Deere Reports Third Quarter Net Income of $1.734 Billion

Deere & Company reported third-quarter net income of $1.734 billion, or $6.29 per share, down from $2.978 billion ($10.20 per share) in Q3 2023. Worldwide net sales and revenues decreased 17% to $13.152 billion. Despite challenging conditions in global agricultural and construction sectors, Deere maintains its full-year net income forecast of approximately $7.0 billion.

The company has taken steps to reduce costs and align production with customer needs in response to weak market conditions. Deere's outlook for fiscal 2024 projects decreased sales across all segments, with Production & Precision Ag and Small Ag & Turf both expected to be down 20% to 25%, while Construction & Forestry is projected to be down 10% to 15%.

Deere & Company ha riportato un utile netto del terzo trimestre di 1,734 miliardi di dollari, ovvero 6,29 dollari per azione, in calo rispetto ai 2,978 miliardi di dollari (10,20 dollari per azione) nel Q3 2023. Le vendite nette e i ricavi a livello mondiale sono diminuiti del 17%, attestandosi a 13,152 miliardi di dollari. Nonostante le condizioni difficili nei settori agricolo e costruttivo globali, Deere mantiene la sua previsione di utile netto per l'intero anno intorno a 7,0 miliardi di dollari.

L'azienda ha adottato misure per ridurre i costi e allineare la produzione alle esigenze dei clienti in risposta alle condizioni di mercato sfavorevoli. Le previsioni di Deere per l'anno fiscale 2024 prevedono una diminuzione delle vendite in tutti i segmenti, con Produzione & Precision Ag e Piccola Agricoltura & Turf che si prevede saranno in calo dal 20% al 25%, mentre Costruzione & Silvicoltura dovrebbe essere in calo dal 10% al 15%.

Deere & Company reportó un ingreso neto en el tercer trimestre de 1.734 millones de dólares, o 6.29 dólares por acción, una disminución desde los 2.978 millones de dólares (10.20 dólares por acción) en el Q3 2023. Las ventas netas y los ingresos a nivel mundial disminuyeron un 17% alcanzando 13.152 millones de dólares. A pesar de las difíciles condiciones en los sectores agrícola y de construcción a nivel global, Deere mantiene su pronóstico de ingreso neto para el año completo de aproximadamente 7.0 mil millones de dólares.

La empresa ha tomado medidas para reducir costos y alinear la producción con las necesidades del cliente en respuesta a las débiles condiciones del mercado. Las proyecciones de Deere para el año fiscal 2024 prevén una disminución de las ventas en todos los segmentos, con Producción & Agri Precisión y Pequeña Agricultura & Césped esperando una caída de entre 20% a 25%, mientras que Construcción & Silvicultura se proyecta en disminución entre 10% a 15%.

디어 & 컴퍼니는 3분기 순이익이 17억 3,400만 달러로 주당 6.29 달러로 보고하였으며, 이는 2023년 3분기 29억 7,800만 달러 (주당 10.20 달러)에서 감소한 수치입니다. 전세계 순매출과 수익은 17% 감소하여 131억 5,200만 달러에 도달했습니다. 세계 농업 및 건설 부문의 어려운 환경에도 불구하고, 디어는 연간 순이익 전망을 약 70억 달러로 유지하고 있습니다.

회사는 시장의 어려운 상황에 대응하여 비용을 줄이고 고객의 요구에 맞춰 생산을 조정하기 위한 조치를 취했습니다. 디어의 2024 회계연도 전망은 모든 부문에서 판매 감소를 예상하고 있으며, 생산 및 정밀 농업과 소규모 농업 및 잔디 부문은 모두 20%에서 25% 감소할 것으로 보이고, 건설 및 임업은 10%에서 15% 감소할 것으로 예상됩니다.

Deere & Company a déclaré un bénéfice net au troisième trimestre de 1,734 milliard de dollars, soit 6,29 dollars par action, en baisse par rapport à 2,978 milliards de dollars (10,20 dollars par action) au T3 2023. Les ventes nettes et les revenus mondiaux ont chuté de 17%, atteignant 13,152 milliards de dollars. Malgré des conditions difficiles dans les secteurs agricoles et de la construction, Deere maintient sa prévision de bénéfice net pour l'année complète d'environ 7,0 milliards de dollars.

L'entreprise a pris des mesures pour réduire les coûts et aligner la production sur les besoins des clients en réponse aux conditions de marché faibles. Les prévisions de Deere pour l'exercice 2024 estiment une baisse des ventes dans tous les segments, avec la Production & l'Agriculture de Précision et la Petite Agriculture & Pelouse qui devraient diminuer de 20% à 25%, tandis que Construction & Foresterie devrait être en baisse de 10% à 15%.

Deere & Company berichtete für das dritte Quartal einen Nettogewinn von 1,734 Milliarden Dollar bzw. 6,29 Dollar pro Aktie, was einen Rückgang von 2,978 Milliarden Dollar (10,20 Dollar pro Aktie) im Q3 2023 darstellt. Der weltweite Nettoumsatz und die Einnahmen sanken um 17% auf 13,152 Milliarden Dollar. Trotz der herausfordernden Bedingungen in den globalen Agrar- und Bausektoren hält Deere an seiner Prognose für den Nettogewinn für das Gesamtjahr von etwa 7,0 Milliarden Dollar fest.

Das Unternehmen hat Maßnahmen ergriffen, um Kosten zu reduzieren und die Produktion an die Bedürfnisse der Kunden anzupassen, als Reaktion auf die schwachen Markbedingungen. Der Ausblick von Deere für das Geschäftsjahr 2024 prognostiziert rückläufige Verkaufszahlen in allen Segmenten, wobei die Bereiche Produktion & Präzisionslandwirtschaft und kleine Landwirtschaft & Rasen jeweils um 20% bis 25% zurückgehen sollen, während im Bereich Bau & Forstwirtschaft ein Rückgang von 10% bis 15% erwartet wird.

- Maintained full-year net income forecast of $7.0 billion despite challenging conditions

- Strong agricultural margins showcasing disciplined execution

- Price realization partially offsetting lower shipment volumes in all segments

- Financial Services segment expecting higher net income in fiscal 2024 due to higher average portfolio balances

- Q3 net income decreased 42% year-over-year to $1.734 billion

- Worldwide net sales and revenues decreased 17% to $13.152 billion in Q3

- Production & Precision Agriculture sales decreased 25% due to lower shipment volumes

- Small Agriculture & Turf sales decreased 18% due to lower shipment volumes

- Construction & Forestry sales decreased 13% due to lower shipment volumes

- Financial Services net income for Q3 decreased 29% year-over-year

- Negative industry outlook for fiscal 2024 across all segments and regions

Insights

Deere's Q3 results reveal a significant decline in performance, with net income dropping

The company's Production & Precision Agriculture segment saw a

Investors should note Deere's proactive cost-reduction measures and strategic production alignment, which could position the company well for a potential market recovery. However, the projected industry outlook for fiscal 2024 suggests continued headwinds, particularly in the U.S. & Canada large agriculture market, expected to be down

Deere's Q3 results reflect a broader market slowdown in the agriculture and construction sectors. The company's outlook for fiscal 2024 paints a challenging picture across multiple geographies and product segments. Notably, the U.S. & Canada large agriculture market is projected to decline by

These projections suggest a cyclical downturn in Deere's core markets, likely driven by factors such as reduced farm incomes, lower commodity prices and economic uncertainties. The construction sector's outlook is slightly better but still negative, with U.S. & Canada construction equipment sales expected to decline

Despite these challenges, Deere's ability to maintain its full-year earnings forecast indicates effective cost management and pricing strategies. The company's focus on precision agriculture and innovative solutions could provide a competitive edge as the industry navigates this downturn.

- Strong ag margins highlight continued value delivery amid market fluctuations.

- Global ag fundamentals are expected to remain weak as construction moderates.

- Full-year net income forecast unchanged despite challenging environment.

Worldwide net sales and revenues decreased 17 percent, to

"John Deere's third-quarter results showcase our disciplined execution in the face of challenging conditions in the global agricultural and construction sectors," said John C. May, chairman and chief executive officer. "Despite facing significant headwinds, our teams have demonstrated resiliency in adapting to market fluctuations, allowing us to remain focused on advancing our strategy and consistently providing exceptional value to our customers."

Company Outlook & Summary

Net income attributable to Deere & Company for fiscal 2024 is forecasted to be approximately

"In response to weak market conditions, we have taken steps to reduce costs and strategically align our production with customer needs," said May. "Although these decisions were difficult, they are vital for our continued success and competitiveness. Our commitment to our customers is at the heart of everything we do, and we are confident that these proactive measures will allow us to continue investing in innovative, high-quality products and solutions that improve our customers' lives."

Deere & Company | Third Quarter | Year to Date | ||||||||||||||

$ in millions, except per share amounts | 2024 | 2023 | % Change | 2024 | 2023 | % Change | ||||||||||

Net sales and revenues | $ | 13,152 | $ | 15,801 | -17 % | $ | 40,572 | $ | 45,839 | -11 % | ||||||

Net income | $ | 1,734 | $ | 2,978 | -42 % | $ | 5,855 | $ | 7,797 | -25 % | ||||||

Fully diluted EPS | $ | 6.29 | $ | 10.20 | $ | 21.04 | $ | 26.35 | ||||||||

Results for the presented periods were affected by special items. See Note 1 of the financial statements for further details.

Production & Precision Agriculture | Third Quarter | |||||||

$ in millions | 2024 | 2023 | % Change | |||||

Net sales | $ | 5,099 | $ | 6,806 | -25 % | |||

Operating profit | $ | 1,162 | $ | 1,782 | -35 % | |||

Operating margin | 22.8 % | 26.2 % | ||||||

Production and precision agriculture sales decreased for the quarter as a result of lower shipment volumes, partially offset by price realization. Operating profit decreased due to lower shipment volumes and employee-separation programs' expenses, presented as a special item below. These factors were partially offset by price realization and lower warranty expenses.

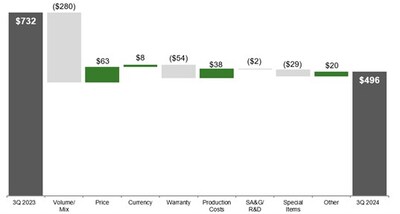

Small Agriculture & Turf | Third Quarter | |||||||

$ in millions | 2024 | 2023 | % Change | |||||

Net sales | $ | 3,053 | $ | 3,739 | -18 % | |||

Operating profit | $ | 496 | $ | 732 | -32 % | |||

Operating margin | 16.2 % | 19.6 % | ||||||

Small agriculture and turf sales decreased for the quarter as a result of lower shipment volumes, partially offset by price realization. Operating profit decreased primarily due to lower shipment volumes and higher warranty expenses, partially offset by price realization.

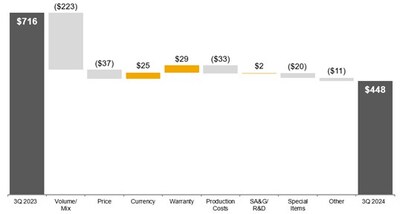

Construction & Forestry | Third Quarter | |||||||

$ in millions | 2024 | 2023 | % Change | |||||

Net sales | $ | 3,235 | $ | 3,739 | -13 % | |||

Operating profit | $ | 448 | $ | 716 | -37 % | |||

Operating margin | 13.8 % | 19.1 % | ||||||

Construction and forestry sales decreased for the quarter due to lower shipment volumes. Operating profit decreased primarily due to lower shipment volumes / sales mix and unfavorable price realization.

Financial Services | Third Quarter | |||||||

$ in millions | 2024 | 2023 | % Change | |||||

Net income | $ | 153 | $ | 216 | -29 % | |||

Financial services net income for the quarter decreased due to a higher provision for credit losses and less-favorable financing spreads, partially offset by income earned on higher average portfolio balances and favorable discrete tax items.

Industry Outlook for Fiscal 2024 | ||||||

Agriculture & Turf | ||||||

Large Ag | Down ~ | |||||

Small Ag & Turf | Down ~ | |||||

Down ~ | ||||||

Down 15 to | ||||||

Down moderately | ||||||

Construction & Forestry | ||||||

Construction Equipment | Down 5 to | |||||

Compact Construction Equipment | Flat to Down | |||||

Global Forestry | Down ~ | |||||

Global Roadbuilding | Flat to Down |

Deere Segment Outlook for Fiscal 2024 | Currency | Price | ||||

$ in millions | Net Sales | Translation | Realization | |||

Production & Precision Ag | Down | ~ Flat | Up ~ | |||

Small Ag & Turf | Down | ~ Flat | Up ~ | |||

Construction & Forestry | Down | ~ Flat | Up ~ | |||

Financial Services | Net Income | ~$ 720 |

Financial Services. Fiscal-year 2024 net income attributable to Deere & Company for the financial services operations is forecasted to be approximately

FORWARD-LOOKING STATEMENTS

Certain statements contained herein, including in the section entitled "Company Outlook & Summary," "Industry Outlook," "Deere Segment Outlook," and "Condensed Notes to Interim Consolidated Financial Statements" relating to future events, expectations, and trends constitute "forward-looking statements" as defined in the Private Securities Litigation Reform Act of 1995 and involve factors that are subject to change, assumptions, risks, and uncertainties that could cause actual results to differ materially. Some of these risks and uncertainties could affect all lines of the company's operations generally while others could more heavily affect a particular line of business.

Forward-looking statements are based on currently available information and current assumptions, expectations, and projections about future events and should not be relied upon. Except as required by law, the company expressly disclaims any obligation to update or revise its forward-looking statements. Many factors, risks, and uncertainties could cause actual results to differ materially from these forward-looking statements. Among these factors are risks related to:

- changes in and compliance with

U.S. , foreign and international laws, regulations, and policies relating to trade, economic sanctions, data privacy, spending, taxing, banking, monetary, environmental (including climate change and engine emissions), and farming policies; - political, economic, and social instability of the geographies in which the company operates, including the ongoing war between

Russia andUkraine and the conflict in theMiddle East ; - adverse macroeconomic conditions, including unemployment, inflation, interest rate volatility, changes in consumer practices due to slower economic growth, and regional or global liquidity constraints;

- worldwide demand for food and different forms of renewable energy;

- the ability to execute business strategies, including the company's Smart Industrial Operating Model, Leap Ambitions, and mergers and acquisitions;

- the ability to understand and meet customers' changing expectations and demand for John Deere products and solutions;

- accurately forecasting customer demand for products and services and adequately managing inventory;

- the ability to integrate new technology, including automation and machine learning, and deliver precision technology and solutions to customers;

- changes to governmental communications channels (radio frequency technology);

- the ability to adapt in highly competitive markets;

- dealer practices and their ability to manage inventory and distribution of John Deere products and to provide support and service precision technology solutions;

- changes in climate patterns, unfavorable weather events, and natural disasters;

- governmental and other actions designed to address climate change in connection with a transition to a lower-carbon economy;

- higher interest rates and currency fluctuations which could adversely affect the

U.S. dollar, customer confidence, access to capital, and demand for John Deere products and solutions; - availability and price of raw materials, components, and whole goods;

- delays or disruptions in the company's supply chain;

- the company's equipment fails to perform as expected, which could result in warranty claims, post-sales repairs or recalls, product liability litigation, and regulatory investigations;

- the ability to attract, develop, engage, and retain qualified employees;

- the impact of workforce reductions on employee retention, morale, and institutional knowledge;

- security breaches, cybersecurity attacks, technology failures, and other disruptions to John Deere information technology infrastructure and products;

- loss of or challenges to intellectual property rights;

- legislation introduced or enacted that could affect the company's business model and intellectual property, such as right to repair or right to modify legislation;

- investigations, claims, lawsuits, or other legal proceedings;

- events that damage the company's reputation or brand, such as the recent social media campaign targeting the company's stance on certain social issues or the company's response thereto;

- the agricultural business cycle, which can be unpredictable and is affected by factors such as world grain stocks, available farm acres, acreage planted, soil conditions, harvest yields, prices for commodities and livestock, input costs, and availability of transport for crops; and

- housing starts and supply, real estate and housing prices, levels of public and non-residential construction, and infrastructure investment.

Further information concerning the company and its businesses, including factors that could materially affect the financial results, is included in the company's filings with the SEC (including, but not limited to, the factors discussed in Item 1A. "Risk Factors" of the company's most recent Annual Report on Form 10‑K and subsequent Quarterly Reports on Form 10-Q). There also may be other factors that the company cannot anticipate or that are not described herein because the company does not currently perceive them to be material.

DEERE & COMPANY THIRD QUARTER 2024 PRESS RELEASE (In millions of dollars) Unaudited | |||||||||||||||||

Three Months Ended | Nine Months Ended | ||||||||||||||||

July 28 | July 30 | % | July 28 | July 30 | % | ||||||||||||

2024 | 2023 | Change | 2024 | 2023 | Change | ||||||||||||

Net sales and revenues: | |||||||||||||||||

Production & precision ag net sales | $ | 5,099 | $ | 6,806 | -25 | $ | 16,529 | $ | 19,826 | -17 | |||||||

Small ag & turf net sales | 3,053 | 3,739 | -18 | 8,663 | 10,886 | -20 | |||||||||||

Construction & forestry net sales | 3,235 | 3,739 | -13 | 10,292 | 11,053 | -7 | |||||||||||

Financial services revenues | 1,489 | 1,228 | +21 | 4,259 | 3,375 | +26 | |||||||||||

Other revenues | 276 | 289 | -4 | 829 | 699 | +19 | |||||||||||

Total net sales and revenues | $ | 13,152 | $ | 15,801 | -17 | $ | 40,572 | $ | 45,839 | -11 | |||||||

Operating profit: * | |||||||||||||||||

Production & precision ag | $ | 1,162 | $ | 1,782 | -35 | $ | 3,857 | $ | 5,160 | -25 | |||||||

Small ag & turf | 496 | 732 | -32 | 1,393 | 2,028 | -31 | |||||||||||

Construction & forestry | 448 | 716 | -37 | 1,682 | 2,179 | -23 | |||||||||||

Financial services | 191 | 286 | -33 | 657 | 565 | +16 | |||||||||||

Total operating profit | 2,297 | 3,516 | -35 | 7,589 | 9,932 | -24 | |||||||||||

Reconciling items ** | 62 | 98 | -37 | 111 | 29 | +283 | |||||||||||

Income taxes | (625) | (636) | -2 | (1,845) | (2,164) | -15 | |||||||||||

Net income attributable to Deere & Company | $ | 1,734 | $ | 2,978 | -42 | $ | 5,855 | $ | 7,797 | -25 | |||||||

* | Operating profit is income from continuing operations before corporate expenses, certain external interest expenses, certain foreign exchange gains and losses, and income taxes. Operating profit for financial services includes the effect of interest expense and foreign exchange gains or losses. |

** | Reconciling items are primarily corporate expenses, certain interest income and expenses, certain foreign exchange gains and losses, pension and postretirement benefit costs excluding the service cost component, and net income attributable to noncontrolling interests. |

DEERE & COMPANY STATEMENTS OF CONSOLIDATED INCOME For the Three and Nine Months Ended July 28, 2024 and July 30, 2023 (In millions of dollars and shares except per share amounts) Unaudited | ||||||||||||

Three Months Ended | Nine Months Ended | |||||||||||

2024 | 2023 | 2024 | 2023 | |||||||||

Net Sales and Revenues | ||||||||||||

Net sales | $ | 11,387 | $ | 14,284 | $ | 35,484 | $ | 41,765 | ||||

Finance and interest income | 1,461 | 1,253 | 4,207 | 3,326 | ||||||||

Other income | 304 | 264 | 881 | 748 | ||||||||

Total | 13,152 | 15,801 | 40,572 | 45,839 | ||||||||

Costs and Expenses | ||||||||||||

Cost of sales | 7,848 | 9,624 | 24,205 | 28,288 | ||||||||

Research and development expenses | 567 | 528 | 1,664 | 1,571 | ||||||||

Selling, administrative and general expenses | 1,278 | 1,110 | 3,608 | 3,392 | ||||||||

Interest expense | 840 | 623 | 2,478 | 1,671 | ||||||||

Other operating expenses | 264 | 310 | 930 | 971 | ||||||||

Total | 10,797 | 12,195 | 32,885 | 35,893 | ||||||||

Income of Consolidated Group before Income Taxes | 2,355 | 3,606 | 7,687 | 9,946 | ||||||||

Provision for income taxes | 625 | 636 | 1,845 | 2,164 | ||||||||

Income of Consolidated Group | 1,730 | 2,970 | 5,842 | 7,782 | ||||||||

Equity in income of unconsolidated affiliates | 1 | 2 | 4 | 5 | ||||||||

Net Income | 1,731 | 2,972 | 5,846 | 7,787 | ||||||||

Less: Net loss attributable to noncontrolling interests | (3) | (6) | (9) | (10) | ||||||||

Net Income Attributable to Deere & Company | $ | 1,734 | $ | 2,978 | $ | 5,855 | $ | 7,797 | ||||

Per Share Data | ||||||||||||

Basic | $ | 6.32 | $ | 10.24 | $ | 21.13 | $ | 26.48 | ||||

Diluted | 6.29 | 10.20 | 21.04 | 26.35 | ||||||||

Dividends declared | 1.47 | 1.25 | 4.41 | 3.70 | ||||||||

Dividends paid | 1.47 | 1.25 | 4.29 | 3.58 | ||||||||

Average Shares Outstanding | ||||||||||||

Basic | 274.5 | 290.8 | 277.1 | 294.4 | ||||||||

Diluted | 275.6 | 292.1 | 278.2 | 295.9 | ||||||||

See Condensed Notes to Interim Consolidated Financial Statements. |

DEERE & COMPANY CONDENSED CONSOLIDATED BALANCE SHEETS (In millions of dollars) Unaudited | |||||||||

July 28 | October 29 | July 30 | |||||||

2024 | 2023 | 2023 | |||||||

Assets | |||||||||

Cash and cash equivalents | $ | 7,004 | $ | 7,458 | $ | 6,576 | |||

Marketable securities | 1,140 | 946 | 841 | ||||||

Trade accounts and notes receivable – net | 7,469 | 7,739 | 9,297 | ||||||

Financing receivables – net | 43,896 | 43,673 | 41,302 | ||||||

Financing receivables securitized – net | 8,274 | 7,335 | 7,001 | ||||||

Other receivables | 2,270 | 2,623 | 3,118 | ||||||

Equipment on operating leases – net | 7,118 | 6,917 | 6,709 | ||||||

Inventories | 7,696 | 8,160 | 9,350 | ||||||

Property and equipment – net | 7,092 | 6,879 | 6,418 | ||||||

Goodwill | 3,960 | 3,900 | 3,994 | ||||||

Other intangible assets – net | 1,030 | 1,133 | 1,199 | ||||||

Retirement benefits | 3,126 | 3,007 | 3,573 | ||||||

Deferred income taxes | 1,898 | 1,814 | 1,360 | ||||||

Other assets | 2,903 | 2,503 | 2,659 | ||||||

Assets held for sale | 2,965 | ||||||||

Total Assets | $ | 107,841 | $ | 104,087 | $ | 103,397 | |||

Liabilities and Stockholders' Equity | |||||||||

Liabilities | |||||||||

Short-term borrowings | $ | 15,294 | $ | 17,939 | $ | 17,143 | |||

Short-term securitization borrowings | 7,869 | 6,995 | 6,608 | ||||||

Accounts payable and accrued expenses | 14,397 | 16,130 | 15,340 | ||||||

Deferred income taxes | 481 | 520 | 506 | ||||||

Long-term borrowings | 42,692 | 38,477 | 38,112 | ||||||

Retirement benefits and other liabilities | 2,156 | 2,140 | 2,536 | ||||||

Liabilities held for sale | 1,803 | ||||||||

Total liabilities | 84,692 | 82,201 | 80,245 | ||||||

Redeemable noncontrolling interest | 84 | 97 | 101 | ||||||

Stockholders' Equity | |||||||||

Total Deere & Company stockholders' equity | 23,062 | 21,785 | 23,048 | ||||||

Noncontrolling interests | 3 | 4 | 3 | ||||||

Total stockholders' equity | 23,065 | 21,789 | 23,051 | ||||||

Total Liabilities and Stockholders' Equity | $ | 107,841 | $ | 104,087 | $ | 103,397 | |||

See Condensed Notes to Interim Consolidated Financial Statements. |

DEERE & COMPANY STATEMENTS OF CONSOLIDATED CASH FLOWS For the Nine Months Ended July 28, 2024 and July 30, 2023 (In millions of dollars) Unaudited | ||||||

2024 | 2023 | |||||

Cash Flows from Operating Activities | ||||||

Net income | $ | 5,846 | $ | 7,787 | ||

Adjustments to reconcile net income to net cash provided by operating activities: | ||||||

Provision (credit) for credit losses | 222 | (64) | ||||

Provision for depreciation and amortization | 1,598 | 1,527 | ||||

Impairments and other adjustments | 53 | 173 | ||||

Share-based compensation expense | 159 | 112 | ||||

Credit for deferred income taxes | (125) | (429) | ||||

Changes in assets and liabilities: | ||||||

Receivables related to sales | (2,446) | (5,059) | ||||

Inventories | 234 | (663) | ||||

Accounts payable and accrued expenses | (1,015) | 47 | ||||

Accrued income taxes payable/receivable | 31 | (595) | ||||

Retirement benefits | (246) | (116) | ||||

Other | (172) | 176 | ||||

Net cash provided by operating activities | 4,139 | 2,896 | ||||

Cash Flows from Investing Activities | ||||||

Collections of receivables (excluding receivables related to sales) | 19,143 | 17,592 | ||||

Proceeds from maturities and sales of marketable securities | 333 | 127 | ||||

Proceeds from sales of equipment on operating leases | 1,451 | 1,445 | ||||

Cost of receivables acquired (excluding receivables related to sales) | (21,113) | (20,714) | ||||

Purchases of marketable securities | (572) | (213) | ||||

Purchases of property and equipment | (1,043) | (887) | ||||

Cost of equipment on operating leases acquired | (2,165) | (1,968) | ||||

Collateral on derivatives – net | 390 | 240 | ||||

Other | (95) | (185) | ||||

Net cash used for investing activities | (3,671) | (4,563) | ||||

Cash Flows from Financing Activities | ||||||

Net proceeds (payments) in short-term borrowings (original maturities three months or less) | (992) | 5,040 | ||||

Proceeds from borrowings issued (original maturities greater than three months) | 15,512 | 9,972 | ||||

Payments of borrowings (original maturities greater than three months) | (10,792) | (5,862) | ||||

Repurchases of common stock | (3,227) | (4,663) | ||||

Dividends paid | (1,202) | (1,065) | ||||

Other | (88) | (43) | ||||

Net cash provided by (used for) financing activities | (789) | 3,379 | ||||

Effect of Exchange Rate Changes on Cash, Cash Equivalents, and Restricted Cash | (6) | 125 | ||||

Net Increase (Decrease) in Cash, Cash Equivalents, and Restricted Cash | (327) | 1,837 | ||||

Cash, Cash Equivalents, and Restricted Cash at Beginning of Period | 7,620 | 4,941 | ||||

Cash, Cash Equivalents, and Restricted Cash at End of Period | $ | 7,293 | $ | 6,778 | ||

See Condensed Notes to Interim Consolidated Financial Statements. |

DEERE & COMPANY

Condensed Notes to Interim Consolidated Financial Statements

(In millions of dollars) Unaudited

(1) Special Items

2024

Employee-Separation Programs

In the third quarter of 2024, the company implemented employee-separation programs for its salaried workforce in several geographic areas, including

The total programs' pretax expenses are estimated to be approximately

PPA | SAT | CF | FS | Total | |||||||||||

Employee-Separation Programs: | |||||||||||||||

Cost of sales | $ | 18 | $ | 9 | $ | 8 | $ | 35 | |||||||

Research and development expenses | 19 | 6 | 1 | 26 | |||||||||||

Selling, administrative and general expenses | 25 | 14 | 11 | $ | 9 | 59 | |||||||||

Total operating profit decrease | $ | 62 | $ | 29 | $ | 20 | $ | 9 | 120 | ||||||

Non-operating profit expenses* | 4 | ||||||||||||||

Total | $ | 124 | |||||||||||||

*Relates primarily to corporate expenses.

Annual pretax savings from these programs are estimated to be approximately

Banco John Deere

In the third quarter of 2024, the company's board of directors authorized the sale of 50 percent of the company's ownership in its wholly owned subsidiary, Banco John Deere S.A. (BJD). BJD, located in

In August 2024, the company entered into an agreement with a Brazilian bank, Banco Bradesco S.A., to invest and become 50 percent owner of BJD.

2023

Brazil Tax Ruling

In the third quarter of 2023, the

Financial Services Financing Incentives Correction

In the second quarter of 2023, the company corrected the accounting treatment for financing incentives offered to John Deere dealers, which impacted the timing of expense recognition and the presentation of incentive costs in the consolidated financial statements. The cumulative effect of this correction,

Summary of 2024 and 2023 Special Items

The following table summarizes the operating profit impact of the special items recorded in millions of dollars for the three months and nine months ended July 28, 2024 and July 30, 2023.

Three Months | Nine Months | |||||||||||||||||||||||||||||

PPA | SAT | CF | FS | Total | PPA | SAT | CF | FS | Total | |||||||||||||||||||||

2024 Expense: | ||||||||||||||||||||||||||||||

Employee-separation programs | $ | 62 | $ | 29 | $ | 20 | $ | 9 | $ | 120 | $ | 62 | $ | 29 | $ | 20 | $ | 9 | $ | 120 | ||||||||||

BJD remeasurement | 15 | 15 | 15 | 15 | ||||||||||||||||||||||||||

Total 2024 expense | 62 | 29 | 20 | 24 | 135 | 62 | 29 | 20 | 24 | 135 | ||||||||||||||||||||

2023 Expense: | ||||||||||||||||||||||||||||||

Financing incentives correction | 173 | 173 | ||||||||||||||||||||||||||||

Period over period change | $ | 62 | $ | 29 | $ | 20 | $ | 24 | $ | 135 | $ | 62 | $ | 29 | $ | 20 | $ | (149) | $ | (38) | ||||||||||

(2) The consolidated financial statements represent the consolidation of all Deere & Company's subsidiaries. The supplemental consolidating data is presented for informational purposes. Transactions between the equipment operations and financial services have been eliminated to arrive at the consolidated financial statements. In the supplemental consolidating data in Note 3 to the financial statements, the "Equipment Operations" represents the enterprise without "Financial Services" which include the company's production and precision agriculture operations, small agriculture and turf operations, and construction and forestry operations, and other corporate assets, liabilities, revenues, and expenses not reflected within "Financial Services."

DEERE & COMPANY (3) SUPPLEMENTAL CONSOLIDATING DATA STATEMENTS OF INCOME For the Three Months Ended July 28, 2024 and July 30, 2023 (In millions of dollars) Unaudited | |||||||||||||||||||||||||

EQUIPMENT | FINANCIAL | ||||||||||||||||||||||||

OPERATIONS | SERVICES | ELIMINATIONS | CONSOLIDATED | ||||||||||||||||||||||

2024 | 2023 | 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||

Net Sales and Revenues | |||||||||||||||||||||||||

Net sales | $ | 11,387 | $ | 14,284 | $ | 11,387 | $ | 14,284 | |||||||||||||||||

Finance and interest income | 155 | 210 | $ | 1,537 | $ | 1,335 | $ | (231) | $ | (292) | 1,461 | 1,253 | 1 | ||||||||||||

Other income | 246 | 222 | 130 | 110 | (72) | (68) | 304 | 264 | 2, 3 | ||||||||||||||||

Total | 11,788 | 14,716 | 1,667 | 1,445 | (303) | (360) | 13,152 | 15,801 | |||||||||||||||||

Costs and Expenses | |||||||||||||||||||||||||

Cost of sales | 7,855 | 9,630 | (7) | (6) | 7,848 | 9,624 | 4 | ||||||||||||||||||

Research and development expenses | 567 | 528 | 567 | 528 | |||||||||||||||||||||

Selling, administrative and general expenses | 962 | 913 | 318 | 199 | (2) | (2) | 1,278 | 1,110 | 4 | ||||||||||||||||

Interest expense | 91 | 94 | 812 | 622 | (63) | (93) | 840 | 623 | 1 | ||||||||||||||||

Interest compensation to Financial Services | 168 | 199 | (168) | (199) | 1 | ||||||||||||||||||||

Other operating expenses | (16) | 34 | 343 | 336 | (63) | (60) | 264 | 310 | 3, 5 | ||||||||||||||||

Total | 9,627 | 11,398 | 1,473 | 1,157 | (303) | (360) | 10,797 | 12,195 | |||||||||||||||||

Income before Income Taxes | 2,161 | 3,318 | 194 | 288 | 2,355 | 3,606 | |||||||||||||||||||

Provision for income taxes | 583 | 564 | 42 | 72 | 625 | 636 | |||||||||||||||||||

Income after Income Taxes | 1,578 | 2,754 | 152 | 216 | 1,730 | 2,970 | |||||||||||||||||||

Equity in income of unconsolidated affiliates | 2 | 1 | 1 | 2 | |||||||||||||||||||||

Net Income | 1,578 | 2,756 | 153 | 216 | 1,731 | 2,972 | |||||||||||||||||||

Less: Net loss attributable to noncontrolling interests | (3) | (6) | (3) | (6) | |||||||||||||||||||||

Net Income Attributable to Deere & Company | $ | 1,581 | $ | 2,762 | $ | 153 | $ | 216 | $ | 1,734 | $ | 2,978 | |||||||||||||

1 | Elimination of intercompany interest income and expense. |

2 | Elimination of Equipment Operations' margin from inventory transferred to equipment on operating leases. |

3 | Elimination of income and expense between Equipment Operations and Financial Services related to intercompany guarantees of investments in certain international markets and intercompany service revenues and expenses. |

4 | Elimination of intercompany service fees. |

5 | Elimination of Financial Services' lease depreciation expense related to inventory transferred to equipment on operating leases. |

DEERE & COMPANY SUPPLEMENTAL CONSOLIDATING DATA (Continued) STATEMENTS OF INCOME For the Nine Months Ended July 28, 2024 and July 30, 2023 (In millions of dollars) Unaudited | |||||||||||||||||||||||||

EQUIPMENT | FINANCIAL | ||||||||||||||||||||||||

OPERATIONS | SERVICES | ELIMINATIONS | CONSOLIDATED | ||||||||||||||||||||||

2024 | 2023 | 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||

Net Sales and Revenues | |||||||||||||||||||||||||

Net sales | $ | 35,484 | $ | 41,765 | $ | 35,484 | $ | 41,765 | |||||||||||||||||

Finance and interest income | 441 | 444 | $ | 4,466 | $ | 3,609 | $ | (700) | $ | (727) | 4,207 | 3,326 | 1 | ||||||||||||

Other income | 732 | 639 | 341 | 378 | (192) | (269) | 881 | 748 | 2, 3 | ||||||||||||||||

Total | 36,657 | 42,848 | 4,807 | 3,987 | (892) | (996) | 40,572 | 45,839 | |||||||||||||||||

Costs and Expenses | |||||||||||||||||||||||||

Cost of sales | 24,226 | 28,306 | (21) | (18) | 24,205 | 28,288 | 4 | ||||||||||||||||||

Research and development expenses | 1,664 | 1,571 | 1,664 | 1,571 | |||||||||||||||||||||

Selling, administrative and general expenses | 2,844 | 2,630 | 771 | 769 | (7) | (7) | 3,608 | 3,392 | 4 | ||||||||||||||||

Interest expense | 314 | 298 | 2,354 | 1,604 | (190) | (231) | 2,478 | 1,671 | 1 | ||||||||||||||||

Interest compensation to Financial Services | 510 | 496 | (510) | (496) | 1 | ||||||||||||||||||||

Other operating expenses | 76 | 172 | 1,018 | 1,043 | (164) | (244) | 930 | 971 | 3, 5 | ||||||||||||||||

Total | 29,634 | 33,473 | 4,143 | 3,416 | (892) | (996) | 32,885 | 35,893 | |||||||||||||||||

Income before Income Taxes | 7,023 | 9,375 | 664 | 571 | 7,687 | 9,946 | |||||||||||||||||||

Provision for income taxes | 1,700 | 2,020 | 145 | 144 | 1,845 | 2,164 | |||||||||||||||||||

Income after Income Taxes | 5,323 | 7,355 | 519 | 427 | 5,842 | 7,782 | |||||||||||||||||||

Equity in income of unconsolidated affiliates | 3 | 4 | 2 | 4 | 5 | ||||||||||||||||||||

Net Income | 5,323 | 7,358 | 523 | 429 | 5,846 | 7,787 | |||||||||||||||||||

Less: Net loss attributable to noncontrolling interests | (9) | (10) | (9) | (10) | |||||||||||||||||||||

Net Income Attributable to Deere & Company | $ | 5,332 | $ | 7,368 | $ | 523 | $ | 429 | $ | 5,855 | $ | 7,797 | |||||||||||||

1 | Elimination of intercompany interest income and expense. |

2 | Elimination of Equipment Operations' margin from inventory transferred to equipment on operating leases. |

3 | Elimination of income and expense between Equipment Operations and Financial Services related to intercompany guarantees of investments in certain international markets and intercompany service revenues and expenses. |

4 | Elimination of intercompany service fees. |

5 | Elimination of Financial Services' lease depreciation expense related to inventory transferred to equipment on operating leases. |

DEERE & COMPANY SUPPLEMENTAL CONSOLIDATING DATA (Continued) CONDENSED BALANCE SHEETS (In millions of dollars) Unaudited | ||||||||||||||||||||||||||||||||||||||

EQUIPMENT | FINANCIAL | |||||||||||||||||||||||||||||||||||||

OPERATIONS | SERVICES | ELIMINATIONS | CONSOLIDATED | |||||||||||||||||||||||||||||||||||

Jul 28 | Oct 29 | Jul 30 | Jul 28 | Oct 29 | Jul 30 | Jul 28 | Oct 29 | Jul 30 | Jul 28 | Oct 29 | Jul 30 | |||||||||||||||||||||||||||

2024 | 2023 | 2023 | 2024 | 2023 | 2023 | 2024 | 2023 | 2023 | 2024 | 2023 | 2023 | |||||||||||||||||||||||||||

Assets | ||||||||||||||||||||||||||||||||||||||

Cash and cash equivalents | $ | 5,385 | $ | 5,720 | $ | 4,858 | $ | 1,619 | $ | 1,738 | $ | 1,718 | $ | 7,004 | $ | 7,458 | $ | 6,576 | ||||||||||||||||||||

Marketable securities | 155 | 104 | 3 | 985 | 842 | 838 | 1,140 | 946 | 841 | |||||||||||||||||||||||||||||

Receivables from Financial Services | 3,951 | 4,516 | 5,312 | $ | (3,951) | $ | (4,516) | $ | (5,312) | 6 | ||||||||||||||||||||||||||||

Trade accounts and notes receivable – net | 1,150 | 1,320 | 1,589 | 8,890 | 8,687 | 9,991 | (2,571) | (2,268) | (2,283) | 7,469 | 7,739 | 9,297 | 7 | |||||||||||||||||||||||||

Financing receivables – net | 82 | 64 | 60 | 43,814 | 43,609 | 41,242 | 43,896 | 43,673 | 41,302 | |||||||||||||||||||||||||||||

Financing receivables securitized – net | 2 | 8,272 | 7,335 | 7,001 | 8,274 | 7,335 | 7,001 | |||||||||||||||||||||||||||||||

Other receivables | 1,821 | 1,813 | 2,599 | 494 | 869 | 599 | (45) | (59) | (80) | 2,270 | 2,623 | 3,118 | 7 | |||||||||||||||||||||||||

Equipment on operating leases – net | 7,118 | 6,917 | 6,709 | 7,118 | 6,917 | 6,709 | ||||||||||||||||||||||||||||||||

Inventories | 7,696 | 8,160 | 9,350 | 7,696 | 8,160 | 9,350 | ||||||||||||||||||||||||||||||||

Property and equipment – net | 7,058 | 6,843 | 6,385 | 34 | 36 | 33 | 7,092 | 6,879 | 6,418 | |||||||||||||||||||||||||||||

Goodwill | 3,960 | 3,900 | 3,994 | 3,960 | 3,900 | 3,994 | ||||||||||||||||||||||||||||||||

Other intangible assets – net | 1,030 | 1,133 | 1,199 | 1,030 | 1,133 | 1,199 | ||||||||||||||||||||||||||||||||

Retirement benefits | 3,047 | 2,936 | 3,503 | 80 | 72 | 71 | (1) | (1) | (1) | 3,126 | 3,007 | 3,573 | 8 | |||||||||||||||||||||||||

Deferred income taxes | 2,192 | 2,133 | 1,393 | 35 | 68 | 65 | (329) | (387) | (98) | 1,898 | 1,814 | 1,360 | 9 | |||||||||||||||||||||||||

Other assets | 2,236 | 1,948 | 2,083 | 675 | 559 | 583 | (8) | (4) | (7) | 2,903 | 2,503 | 2,659 | ||||||||||||||||||||||||||

Assets held for sale | 2,965 | 2,965 | ||||||||||||||||||||||||||||||||||||

Total Assets | $ | 39,765 | $ | 40,590 | $ | 42,328 | $ | 74,981 | $ | 70,732 | $ | 68,850 | $ | (6,905) | $ | (7,235) | $ | (7,781) | $ | 107,841 | $ | 104,087 | $ | 103,397 | ||||||||||||||

Liabilities and Stockholders' Equity | ||||||||||||||||||||||||||||||||||||||

Liabilities | ||||||||||||||||||||||||||||||||||||||

Short-term borrowings | $ | 983 | $ | 1,230 | $ | 1,773 | $ | 14,311 | $ | 16,709 | $ | 15,370 | $ | 15,294 | $ | 17,939 | $ | 17,143 | ||||||||||||||||||||

Short-term securitization borrowings | 1 | 7,868 | 6,995 | 6,608 | 7,869 | 6,995 | 6,608 | |||||||||||||||||||||||||||||||

Payables to Equipment Operations | 3,951 | 4,516 | 5,312 | $ | (3,951) | $ | (4,516) | $ | (5,312) | 6 | ||||||||||||||||||||||||||||

Accounts payable and accrued expenses | 13,880 | 14,862 | 14,403 | 3,141 | 3,599 | 3,307 | (2,624) | (2,331) | (2,370) | 14,397 | 16,130 | 15,340 | 7 | |||||||||||||||||||||||||

Deferred income taxes | 420 | 452 | 420 | 390 | 455 | 184 | (329) | (387) | (98) | 481 | 520 | 506 | 9 | |||||||||||||||||||||||||

Long-term borrowings | 6,592 | 7,210 | 7,299 | 36,100 | 31,267 | 30,813 | 42,692 | 38,477 | 38,112 | |||||||||||||||||||||||||||||

Retirement benefits and other liabilities | 2,048 | 2,032 | 2,423 | 109 | 109 | 114 | (1) | (1) | (1) | 2,156 | 2,140 | 2,536 | 8 | |||||||||||||||||||||||||

Liabilities held for sale | 1,803 | 1,803 | ||||||||||||||||||||||||||||||||||||

Total liabilities | 23,924 | 25,786 | 26,318 | 67,673 | 63,650 | 61,708 | (6,905) | (7,235) | (7,781) | 84,692 | 82,201 | 80,245 | ||||||||||||||||||||||||||

Redeemable noncontrolling interest | 84 | 97 | 101 | 84 | 97 | 101 | ||||||||||||||||||||||||||||||||

Stockholders' Equity | ||||||||||||||||||||||||||||||||||||||

Total Deere & Company stockholders' equity | 23,062 | 21,785 | 23,048 | 7,308 | 7,082 | 7,142 | (7,308) | (7,082) | (7,142) | 23,062 | 21,785 | 23,048 | 10 | |||||||||||||||||||||||||

Noncontrolling interests | 3 | 4 | 3 | 3 | 4 | 3 | ||||||||||||||||||||||||||||||||

Financial Services equity | (7,308) | (7,082) | (7,142) | 7,308 | 7,082 | 7,142 | 10 | |||||||||||||||||||||||||||||||

Adjusted total stockholders' equity | 15,757 | 14,707 | 15,909 | 7,308 | 7,082 | 7,142 | 23,065 | 21,789 | 23,051 | |||||||||||||||||||||||||||||

Total Liabilities and Stockholders' Equity | $ | 39,765 | $ | 40,590 | $ | 42,328 | $ | 74,981 | $ | 70,732 | $ | 68,850 | $ | (6,905) | $ | (7,235) | $ | (7,781) | $ | 107,841 | $ | 104,087 | $ | 103,397 | ||||||||||||||

6 | Elimination of receivables / payables between Equipment Operations and Financial Services. |

7 | Primarily reclassification of sales incentive accruals on receivables sold to Financial Services. |

8 | Reclassification of net pension assets / liabilities. |

9 | Reclassification of deferred tax assets / liabilities in the same taxing jurisdictions. |

10 | Elimination of Financial Services' equity. |

DEERE & COMPANY SUPPLEMENTAL CONSOLIDATING DATA (Continued) STATEMENTS OF CASH FLOWS For the Nine Months Ended July 28, 2024 and July 30, 2023 (In millions of dollars) Unaudited | |||||||||||||||||||||||||

EQUIPMENT | FINANCIAL | ||||||||||||||||||||||||

OPERATIONS | SERVICES | ELIMINATIONS | CONSOLIDATED | ||||||||||||||||||||||

2024 | 2023 | 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||

Cash Flows from Operating Activities | |||||||||||||||||||||||||

Net income | $ | 5,323 | $ | 7,358 | $ | 523 | $ | 429 | $ | 5,846 | $ | 7,787 | |||||||||||||

Adjustments to reconcile net income to net cash provided by operating activities: | |||||||||||||||||||||||||

Provision (credit) for credit losses | 10 | 3 | 212 | (67) | 222 | (64) | |||||||||||||||||||

Provision for depreciation and amortization | 932 | 872 | 773 | 757 | $ | (107) | $ | (102) | 1,598 | 1,527 | 11 | ||||||||||||||

Impairments and other adjustments | 53 | 173 | 53 | 173 | |||||||||||||||||||||

Share-based compensation expense | 159 | 112 | 159 | 112 | 12 | ||||||||||||||||||||

Distributed earnings of Financial Services | 250 | 31 | (250) | (31) | 13 | ||||||||||||||||||||

Credit for deferred income taxes | (49) | (322) | (76) | (107) | (125) | (429) | |||||||||||||||||||

Changes in assets and liabilities: | |||||||||||||||||||||||||

Receivables related to sales | 106 | (293) | (2,552) | (4,766) | (2,446) | (5,059) | 14, 16 | ||||||||||||||||||

Inventories | 391 | (534) | (157) | (129) | 234 | (663) | 15 | ||||||||||||||||||

Accounts payable and accrued expenses | (924) | 730 | 212 | 303 | (303) | (986) | (1,015) | 47 | 16 | ||||||||||||||||

Accrued income taxes payable/receivable | 13 | (619) | 18 | 24 | 31 | (595) | |||||||||||||||||||

Retirement benefits | (241) | (115) | (5) | (1) | (246) | (116) | |||||||||||||||||||

Other | (109) | 247 | 44 | (15) | (107) | (56) | (172) | 176 | 11, 12, 15 | ||||||||||||||||

Net cash provided by operating activities | 5,702 | 7,358 | 1,754 | 1,496 | (3,317) | (5,958) | 4,139 | 2,896 | |||||||||||||||||

Cash Flows from Investing Activities | |||||||||||||||||||||||||

Collections of receivables (excluding receivables related to sales) | 19,826 | 18,440 | (683) | (848) | 19,143 | 17,592 | 14 | ||||||||||||||||||

Proceeds from maturities and sales of marketable securities | 56 | 68 | 277 | 59 | 333 | 127 | |||||||||||||||||||

Proceeds from sales of equipment on operating leases | 1,451 | 1,445 | 1,451 | 1,445 | |||||||||||||||||||||

Cost of receivables acquired (excluding receivables related to sales) | (21,395) | (21,043) | 282 | 329 | (21,113) | (20,714) | 14 | ||||||||||||||||||

Purchases of marketable securities | (220) | (19) | (352) | (194) | (572) | (213) | |||||||||||||||||||

Purchases of property and equipment | (1,041) | (885) | (2) | (2) | (1,043) | (887) | |||||||||||||||||||

Cost of equipment on operating leases acquired | (2,377) | (2,143) | 212 | 175 | (2,165) | (1,968) | 15 | ||||||||||||||||||

Decrease (increase) in investment in Financial Services | 11 | (811) | (11) | 811 | 17 | ||||||||||||||||||||

Increase in trade and wholesale receivables | (3,255) | (6,270) | 3,255 | 6,270 | 14 | ||||||||||||||||||||

Collateral on derivatives – net | 390 | 240 | 390 | 240 | |||||||||||||||||||||

Other | (88) | (210) | (8) | 24 | 1 | 1 | (95) | (185) | |||||||||||||||||

Net cash used for investing activities | (1,282) | (1,857) | (5,445) | (9,444) | 3,056 | 6,738 | (3,671) | (4,563) | |||||||||||||||||

Cash Flows from Financing Activities | |||||||||||||||||||||||||

Net proceeds (payments) in short-term borrowings (original maturities three months or less) | 81 | (152) | (1,073) | 5,192 | (992) | 5,040 | |||||||||||||||||||

Change in intercompany receivables/payables | 558 | 1,476 | (558) | (1,476) | |||||||||||||||||||||

Proceeds from borrowings issued (original maturities greater than three months) | 115 | 60 | 15,397 | 9,912 | 15,512 | 9,972 | |||||||||||||||||||

Payments of borrowings (original maturities greater than three months) | (1,061) | (116) | (9,731) | (5,746) | (10,792) | (5,862) | |||||||||||||||||||

Repurchases of common stock | (3,227) | (4,663) | (3,227) | (4,663) | |||||||||||||||||||||

Capital Investment from Equipment Operations | (11) | 811 | 11 | (811) | 17 | ||||||||||||||||||||

Dividends paid | (1,202) | (1,065) | (250) | (31) | 250 | 31 | (1,202) | (1,065) | 13 | ||||||||||||||||

Other | (37) | 4 | (51) | (47) | (88) | (43) | |||||||||||||||||||

Net cash provided by (used for) financing activities | (4,773) | (4,456) | 3,723 | 8,615 | 261 | (780) | (789) | 3,379 | |||||||||||||||||

Effect of Exchange Rate Changes on Cash, Cash Equivalents, and Restricted Cash | 12 | 108 | (18) | 17 | (6) | 125 | |||||||||||||||||||

Net Increase (Decrease) in Cash, Cash Equivalents, and Restricted Cash | (341) | 1,153 | 14 | 684 | (327) | 1,837 | |||||||||||||||||||

Cash, Cash Equivalents, and Restricted Cash at Beginning of Period | 5,755 | 3,781 | 1,865 | 1,160 | 7,620 | 4,941 | |||||||||||||||||||

Cash, Cash Equivalents, and Restricted Cash at End of Period | $ | 5,414 | $ | 4,934 | $ | 1,879 | $ | 1,844 | $ | 7,293 | $ | 6,778 | |||||||||||||

11 | Elimination of depreciation on leases related to inventory transferred to equipment on operating leases. |

12 | Reclassification of share-based compensation expense. |

13 | Elimination of dividends from Financial Services to the Equipment Operations, which are included in the Equipment Operations operating activities. |

14 | Primarily reclassification of receivables related to the sale of equipment. |

15 | Reclassification of direct lease agreements with retail customers. |

16 | Reclassification of sales incentive accruals on receivables sold to Financial Services. |

17 | Elimination of change in investment from Equipment Operations to Financial Services. |

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/deere-reports-third-quarter-net-income-of-1-734-billion-302223455.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/deere-reports-third-quarter-net-income-of-1-734-billion-302223455.html

SOURCE John Deere Company