America’s Car-Mart Reports Second Quarter Fiscal Year 2025 Results

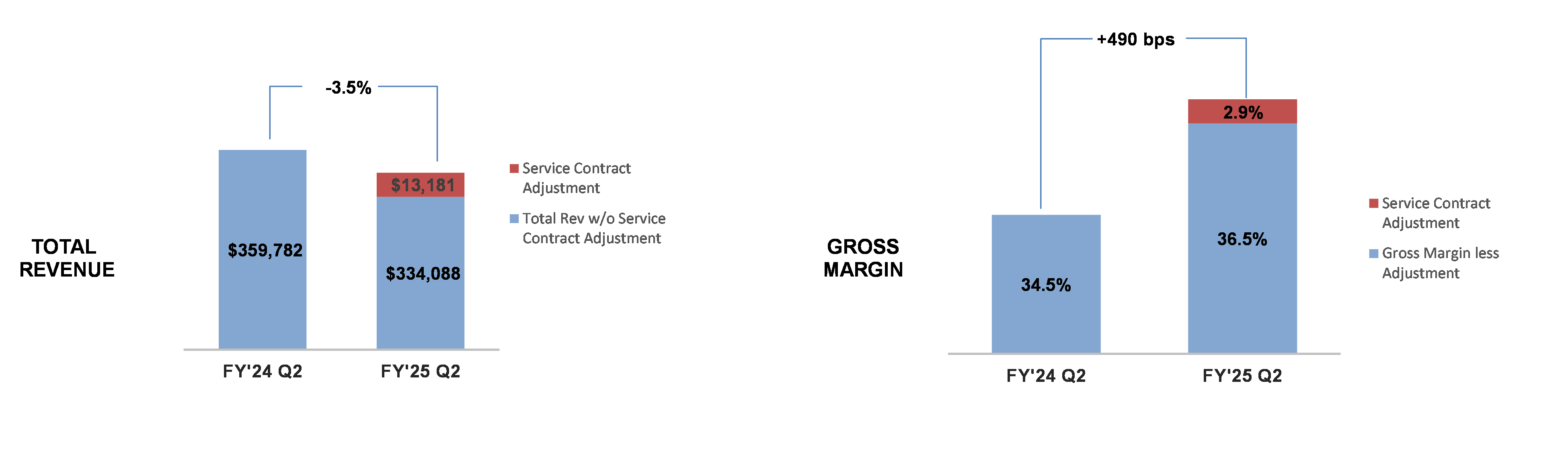

America's Car-Mart (NASDAQ: CRMT) reported Q2 FY2025 results with total revenue declining 3.5% to $347.3 million. The company posted diluted earnings per share of $0.61, compared to a loss of $4.30 in the previous year. Key highlights include:

- Interest income increased 3.6%

- Total collections rose 3.3% to $173.8 million

- Gross margin improved to 39.4%

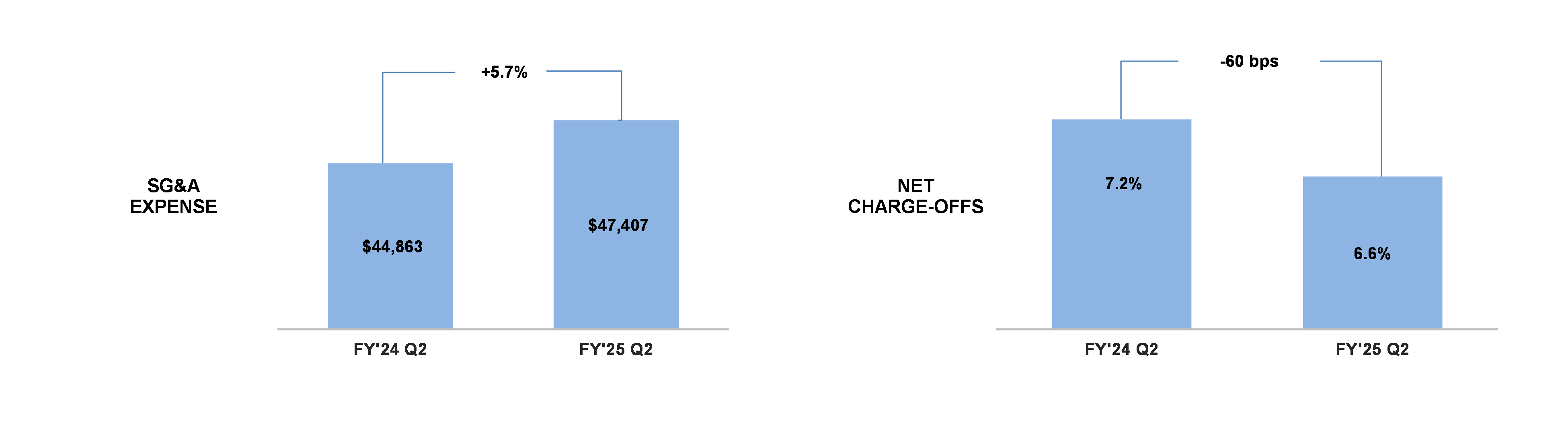

- Net charge-offs decreased to 6.6% from 7.2%

- Retail units sold decreased 9.1% to 13,784

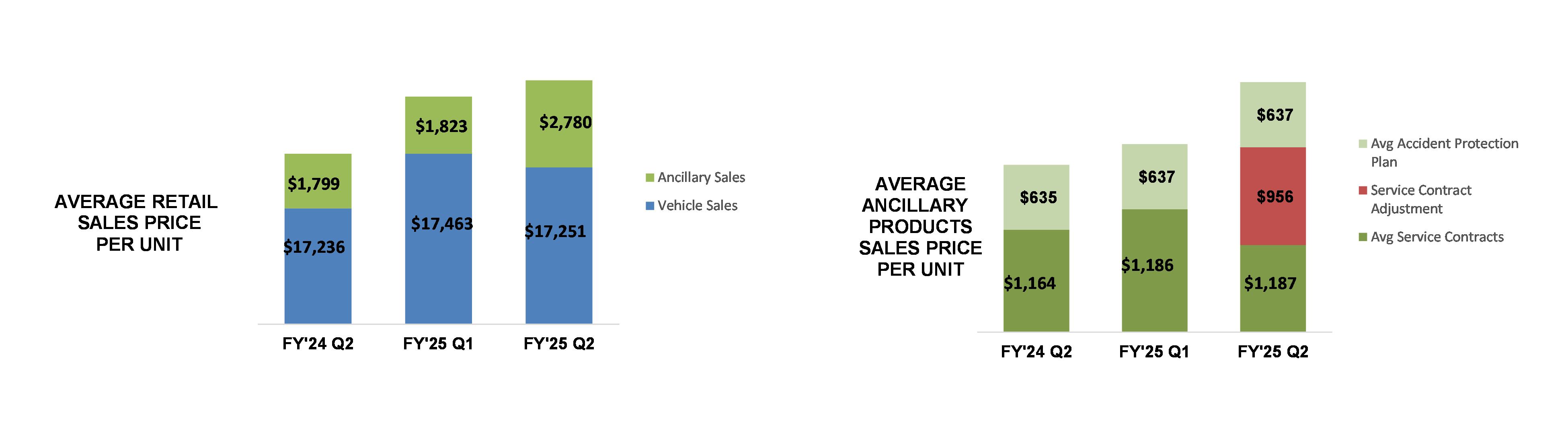

The company made an accounting adjustment to its service contract program, resulting in $13.2 million additional revenue recognition. Excluding this adjustment, the adjusted loss per share was $0.24. The average vehicle retail sales price decreased to $17,251, marking the second consecutive quarterly decline.

America's Car-Mart (NASDAQ: CRMT) ha riportato i risultati del secondo trimestre dell'anno fiscale 2025, con un fatturato totale in calo del 3,5% a 347,3 milioni di dollari. L'azienda ha registrato un utile per azione diluito di $0,61, rispetto a una perdita di $4,30 dell'anno precedente. I punti salienti includono:

- I proventi da interessi sono aumentati del 3,6%

- Le entrate totali sono aumentate del 3,3% a 173,8 milioni di dollari

- Il margine lordo è migliorato al 39,4%

- Le cancellazioni nette sono scese al 6,6% rispetto al 7,2%

- Le unità vendute al dettaglio sono diminuite del 9,1% a 13.784

L'azienda ha effettuato un aggiustamento contabile al suo programma di contratti di servizio, risultando in un riconoscimento di fatturato aggiuntivo di 13,2 milioni di dollari. Escludendo questo aggiustamento, la perdita per azione rettificata è stata di $0,24. Il prezzo di vendita al dettaglio medio dei veicoli è diminuito a $17.251, segnando il secondo calo trimestrale consecutivo.

America's Car-Mart (NASDAQ: CRMT) reportó los resultados del segundo trimestre del año fiscal 2025, con ingresos totales en disminución del 3.5% a $347.3 millones. La compañía registró ganancias diluidas por acción de $0.61, en comparación con una pérdida de $4.30 en el año anterior. Los puntos clave incluyen:

- Los ingresos por intereses aumentaron un 3.6%

- Las recaudaciones totales subieron un 3.3% a $173.8 millones

- El margen bruto mejoró al 39.4%

- Las cancelaciones netas disminuyeron al 6.6% desde el 7.2%

- Las unidades vendidas al por menor disminuyeron un 9.1% a 13,784

La empresa realizó un ajuste contable a su programa de contratos de servicio, lo que resultó en un reconocimiento de ingresos adicional de $13.2 millones. Excluyendo este ajuste, la pérdida ajustada por acción fue de $0.24. El precio medio de venta al por menor de los vehículos disminuyó a $17,251, marcando la segunda caída trimestral consecutiva.

아메리카 카마트 (NASDAQ: CRMT)는 2025 회계연도 2분기 실적을 발표했으며, 총 수익이 3.5% 감소한 3억 4720만 달러에 이르렀습니다. 회사는 작년 같은 기간에 비해 주당 희석 이익이 $0.61로 보고되었으며, 작년에는 $4.30의 손실을 기록했습니다. 주요 하이라이트는 다음과 같습니다:

- 이자 수익이 3.6% 증가했습니다.

- 총 징수액이 3.3% 증가하여 1억 7380만 달러에 달했습니다.

- 총 수익률이 39.4%로 개선되었습니다.

- 순 차감액이 7.2%에서 6.6%로 감소했습니다.

- 소매 판매된 차량 수가 13,784대로 9.1% 감소했습니다.

회사는 서비스 계약 프로그램에 대한 회계 조정을 시행하여 1320만 달러의 추가 수익 인식을 실현했습니다. 이 조정을 제외하면, 조정된 주당 손실은 $0.24였습니다. 평균 차량 소매 판매 가격은 $17,251로 감소하여 두 분기 연속 하락세를 기록했습니다.

America's Car-Mart (NASDAQ: CRMT) a annoncé ses résultats du deuxième trimestre de l'exercice 2025, avec des revenus totaux en baisse de 3,5 % à 347,3 millions de dollars. L'entreprise a affiché un bénéfice par action dilué de 0,61 $, contre une perte de 4,30 $ l'année précédente. Les principaux points forts incluent :

- Les produits d'intérêt ont augmenté de 3,6 %

- Les encaissements totaux ont augmenté de 3,3 % pour atteindre 173,8 millions de dollars

- La marge brute s'est améliorée à 39,4 %

- Les créances douteuses nettes ont diminué à 6,6 % contre 7,2 %

- Les unités de vente au détail ont diminué de 9,1 % à 13 784

L'entreprise a effectué un ajustement comptable à son programme de contrat de service, ce qui a entraîné une reconnaissance de revenus supplémentaire de 13,2 millions de dollars. En excluant cet ajustement, la perte par action ajustée s'est élevée à 0,24 $. Le prix moyen de vente au détail des véhicules a chuté à 17 251 $, marquant la deuxième baisse trimestrielle consécutive.

America's Car-Mart (NASDAQ: CRMT) hat die Ergebnisse des zweiten Quartals des Geschäftsjahres 2025 veröffentlicht, mit einem Rückgang des Gesamteinkommens um 3,5% auf 347,3 Millionen Dollar. Das Unternehmen vermeldete einen verwässerten Gewinn pro Aktie von 0,61 Dollar, verglichen mit einem Verlust von 4,30 Dollar im Vorjahr. Wichtige Höhepunkte sind:

- Die Zinserträge stiegen um 3,6%

- Die Gesamteinnahmen erhöhten sich um 3,3% auf 173,8 Millionen Dollar

- Die Bruttomarge verbesserte sich auf 39,4%

- Die Nettoshort-Positionen sanken von 7,2% auf 6,6%

- Die verkauften Einzelhandelseinheiten verringerten sich um 9,1% auf 13.784

Das Unternehmen nahm eine buchhalterische Anpassung seines Dienstleistungsvertragsprogramms vor, die zu einem zusätzlichen Umsatz von 13,2 Millionen Dollar führte. Ohne diese Anpassung lag der bereinigte Verlust pro Aktie bei 0,24 Dollar. Der durchschnittliche Verkaufspreis von Fahrzeugen im Einzelhandel fiel auf 17.251 Dollar, was den zweiten aufeinanderfolgenden quartalsweisen Rückgang markiert.

- None.

- None.

Insights

The Q2 FY25 results present a mixed picture with some concerning trends but also signs of operational improvements. Total revenue declined 3.5% to

Key positives include improved gross margins at

The balance sheet has been strengthened through recent equity offering and securitization, raising net proceeds of

However, challenges remain with declining sales volumes and increased SG&A expenses. The reported EPS of

The credit portfolio metrics show encouraging trends in risk management. The reduction in allowance for credit losses to

The enhanced loan origination system is driving better credit quality, with improved down payments (up 30 basis points to

However, the high interest rate environment continues to pressure financing costs, with interest expense increasing

ROGERS, Ark., Dec. 05, 2024 (GLOBE NEWSWIRE) -- America’s Car-Mart, Inc. (NASDAQ: CRMT) (“we,” “Car-Mart” or the “Company”), today reported financial results for the second quarter ended October 31, 2024.

| Second Quarter Key Highlights (FY’25 Q2 vs. FY’24 Q2, unless otherwise noted) |

|

|

|

|

|

|

|

|

President and CEO Doug Campbell commentary:

“As we navigated industry and economic pressures, we made strategic decisions to ensure we exited stronger and better positioned to profitably grow our market share during the second half of the fiscal year. I am pleased with our progress, as we continue to benefit from our enhanced underwriting or loan origination system (LOS). We improved deal structures, generated higher down payments, and benefited from higher collections and gross margins. We continue to focus on improving affordability for customers by reducing the average retail price. We’re closely managing expenses during ongoing implementation of technology upgrades to strengthen our operations. We believe Car-Mart is well positioned for future growth and profitability.”

1 During the second quarter of fiscal year 2025, the Company made an adjustment after a performance analysis on our service contract program leading to an accounting change reducing the estimated revenue recognition period. This analysis revealed that our customers reach the mileage portion of their service contract

| Second Quarter Fiscal Year 2025 Key Operating Metrics |

Dollars in thousands, except per unit data. Dollar and percentage changes may not recalculate due to rounding. Charts may not be to scale.

| Second Quarter Business Review |

Note: Discussions in each section provide information for the second quarter of fiscal year 2025 compared to the second quarter of fiscal year 2024, unless otherwise noted.

TOTAL REVENUE – A

SALES – Sales were 13,784 units vs. 15,162 units. The

GROSS PROFIT – Gross profit margin as a percentage of sales was

NET CHARGE-OFFS – Net charge-offs as a percentage of average finance receivables improved to

ALLOWANCE FOR CREDIT LOSSES – The allowance for credit loss as a percentage of finance receivables, net of deferred revenue and pending accident protection plan claims, decreased from

UNDERWRITING – Average down payments improved 30 bps to

SG&A EXPENSE – SG&A expense was up

LEVERAGE & LIQUIDITY – Debt to finance receivables and debt, net of cash, to finance receivables (non-GAAP)2 were

ANNUAL CASH-ON-CASH RETURNS – The Company continues to generate solid cash-on-cash returns.

The following table sets forth the actual and projected cash-on-cash returns as of October 31, 2024, for the Company’s finance receivables by origination year. The return percentages provided for contracts originated in fiscal years 2017 through 2020 reflect the Company’s actual cash-on-cash returns.

| Cash-on-Cash Returns3 | ||||

| Loan Origination Year | Prior Quarter Projected | Current Quarter Actual/Projected | Variance | % of A/R Remaining |

| FY2017 | * | * | ||

| FY2018 | * | * | ||

| FY2019 | * | * | ||

| FY2020 | * | * | ||

| FY2021 | - | |||

| FY2022 | - | |||

| FY2023 | - | |||

| FY2024 | - | |||

| FY2025 | - | |||

| * 2017 - 2020 Pools' Current Projection reflects actual cash-on-cash returns | ||||

2 Calculation of this non-GAAP financial measure and a reconciliation to the most directly comparable GAAP measure are included in the tables accompanying this release.

3 “Cash-on-cash returns” represent the return on cash invested by the Company in the vehicle finance loans the Company originates and is calculated with respect to a pool of loans (or finance receivables) by dividing total “cash in” less “cash out” by total “cash out” with respect to such pool. “Cash in” represents the total cash the Company expects to collect on the pool of finance receivables, including credit losses. This includes down-payments, principal and interest collected (including special and seasonal payments) and the fair market value of repossessed vehicles, if applicable. “Cash out” includes purchase price paid by the Company to acquire the vehicle (including reconditioning and transportation costs), and all other post-sale expenses as well as expenses related to our ancillary products. The calculation assumes estimates on expected credit losses net of fair market value of repossessed vehicles and the related timing of such losses as well as post sales repair expenses and special payments. The Company evaluates and updates expected credit losses quarterly. The credit quality of each pool is monitored and compared to prior and initial forecasts and is reflected in our on-going internal cash-on-cash projections.

| Key Operating Results |

| Three Months Ended | |||||||||||||||||

| October 31, | |||||||||||||||||

| 2024 | 2023 | % Change | |||||||||||||||

| Operating Data: | |||||||||||||||||

| Retail units sold | 13,784 | 15,162 | (9.1) | % | |||||||||||||

| Average number of stores in operation | 154 | 154 | - | ||||||||||||||

| Average retail units sold per store per month | 29.8 | 32.8 | (9.1) | ||||||||||||||

| Average retail sales price | $ | 20,031 | $ | 19,035 | 5.2 | ||||||||||||

| Total gross profit per retail unit sold | $ | 8,166 | $ | 6,835 | 19.5 | ||||||||||||

| Total gross profit percentage | |||||||||||||||||

| Same store revenue growth | (8.4)% | ||||||||||||||||

| Net charge-offs as a percent of average finance receivables | |||||||||||||||||

| Total collected (principal, interest and late fees), in thousands | $ | 173,778 | $ | 168,282 | 3.3 | ||||||||||||

| Average total collected per active customer per month | $ | 560 | $ | 533 | 5.1 | ||||||||||||

| Average percentage of finance receivables-current (excl. 1-2 day) | |||||||||||||||||

| Average down-payment percentage | |||||||||||||||||

| Six Months Ended | |||||||||||||||||

| October 31, | |||||||||||||||||

| 2024 | 2023 | % Change | |||||||||||||||

| Operating Data: | |||||||||||||||||

| Retail units sold | 28,175 | 31,074 | (9.3) | % | |||||||||||||

| Average number of stores in operation | 155 | 155 | - | ||||||||||||||

| Average retail units sold per store per month | 30.3 | 33.4 | (9.3) | ||||||||||||||

| Average retail sales price | $ | 19,650 | $ | 18,914 | 3.9 | ||||||||||||

| Total gross profit per retail unit sold | $ | 7,568 | $ | 6,801 | 11.3 | ||||||||||||

| Total gross profit percentage | |||||||||||||||||

| Same store revenue growth | (8.2)% | ||||||||||||||||

| Net charge-offs as a percent of average finance receivables | |||||||||||||||||

| Total collected (principal, interest and late fees), in thousands | $ | 346,650 | $ | 334,029 | 3.8 | ||||||||||||

| Average total collected per active customer per month | $ | 561 | $ | 534 | 5.0 | ||||||||||||

| Average percentage of finance receivables-current (excl. 1-2 day) | |||||||||||||||||

| Average down-payment percentage | |||||||||||||||||

| Period End Data: | |||||||||||||||||

| Stores open | 154 | 153 | 0.7 | % | |||||||||||||

| Accounts over 30 days past due | |||||||||||||||||

| Active customer count | 103,336 | 104,596 | (1.2) | ||||||||||||||

| Principal balance of finance receivables (in thousands) | $ | 1,473,794 | $ | 1,463,398 | 0.7 | ||||||||||||

| Weighted average total contract term | 48.2 | 47.3 | 1.9 | ||||||||||||||

| Conference Call and Webcast |

The Company will hold a conference call to discuss its quarterly results on Thursday, December 5, 2024, at 9 am ET. Participants may access the conference call via webcast using this link: Webcast Link. To participate via telephone, please register in advance using this Registration Link. Upon registration, all telephone participants will receive a one-time confirmation email detailing how to join the conference call, including the dial-in number along with a unique PIN that can be used to access the call. All participants are encouraged to dial in 10 minutes prior to the start time. A replay and transcript of the conference call and webcast will be available on-demand for 12 months.

| About America’s Car-Mart, Inc. |

America’s Car-Mart, Inc. (the “Company”) operates automotive dealerships in 12 states and is one of the largest publicly held automotive retailers in the United States focused exclusively on the “Integrated Auto Sales and Finance” segment of the used car market. The Company emphasizes superior customer service and the building of strong personal relationships with its customers. The Company operates its dealerships primarily in smaller cities throughout the South-Central United States, selling quality used vehicles and providing financing for substantially all of its customers. For more information about America’s Car-Mart, including investor presentations, please visit our website at www.car-mart.com.

| Non-GAAP Financial Measures |

This news release contains financial information determined by methods other than in accordance with generally accepted accounting principles (GAAP). We present adjusted diluted earnings (loss) per share, adjusted gross margin as a percentage of finance receivables, and total debt, net of total cash, to finance receivables, each a non-GAAP measure, as supplemental measures of our performance. We believe adjusted diluted earnings (loss) per share and adjusted gross margin as a percentage of sales are useful measures of our operating results because they exclude the impacts of an adjustment that is not indicative of our underlying operating performance. We believe total debt, net of total cash, to finance receivables is a useful measure to monitor leverage and evaluate balance sheet risk. These measures should not be considered in isolation or as a substitute for reported GAAP results because they may include or exclude certain items as compared to similar GAAP-based measures, and such measures may not be comparable to similarly-titled measures reported by other companies. We strongly encourage investors to review our consolidated financial statements included in publicly filed reports in their entirety and not rely solely on any one, single financial measure or communication. The most directly comparable GAAP financial measure, as well as a reconciliation to the comparable GAAP financial measure, for non-GAAP financial measures are presented in the tables of this release.

| Forward-Looking Statements |

This news release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements address the Company’s future objectives, plans and goals, as well as the Company’s intent, beliefs and current expectations and projections regarding future operating performance and can generally be identified by words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “project,” “foresee,” and other similar words or phrases. Specific events addressed by these forward-looking statements may include, but are not limited to:

- operational infrastructure investments;

- same dealership sales and revenue growth;

- customer growth and engagement;

- gross profit percentages;

- gross profit per retail unit sold;

- business acquisitions;

- inventory acquisition, reconditioning, transportation, and remarketing;

- technological investments and initiatives;

- future revenue growth;

- receivables growth as related to revenue growth;

- new dealership openings;

- performance of new or existing dealerships;

- interest rates;

- future credit losses;

- the Company’s collection results, including but not limited to collections during income tax refund periods;

- cash-on-cash returns from the collection of contracts originated by the Company

- seasonality; and

- the Company’s business, operating and growth strategies and expectations.

These forward-looking statements are based on the Company’s current estimates and assumptions and involve various risks and uncertainties. As a result, you are cautioned that these forward-looking statements are not guarantees of future performance, and that actual results could differ materially from those projected in these forward-looking statements. Factors that may cause actual results to differ materially from the Company’s projections include, but are not limited to:

- general economic conditions in the markets in which the Company operates, including but not limited to fluctuations in gas prices, grocery prices and employment levels and inflationary pressure on operating costs;

- the availability of quality used vehicles at prices that will be affordable to our customers, including the impacts of changes in new vehicle production and sales;

- the ability to leverage the Cox Automotive services agreement to perform reconditioning and improve vehicle quality to reduce the average vehicle cost, improve gross margins, reduce credit loss, and enhance cash flow;

- the availability of credit facilities and access to capital through securitization financings or other sources on terms acceptable to us, and any increase in the cost of capital, to support the Company’s business;

- the Company’s ability to underwrite and collect its contracts effectively, including whether anticipated benefits from the Company’s recently implemented loan origination system are achieved as expected or at all;

- competition;

- dependence on existing management;

- ability to attract, develop, and retain qualified general managers;

- changes in consumer finance laws or regulations, including but not limited to rules and regulations that have recently been enacted or could be enacted by federal and state governments;

- the ability to keep pace with technological advances and changes in consumer behavior affecting our business;

- security breaches, cyber-attacks, or fraudulent activity;

- the ability to identify and obtain favorable locations for new or relocated dealerships at reasonable cost;

- the ability to successfully identify, complete and integrate new acquisitions;

- the occurrence and impact of any adverse weather events or other natural disasters affecting the Company’s dealerships or customers; and

- potential business and economic disruptions and uncertainty that may result from any future public health crises and any efforts to mitigate the financial impact and health risks associated with such developments.

Additionally, risks and uncertainties that may affect future results include those described from time to time in the Company’s SEC filings. The Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the dates on which they are made.

| Contact for information |

Vickie Judy, CFO

479-464-9944

Investor_relations@car-mart.com

| America's Car-Mart, Inc. | ||||||||||||||||||||||||||

| Consolidated Results of Operations | ||||||||||||||||||||||||||

| (Amounts in thousands, except per share data) | ||||||||||||||||||||||||||

| As a % of Sales | ||||||||||||||||||||||||||

| Three Months Ended | Three Months Ended | |||||||||||||||||||||||||

| October 31, | October 31, | |||||||||||||||||||||||||

| 2024 | 2023 | % Change | 2024 | 2023 | ||||||||||||||||||||||

| Statements of Operations: | ||||||||||||||||||||||||||

| Revenues: | ||||||||||||||||||||||||||

| Sales(4) | $ | 285,774 | $ | 300,400 | (4.9 | ) | % | 100.0 | % | 100.0 | % | |||||||||||||||

| Interest income | 61,495 | 59,382 | 3.6 | 21.5 | 19.8 | |||||||||||||||||||||

| Total(4) | 347,269 | 359,782 | (3.5 | ) | 121.5 | 119.8 | ||||||||||||||||||||

| . | ||||||||||||||||||||||||||

| Costs and expenses: | ||||||||||||||||||||||||||

| Cost of sales(4) | 173,215 | 196,763 | (12.0 | ) | 60.6 | 65.5 | ||||||||||||||||||||

| Selling, general and administrative | 47,407 | 44,863 | 5.7 | 16.6 | 14.9 | |||||||||||||||||||||

| Provision for credit losses | 99,522 | 135,395 | (26.5 | ) | 34.8 | 45.1 | ||||||||||||||||||||

| Interest expense | 18,042 | 16,582 | 8.8 | 6.3 | 5.5 | |||||||||||||||||||||

| Depreciation and amortization | 1,926 | 1,696 | 13.6 | 0.7 | 0.6 | |||||||||||||||||||||

| Loss on disposal of property and equipment | 41 | 74 | (44.6 | ) | - | - | ||||||||||||||||||||

| Total(4) | 340,153 | 395,373 | (14.0 | ) | 119.0 | 131.6 | ||||||||||||||||||||

| Income (loss) before taxes | 7,116 | (35,591 | ) | 2.5 | (11.8 | ) | ||||||||||||||||||||

| Provision (benefit) for income taxes | 2,017 | (8,128 | ) | 0.7 | (2.7 | ) | ||||||||||||||||||||

| Net income (loss) | $ | 5,099 | $ | (27,463 | ) | 1.8 | (9.1 | ) | ||||||||||||||||||

| Dividends on subsidiary preferred stock | $ | (10 | ) | $ | (10 | ) | ||||||||||||||||||||

| Net income (loss) attributable to common shareholders | $ | 5,089 | $ | (27,473 | ) | |||||||||||||||||||||

| Earnings per share: | ||||||||||||||||||||||||||

| Basic | $ | 0.62 | $ | (4.30 | ) | |||||||||||||||||||||

| Diluted | $ | 0.61 | $ | - | ||||||||||||||||||||||

| Weighted average number of shares used in calculation: | ||||||||||||||||||||||||||

| Basic | 8,147,971 | 6,386,208 | ||||||||||||||||||||||||

| Diluted | 8,292,459 | 6,386,208 | ||||||||||||||||||||||||

| America's Car-Mart, Inc. Consolidated Results of Operations | ||||||||||||||||||||||||||

| (Amounts in thousands, except per share data) | ||||||||||||||||||||||||||

| As a % of Sales | ||||||||||||||||||||||||||

| Six Months Ended | Six Months Ended | |||||||||||||||||||||||||

| October 31, | October 31, | |||||||||||||||||||||||||

| 2024 | 2023 | % Change | 2024 | 2023 | ||||||||||||||||||||||

| Statements of Operations: | ||||||||||||||||||||||||||

| Revenues: | ||||||||||||||||||||||||||

| Sales(4) | $ | 573,022 | $ | 610,737 | (6.2 | ) | % | 100.0 | % | 100.0 | % | |||||||||||||||

| Interest income | 122,010 | 115,838 | 5.3 | 21.3 | 19.0 | |||||||||||||||||||||

| Total(4) | 695,032 | 726,575 | (4.3 | ) | 121.3 | 119.0 | ||||||||||||||||||||

| Costs and expenses: | ||||||||||||||||||||||||||

| Cost of sales(4) | 359,785 | 399,410 | (9.9 | ) | 62.8 | 65.4 | ||||||||||||||||||||

| Selling, general and administrative | 94,118 | 91,333 | 3.0 | 16.4 | 15.0 | |||||||||||||||||||||

| Provision for credit losses | 194,945 | 231,718 | (15.9 | ) | 34.0 | 37.9 | ||||||||||||||||||||

| Interest expense | 36,354 | 30,856 | 17.8 | 6.3 | 5.1 | |||||||||||||||||||||

| Depreciation and amortization | 3,810 | 3,389 | 12.4 | 0.7 | 0.6 | |||||||||||||||||||||

| Loss on disposal of property and equipment | 87 | 240 | (63.8 | ) | - | - | ||||||||||||||||||||

| Total(4) | 689,099 | 756,946 | (9.0 | ) | 120.2 | 124.0 | ||||||||||||||||||||

| Income (loss) before taxes | 5,933 | (30,371 | ) | 1.0 | (5.0 | ) | ||||||||||||||||||||

| Provision (benefit) for income taxes | 1,798 | (7,094 | ) | 0.3 | (1.2 | ) | ||||||||||||||||||||

| Net income (loss) | $ | 4,135 | $ | (23,277 | ) | 0.7 | (3.8 | ) | ||||||||||||||||||

| Dividends on subsidiary preferred stock | $ | (20 | ) | $ | (20 | ) | ||||||||||||||||||||

| Net income (loss) attributable to common shareholders | $ | 4,115 | $ | (23,297 | ) | |||||||||||||||||||||

| Earnings per share: | ||||||||||||||||||||||||||

| Basic | $ | 0.57 | $ | (3.65 | ) | |||||||||||||||||||||

| Diluted | $ | 0.55 | $ | - | ||||||||||||||||||||||

| Weighted average number of shares used in calculation: | ||||||||||||||||||||||||||

| Basic | 7,272,364 | 6,383,956 | ||||||||||||||||||||||||

| Diluted | 7,423,936 | 6,383,956 | ||||||||||||||||||||||||

| (4) Some items in the prior year financial statements were reclassified to conform to the current presentation. Reclassification had no effect on the prior year net income or shareholders equity. | ||||||||||||||||||||||||||

| America's Car-Mart, Inc. | ||||||||||||||

| Condensed Consolidated Balance Sheet and Other Data | ||||||||||||||

| (Amounts in thousands, except per share data) | ||||||||||||||

| October 31, | April 30, | October 31, | ||||||||||||

| 2024 | 2024 | 2023 | ||||||||||||

| Cash and cash equivalents | $ | 8,006 | $ | 5,522 | $ | 4,313 | ||||||||

| Restricted cash from collections on auto finance receivables | $ | 121,678 | $ | 88,925 | $ | 90,180 | ||||||||

| Finance receivables, net | $ | 1,132,618 | $ | 1,098,591 | $ | 1,105,236 | ||||||||

| Inventory | $ | 122,102 | $ | 107,470 | $ | 113,846 | ||||||||

| Total assets | $ | 1,575,176 | $ | 1,477,644 | $ | 1,487,149 | ||||||||

| Revolving lines of credit, net | $ | 107,365 | $ | 200,819 | $ | 165,509 | ||||||||

| Notes payable, net | $ | 656,414 | $ | 553,629 | $ | 579,030 | ||||||||

| Treasury stock | $ | 298,198 | $ | 297,786 | $ | 297,489 | ||||||||

| Total equity | $ | 553,665 | $ | 470,750 | $ | 476,609 | ||||||||

| Shares outstanding | 8,253,186 | 6,394,675 | 6,392,838 | |||||||||||

| Book value per outstanding share | $ | 67.13 | $ | 73.68 | $ | 74.62 | ||||||||

| Allowance as % of principal balance net of deferred revenue | 24.72 | % | 25.32 | % | 26.04 | % | ||||||||

| Changes in allowance for credit losses: | ||||||||||||||

| Six months ended | ||||||||||||||

| October 31, | ||||||||||||||

| 2024 | 2023 | |||||||||||||

| Balance at beginning of period | $ | 331,260 | $ | 299,608 | ||||||||||

| Provision for credit losses | 194,945 | 231,718 | ||||||||||||

| Charge-offs, net of collateral recovered | (189,512 | ) | (186,996 | ) | ||||||||||

| Balance at end of period | $ | 336,693 | $ | 344,330 | ||||||||||

| America's Car-Mart, Inc. | ||||||||||

| Condensed Consolidated Statements of Cash Flows | ||||||||||

| (Amounts in thousands) | ||||||||||

| Six Months Ended | ||||||||||

| October 31, | ||||||||||

| 2024 | 2023 | |||||||||

| Operating activities: | ||||||||||

| Net (loss) | $ | 4,135 | $ | (23,277) | ||||||

| Provision for credit losses | 194,945 | 231,718 | ||||||||

| Losses on claims for accident protection plan | 16,797 | 15,173 | ||||||||

| Depreciation and amortization | 3,810 | 3,389 | ||||||||

| Finance receivable originations | (527,487) | (580,082) | ||||||||

| Finance receivable collections | 224,640 | 218,208 | ||||||||

| Inventory | 48,141 | 65,123 | ||||||||

| Deferred accident protection plan revenue | (880) | 1,306 | ||||||||

| Deferred service contract revenue | (13,300) | 4,042 | ||||||||

| Income taxes, net | (974) | (8,605) | ||||||||

| Other | 12,967 | (3,125) | ||||||||

| Net cash used in operating activities | (37,206) | (76,130) | ||||||||

| Investing activities: | ||||||||||

| Purchase of investments | (9,865) | - | ||||||||

| Purchase of property and equipment and other | 24 | (1,588) | ||||||||

| Net cash used in investing activities | (9,841) | (1,588) | ||||||||

| Financing activities: | ||||||||||

| Change in revolving credit facility, net | (93,127) | (2,152) | ||||||||

| Payments on notes payable | (345,622) | (250,935) | ||||||||

| Change in cash overdrafts | 2,074 | 1,416 | ||||||||

| Issuances of notes payable | 449,889 | 360,340 | ||||||||

| Debt issuance costs | (4,467) | (4,091) | ||||||||

| Purchase of common stock | (412) | (69) | ||||||||

| Dividend payments | (20) | (20) | ||||||||

| Exercise of stock options and issuance of common stock | 73,969 | (312) | ||||||||

| Net cash provided by financing activities | 82,284 | 104,177 | ||||||||

| Increase in cash, cash equivalents, and restricted cash | $ | 35,237 | $ | 26,459 | ||||||

| America's Car-Mart, Inc. | ||||||||||

| Reconciliation of Non-GAAP Financial Measures | ||||||||||

| (Amounts in thousands) | ||||||||||

| Calculation of Debt, Net of Total Cash, to Finance Receivables: | ||||||||||

| October 31, 2024 | April 30, 2024 | |||||||||

| Debt: | ||||||||||

| Revolving lines of credit, net | $ | 107,365 | $ | 200,819 | ||||||

| Notes payable, net | 656,414 | 553,629 | ||||||||

| Total debt | $ | 763,779 | $ | 754,448 | ||||||

| Cash: | ||||||||||

| Cash and cash equivalents | $ | 8,006 | $ | 5,522 | ||||||

| Restricted cash from collections on auto finance receivables | 121,678 | 88,925 | ||||||||

| Total cash, cash equivalents, and restricted cash | $ | 129,684 | $ | 94,447 | ||||||

| Debt, net of total cash | $ | 634,095 | $ | 660,001 | ||||||

| Principal balance of finance receivables | $ | 1,473,794 | $ | 1,435,388 | ||||||

| Ratio of debt to finance receivables | 51.8 | % | 52.6 | % | ||||||

| Ratio of debt, net of total cash, to finance receivables | 43.0 | % | 46.0 | % | ||||||

| Three Months Ended | Six Months Ended | |||||||||

| October 31, | October 31, | |||||||||

| Calculation of Adjusted Gross Margin | 2024 | 2024 | ||||||||

| Sales (A) | $ | 285,774 | $ | 573,022 | ||||||

| Less: Service contract adjustment to sales | (13,181 | ) | (13,181 | ) | ||||||

| Adjusted sales (B) | 272,593 | 559,841 | ||||||||

| Cost of sales (C) | (173,215 | ) | (359,785 | ) | ||||||

| Gross margin (A-C) | $ | 112,559 | $ | 213,237 | ||||||

| Adjusted gross margin (B-C) | $ | 99,378 | $ | 200,056 | ||||||

| Gross margin as a % of sales (A-C/A) | 39.4 | % | 37.2 | % | ||||||

| Adjusted gross margin as a % of sales (B-C/B) | 36.5 | % | 35.7 | % | ||||||

| Three Months Ended | ||||||||||

| October 31, | ||||||||||

| Calculation of Adjusted Earnings (Loss) Per Share | 2024 | |||||||||

| Net income attributable to common shareholders (D) | $ | 5,089 | ||||||||

| Service contract adjustment to sales (E) | 13,181 | |||||||||

| Credit loss impact of adjustment (F) | (3,258 | ) | ||||||||

| Pre-tax impact of adjustment (G) | 9,923 | |||||||||

| Tax effect of adjustment (effective tax rate of | (2,812 | ) | ||||||||

| Post-tax impact of adjustment (G+H) | 7,111 | |||||||||

| Adjusted net income (loss) attributable to common shareholders (D-(G+H)) | (2,022 | ) | ||||||||

| Weighted average diluted shares outstanding | 8,292 | |||||||||

| Adjusted (loss) per share | $ | (0.24 | ) | |||||||

| Diluted earnings per share (GAAP) | $ | 0.61 | ||||||||

| Diluted earnings per share impact of adjustment | $ | 0.85 | ||||||||

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/bfa42c2b-4e44-470f-b96c-6776ace16f96

https://www.globenewswire.com/NewsRoom/AttachmentNg/c8a31827-6416-4053-8972-c8a103a202c8

https://www.globenewswire.com/NewsRoom/AttachmentNg/3ccc7626-309a-4fd6-a2cd-e41d3ee4bc91