Mixed Performance in the Latest CoStar Composite Price Indices

Industrial and Retail Led Property Indices While Office and Multifamily Lagged; the South Topped Regional Index Growth

(Graphic: Business Wire)

CCRSI National Results Highlights

-

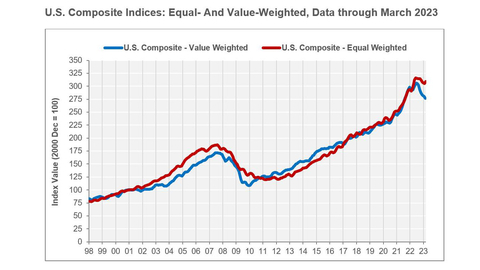

U.S. COMPOSITE PRICE INDICES WERE MIXED INMARCH 2023 . The value-weightedU.S. Composite Index, more heavily influenced by high-value trades common in core markets, fell for the eighth consecutive month to 277, a decline of1.3% over the prior month. The index also slumped5.2% during the 12 months ending inMarch 2023 . -

Conversely, the equal-weighted

U.S. Composite Index, which reflects the more numerous but lower-priced property sales typical of secondary and tertiary markets, rose four points to 309 inMarch 2023 , an increase of1.3% over the prior month. The most recent uptick follows seven of the last eight months of declines. The index gained4.8% during the 12 months ending inMarch 2023 . - Both composite indices have been on a broad deceleration trend in growth for the last nine months as markets respond to higher interest rates and falling tenant demand.

-

THE EQUAL-WEIGHTED GENERAL COMMERCIAL COMPOSITE PRICE INDEX OUTPACED INVESTMENT GRADE IN

MARCH 2023 . -

The general commercial sub-index, more heavily influenced by smaller, lower-priced assets, gained

1.3% inMarch 2023 , the second positive advance of the last five months. The index climbed6.2% over the 12 months ending inMarch 2023 . -

The investment grade sub-index, more heavily influenced by higher-value assets, declined by

1.4% inMarch 2023 , retreating in seven of the last nine months. The index gave back3.4% of value during the 12 months ending inMarch 2023 , the fourth consecutive month of year-over-year price declines. -

OVERALL TRANSACTION VOLUME FELL

26% FROM THE PRIOR YEAR INMARCH 2023 . Composite pair volume of$169.4 billion March 2023 marked a26.3% decline from the 12 months ending inMarch 2022 . The pullback in volume was more concentrated at the upper end of the market, with the Investment Grade segment plunging31.1% inMarch 2023 , compared to General Commercial’s shallower descent of16.8% over the same period. -

DISTRESSED REPEAT-SALE TRADES REMAIN AT HISTORICALLY LOW LEVELS. Only 24 of the 1,164 repeat-sale trades in

March 2023 , or about2.1% , were distressed sales. In comparison, the monthly average share of distressed sales in the five years ending inFebruary 2020 , before the onset of the pandemic, was3.6% . General commercial accounted for 18 distressed trades, or1.6% of all repeat-sales transactions inMarch 2023 , below its five-year pre-pandemic monthly average of2.6% . Only six investment grade distressed sales were recorded in the month, accounting for0.5% of all repeat sales trades, below its five-year pre-pandemic monthly average of1.1% .

Quarterly CCRSI Property Type Results

-

PROPERTY TYPE PRICE FLUCTUATIONS WERE MIXED IN THE FIRST QUARTER. Including land and hospitality, the property type indices’ average price growth treaded water in the first quarter of 2023, up just

0.2% . Excluding these two market segments, the four main property types experienced the third consecutive quarter of average price declines, falling1.2% in the most recent quarter. The primary market indices within each property sector, dominated by the large, core, coastal metros, fell at a similar pace of minus1.4% , confirming that commercial property price declines have become broad-based. -

THE PRIME INDUSTRIAL INDEX LED GROWTH AMONG THE FOUR MAJOR PROPERTY TYPES. The Prime

U.S. Industrial Index was up2.5% in the first quarter of 2023 and10.8% in the 12 months ending inMarch 2023 . The equal-weightedU.S. Industrial Index, including a broader mix of asset qualities, underperformed the Prime Index with a modest decline of0.1% in the quarter. The Prime Industrial Index was the only Prime property type index to hold in positive territory in the first quarter. -

THE IMPACT OF HIGHER INTEREST RATES WAS MOST VISIBLE IN THE MULTIFAMILY INDEX. The equal-weighted

U.S. Multifamily Index fell by2.4% in the first quarter of 2023 and dropped2.2% in the 12 months ending inMarch 2023 . TheU.S. Multifamily Index showed the sharpest annual decline in values since the interest rate hiking cycle began in the first quarter of 2022. Debt for multifamily transactions was plentiful and drove investor demand in the sector. The index appreciated by2.8% in the 12 months ending inMarch 2023 in Prime Multifamily markets but fell2.8% in the quarter. -

OFFICE PRICE DECLINES CONTINUED IN THE FIRST QUARTER. The

U.S. Office Index sagged2.4% in the first quarter of 2023, taking its cumulative decline to minus5% during the previous three quarters. Office prices were down1.4% in the 12 months ending inMarch 2023 , marking the first annual decline since the second quarter of 2012. In addition, pricing growth in the Prime Office Index advanced at a negligible pace of0.4% in the 12 months ending inMarch 2023 while slumping2.8% in the quarter. -

RETAIL PRICING FOOTED SIDEWAYS IN THE FIRST QUARTER. The

U.S. Retail Index rose just0.2% in the first quarter of 2023 and3.3% in the 12 months ending inMarch 2023 . The tendency of high-profile pair trends to swing the data around at the top end of retail space can lead to strong quarterly fluctuations. TheU.S. Prime Retail Index dipped2.6% in the first quarter while appreciating12.3% over the year prior. The three-quarter trend in the Prime Retail Index saw values surge9.9% in the third quarter of 2022 before giving back2.8% and2.6% in the fourth quarter of 2022 and the first quarter of 2023, respectively. -

U.S. HOSPITALITY INDEX REVERSED TWO QUARTERS OF PRICE DECLINES. TheU.S. Hospitality Index was up1.4% in the first quarter of 2023, contributing to annual gains of2.7% in the 12 months ending inMarch 2023 . Demand was strong in the luxury segment. -

U.S. LAND INDEX LED ALL PROPERTY TYPE SEGMENTS WITH16.3% ANNUAL GROWTH. TheU.S. Land Index is the most volatile of the property-type indices. After posting no growth in the prior quarter, the index bounced4.7% in the first quarter, translating to an annual gain of16.3% in the 12 months ending inMarch 2023 . TheU.S. Land Index reflects the heightened demand for development sites in recent years but should slow in the coming quarters as construction financing falls under increased scrutiny.

Quarterly CCRSI Regional Results

-

QUARTERLY PRICE DECLINES EMERGE IN CERTAIN REGIONS, WITH THE SOUTH OUTPERFORMING. The four property types within each region produce 16 total property-type regions. Ten of the 16 showed price declines in the first quarter of 2023 over the prior quarter, while the remaining six reversed negative price momentum in the preceding quarter. The South Composite Index pared back some of the losses conceded in the fourth quarter of 2022 by appreciating across each property type in the first quarter of 2023. The index’s annual gains were led by industrial at

10.5% over the prior 12-month period, while retail and multifamily grew at5.3% and4.5% , respectively. The South Office Index rose3.8% over the preceding year.

-

OFFICE AND INDUSTRIAL DROVE ANNUAL PRICE GAINS IN THE NORTHEAST. The Northeast Composite Index advanced by

5.3% in the 12 months ending inMarch 2023 , the most substantial annual growth rate among the four regions. Its outperformance was due to solid growth in the Northeast Industrial Index at9.7% and the Northeast Office Index at10.9% , influenced by the surge in life sciences demand. As a result, the office sector in the Northeast signified the most robust annual growth rate among the 16 regional property type indices. Meanwhile, the Northeast Multifamily Index expanded by3.2% over the previous year, and the Retail Index faired similarly at3.1% . However, the northeast indices experienced negative quarterly price momentum, led by industrial, down2.2% , and retail, giving back2% . The office and multifamily indices also edged lower, slashing1.9% off their values from the prior quarter.

-

THE MIDWEST SHOWED MIXED PERFORMANCE AS INDUSTRIAL PROVED TO BE A BRIGHT SPOT. On an annual basis, the Midwest Composite Index climbed

2.5% in the first quarter of 2023, while the quarterly gain of1.3% reversed two consecutive months of declines. Three property sectors in the midwestern indices soured performance with negative pricing over the prior year. Uniquely, industrial showed strength, growing6.8% over the preceding year, while the indices for office, retail, and multifamily contracted by2.6% ,0.9% , and0.7% , respectively.

-

WESTWARD EXPANSION SLOWED. The West Composite Index ended the first quarter of 2023 at minus

2.3% compared to the prior quarter. The index also fell2.1% over the 12 months ending in the first quarter of 2023. Of the 16 property-type regions, the West’s Multifamily Index fared the worst by declining6.3% over the prior year and finishing in the red for the third consecutive quarter, down2.2% to start the year.

Monthly CCRSI Results, Data through |

||||

|

1 Month

|

1 Quarter

|

1 Year

|

Trough to

|

Value-Weighted |

- |

- |

- |

|

Equal-Weighted |

|

|

|

|

|

- |

- |

- |

|

|

|

|

|

|

1 Trough Date: |

||||

About The CoStar Commercial Repeat-Sale Indices

The CoStar Commercial Repeat-Sale Indices (CCRSI) are the most comprehensive and accurate measures of commercial real estate prices in

The CoStar indices are constructed using a repeat sales methodology, widely considered the most accurate measure of price changes for real estate. This methodology measures the movement in the prices of commercial properties by collecting data on actual transaction prices. When a property is sold more than once, a sales pair is created. The prices from the first and second sales are then used to calculate price movement for the property. The aggregated price changes from all the sales pairs are used to create a price index. Historical price indices are revised as additional repeat transactions are recorded.

Available Monthly and Quarterly CCRSI Indices

|

||||

National

|

National

|

Regional

|

Regional

|

Prime

|

All Properties |

Office |

Northeast |

Northeast: Office, Multifamily, Industrial, Retail |

Office |

General Commercial |

Retail |

Midwest |

Midwest: Office, Multifamily, Industrial, Retail |

Multifamily |

Investment-Grade |

Industrial |

South |

South: Office, Multifamily, Industrial, Retail |

Industrial |

|

Multifamily |

West |

West: Office, Multifamily, Industrial, Retail |

Retail |

|

Hospitality |

|

|

|

|

Land |

|

|

|

Prime Office Markets |

|

Prime Industrial Markets |

||

CBSA Listed Alphabetically |

|

|

CBSA Listed Alphabetically |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Prime Retail Markets |

|

Prime Multifamily Markets |

||

|

CBSA Listed Alphabetically |

|

|

CBSA Listed Alphabetically |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For more information about the CCRSI Indices, including the full accompanying data set and research methodology, legal notices, and disclaimer, please visit http://costargroup.com/costar-news/ccrsi.

About

View source version on businesswire.com: https://www.businesswire.com/news/home/20230428005331/en/

News Media:

Vice President

(202) 346-6775

mblocher@costar.com

Source: