Carvana Launches Streamlined Shopping and Checkout Experience for Used EV Buyers

Customers Can Now Realize Upfront Savings with Clean Vehicle Tax Credit Integration at Point of Sale

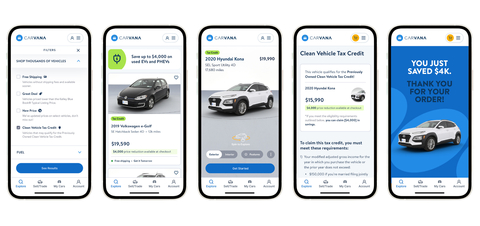

Carvana's Clean Vehicle Tax Credit Integration (Photo: Business Wire)

“Carvana has always believed in using technology to make the car buying process easier, more transparent and more accessible for our customers. By integrating the federal tax credit directly into our ecommerce experience, we are driving convenience and savings for the increasing portion of our customers interested in buying EVs," said Dan Gill, Chief Product Officer at Carvana.

Available now, Carvana's automated system checks vehicle eligibility and applies the Clean Vehicle Tax Credit to the purchase at checkout for eligible customers who elect to transfer their credit to Carvana. Rather than waiting for a lower tax bill next year, customers can now seamlessly access up-front savings of up to

"The detailed vehicle eligibility checks we’re running behind the scenes help customers shop with confidence while the integrated tax credit savings help customers take advantage of more affordable entry points to the growing EV category,” Gill continued.

Carvana has sold electric vehicles since 2013, its first year in operation. Since then, the Company’s sales of EVs and PHEVs have grown significantly as a broader range of vehicles has made its way into the used fleet and into Carvana’s inventory. The company continues to expand its selection of EVs and PHEVs to satisfy customer demand at all price points.

For additional information on the Clean Vehicle Tax Credit and to search for eligible vehicles, customers can visit https://www.carvana.com/used-ev-tax-credit.

About Carvana

Carvana’s mission is to change the way people buy and sell cars. Over the past decade, Carvana has revolutionized automotive retail and delighted millions of customers with an offering that is fun, fast, and fair. With Carvana, customers can choose from tens of thousands of vehicles, get financing, trade-in, and complete a purchase entirely online with the convenience of home delivery or local pick up in over 300 U.S. markets. Carvana’s vertically integrated platform is powered by its passionate team, unique national infrastructure, and purpose-built technology. Carvana is a Fortune 500 company and is proud to be recognized by Forbes as one of America’s Best Employers.

For more information, please visit www.carvana.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240710973686/en/

Carvana Communications

press@carvana.com

Source: Carvana