Cerrado Gold Announces Resumption of Trading and Provides Update and Full-Year Guidance for Minera Don Nicholas Mine

Cerrado Gold (TSXV:CERT)(OTCQX:CRDOF) announces the resumption of trading on August 8, 2024, and provides updates on its Minera Don Nicholas (MDN) mine in Argentina. Key highlights include:

1. Q2/24 production of 16,255 Gold Equivalent Ounces (GEO)

2. Full-year 2024 guidance: 50,000-60,000 GEO at AISC of US$1,200-1,400/oz

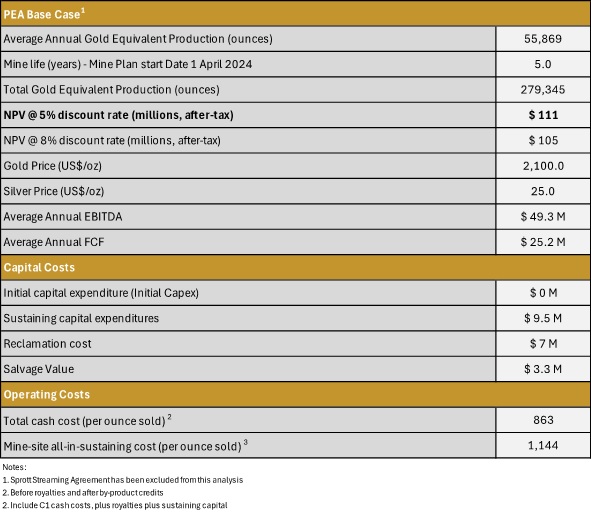

3. Recent PEA results show NPV (5%) of $111MM at $2100/oz gold over a 5-year mine plan

4. Life of Mine Average annual EBITDA of US$49 Million and FCF of US$25 Million

5. Additional US$45 million cash expected from the sale of the Monte do Carmo project in Brazil

The company is focusing on expanding heap leach operations and strengthening its balance sheet through improved operating performance and strong gold prices.

Cerrado Gold (TSXV:CERT)(OTCQX:CRDOF) annuncia la ripresa delle negoziazioni l'8 agosto 2024 e fornisce aggiornamenti sulla sua miniera Minera Don Nicholas (MDN) in Argentina. I principali punti salienti includono:

1. Produzione del Q2/24 di 16.255 once equivalenti d'oro (GEO)

2. Indicazioni per l'intero anno 2024: 50.000-60.000 GEO con AISC di 1.200-1.400 USD/oncia

3. I recenti risultati del PEA mostrano un NPV (5%) di 111 milioni di dollari a 2.100 USD/oncia d'oro su un piano minerario di 5 anni

4. EBITDA medio annuale della vita della miniera di 49 milioni di dollari USA e FCF di 25 milioni di dollari USA

5. Ulteriori 45 milioni di dollari USA in contante previsti dalla vendita del progetto Monte do Carmo in Brasile

L'azienda si concentra sull'espansione delle operazioni di heap leach e sul rafforzamento del proprio bilancio attraverso un miglioramento delle performance operative e forti prezzi dell'oro.

Cerrado Gold (TSXV:CERT)(OTCQX:CRDOF) anuncia la reanudar las operaciones el 8 de agosto de 2024 y proporciona actualizaciones sobre su mina Minera Don Nicholas (MDN) en Argentina. Los puntos destacados incluyen:

1. Producción del Q2/24 de 16,255 Onzas de Equivalente de Oro (GEO)

2. Orientación para el año completo 2024: 50,000-60,000 GEO con AISC de 1,200-1,400 USD/onza

3. Los resultados recientes del PEA muestran un NPV (5%) de 111 millones de dólares a 2,100 USD/onza de oro en un plan de mina de 5 años

4. EBITDA anual promedio de la vida útil de la mina de 49 millones de dólares y FCF de 25 millones de dólares

5. Se esperan 45 millones de dólares en efectivo adicionales de la venta del proyecto Monte do Carmo en Brasil

La empresa se está centrando en expandir las operaciones de lixiviación por pilas y en fortalecer su balance mediante una mejora en el rendimiento operativo y fuertes precios del oro.

Cerrado Gold (TSXV:CERT)(OTCQX:CRDOF)는 2024년 8월 8일에 거래 재개를 발표하고 아르헨티나의 Minera Don Nicholas (MDN) 광산에 대한 업데이트를 제공합니다. 주요 사항은 다음과 같습니다:

1. 2024년 2분기 생산량: 16,255 골드 동등 온스 (GEO)

2. 2024년 전체 연도 목표: 50,000-60,000 GEO 및 AISC 1,200-1,400 USD/온스

3. 최근 PEA 결과는 5년 광산 계획에서 2,100 USD/온스 금 기준으로 NPV (5%)가 1억 1,100만 달러임을 보여줍니다.

4. 광산 평균 연간 EBITDA는 4,900만 달러 및 FCF는 2,500만 달러입니다.

5. 브라질의 Monte do Carmo 프로젝트 매각에서 추가로 4,500만 달러 현금이 예상됩니다.

회사는 힙 리치 운영 확장과 운영 성과 개선 및 강력한 금 가격을 통해 재무 건전성을 강화하는 데 집중하고 있습니다.

Cerrado Gold (TSXV:CERT)(OTCQX:CRDOF) annonce la reprise des échanges le 8 août 2024 et fournit des mises à jour sur sa mine Minera Don Nicholas (MDN) en Argentine. Les points clés incluent :

1. Production du T2/24 de 16 255 Onces d'Équivalent Or (GEO)

2. Prévision pour l'année 2024 : 50 000-60 000 GEO avec AISC de 1 200-1 400 USD/onze

3. Les résultats récents du PEA montrent un NPV (5%) de 111 millions USD à 2 100 USD/onze d'or sur un plan minier de 5 ans

4. EBITDA moyen annuel sur la durée de vie de la mine de 49 millions USD et FCF de 25 millions USD

5. 45 millions USD en espèces supplémentaires attendus de la vente du projet Monte do Carmo au Brésil

L'entreprise se concentre sur l'expansion des opérations de lixiviation en tas et sur le renforcement de son bilan grâce à de meilleures performances opérationnelles et des prix de l'or élevés.

Cerrado Gold (TSXV:CERT)(OTCQX:CRDOF) gibt die Wiederaufnahme des Handels am 8. August 2024 bekannt und informiert über sein Minera Don Nicholas (MDN) Bergwerk in Argentinien. Die wichtigsten Highlights sind:

1. Produktion im Q2/24 von 16.255 Goldäquivalent-Ounzen (GEO)

2. Jahresprognose 2024: 50.000-60.000 GEO bei AISC von 1.200-1.400 USD/Unze

3. Die neuesten PEA-Ergebnisse zeigen einen NPV (5%) von 111 Millionen USD bei 2.100 USD/Unze Gold über einen 5-Jahres-Minenplan

4. Lebenslang durchschnittliches jährliches EBITDA von 49 Millionen USD und FCF von 25 Millionen USD

5. Zusätzliche 45 Millionen USD in bar, die durch den Verkauf des Projekts Monte do Carmo in Brasilien erwartet werden

Das Unternehmen konzentriert sich darauf, die Heap-Leach-Operationen auszubauen und seine Bilanz durch verbesserte Betriebsleistungen und starke Goldpreise zu stärken.

- Q2/24 production of 16,255 Gold Equivalent Ounces (GEO)

- Full-year 2024 guidance of 50,000-60,000 GEO at AISC of US$1,200-1,400/oz

- PEA results show NPV (5%) of $111MM at $2100/oz gold over a 5-year mine plan

- Life of Mine Average annual EBITDA of US$49 Million and FCF of US$25 Million

- Additional US$45 million cash expected from the sale of the Monte do Carmo project

- Second crusher being commissioned to support expansion of heap leach operations

- Operating cashflow supporting the strengthening of the balance sheet

- Material reduction expected in negative working capital position

- Challenging winter period for operations

- High-grade material from Calandrias Norte pit is being exhausted

Common shares to resume trading at the opening on August 8th, 2024

MDN operations are performing well with Q2/24 production of 16,255 Gold Equivalent Ounces ("GEO")

Full-Year production guidance of 50,000 - 60,000 GEO at AISC of US

$1,200 -1,400/ozRecent PEA results for MDN show an NPV (

5% ) of$111M M at$210 0/oz gold over a 5-year mine plan producing an average of approximately 56,000 GEO per annumLife of Mine Average annual EBITDA of US

$49 Million and FCF of US$25 Million LOM average EBITDA of US

$64 Million and FCF of US$29 Million at Spot prices1

Additional US

$45 million cash expected between March 2025-2027 from the sale of the Monte do Carmo project in BrazilSecond crusher on site is being commissioned to support further expansion of heap leach operations

Operating cashflow continues to support the strengthening of the balance sheet

TORONTO, ON / ACCESSWIRE / August 7, 2024 / Cerrado Gold Inc. (TSXV:CERT)(OTCQX:CRDOF) ("Cerrado" or the "Company") is pleased to announce that further to its news release of June 27, 2024, the Company has been advised by the TSX Venture Exchange (the "Exchange") that trading of the Company's common shares on the Exchange will resume at the opening of the market on August 8, 2024.

Further, as previously released on July 17, 2024, the Company is pleased to announce that operations at its wholly-owned Minera Don Nicolas project in Argentina continue to perform well during a typically challenging winter period. As previously announced, production for Q2 was 16,255 Gold Equivalent Ounces ("GEO") as production from the heap leach continues to perform well. A second crusher has now arrived at site and will be installed to support a further expansion of capacity at the Calandrias Sur heap leach operation.

First half of 2024, production of 27,459 GEO has been achieved. The Company is guiding for 2024 total production of between 50,000-60,000 GEO at an All-In-Sustaining Cost between US

Improved operating performance and ongoing strength in gold prices continue to support the repayment of local debt and payables in Argentina, and we expect to see a material reduction in our negative working capital position going forward.

In addition, as outlined in a press release dated August 6th, 2024, Cerrado announced the results of an NI 43-101 Preliminary Economic Assessment ("PEA") and an updated Mineral Resource Estimate ("MRE") for its Minera Don Nicolas mine located in Santa Cruz Province, Argentina. The work was completed by GeoEstima SpA (Chile), and a summary of the results is presented below.

PEA Summary Results

The PEA highlights a robust 5-year mine life using our current inventory of mineralized material. As high-grade material from our Calandrias Norte pit is exhausted, the heap leach at Calandrias Sur and a second potential heap leach at Martinetas will generate strong cashflows, allowing the Company to support continued deleveraging while refocusing efforts on exploration to add additional high-grade ounces to the mine plan, support underground development and expand the life of mine.

Mark Brennan, CEO and Chairman commented, "With operations performing well, the heap leach hitting its stride and trading resuming in our shares, we are now putting behind us what has been a very challenging period for the Company. Going forward, strong operating results leading to an improved financial position as supported by our recently completed PEA for MDN, and the potential for additional cash proceeds of US

About Cerrado

Cerrado Gold is a Toronto-based gold production, development, and exploration company focused on gold projects in South America. The Company is the

In Argentina, Cerrado is maximizing asset value at its Minera Don Nicolas operation through continued operational optimization and is growing production through its operations at the Las Calandrias Heap Leach project. An extensive campaign of exploration is ongoing to further unlock potential resources in our highly prospective land package in the heart of the Deseado Masiff.

In Canada, Cerrado holds a

For more information about Cerrado please visit our website at: www.cerradogold.com.

Mark Brennan

CEO and Chairman

Mike McAllister

Vice President, Investor Relations

Tel: +1-647-805-5662

mmcallister@cerradogold.com

Disclaimer

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

This press release contains statements that constitute "forward-looking information" (collectively, "forward-looking statements") within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements contained in this press release include, without limitation, statements regarding the business and operations of Cerrado, the trading date for the Company's common shares on the TSX Venture Exchange, the performance of the Minera Don Nicolas mine including management guidance in respect of production and costs, the strength of the price of gold, repayment of debt and working capital, the anticipated date of release of Q2 financial statements and the receipt of funds related to the sale of the Monte Do Carmo project In making the forward- ooking statements contained in this press release, Cerrado has made certain assumptions. Although Cerrado believes that the expectations reflected in forward-looking statements are reasonable, it can give no assurance that the expectations of any forward-looking statements will prove to be correct. Known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to general business, economic, competitive, political and social uncertainties. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, Cerrado disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward-looking statements or otherwise

SOURCE: Cerrado Gold Inc.

View the original press release on accesswire.com