Cerrado Gold Announces Q3 Gold Production Results For Its Minera Don Nicolas Mine In Argentina

Cerrado Gold Inc. (TSX.V:CERT, OTCQX:CRDOF) has announced its Q3 2024 production results for the Minera Don Nicolas Mine in Argentina. Key highlights include:

Q3 Production of 16,604 Gold Equivalent Ounces (GEO), slightly up from 16,255 GEO in Q2 and significantly higher than 11,204 in Q1, 2024. The Calandrias Norte high-grade ore was supplemented by additional pits, extending CIL operation into 2025. Heap leach operations produced 3,404 GEO during the quarter, with a record of 1,644 GEO in August.

The company's balance sheet has improved, with approximately US$12m in current liabilities repaid since March 2024. Cerrado is focusing on doubling crushing capacity at Calandrias Sur and aiming to increase heap leach production to 4,500 GEO per month. The installation of a new secondary crusher is expected by the end of Q4, which should reduce fleet and operating costs.

Cerrado Gold Inc. (TSX.V:CERT, OTCQX:CRDOF) ha annunciato i risultati di produzione del terzo trimestre 2024 per la Minera Don Nicolas in Argentina. I principali punti salienti includono:

Produzione del terzo trimestre di 16.604 once d'oro equivalenti (GEO), leggermente superiore a 16.255 GEO nel secondo trimestre e significativamente più alta rispetto a 11.204 nel primo trimestre del 2024. Il minerale ad alta legge di Calandrias Norte è stato integrato da ulteriori pozzi, estendendo l'operazione di CIL nel 2025. Le operazioni di leaching in pila hanno prodotto 3.404 GEO durante il trimestre, con un record di 1.644 GEO in agosto.

Il bilancio dell'azienda è migliorato, con circa 12 milioni di dollari statunitensi di passività correnti rimborsate da marzo 2024. Cerrado si sta concentrando sul raddoppio della capacità di frantumazione a Calandrias Sur e mira ad aumentare la produzione di leaching in pila a 4.500 GEO al mese. L'installazione di un nuovo frantoio secondario è prevista entro la fine del quarto trimestre, il che dovrebbe ridurre i costi di flotta e operativi.

Cerrado Gold Inc. (TSX.V:CERT, OTCQX:CRDOF) ha anunciado sus resultados de producción del tercer trimestre de 2024 para la Minera Don Nicolás en Argentina. Los puntos destacados incluyen:

Producción del tercer trimestre de 16.604 onzas equivalentes de oro (GEO), ligeramente superior a las 16.255 GEO en el segundo trimestre y significativamente más alta que las 11.204 en el primer trimestre de 2024. El mineral de alta ley de Calandrias Norte fue complementado por pozos adicionales, extendiendo la operación de CIL hasta 2025. Las operaciones de lixiviación en pilas produjeron 3.404 GEO durante el trimestre, con un récord de 1.644 GEO en agosto.

El balance de la empresa ha mejorado, con aproximadamente 12 millones de dólares estadounidenses en pasivos corrientes pagados desde marzo de 2024. Cerrado se enfoca en duplicar la capacidad de trituración en Calandrias Sur y tiene como objetivo aumentar la producción de lixiviación en pilas a 4.500 GEO por mes. Se espera la instalación de una nueva trituradora secundaria para finales del cuarto trimestre, lo que debería reducir los costos de flota y operativos.

Cerrado Gold Inc. (TSX.V:CERT, OTCQX:CRDOF)는 아르헨티나의 Minera Don Nicolás 광산에 대한 2024년 3분기 생산 결과를 발표했습니다. 주요 하이라이트는 다음과 같습니다:

3분기 금 환산 온스(GEO) 16,604온스 생산, 2분기 16,255 GEO에서 약간 상승했으며, 2024년 1분기 11,204 GEO보다 상당히 높습니다. Calandrias Norte의 고급 광석은 추가 구덩이로 보완되어 2025년까지 CIL 운영이 연장되었습니다. Heap leach 작업은 분기 동안 3,404 GEO를 생산했으며, 8월에는 1,644 GEO의 기록을 세웠습니다.

회사의 재무 상태가 개선되었습니다, 2024년 3월 이후 약 1,200만 달러의 현재 부채가 상환되었습니다. Cerrado는 Calandrias Sur에서 파쇄 능력을 두 배로 늘리는 데 집중하고 있으며, heap leach 생산을 월 4,500 GEO로 늘릴 계획입니다. 새로운 보조 분쇄기가 4분기 말까지 설치될 예정이며, 이는 차량 및 운영 비용을 줄이는 데 도움이 될 것입니다.

Cerrado Gold Inc. (TSX.V:CERT, OTCQX:CRDOF) a annoncé ses résultats de production du troisième trimestre 2024 pour la mine Minera Don Nicolás en Argentine. Les principaux points à retenir incluent :

Production du troisième trimestre de 16 604 onces d'or équivalentes (GEO), légèrement en hausse par rapport à 16 255 GEO au deuxième trimestre et nettement supérieur aux 11 204 du premier trimestre 2024. Le minerai de haute qualité de Calandrias Norte a été complété par des fosses supplémentaires, prolongeant l'opération CIL jusqu'en 2025. Les opérations de lixiviation en tas ont produit 3 404 GEO au cours du trimestre, avec un record de 1 644 GEO en août.

Le bilan de l'entreprise s'est amélioré, avec environ 12 millions de dollars américains de passifs courants remboursés depuis mars 2024. Cerrado se concentre sur le doublement de la capacité de concassage à Calandrias Sur et vise à augmenter la production de lixiviation en tas à 4 500 GEO par mois. L'installation d'un nouveau concasseur secondaire est prévue d'ici la fin du quatrième trimestre, ce qui devrait réduire les coûts de flotte et d'exploitation.

Cerrado Gold Inc. (TSX.V:CERT, OTCQX:CRDOF) hat die Produktionszahlen für das dritte Quartal 2024 für die Minera Don Nicolás Mine in Argentinien bekannt gegeben. Zu den wichtigsten Punkten gehören:

Produktion im dritten Quartal von 16.604 Goldäquivalent-Unzen (GEO), leicht gestiegen von 16.255 GEO im zweiten Quartal und deutlich höher als 11.204 im ersten Quartal 2024. Das hochgradige Erz von Calandrias Norte wurde durch zusätzliche Gruben ergänzt, wodurch der CIL-Betrieb bis 2025 verlängert wird. Die Heap-Leach-Operationen produzierten im Quartal 3.404 GEO, mit einem Rekord von 1.644 GEO im August.

Die Bilanz des Unternehmens hat sich verbessert, da seit März 2024 etwa 12 Millionen US-Dollar an kurzfristigen Verbindlichkeiten zurückgezahlt wurden. Cerrado konzentriert sich darauf, die Zerkleinerungskapazität in Calandrias Sur zu verdoppeln, und strebt an, die Heap-Leach-Produktion auf 4.500 GEO pro Monat zu steigern. Die Installation einer neuen sekundären Brechanlage wird bis Ende des vierten Quartals erwartet, was die Flotten- und Betriebskosten senken sollte.

- Q3 production increased to 16,604 GEO, up from 16,255 GEO in Q2 and 11,204 in Q1 2024

- Heap leach operations produced 3,404 GEO in Q3, with a record 1,644 GEO in August

- Current liabilities reduced by approximately US$12 million since March 2024

- CIL plant operation extended into 2025 with additional high-grade ore sources

- New secondary crusher expected to double crushing capacity and reduce operating costs

- Calandrias Norte high-grade open pit ore was exhausted

- Slight decline in heap leach production in September due to adjustments for expansion

Q3 Production of 16,604 Gold Equivalent Ounces ("GEO") vs 16,255 GEO in Q2 and 11,204 in Q1, 2024.

Calandrias Norte high-grade ore supplemented by additional pits extending CIL operation into 2025.

Production of 3,404, GEO from Heap leach operations during the quarter with a record of 1,644 GEO in August.

Balance sheet continues to improve, with approximately US

$12m in current liabilities repaid since March 2024.

TORONTO, ON / ACCESSWIRE / October 16, 2024 / Cerrado Gold Inc. [TSX.V:CERT][OTCQX:CRDOF] ("Cerrado" or the "Company") announces production results for the third quarter ended September, 2024 ("Q3 2024") from the Minera Don Nicolas Mine in Santa Cruz Province, Argentina ("MDN"). Full third quarter financial results are expected to be released in November 2024.

Q3 Operating Highlights

Q3 Production of 16,604 GEO vs 16,255 GEO in Q2 and 11,204 in Q1, 2024.

Choique and Zorro pits supplemented CIL feed from Calandrias Norte during the quarter. CIL plant will continue operating until the end of January 2025.

Focus remains on doubling up crushing capacity at Calandrias Sur and bringing heap leach production up to 4,500 GEO per month.

Operational results for Q3 2024 demonstrated a slight increase in production over the the previous quarter, highlighting stabilized operations. Ore from the Calandrias Norte high-grade open pit was exhausted but replaced by additional high-grade feed from two additional pits. In addition, the ramp up of heap leach operations continued to improve as crushing capacity continued to climb with record production of 1,644 GEO in August before a slight decline in September as some adjustments were put in place to support the overall expansion of the facilities. The performance of the Heap leach continues to depend on the crushing circuit. To maintain production rates until an additional crushing circuit is installed, two mobile crushers were added, resulting in a total crushing capacity of 300,000 tons per month. The design of a new crushing circuit is complete, and a secondary crusher has been ordered. The secondary crusher will double the capacity with a single crushing circuit supporting the ramp up in production from the heap leach operations. The installation of the secondary crusher is expected to reduce fleet and operating costs. The new circuit is expected to operate by the end of the 4th quarter, at which time the mobile crushers will be placed on stand by. Recovery rates are in line with expectations given ore on the pad to date.

The Company has also continued to make progress in improving its working capital position during the quarter, partly due to the cashflow generated by high gold prices and strong production. At quarter end, the Company's total current liabilities (including payables, loans, and amounts due to the Sellers) have been reduced by approximately US

Mark Brennan, CEO and Chairman commented, "Production in the third quarter remained strong over the second quarter owing to additional high-grade feed to the CIL as well as increasing production from the heap leach facility. As crushing performance continues to improve, we expect to see heap leach production continue its upward trajectory towards the targeted 4,500 GEO per month with a commiserate reduction in operating costs."

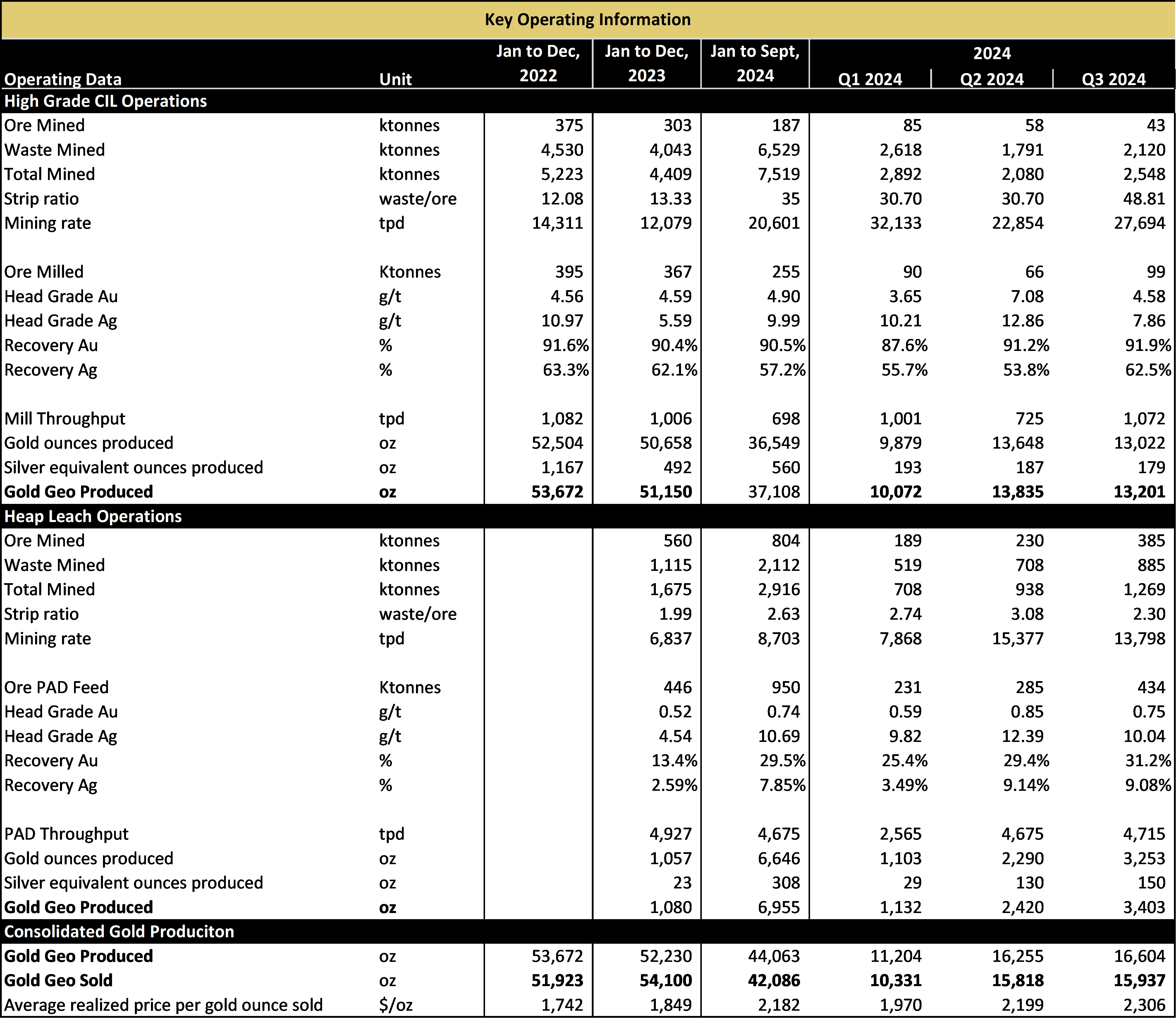

Table 1. Key Operating Information

Review of Technical Information

The scientific and technical information in this press release has been reviewed and approved by Sergio Gelcich, P.Geo., Vice President, Exploration for Cerrado Gold Inc., who is a Qualified Person as defined in National Instrument 43-101.

About Cerrado

Cerrado Gold is a Toronto-based gold production, development, and exploration company focused on gold projects in South America. The Company is the

In Argentina, Cerrado is maximizing asset value at its Minera Don Nicolas operation through continued operational optimization and is growing production through its operations at the Las Calandrias Heap Leach project. An extensive campaign of exploration is ongoing to further unlock potential resources in our highly prospective land package in the heart of the Deseado Masiff.

In Canada, Cerrado holds a

For more information about Cerrado please visit our website at: www.cerradogold.com.

Mark Brennan

CEO and Chairman

Mike McAllister

Vice President, Investor Relations

Tel: +1-647-805-5662

mmcallister@cerradogold.com

Disclaimer

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

This press release contains statements that constitute "forward-looking information" (collectively, "forward-looking statements") within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements contained in this press release include, without limitation, statements regarding the business and operations of Cerrado, the potential for additional crushing capacity that may be added, the performance of the heap leach pad, CIL plant life extension, anticipated production in Q4 2024 and anticipated strengthening of the Company's financial position. In making the forward- looking statements contained in this press release, Cerrado has made certain assumptions. Although Cerrado believes that the expectations reflected in forward-looking statements are reasonable, it can give no assurance that the expectations of any forward-looking statements will prove to be correct. Known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to general business, economic, competitive, political and social uncertainties. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, Cerrado disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward-looking statements or otherwise.

SOURCE: Cerrado Gold Inc.

View the original press release on accesswire.com