PULSE® Study Finds Debit’s Importance to Consumers Continues to Increase

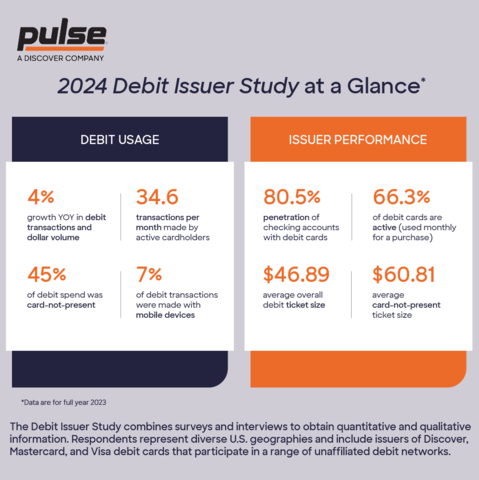

The 2024 PULSE Debit Issuer Study, commissioned by Discover Financial Services' PULSE debit network, reveals a rise in the use of debit cards among U.S. consumers. Key findings include an increase in the total number of debit cards, transactions, and annual spend per active card in 2023. Active cardholders averaged 34.6 transactions per month, with 46.89% of transactions being card-not-present (CNP) and 38% of debit cards loaded into mobile wallets. The average debit ticket size was $46.89, with an annual spend per active card at $17,274. Mobile devices accounted for 7% of all debit transactions, and issuers plan to introduce digital instant-issuance capabilities. The study also notes challenges such as a pending reduction in Regulation II's interchange cap, increased competition, and the impact of real-time payments growth.

Lo studio 2024 PULSE Debit Issuer, commissionato dal network di carte di debito PULSE di Discover Financial Services, rivela un aumento nell'uso delle carte di debito tra i consumatori statunitensi. I principali risultati includono un incremento nel numero totale di carte di debito, transazioni e spesa annuale per carta attiva nel 2023. I titolari attivi di carte hanno effettuato in media 34,6 transazioni al mese, con il 46,89% delle transazioni che risulta essere senza presentazione fisica della carta (CNP) e il 38% delle carte di debito caricate in portafogli digitali. La dimensione media degli acquisti con carta era di $46,89, con una spesa annuale per carta attiva di $17.274. I dispositivi mobili rappresentavano il 7% di tutte le transazioni con carta di debito, e gli emittenti pianificano di introdurre funzionalità di emissione digitale immediata. Lo studio menziona anche sfide come una possibile riduzione del tetto delle commissioni di interscambio secondo la Regolamentazione II, un aumento della concorrenza e l'impatto della crescita dei pagamenti in tempo reale.

El estudio de emisores de débito PULSE 2024, encargado por la red de débito PULSE de Discover Financial Services, revela un aumento en el uso de tarjetas de débito entre los consumidores de EE. UU. Los hallazgos clave incluyen un incremento en el número total de tarjetas de débito, transacciones y gasto anual por tarjeta activa en 2023. Los titulares activos de tarjetas promediaron 34.6 transacciones por mes, con el 46.89% de las transacciones siendo sin tarjeta presente (CNP) y el 38% de las tarjetas de débito cargadas en billeteras móviles. El tamaño promedio del ticket de débito fue de $46.89, con un gasto anual por tarjeta activa de $17,274. Los dispositivos móviles representaron el 7% de todas las transacciones de débito, y los emisores planean introducir capacidades de emisión digital instantánea. El estudio también señala desafíos como una reducción prevista en el límite de comisiones de intercambio de la Regulación II, mayor competencia y el impacto del crecimiento de los pagos en tiempo real.

2024 PULSE 직불 카드 발급자 연구는 Discover Financial Services의 PULSE 직불 카드 네트워크가 의뢰한 것으로, 미국 소비자들 사이에서 직불 카드 사용이 증가하고 있음을 보여줍니다. 주요 발견 사항으로는 2023년 직불 카드 총 수, 거래 수 및 활성 카드당 연간 지출이 증가한 것입니다. 활성 카드 소지자는 월평균 34.6회의 거래를 했으며, 거래의 46.89%는 카드 비제출 거래(CNP)로, 38%의 직불 카드가 모바일 지갑에 담겨 있었습니다. 평균 직불 카드 거래 금액은 $46.89였고, 활성 카드당 연간 지출은 $17,274였습니다. 모바일 기기가 모든 직불 카드 거래의 7%를 차지하며, 발급자는 디지털 즉시 발급 기능을 도입할 계획입니다. 이 연구는 또한 Regulation II의 교환 수수료 상한 감소, 증가하는 경쟁, 실시간 결제 성장의 영향을 포함한 도전 과제가 있음을 지적합니다.

La recherche sur les émetteurs de cartes de débit PULSE 2024, commandée par le réseau de cartes de débit PULSE de Discover Financial Services, révèle une augmentation de l'utilisation des cartes de débit parmi les consommateurs américains. Les résultats clés incluent une augmentation du nombre total de cartes de débit, des transactions et des dépenses annuelles par carte active en 2023. Les titulaires de cartes actifs ont effectué en moyenne 34,6 transactions par mois, avec 46,89 % de ces transactions étant sans carte physique (CNP) et 38 % des cartes de débit chargées dans des portefeuilles mobiles. Le montant moyen des transactions par carte de débit était de 46,89 $, avec des dépenses annuelles par carte active de 17 274 $. Les appareils mobiles représentaient 7 % de toutes les transactions par carte de débit, et les émetteurs prévoient d'introduire des capacités d'émission numérique instantanée. L'étude note également des défis tels qu'une réduction prévue du plafond de commission de la Réglementation II, une concurrence accrue et l'impact de la croissance des paiements en temps réel.

Die 2024 PULSE Debit Issuer Studie, beauftragt von Discover Financial Services' PULSE Debit Netzwerk, zeigt einen Anstieg der Nutzung von Debitkarten unter US-Verbrauchern. Zu den wichtigsten Ergebnissen gehören ein Anstieg der Gesamtzahl von Debitkarten, der Transaktionen und der jährlichen Ausgaben pro aktiver Karte im Jahr 2023. Aktive Karteninhaber führten durchschnittlich 34,6 Transaktionen pro Monat durch, wobei 46,89% der Transaktionen ohne Vorlegen der Karte (CNP) erfolgten und 38% der Debitkarten in mobilen Geldbörsen gespeichert waren. Die durchschnittliche Debitkartentransaktion betrug $46,89, mit jährlichen Ausgaben pro aktiver Karte in Höhe von $17.274. Mobile Geräte machten 7% aller Debitkartentransaktionen aus, und die Emittenten planen die Einführung von digitalen Sofortausgabelösungen. Die Studie weist auch auf Herausforderungen wie eine bevorstehende Reduzierung der Obergrenze für Interchange-Gebühren gemäß Regulation II, steigenden Wettbewerb und die Auswirkungen des Wachstums in Echtzeit-Zahlungen hin.

- Annual spend per active card increased to $17,274, growing at an average of 8.1% per year from 2018 to 2023.

- Point-of-sale transactions grew at an average annual rate of 4.4% between 2018 and 2023.

- Mobile devices originated 7% of all debit transactions, showing the rise of digital and mobile payment trends.

- Debit card active rates declined slightly by 0.2% per year from 2018 to 2023.

- Pending reduction in Regulation II's interchange cap, affecting issuers with $10 billion or more in assets.

- Increased competition from both traditional institutions and digital challengers.

Insights

The 2024 PULSE Debit Issuer Study reveals significant trends in consumer debit usage, indicating a positive outlook for financial institutions in the debit card sector. Key findings include:

- Increase in debit transactions (

4.4% annual growth) and spend (8.1% annual growth) - Rise in average ticket size to

$46.89 - Growth in Card-Not-Present (CNP) transactions, now accounting for

45% of debit spend 38% of debit cards loaded into digital wallets

These trends suggest strong consumer adoption and increasing revenue potential for issuers. However, challenges like the pending Regulation II interchange cap reduction and competition from digital challengers may impact profitability. Issuers should focus on optimizing usage rates and investing in digital capabilities to maintain their competitive edge in this evolving landscape.

The study highlights shifting consumer behavior towards digital and mobile payments, presenting both opportunities and challenges for the financial sector:

- CNP transactions grew

5.2% year-over-year, indicating a strong e-commerce trend 7% of all debit transactions originated from mobile devices- Digital wallet adoption is significant, with Apple Pay leading the market

These trends suggest a need for financial institutions to prioritize digital strategies. The planned introduction of digital instant-issuance by

The study reveals significant technological shifts in the debit card industry:

- Digital issuance emerging as a top priority for issuers

38% of debit cards already loaded into digital wallets- Mobile devices accounting for

15% of in-store contactless payments

These trends indicate a rapid digital transformation in the sector. The focus on digital instant-issuance offers benefits like improved convenience and cost savings. However, it also presents cybersecurity challenges as more transactions move to digital platforms. Issuers must invest in robust security measures and fraud prevention technologies to protect against emerging threats in this increasingly digital landscape. The potential growth of real-time payments could further disrupt the industry, requiring continuous technological adaptation from financial institutions.

Card-Not-Present Transactions Account for

The 2024 PULSE Debit Issuer Study found more

“The ease and convenience of debit has made it a cornerstone of the retail banking customer experience,” said Steve Sievert, executive vice president of Marketing and Brand Management with PULSE. “With active cardholders now using debit for more than 400 transactions per year, a debit card serves as a daily reminder of the value of the relationship between a consumer and their financial institution.”

Debit Used Daily

The 2024 Debit Issuer Study found the number of debit transactions is growing faster than spend. Active cardholders completed 34.6 transactions per month in 2023, including 30.7 point-of-sale (POS) transactions, 2 account-to-account transfers, and 1.9 ATM transactions. POS use grew at an average annual rate of

Issuers reported a debit penetration rate (percentage of accounts with an associated debit card) of

Card-not-Present (CNP) Gained Share

Mobile and Digital Trends

Mobile devices originated

Issuers reported an average of three digital wallet transactions per active card per month in 2023, with an average value of

Digital issuance, through which an institution pushes debit card credentials directly to the digital wallet prior to physical card issuance, is the number one new capability issuers plan to introduce. Half of issuers reported plans to add digital instant-issuance capabilities. Benefits of digital issuance include superior convenience, no lag to use, and significant cost savings for the institution.

Debit Faces Shifting Dynamics

In addition to benefiting from debit’s continued growth and evolution, issuers are responding to three macro trends impacting debit:

-

A pending reduction in Regulation II’s interchange cap for covered issuers (those with

$10 billion - Increased competition from both traditional institutions and digital challengers.

- The potential impacts of real-time payments growth.

As issuers respond to these developments, they revealed three key priorities for the remainder of 2024 and into 2025:

- Continue to optimize penetration, active, and usage rates.

- Strengthen their fight against fraud.

- Invest in new digital capabilities, such as instant digital issuance and cardholder visibility into recurring payments.

For more information, visit the PULSE Debit Issuer Study resource center.

About the Study

The 2024 Debit Issuer Study is the 19th installment in the study series, commissioned by PULSE and conducted by Banking & Payments Group, an independent management consulting firm that specializes in the retail payments market. The study provides an objective fact base on debit issuer performance and financial institutions’ outlook for the debit business. Study respondents included large banks, credit unions and community banks. The sample is representative of the

About PULSE

PULSE is a leader in debit payments, global cash access, and account transfers, and we deliver exceptional value, choice, and convenience to clients across the payments ecosystem. We enable reliable and secure digital money movement for a wide variety of debit card programs through our PULSE Network, the Discover® Debit program, an advanced fraud-detection platform, and partner-support services. Our commitment to continuous improvement, innovation, and prioritizing the unique business needs of our clients empowers payment solutions that meet the evolving demands of consumers. PULSE is a Discover (NYSE: DFS) company and part of the Discover Global Network. For more information, visit PulseNetwork.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240808048611/en/

Anne Uwabor, 832-214-0234

PULSE

anneuwabor@pulsenetwork.com

Dan Keeney, 800-596-8708

DPK Public Relations

dan@dpkpr.com

Source: PULSE