Apartments.com Publishes Multifamily Rent Report for Fourth Quarter of 2023

- None.

- None.

Insights

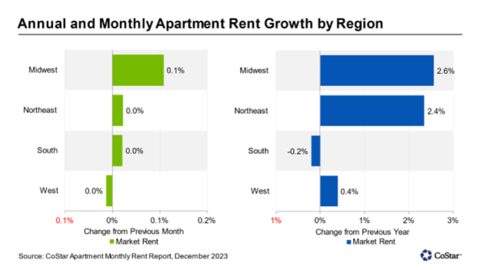

The recent multifamily rent trends report underscores significant supply-demand dynamics within the U.S. housing market. The data indicates a supply glut, particularly in luxury segments, which has led to increased vacancy rates and decelerated rent growth. This trend is particularly pronounced in the South, where oversupply has led to negative rent growth. However, the Midwest and Northeast regions have maintained a healthier balance, supporting stronger rent performance. The differential regional performance could signal shifting investor preferences, with potential capital reallocation to markets demonstrating stronger rent resilience.

Looking ahead, the projected decrease in unit completions for 2024 may alleviate some of the pressure on vacancy rates and rent growth. However, the existing oversupply, especially in luxury and Southern markets, could continue to weigh on the sector. Stakeholders should monitor regional economic drivers, migration patterns and job market health as these factors will likely influence future multifamily market performance.

The multifamily real estate sector's performance, as indicated by the report, has direct implications for REITs and other investment vehicles that have significant exposure to residential properties. The oversupply and resultant high vacancy rates may lead to downward pressure on the net operating income (NOI) of these properties, potentially affecting the dividends and valuations of related REITs. Investors should be cautious of geographic concentration in their real estate portfolios, particularly in areas where rent growth has turned negative.

Additionally, the shift in demand towards 3-star properties over the luxury segment suggests a potential pivot in investment strategy, favoring mid-tier over high-end developments. The report's findings could influence stock performance for companies involved in property development, management and ownership, especially those with a significant stake in the multifamily space.

The multifamily rent trends report provides insights into broader economic conditions, such as consumer confidence and inflationary pressures. The increased demand for 3-star properties over 1- and 2-star units could reflect a slight easing of economic strain on middle-income households, possibly due to improved employment conditions or wage growth. However, the continued struggle for lower-income households, as evidenced by negative absorption rates in lower-tier properties, highlights ongoing affordability challenges.

The report also suggests that regional economic disparities are likely influencing housing demand, with some areas outperforming others. This uneven growth could have long-term implications for urban planning, fiscal policy and federal housing assistance programs. Policymakers and business leaders should consider these trends when making decisions about infrastructure investments and housing-related subsidies or regulations.

Annual and Monthly Apartment Rent Growth by Region (Graphic: Business Wire)

“The

RECORD UNIT COMPLETIONS CAUSE SUPPLY-DEMAND IMBALANCE, HIGHER VACANCY

In 2023, 565,000 new units were delivered, the highest number of units completed since the mid-1980s. The record number of deliveries caused an imbalance between supply and demand, pushing the vacancy rate higher from

REGIONAL ANNUAL RENT GROWTH DIFFERENCES

With vacancy rising throughout 2023, average annual asking rent growth decelerated from

Of the top 50 markets across the country,

On the other hand, rents fell by

DEMAND FOR 3-STAR PROPERTIES RISES, 1- AND 2-STAR REMAIN THE WEAKEST

Over 300,000 units across 4- and 5-star properties were absorbed in 2023. However, with the majority of new supply coming into the luxury market, annual asking rent growth decreased in this segment, finishing the year at negative

In contrast, demand for 3-star properties rose, with net absorption rebounding from negative 18,000 units in 2022 to a positive 64,000 units in 2023, helping to keep rent growth positive for this sector at

Demand for 1- and 2-star properties remained the weakest, with 2023 marking the second consecutive year of negative absorption. Households at this price point continued to struggle with higher costs for housing and everyday items, pushing some to seek alternative housing solutions, such as moving in with roommates or returning to family homes.

LOOKING AHEAD

After reaching a 40-year record high for unit completions in 2023, the multifamily market may be able to recover some in 2024. Only 444,000 units are projected to be delivered in 2024, a

ABOUT COSTAR GROUP

CoStar Group (NASDAQ: CSGP) is a leading provider of online real estate marketplaces, information, and analytics in the property markets. Founded in 1987, CoStar Group conducts expansive, ongoing research to produce and maintain the largest and most comprehensive database of real estate information. CoStar is the global leader in commercial real estate information, analytics, and news, enabling clients to analyze, interpret and gain unmatched insight on property values, market conditions and availabilities. Apartments.com is the leading online marketplace for renters seeking great apartment homes, providing property managers and owners a proven platform for marketing their properties. LoopNet is the most heavily trafficked online commercial real estate marketplace with over twelve million monthly global unique visitors. STR provides premium data benchmarking, analytics, and marketplace insights for the global hospitality industry. Ten-X offers a leading platform for conducting commercial real estate online auctions and negotiated bids. Homes.com is the fastest growing online residential marketplace that connects agents, buyers, and sellers. OnTheMarket is a leading residential property portal in the

ABOUT APARTMENTS.COM

Apartments.com is the leading online apartment listing website, offering renters access to information on more than 1,000,000 available units for rent. Powered by CoStar, the Apartments.com Network of sites includes Apartments.com, ApartmentFinder.com, ApartmentHomeLiving.com, Apartamentos.com, WestsideRentals.com, ForRent.com, ForRentUniversity.com, After55.com and CorporateHousing.com.

Apartments.com is supported by the industry's largest professional research team, which has visited and photographed over 500,000 properties nationwide. The team makes over one million calls each month to apartment owners and property managers, collecting and verifying current availabilities, rental rates, pet policies, fees, leasing incentives, concessions, and more. Apartments.com offers more rental listings than any other apartments website, and innovative features including a drawing tool that allows users to define their own search areas on a map, and a "Travel Time" feature that lets users search for rentals in proximity to a specific address. Apartments.com creates easy access to its listings through a responsive website and iOS and Android apps and provides unmatched exposure for its advertisers through an intuitive name, strategic search engine placements and innovative emerging media.

The Apartments.com Network reaches millions of renters nationwide, driving both qualified traffic and highly engaged renters to leasing offices.

This news release includes "forward-looking statements" including, without limitation, statements regarding CoStar's expectations or beliefs regarding the future. These statements are based upon current beliefs and are subject to many risks and uncertainties that could cause actual results to differ materially from these statements. The following factors, among others, could cause or contribute to such differences: the risk that new unit deliveries do not occur when expected, or at all; and the risk that multifamily vacancy rates are not as expected. More information about potential factors that could cause results to differ materially from those anticipated in the forward-looking statements include, but are not limited to, those stated in CoStar’s filings from time to time with the Securities and Exchange Commission, including in CoStar’s Annual Report on Form 10-K for the year ended December 31, 2022 and Forms 10-Q for the quarterly periods ended March 31, 2023, June 30, 2023, and September 30, 2023, each of which is filed with the SEC, including in the “Risk Factors” section of those filings, as well as CoStar’s other filings with the SEC available at the SEC’s website (www.sec.gov). All forward-looking statements are based on information available to CoStar on the date hereof, and CoStar assumes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240108656944/en/

NEWS MEDIA:

Matthew Blocher

CoStar Group

(202) 346-6775

mblocher@costargroup.com

Source: CoStar Group