great North.

Dril-Quip is optimistic about the merger with Innovex Downhole Solutions, expected to close in Q3 2024, aiming for immediate accretive benefits and synergies across key markets.

Dril-Quip (NYSE:DRQ) ha annunciato i risultati del secondo trimestre 2024 con un fatturato di $120,3 milioni, in aumento del 9,1% rispetto al trimestre precedente e del 34,3% su base annua. I comparti sottomarini hanno registrato ordini per $54,1 milioni, con un aumento sequenziale del 25%. Tuttavia, includendo una cancellazione di $39,6 milioni, le prenotazioni sono state di $12,8 milioni.

La perdita netta è stata ridotta a $1,8 milioni rispetto ai $20 milioni del primo trimestre 2024. L'EBITDA rettificato è migliorato a $16,5 milioni, con un aumento sequenziale di $6,3 milioni. Il margine lordo è salito al 30,8%.

L'azienda ha messo in evidenza le partnership strategiche e le acquisizioni di successo, in particolare nel settore dei prodotti sottomarini e nella costruzione di pozzi. La crescita del fatturato è stata guidata dall'aumento delle consegne di head di pozzo sottomarino e dall'acquisizione di Great North.

Dril-Quip è ottimista riguardo alla fusione con Innovex Downhole Solutions, prevista per il terzo trimestre 2024, puntando a benefici immediati e sinergie nei principali mercati.

Dril-Quip (NYSE:DRQ) anunció los resultados del segundo trimestre de 2024 con unos ingresos de $120.3 millones, un 9.1% más secuencialmente y un 34.3% interanual. Los Productos Submarinos vieron órdenes de $54.1 millones, un aumento del 25% secuencial. Sin embargo, incluyendo una cancelación de $39.6 millones, las reservas fueron de $12.8 millones.

La pérdida neta se redujo a $1.8 millones, desde $20 millones en el primer trimestre de 2024. El EBITDA ajustado mejoró a $16.5 millones, un aumento secuencial de $6.3 millones. El margen bruto aumentó al 30.8%.

La compañía destacó asociaciones estratégicas y adquisiciones exitosas, especialmente en Productos Submarinos y Construcción de Pozos. El crecimiento de los ingresos fue impulsado por un aumento en las entregas de cabezales de pozo submarinos y la adquisición de Great North.

Dril-Quip es optimista sobre la fusión con Innovex Downhole Solutions, que se espera cerrar en el tercer trimestre de 2024, buscando beneficios inmediatos y sinergias en los principales mercados.

Dril-Quip (NYSE:DRQ)는 2024년 2분기 실적을 발표하며 매출이 $120.3 백만으로, 전분기 대비 9.1% 증가하고, 전년 동기 대비 34.3% 증가했다고 밝혔습니다. 수중 제품 부문에서 주문이 $54.1 백만으로 25% 증가하였습니다. 그러나 $39.6 백만의 취소를 포함하면, 예약액은 $12.8 백만에 그쳤습니다.

순손실은 2024년 1분기의 $20 백만에서 $1.8 백만으로 줄어들었습니다. 조정 EBITDA는 $16.5 백만으로, 전분기 대비 $6.3 백만 증가했습니다. 총 마진은 30.8%로 상승했습니다.

회사는 특히 수중 제품과 우물 건설 분야에서 성공적인 전략적 파트너십과 인수를 강조했습니다. 매출 성장은 수중 우물 헤드 납품 증가와 Great North의 인수로 촉진되었습니다.

Dril-Quip는 2024년 3분기에 마무리될 것으로 예상되는 Innovex Downhole Solutions와의 합병에 대해 낙관적이며, 주요 시장에서의 즉각적인 이익과 시너지를 목표로 하고 있습니다.

Dril-Quip (NYSE:DRQ) a annoncé les résultats du deuxième trimestre 2024 avec un chiffre d'affaires de 120,3 millions de dollars, en hausse de 9,1 % par rapport au trimestre précédent et de 34,3 % par rapport à l'année précédente. Les produits sous-marins ont enregistré des commandes de 54,1 millions de dollars, soit une augmentation séquentielle de 25 %. Cependant, en incluant une annulation de 39,6 millions de dollars, les réservations s'élevaient à 12,8 millions de dollars.

La perte nette a été réduite à 1,8 million de dollars, contre 20 millions de dollars au premier trimestre 2024. L'EBITDA ajusté s'est amélioré à 16,5 millions de dollars, en hausse de 6,3 millions de dollars par rapport au trimestre précédent. La marge brute a augmenté à 30,8 %.

L'entreprise a mis en avant des partenariats stratégiques et des acquisitions réussies, notamment dans les produits sous-marins et la construction de puits. La croissance du chiffre d'affaires a été stimulée par une augmentation des livraisons de têtes de puits sous-marins et par l'acquisition de Great North.

Dril-Quip est optimiste quant à la fusion avec Innovex Downhole Solutions, qui devrait être finalisée au troisième trimestre 2024, visant des avantages et des synergies immédiats dans les principaux marchés.

Dril-Quip (NYSE:DRQ) gab die Ergebnisse für das 2. Quartal 2024 bekannt, mit einem Umsatz von $120,3 Millionen, was einem Anstieg von 9,1% im Vergleich zum vorherigen Quartal und 34,3% im Vergleich zum Vorjahr entspricht. Unterwasserprodukte verzeichneten Bestellungen in Höhe von $54,1 Millionen, was einem sequenziellen Anstieg von 25% entspricht. Allerdings betrugen die Buchungen, unter Berücksichtigung einer Stornierung in Höhe von $39,6 Millionen, nur $12,8 Millionen.

Der Nettoverlust verringerte sich auf $1,8 Millionen, von $20 Millionen im 1. Quartal 2024. Das angepasste EBITDA verbesserte sich auf $16,5 Millionen, ein sequenzieller Anstieg um $6,3 Millionen. Die Bruttomarge stieg auf 30,8%.

Das Unternehmen hob erfolgreiche strategische Partnerschaften und Akquisitionen hervor, insbesondere im Bereich Unterwasserprodukte und Bohrlochbau. Das Umsatzwachstum wurde durch erhöhte Lieferungen von Unterwasserbohrköpfen und die Übernahme von Great North vorangetrieben.

Dril-Quip ist optimistisch bezüglich der Fusion mit Innovex Downhole Solutions, die voraussichtlich im 3. Quartal 2024 abgeschlossen wird, und zielt auf sofortige Vorteile und Synergien in wichtigen Märkten ab.

- Revenue increased 9.1% sequentially and 34.3% YoY to $120.3 million.

- Net loss decreased to $1.8 million from $20 million in Q1 2024.

- Adjusted EBITDA improved to $16.5 million, up $6.3 million sequentially.

- Gross margin rose to 30.8%, up 194 basis points sequentially.

- Subsea Products orders increased 25% sequentially to $54.1 million.

- Well Construction segment demonstrated 25% proforma YoY growth.

- Subsea Products bookings affected by a $39.6 million project cancellation.

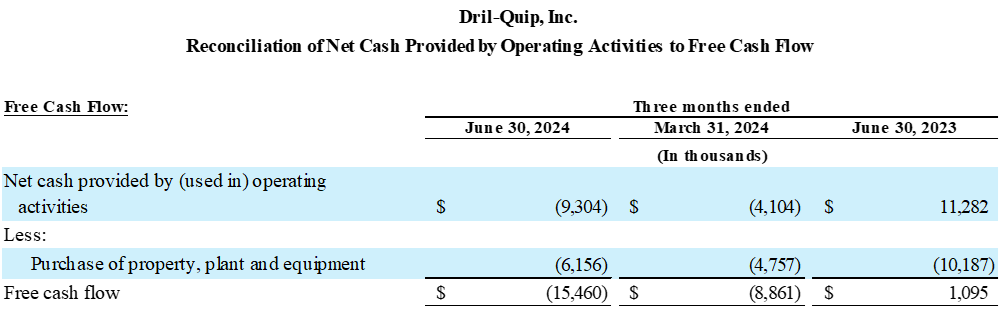

- Free cash flow use of $15.5 million, a sequential decrease of $6.6 million.

- SG&A expenses increased $7.7 million YoY to $29.8 million.

Insights

Dril-Quip's Q2 2024 results present a mixed picture with some positive trends and ongoing challenges. Revenue growth of 34.3% year-over-year to

However, the company still reported a net loss of

The Subsea Product orders of

The pending merger with Innovex Downhole Solutions is a pivotal move that could reshape Dril-Quip's market position and financial outlook. Investors should closely monitor the integration process and potential synergies post-merger.

The company's cash flow remains a concern, with negative free cash flow of

Dril-Quip's Q2 results reflect the ongoing recovery in the offshore energy sector, particularly in deepwater activities. The 34.3% year-over-year revenue growth outpaces the industry average, indicating market share gains or expansion into high-growth niches.

The company's strategic shift towards diversification is evident in the Well Construction segment's performance, now accounting for over 40% of revenue. This move into onshore operations through acquisitions like Great North provides a hedge against offshore market volatility.

The success of the One Subsea wellhead collaboration and the recent Petrobras tender win highlight Dril-Quip's strong position in the subsea equipment market. However, the cancellation of a

The upcoming merger with Innovex is a game-changer, potentially creating a more resilient entity with a broader product portfolio and enhanced market presence. This consolidation trend is likely to continue in the oilfield services sector as companies seek scale and efficiency.

Looking ahead, the company's expectation of continued strong revenue levels in H2 2024 aligns with industry projections of sustained offshore activity. However, investors should remain cautious about potential market volatility and geopolitical risks that could impact oil prices and, consequently, offshore investments.

HOUSTON, TX / ACCESSWIRE / August 1, 2024 / Dril-Quip, Inc. (NYSE:DRQ), (the "Company" or "Dril-Quip"), a developer, manufacturer and provider of highly engineered equipment, service, and innovative technologies for use in the energy industry, today reported operational and financial results for the three months ended June 30, 2024.

Second Quarter Highlights

Revenue of

$120.3 million , an increase of9.1% sequentially and34.3% year-over-yearSubsea Products orders booked of

$54.1 million , increasing25% sequentially. Net of a subsea tree customer project cancellation for$39.6 million , Subsea Product Bookings were$12.8 million Net Loss of

$1.8 million , an improvement of$18.2 million sequentially and a decrease of$5.3 million year-over-yearAdjusted EBITDA of

$16.5 million increased$6.3 million sequentially and$7.7 million year-over-yearGross Margin of

30.8% increased 194 basis points sequentially and 417 basis points year-over-yearPreviously announced merger with Innovex Downhole Solutions ("Innovex") remains on track to close in the third quarter of 2024

Management Commentary

"We experienced robust revenue growth and strong performance across several of our key businesses in the second quarter, particularly in our Subsea Products and Well Construction segments, which have also benefited from recent strategic partnerships and acquisitions. The Well Construction segment was especially robust with proforma year on year growth of

"Our achievements this quarter are a testament to the effectiveness of our teams and strategy and set us up for further success as we work towards our transformative combination with Innovex. We look forward to the significant benefits for the combined company including scale, cross-selling opportunities, attractive synergies and diversified presence across the most compelling markets, through a transaction that is immediately accretive to all key financial measures. We expect the transaction to close in the third quarter and look forward to the significant opportunities ahead for our customers, employees and shareholders."

Operational and Financial Results

Revenue, Bookings, Cost of Sales and Gross Operating Margin

Consolidated revenue for the second quarter of 2024 was

The positive performance in the Well Construction segment was led by offshore liner hanger growth in West Africa, partially offset by the headwinds of the seasonally expected breakup season in Canada. Additionally, the year-over-year revenue increase was driven by the acquisition of Great North, which contributed

The Well Construction segment consists entirely of acquisitions completed by Dril-Quip in recent years and accounted for more than

Subsea Product orders booked in the second quarter of 2024 were

Cost of sales for the second quarter of 2024 was

Selling, General, Administrative, and Engineering & Other Expenses

Selling, general and administrative ("SG&A") expenses for the second quarter of 2024 were

Engineering and product development expenses were

Net Loss, Adjusted EBITDA and Free Cash Flow

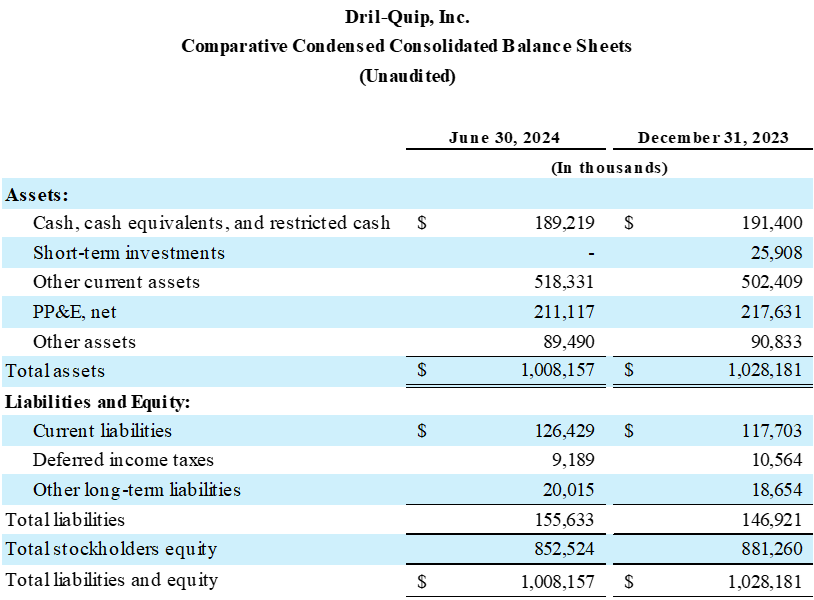

For the second quarter of 2024, the Company reported net loss of

Adjusted EBITDA totaled

Cash used in operations was

Capital expenditures in the second quarter of 2024 were

Outlook

Due to the pending merger with Innovex, the Company has suspended providing earnings guidance updates. Accordingly, investors are cautioned not to rely on historical forward-looking statements as those forward-looking statements were the estimates of management only as of the date provided and were subject to the specific risks and uncertainties that accompanied such forward-looking statements.

Transaction Update

Dril-Quip continues make progress towards the completion of its previously announced merger with Innovex Downhole Solutions. On May 1, 2024, the Company filed a preliminary proxy statement with the SEC.

The transaction has been approved by the Boards of Directors of both companies. The Company expects that the merger will be completed in the third quarter of 2024, subject to customary closing conditions.

Conference Call

Due to the pending merger with Innovex, Dril-Quip will not host a conference call or webcast to discuss its second quarter 2024 results.

About Dril-Quip

Dril-Quip is a developer, manufacturer and provider of highly engineered equipment, service and innovative technologies for use in the energy industry.

Investors should note that Dril-Quip announces material financial information in Securities and Exchange Commission ("SEC") filings, press releases and public conference calls. Dril-Quip may use the Investors section of its website (www.dril-quip.com) to communicate with investors. It is possible that the financial and other information posted there could be deemed to be material information. Information on Dril-Quip's website is not part of this release.

Forward-Looking Statements

Statements contained herein relating to future operations and financial results that are forward-looking statements, including those related to market conditions, benefits of the pending merger with Innovex, benefits of the recently completed acquisition of Great North, anticipated project bookings, anticipated timing of delivery of new orders, anticipated revenues, costs, cost synergies and savings, possible acquisitions, new product offerings and related revenues, share repurchases and expectations regarding operating results, are based upon certain assumptions and analyses made by the management of the Company in light of its experience and perception of historical trends, current conditions, expected future developments and other factors. These statements are subject to risks beyond the Company's control, including, but not limited to, risks related to the pending merger with Innovex, including uncertainty as to whether the conditions to closing the merger will be satisfied or whether the mergers will be completed, the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement, the impact of actions taken by the Organization of Petroleum Exporting Countries and the expanded alliance (OPEC+) with respect to their production levels and the effects thereof, risks related to the recently completed acquisition, including the risk that the benefits of the Great North acquisition may not be fully realized or may take longer to realize than expected, that we will fail to successfully integrate the properties and assets into our business and that management attention will be diverted to integration-related issues, the impact of general economic conditions, including inflationary pressures and interest rates, a general economic slowdown or recession or instability in financial institutions, on economic activity and on our operations, the general volatility of oil and natural gas prices and cyclicality of the oil and gas industry, declines in investor and lender sentiment with respect to, and new capital investments in, the oil and gas industry, project terminations, suspensions or scope adjustments to contracts, uncertainties regarding the effects of new governmental regulations, the Company's international operations, operating risks, the impact of our customers and the global energy sector shifting some of their asset allocation from fossil-fuel production to renewable energy resources, and other factors detailed in the Company's public filings with the SEC. Investors are cautioned that any such statements are not guarantees of future performance and actual outcomes may vary materially from those indicated.

Important Information for Stockholders

In connection with the proposed merger of the Company and Innovex, the Company has filed with the SEC a registration statement on Form S-4 (as amended, the "Registration Statement") on May 1, 2024, that included a proxy statement/prospectus (the "Proxy Statement/Prospectus"). The information in the Registration Statement is not complete and may be changed. The Company has filed other relevant documents with the SEC regarding the proposed merger. This document is not a substitute for the Proxy Statement/Prospectus or Registration Statement or any other document that the Company has filed with the SEC. STOCKHOLDERS ARE URGED TO CAREFULLY READ THE REGISTRATION STATEMENT, PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER RELEVANT DOCUMENTS THAT HAVE BEEN FILED BY THE COMPANY WITH THE SEC IN THEIR ENTIRETY BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. Such stockholders can obtain free copies of the Registration Statement and Proxy Statement/Prospectus and other documents containing important information about the Company, Innovex and the proposed merger through the website maintained by the SEC at http://www.sec.gov. Additional information is available on the Company's website, www.dril-quip.com.

No Offer or Solicitation

This communication is not intended to and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Participants in the Solicitation

The Company and its directors and executive officers may be deemed to be participants in the solicitation of proxies from stockholders in connection with the proposed merger. Information about the Company's directors and executive officers including a description of their interests in the Company is included in the Company's most recent Annual Report on Form 10-K/A, including any information incorporated therein by reference, as filed with the SEC. Additional information regarding these persons and their interests in the proposed merger is included in the Proxy Statement/Prospectus relating to the proposed merger filed with the SEC. These documents can be obtained free of charge from the sources indicated above. Innovex and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the Company stockholders in connection with the proposed merger. A list of the names of such directors and executive officers and information regarding their interests in the proposed merger is included in the Proxy Statement/Prospectus relating to the proposed merger filed with the SEC.

Non-GAAP Financial Information

Free Cash Flow and Adjusted EBITDA are non-GAAP measures.

Free Cash Flow is defined as net cash provided by operating activities less cash used in the purchase of property, plant and equipment.

Adjusted EBITDA is defined as net income (loss) excluding income taxes, interest income and expense, depreciation and amortization expense, stock-based compensation, non-cash gains or losses from foreign currency exchange rate changes as well as other significant non-cash items and other adjustments for certain charges and credits.

The Company believes that these non-GAAP measures enable it to evaluate and compare more effectively the results of our operations period over period and identify operating trends by removing the effect of its capital structure from its operating structure. In addition, the Company believes that these measures are supplemental measurement tools used by analysts and investors to help evaluate overall operating performance, ability to pursue and service possible debt opportunities and make future capital expenditures. Free Cash Flow and Adjusted EBITDA do not represent funds available for our discretionary use and are not intended to represent or to be used as a substitute for net income (loss) or net cash provided by operating activities, as measured under U.S. generally accepted accounting principles ("GAAP").

See "Unaudited Non-GAAP Financial Measures" below for additional information concerning non-GAAP financial information, including a reconciliation of the non-GAAP financial information presented in this press release to the most directly comparable financial information presented in accordance with GAAP. Non-GAAP financial information supplements and should be read together with, and is not an alternative or substitute for, the Company's financial results reported in accordance with GAAP. Because non-GAAP financial information is not standardized, it may not be possible to compare these financial measures with other companies' non-GAAP financial measures.

Investor Relations Contact

Erin Fazio, Director of Corporate Finance

Erin_Fazio@dril-quip.com

Dril-Quip, Inc.

Comparative Condensed Consolidated Income Statement

(Unaudited)

| Three months ended |

| ||||||||||

| June 30, 2024 |

|

| March 31, 2024 |

|

| June 30, 2023 |

| ||||

| (In thousands, except per share data) |

| ||||||||||

Revenues: |

|

|

|

|

|

|

|

|

| |||

Products |

| $ | 74,330 |

|

| $ | 64,562 |

|

| $ | 55,828 |

|

Services |

|

| 32,714 |

|

|

| 30,187 |

|

|

| 23,733 |

|

Leasing |

|

| 13,298 |

|

|

| 15,548 |

|

|

| 10,046 |

|

Total revenues |

|

| 120,342 |

|

|

| 110,297 |

|

|

| 89,607 |

|

Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales |

|

| 83,229 |

|

|

| 78,419 |

|

|

| 65,711 |

|

Selling, general and administrative |

|

| 29,771 |

|

|

| 29,991 |

|

|

| 22,114 |

|

Engineering and product development |

|

| 3,588 |

|

|

| 3,738 |

|

|

| 3,202 |

|

Restructuring and other charges |

|

| - |

|

|

| - |

|

|

| (610 | ) |

Gain on sale of property, plant and equipment |

|

| 54 |

|

|

| (200 | ) |

|

| (738 | ) |

Acquisition costs |

|

| 1,695 |

|

|

| 19,046 |

|

|

| 1,134 |

|

Change in fair value of earn-out liability |

|

| - |

|

|

| - |

|

|

| - |

|

Foreign currency transaction loss (gain) |

|

| 6,671 |

|

|

| (1,895 | ) |

|

| (4,812 | ) |

Total costs and expenses |

|

| 125,008 |

|

|

| 129,099 |

|

|

| 86,001 |

|

Operating income (loss) |

|

| (4,666 | ) |

|

| (18,802 | ) |

|

| 3,606 |

|

Interest income, net |

|

| (2,053 | ) |

|

| (2,196 | ) |

|

| (1,979 | ) |

Income tax provision (benefit) |

|

| (801 | ) |

|

| 3,378 |

|

|

| 2,102 |

|

Net income (loss) |

| $ | (1,812 | ) |

| $ | (19,984 | ) |

| $ | 3,483 |

|

Net income (loss) per share |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

| $ | (0.05 | ) |

| $ | (0.58 | ) |

| $ | 0.10 |

|

Diluted |

| $ | (0.05 | ) |

| $ | (0.58 | ) |

| $ | 0.10 |

|

Depreciation and amortization |

| $ | 8,007 |

|

| $ | 8,432 |

|

| $ | 7,049 |

|

Capital expenditures |

| $ | 6,156 |

|

| $ | 4,757 |

|

| $ | 10,187 |

|

Weighted Average Shares Outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

| 34,437 |

|

|

| 34,417 |

|

|

| 34,130 |

|

Diluted |

|

| 34,437 |

|

|

| 34,417 |

|

|

| 34,490 |

|

View the original press release on accesswire.com