Jansz-Io Compression Project to Proceed

Chevron Corporation (NYSE: CVX) announced that its subsidiary, Chevron Australia Pty Ltd, will advance the $4 billion (AU$6 billion) Jansz-Io Compression (J-IC) project. This investment marks a significant commitment to Australian operations, following the Gorgon Stage 2 project. The J-IC project aims to enhance gas supply from the Jansz-Io field to the LNG plants on Barrow Island using advanced subsea compression technology, which will help in energy transitions across the Asia Pacific. Construction is projected to take five years.

- Chevron's $4 billion investment in the Jansz-Io Compression project demonstrates strong commitment to Australian energy operations.

- The project will utilize advanced subsea compression technology to enhance gas supply to LNG plants, supporting energy transition.

- None.

Insights

Analyzing...

Chevron Corporation (NYSE: CVX) today announced that its wholly owned subsidiary Chevron Australia Pty Ltd. (Chevron Australia) as operator and the Gorgon joint venture participants will proceed with the approximately

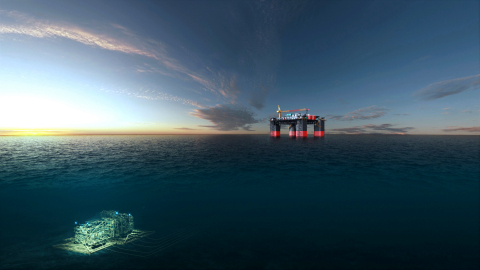

Jansz-Io Compression project - Field Control Station and Subsea Compression Station. (Photo: Business Wire)

Nigel Hearne, Chevron Eurasia Pacific Exploration and Production president, said J-IC represents Chevron’s most significant capital investment in Australia since the sanctioning of the Gorgon Stage 2 project in 2018.

“Using world-leading subsea compression technology, J-IC is positioned to maintain gas supply from the Jansz-Io field to the three existing LNG trains and domestic gas plant on Barrow Island,” Hearne said.

“This will maintain an important source of clean-burning natural gas to customers that will enable energy transitions in countries across the Asia Pacific region.”

A modification of the existing Gorgon development, J-IC will involve the construction and installation of a 27,000-tonne normally unattended floating Field Control Station (FCS), approximately 6,500 tonnes of subsea compression infrastructure and a 135km submarine power cable linked to Barrow Island.

Construction and installation activities are estimated to take approximately five years to complete.

J-IC follows the Gorgon Stage 2 project, which is nearing completion of the installation phase, to supply gas to the Gorgon plant from four new Jansz-Io and seven new Gorgon wells.

The Chevron-operated Gorgon Project is a joint venture between the Australian subsidiaries of Chevron (47.333 percent), ExxonMobil (25 percent), Shell (25 percent), Osaka Gas (1.25 percent), Tokyo Gas (1 percent) and JERA (0.417 percent).

Chevron is one of the world’s leading integrated energy companies. We believe affordable, reliable and ever-cleaner energy is essential to achieving a more prosperous and sustainable world. Chevron produces crude oil and natural gas; manufactures transportation fuels, lubricants, petrochemicals and additives; and develops technologies that enhance our business and the industry. To advance a lower-carbon future, we are focused on cost efficiently lowering our carbon intensity, increasing renewables and offsets in support of our business, and investing in low-carbon technologies that enable commercial solutions. More information about Chevron is available at www.chevron.com.

NOTICE

CAUTIONARY STATEMENTS RELEVANT TO FORWARD-LOOKING INFORMATION FOR THE PURPOSE OF “SAFE HARBOR” PROVISIONS OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

This news release contains forward-looking statements relating to Chevron’s operations that are based on management's current expectations, estimates and projections about the petroleum, chemicals and other energy-related industries. Words or phrases such as “anticipates,” “expects,” “intends,” “plans,” “targets,” “advances,” “commits,” “forecasts,” “projects,” “believes,” “approaches,” “seeks,” “schedules,” “estimates,” “positions,” “pursues,” “may,” “could,” “should,” “will,” “budgets,” “outlook,” “trends,” “guidance,” “focus,” “on track,” “goals,” “objectives,” “strategies,” “opportunities,” “poised,” “potential” and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond the company’s control and are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. The reader should not place undue reliance on these forward-looking statements, which speak only as of the date of this news release. Unless legally required, Chevron undertakes no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

Among the important factors that could cause actual results to differ materially from those in the forward-looking statements are: changing crude oil and natural gas prices and demand for our products, and production curtailments due to market conditions; crude oil production quotas or other actions that might be imposed by the Organization of Petroleum Exporting Countries and other producing countries; public health crises, such as pandemics (including coronavirus (COVID-19)) and epidemics, and any related government policies and actions; changing economic, regulatory and political environments in the various countries in which the company operates; general domestic and international economic and political conditions; changing refining, marketing and chemicals margins; the company’s ability to realize anticipated cost savings, expenditure reductions and efficiencies associated with enterprise transformation initiatives; actions of competitors or regulators; timing of exploration expenses; timing of crude oil liftings; the competitiveness of alternate-energy sources or product substitutes; technological developments; the results of operations and financial condition of the company’s suppliers, vendors, partners and equity affiliates, particularly during extended periods of low prices for crude oil and natural gas during the COVID-19 pandemic; the inability or failure of the company’s joint-venture partners to fund their share of operations and development activities; the potential failure to achieve expected net production from existing and future crude oil and natural gas development projects; potential delays in the development, construction or start-up of planned projects; the potential disruption or interruption of the company’s operations due to war, accidents, political events, civil unrest, severe weather, cyber threats, terrorist acts, or other natural or human causes beyond the company’s control; the potential liability for remedial actions or assessments under existing or future environmental regulations and litigation; significant operational, investment or product changes required by existing or future environmental statutes and regulations, including international agreements and national or regional legislation and regulatory measures to limit or reduce greenhouse gas emissions; the potential liability resulting from pending or future litigation; the company's ability to achieve the anticipated benefits from the acquisition of Noble Energy, Inc.; the company’s future acquisitions or dispositions of assets or shares or the delay or failure of such transactions to close based on required closing conditions; the potential for gains and losses from asset dispositions or impairments; government mandated sales, divestitures, recapitalizations, industry-specific taxes, tariffs, sanctions, changes in fiscal terms or restrictions on scope of company operations; foreign currency movements compared with the U.S. dollar; material reductions in corporate liquidity and access to debt markets; the receipt of required Board authorizations to pay future dividends; the effects of changed accounting rules under generally accepted accounting principles promulgated by rule-setting bodies; the company’s ability to identify and mitigate the risks and hazards inherent in operating in the global energy industry; and the factors set forth under the heading “Risk Factors” on pages 18 through 23 of the company's 2020 Annual Report on Form 10-K and in other subsequent filings with the U.S. Securities and Exchange Commission. Other unpredictable or unknown factors not discussed in this news release could also have material adverse effects on forward-looking statements.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210701005975/en/