Cerrado Gold Announces Third Quarter Financial Results

Cerrado Gold reported Q3 2024 production of 16,604 Gold Equivalent Ounces (GEO), maintaining its full-year guidance of 50,000-60,000 GEO. The company achieved Adjusted EBITDA of $7.4 million and reduced its working capital deficit by over $20 million year to date. The company completed the sale of Monte Do Carmo gold project to Amarillo for a total consideration of US$60 million, with US$45 million already received and US$15 million expected within 28 months. Q3 revenue reached $36.7 million from selling 15,505 ounces of gold at an average price of $2,329 per ounce.

Cerrado Gold ha riportato una produzione nel terzo trimestre del 2024 di 16.604 once d'oro equivalente (GEO), mantenendo le previsioni per l'intero anno tra 50.000 e 60.000 GEO. L'azienda ha raggiunto un EBITDA rettificato di 7,4 milioni di dollari e ha ridotto il proprio deficit di capitale circolante di oltre 20 milioni di dollari dall'inizio dell'anno. L'azienda ha completato la vendita del progetto aurifero Monte Do Carmo ad Amarillo per un corrispettivo totale di 60 milioni di dollari, con 45 milioni già ricevuti e 15 milioni attesi entro 28 mesi. I ricavi del terzo trimestre hanno raggiunto 36,7 milioni di dollari grazie alla vendita di 15.505 once d'oro a un prezzo medio di 2.329 dollari per oncia.

Cerrado Gold reportó una producción en el tercer trimestre de 2024 de 16,604 onzas equivalentes de oro (GEO), manteniendo su guía anual de entre 50,000 y 60,000 GEO. La compañía logró un EBITDA ajustado de 7.4 millones de dólares y redujo su déficit de capital de trabajo en más de 20 millones de dólares en lo que va del año. La compañía completó la venta del proyecto de oro Monte Do Carmo a Amarillo por un total de 60 millones de dólares, habiéndose recibido ya 45 millones de dólares y esperando 15 millones dentro de 28 meses. Los ingresos del tercer trimestre llegaron a 36.7 millones de dólares por la venta de 15,505 onzas de oro a un precio promedio de 2,329 dólares por onza.

세라도 골드(Cerrado Gold)는 2024년 3분기에 16,604 금 동등 온스(GEO)의 생산량을 보고하며 연간 가이던스인 50,000-60,000 GEO를 유지하고 있습니다. 회사는 조정 EBITDA 740만 달러를 달성했으며, 올해 초부터 운영 자본 부족을 2천만 달러 이상 줄였습니다. 회사는 아마릴로(Amarillo)에게 몬떼 도 카르모(Monte Do Carmo) 금 프로젝트를 총 6천만 달러에 판매하는 계약을 완료하였으며, 이 중 4천5백만 달러는 이미 수령했고 1천5백만 달러는 28개월 이내에 받을 것으로 예상하고 있습니다. 3분기 매출은 3천6백70만 달러로, 15,505온스의 금을 온스당 평균 2,329달러에 판매하여 달성하였습니다.

Cerrado Gold a rapporté une production au troisième trimestre 2024 de 16 604 onces d'or équivalentes (GEO), maintenant ainsi ses prévisions annuelles de 50 000 à 60 000 GEO. La société a réalisé un EBITDA ajusté de 7,4 millions de dollars et a réduit son déficit de fonds de roulement de plus de 20 millions de dollars depuis le début de l'année. La société a finalisé la vente du projet aurifère Monte Do Carmo à Amarillo pour un montant total de 60 millions de dollars, dont 45 millions de dollars ont déjà été reçus et 15 millions de dollars sont attendus dans les 28 mois. Les revenus du troisième trimestre ont atteint 36,7 millions de dollars grâce à la vente de 15 505 onces d'or à un prix moyen de 2 329 dollars par once.

Cerrado Gold berichtete eine Produktion von 16.604 Goldäquivalent-Unzen (GEO) im dritten Quartal 2024 und hält damit die Prognose für das Gesamtjahr von 50.000 bis 60.000 GEO aufrecht. Das Unternehmen erzielte ein bereinigtes EBITDA von 7,4 Millionen Dollar und reduzierte seinen Working Capital-Defizit um über 20 Millionen Dollar seit Jahresbeginn. Das Unternehmen hat den Verkauf des Monte Do Carmo Goldprojekts an Amarillo für insgesamt 60 Millionen Dollar abgeschlossen, wobei bereits 45 Millionen Dollar erhalten wurden und weitere 15 Millionen Dollar innerhalb von 28 Monaten erwartet werden. Die Einnahmen im dritten Quartal betrugen 36,7 Millionen Dollar aus dem Verkauf von 15.505 Unzen Gold zu einem durchschnittlichen Preis von 2.329 Dollar pro Unze.

- Revenue increased to $36.7M in Q3 2024 from $21.6M in Q3 2023

- Gold production increased 65% YoY to 16,604 GEO

- Received US$45M from Monte Do Carmo sale with additional US$15M expected

- Total cash costs decreased to $1,617 per ounce from $1,689 YoY

- Net income of $1.5M compared to $0.4M loss in Q3 2023

- Production costs increased due to higher labor costs

- Loss of $2.4M on fair value remeasurement of MDN stream obligation

- Loss of $3.1M on fair value remeasurement of MDC secured note

- AISC remains high at $1,678 per ounce

Gold equivalent production of 16,604 Gold Equivalent Ounces ("GEO") for Q3; On track for full year guidance of 50,000-60,000 GEO

Adjusted EBITDA of

$7.4 million for Q3, 2024Decrease in the working capital deficit by over US

$20 million year to date

TORONTO, ON / ACCESSWIRE / November 28, 2024 / Cerrado Gold Inc. (TSXV:CERT)(OTCQX:CRDOF)(FRA:BAI0) ("Cerrado" or the "Company") announces its operational and financial results for the third quarter ("Q3/24") including its Minera Don Nicolas ("MDN") gold project in Santa Cruz Province, Argentina and its Mont Sorcier High Quality Iron Project in Quebec. The Company's Q3/24 financial results continue to consolidate the expenses, assets, and liabilities related to the Monte Do Carmo gold project ("MDC") as the sale of MDC (the "Transaction") to Amarillo Mineração do Brasil Ltda. ("Amarillo"), a wholly-owned subsidiary of Hochschild Mining PLC ("Hochschild), was completed subsequent to quarter end. The sale was in connection with the exercise of Amarillo's option pursuant to an option agreement dated March 5, 2024 (the "Option Agreement").

In connection with the Transaction, Cerrado received closing cash payments totaling US

Production results for MDN were previously released on October 16, 2024. The Company's financial results are reported and available on SEDAR+ (www.sedarplus.com) and the Company's website (www.cerradogold.com).

Q3/24 MDN Operating Highlights

Q3/24 production of 16,604 GEO

Q3/24 Adjusted EBITDA of

$7.4 million AISC of

$1,678 during Q3; focus on cost reduction initiatives has begunRecent 43-101 Mineral Resource Update and Preliminary Economic Assessment Completed for MDN showing an NPV5% of

$111M M at$2,100 oz gold price over a 5 year mine lifeFocus remains on delivering cashflow and strengthening the balance sheet with significant progress made towards debt reduction during the quarter

Operational results for Q3 2024 demonstrated a slight increase in production over the previous quarter, highlighting greater stability in operations. Ore from the Calandrias Norte high-grade open pit was exhausted late in the quarter and is now being replaced by additional high-grade feed from two additional pits. The CIL plant is now expected to continue production until early 2025 as operations continue to transition to solely heap leach production. The ramp up of heap leach operations continued to improve as crushing capacity continued to climb with record production of 1,664 GEO in August before a slight decline in September as some adjustments were put in place to support the overall expansion of the facilities. The performance of the heap leach continues to depend on the output of the crushing circuit. The installation of the secondary crusher is expected to reduce fleet and operating costs. The new circuit is expected to be fully operational by the end of the 4th quarter, at which time the mobile crushers will be placed on standby. Recovery rates are in line with expectations given ore on the pad to date.

Mark Brennan, CEO and Chairman commented, "The results from this quarter further confirm we have entered into a more stable period of operations. We expect this to continue for the remainder of the year as the heap leach operation continues to ramp up to its expanded capacity. The cashflow from operations, combined with funds received from the sale of the MDC project, have had a significant positive impact on our working capital position, and we are now positioned to deploy capital in a strategic and fiscally prudent manner to ramp up exploration efforts at MDN, complete a bankable feasibility study at our high grade Mont Sorcier iron project and fund our recently announced normal course issuer bid."

Q3 Financial Performance

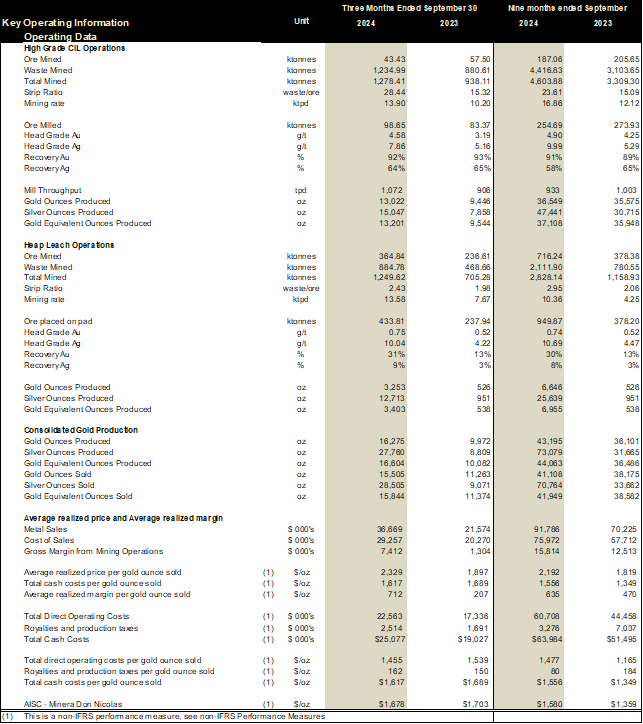

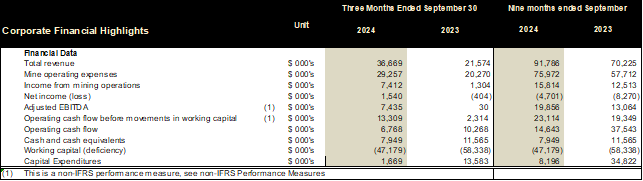

Table 1. Q3 2024 Operational and Financial Performance

The Company produced 16,604 GEO during the third quarter ended September 30, 2024, as compared to 10,082 GEO for the third quarter ended September 30, 2023. Production is higher in the three months ended September 30, 2024, due to

The Company generated revenue of

Cost of sales for the third quarter ended September 30, 2024, were

Total cash costs (including royalties) per ounce sold were

Net income for the third quarter ended September 30, 2024, was

The Company incurred general and administrative expenses of

Other expense of

Normal Course Issuer Bid

As previously announced on November 13, 2024, the Company announced TSX Venture Exchange approval for the Company's notice to implement a normal course issuer bid (the "NCIB") permitting the Company to repurchase, for cancellation, up to 5,170,903 common shares ("Common Shares") of the Company, representing

Share Incentive Issuances

The Company also announces it has issued 200,000 share purchase options at an exercise price of C

Review of Technical Information

The scientific and technical information in this press release has been reviewed and approved by Sergio Gelcich, P.Geo., Vice President, Exploration for Cerrado Gold Inc., who is a Qualified Person as defined in National Instrument 43-101.

About Cerrado

Cerrado Gold is a Toronto-based gold production, development, and exploration company focused on gold projects in South America. The Company is the

In Argentina, Cerrado is maximizing asset value at its Minera Don Nicolas operation through continued operational optimization and is growing production through its operations at the Las Calandrias heap leach project. An extensive campaign of exploration is ongoing to further unlock potential resources in our highly prospective land package in the heart of the Deseado Masiff.

In Canada, Cerrado holds a

For more information about Cerrado please visit our website at: www.cerradogold.com.

Mark Brennan

CEO and Chairman

Mike McAllister

Vice President, Investor Relations

Tel: +1-647-805-5662

mmcallister@cerradogold.com

Disclaimer

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

This press release contains statements that constitute "forward-looking information" (collectively, "forward-looking statements") within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements contained in this press release include, without limitation, statements regarding the business and operations of Cerrado, anticipated continued improvements in operating results and working capital position, receipt of funds due from Amarillo within 28 months, stabilizing operations at MDN, ramp up of the heap leach operation and assumptions set out in the PEA. In making the forward- looking statements contained in this press release, Cerrado has made certain assumptions. Although Cerrado believes that the expectations reflected in forward-looking statements are reasonable, it can give no assurance that the expectations of any forward-looking statements will prove to be correct. Known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to general business, economic, competitive, political and social uncertainties. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, Cerrado disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward-looking statements or otherwise.

SOURCE: Cerrado Gold Inc.

View the original press release on accesswire.com