Apartments.com Releases Multifamily Rent Growth Report for Second Quarter of 2024

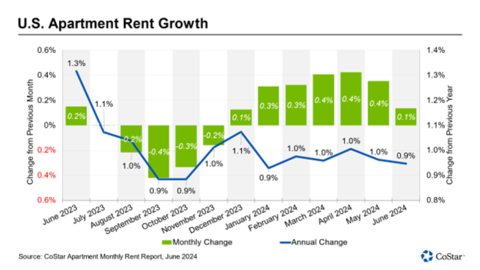

Today, Apartments.com, part of the CoStar Group, unveiled its Q2 2024 multifamily rent trends report. The U.S. multifamily market showed strong demand, with 170,000 units absorbed, the highest since Q3 2021. Despite 180,000 new units being delivered, the vacancy rate held steady at 7.8%, marking the first non-increase in nearly three years. National annual rent growth slightly dipped to 0.9% in June. The Midwest and Northeast fared better with a 2.4% annual rent growth, while the West saw only 0.5%. The South struggled with zero annual rent growth due to oversupply. Louisville led in rent growth among top markets with a 4.9% increase, whereas Austin saw a 5.7% decline. Absorptions were strongest in luxury units but rent growth remained weakest in this segment. Improved consumer confidence and lower inflation spurred demand, especially for mid-priced and low-priced properties.

- 170,000 units absorbed in Q2 2024, highest since Q3 2021.

- Vacancy rate steady at 7.8%, first non-increase in nearly three years.

- Midwest and Northeast annual rent growth at 2.4%.

- Louisville recorded strongest annual rent growth at 4.9%.

- 3-Star properties saw rent growth accelerate to 1.5%.

- National annual rent growth dipped to 0.9% in June.

- West markets experienced only 0.5% annual rent growth.

- Southern markets struggled with zero annual rent growth due to oversupply.

- Austin rents fell by 5.7% over the past 12 months.

- Luxury segment had weakest rent growth, finishing June at 0.2%.

Insights

Despite a small dip in the national average annual asking rent growth to

Examining the financial implications, the report underscores a balanced supply-demand state, positively impacting market stability. The absorption of 170,000 units is a significant marker of recovery, potentially translating into consistent revenue streams for property owners. The steady vacancy rate and slight dip in rent growth highlight a market correction phase, post the rapid 2021-2022 deceleration. Investors should note the nuanced market outlook: Northeast and Midwest regions present promising returns, given their rent growth metrics. Meanwhile, South regions and luxury segments may face revenue constraints due to oversupply. The stability in mid-tier properties (3-Star) denotes a favorable investment environment, driven by increased consumer confidence and economic expansion. This segmented approach can aid investors in diversifying and strategizing based on regional and property tier dynamics.

The current multifamily market trends reflect broader economic conditions. The stabilization of vacancy rates combined with the absorption of units points to an improving economy with lower inflation and better consumer confidence. The regional disparities, with the South facing oversupply issues, indicate the importance of localized economic conditions. Luxury segments witnessing weak rent growth at

The

The national average annual asking rent growth dipped slightly to

Midwest and Northeast markets have avoided oversupply conditions and tied with solid rent growth of

At

At the opposite end of the scale, rents fell by

Absorption was led by 4&5-Star units, with just over 123,000 units in the quarter. However, with most new supply aimed at the luxury market, annual asking rent growth remained the weakest in that segment and finished June at

Improving consumer conditions can also be observed in demand for 1&2-Star properties. After two years of negative absorption, the lowest price point finally turned positive in 2024. Households at this price point struggled in 2022 and 2023 with higher housing costs and the elevated costs of everyday items, pushing some to seek alternative housing solutions such as moving in with roommates or returning to the family home. But in 2024, 1&2 Star demand has registered almost 6,000 units.

After completions of multifamily units reached a 40-year record in 2023, the outlook this year is for continued high supply. The multifamily market is projected to add 574,000 units in 2024, which is only a slight pullback from the prior year’s record. Property operations in the second half of 2024 could vary widely depending on the market and the price point. Markets in the South and luxury properties remain most at risk for weakness due to oversupply conditions, while Midwest and Northeast locations and mid-priced 3-star properties could outperform.

ABOUT COSTAR GROUP, INC.

CoStar Group (NASDAQ: CSGP) is a leading provider of online real estate marketplaces, information, and analytics in the property markets. Founded in 1987, CoStar Group conducts expansive, ongoing research to produce and maintain the largest and most comprehensive database of real estate information. CoStar is the global leader in commercial real estate information, analytics, and news, enabling clients to analyze, interpret and gain unmatched insight on property values, market conditions and availabilities. Apartments.com is the leading online marketplace for renters seeking great apartment homes, providing property managers and owners a proven platform for marketing their properties. LoopNet is the most heavily trafficked online commercial real estate marketplace with over twelve million monthly global unique visitors. STR provides premium data benchmarking, analytics, and marketplace insights for the global hospitality industry. Ten-X offers a leading platform for conducting commercial real estate online auctions and negotiated bids. Homes.com is the fastest growing online residential marketplace that connects agents, buyers, and sellers. OnTheMarket is a leading residential property portal in the

This news release includes "forward-looking statements" including, without limitation, statements regarding CoStar's expectations or beliefs regarding the future. These statements are based upon current beliefs and are subject to many risks and uncertainties that could cause actual results to differ materially from these statements. The following factors, among others, could cause or contribute to such differences: the risk that new unit deliveries do not occur when expected, or at all; and the risk that multifamily vacancy rates are not as expected. More information about potential factors that could cause results to differ materially from those anticipated in the forward-looking statements include, but are not limited to, those stated in CoStar’s filings from time to time with the Securities and Exchange Commission, including in CoStar’s Annual Report on Form 10-K for the year ended December 31, 2023, which is filed with the SEC, including in the “Risk Factors” section of those filings, as well as CoStar’s other filings with the SEC available at the SEC’s website (www.sec.gov). All forward-looking statements are based on information available to CoStar on the date hereof, and CoStar assumes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240710296231/en/

NEWS MEDIA:

Matthew Blocher

Vice President

CoStar Group Corporate Marketing & Communications

(202)-346-6775

mblocher@costar.com

Source: CoStar Group