Canagold Drilling Reports Two Highest Grade Drill Results of 54 Hole Program Including 13.6 gpt Gold over 25.1 m Length and 34.4 gpt over 6.6 m Length at New Polaris Project, BC

Canagold Resources Ltd. announced significant gold assay results from its New Polaris Gold project in British Columbia. The final results from the 30,000-meter drill program revealed 34.4 gpt gold over 6.6 meters and 13.6 gpt gold over 25.1 meters, marking the best results of the program. The company plans to upgrade Inferred Resources to Indicated Resources, enhancing shareholder value. These results bolster confidence in the ongoing exploration efforts, with drilling set to resume in summer 2022.

- 34.4 gpt gold over 6.6 m and 13.6 gpt gold over 25.1 m reported, marking significant assay results.

- The results exceeded expectations, showcasing potential for increased shareholder value.

- The infill drill program aims to upgrade Inferred to Indicated Resources for future feasibility studies.

- None.

VANCOUVER, BC / ACCESSWIRE / June 28, 2022 / Canagold Resources Ltd. (TSX:CCM)(OTCQB:CRCUF)(Frankfurt:CANA) announces sample assay results from four more drill holes from the expanded drill program at its

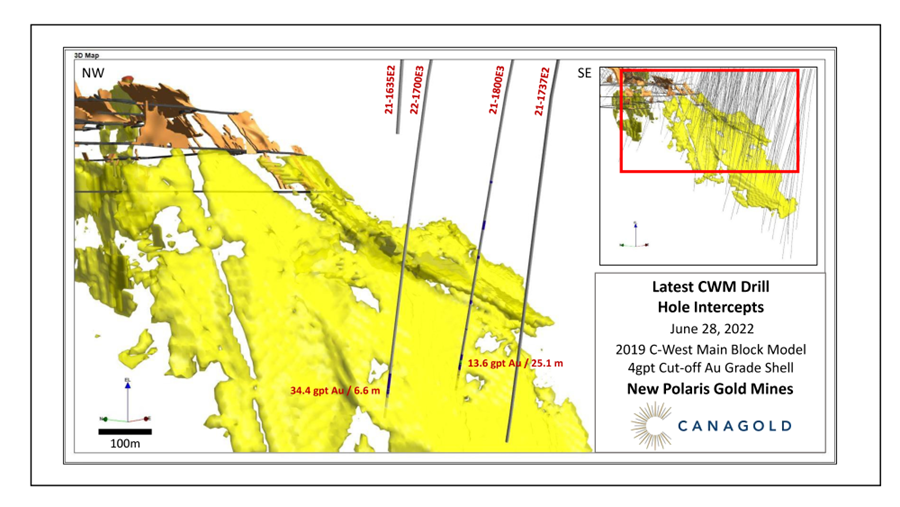

Two of the drill holes returned significant intercepts of gold mineralization in the C-West Main ("CWM"). These are the final results from the 54 hole, 30,000 meter ("m") drill program completed at the end of February 2022. Gold was analyzed by metallic screen fire assay method due to the presence of visible gold observed during geological logging of the drill core.

Highlights :

- 34.4 grams per tonne ("gpt") gold ("Au") over 6.6 m from 362.7 m down hole in Hole 21-1700E3

- Including 646 gpt Au over 0.3 m from 367.1 m

- 17.0 gpt Au over 9.0 m from 362.1 m, in Hole 21-1800E3

- Including 33.2 gpt Au over 3.0 m from 363.1 m, and

- 37.2 gpt Au over 5.0 m from 382.2 m in Hole 21-1800E3

- Including 66.8 gpt over 2.5 m from 383.2 m

- 13.6 gpt Au over 25.1 m from 362.1 m combined interval in Hole 21-1800E3

Scott Eldridge, Canagold CEO, said, "Today's result of 13.6 gpt gold over 25.1 metres is the best drill intercept of the entire 30,000 metre, 54 hole program. In addition, the 34.4 gpt gold over 6.6 metres is the second-best drill result of the program. We continue to see visible gold in selected intervals, including the highest single gold sample result ever on the property at 646 grams per tonne gold. Today's intercept length of a combined 25.1 meters also marks the longest mineralized interval ever on the project. In totality, the results of the recently completed drill program have exceeded our expectations and clearly show we can unlock much more shareholder value at New Polaris as we continue to de-risk the asset."

Bradford Cooke, Canagold Chairman and Founder, commented, " Results like those reported today are exactly why shareholders should vote in favour of the Company's board nominees at the upcoming AGM on July 19, 2022. We laid out a stepwise program to systematically upgrade and expand the resources, in advance of a new resource estimate, an interim economic study and a feasibility study, and these results certainly support that approach. Your management and board are dedicated to unfolding the full potential of the New Polaris gold mine project for the benefit of the Company and ALL of the shareholders, not just ONE shareholder."

Top 10 Gold Mineralized Intercepts From 30,000m Drill Program:

Hole-ID | From (m) | To (m) | Length (m) | Au (gpt) | Vein |

21-1800E3 | 362.1 | 387.2 | 25.1 | 13.6 | CWM |

21-1700E3 | 362.7 | 369.3 | 6.6 | 34.4 | CWM |

21-1783E2 | 378.0 | 391.0 | 13.0 | 15.8 | CWM |

21-1905E2 | 380.9 | 398.7 | 17.8 | 11.1 | C10 |

21-1783E1 | 323.0 | 329.6 | 6.6 | 24.2 | CWM |

21-1890E1 | 343.0 | 351.4 | 8.4 | 17.1 | C10 |

22-1844E2W1A | 679.8 | 698.4 | 18.6 | 7.54 | Unnamed |

21-1783E5 | 433.6 | 437.5 | 3.9 | 30.8 | CWM |

22-1844E2W2A | 453.2 | 475.8 | 22.6 | 5.27 | C10 |

21-1750E1 | 299.0 | 308.0 | 9.0 | 12.0 | CWM |

Further Details of Current Results:

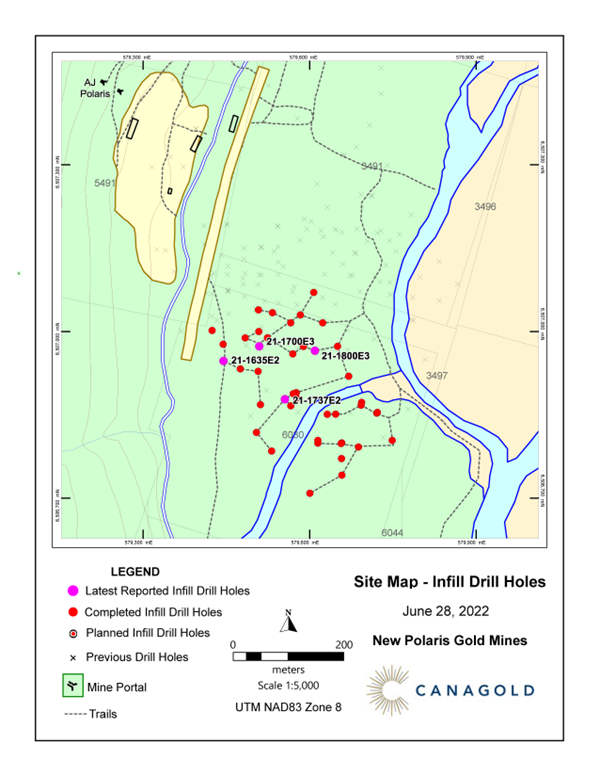

The two other drill holes (21-1635E2 and 21-1737E2) were abandoned before reaching target depth due to drilling difficulties and three other holes did not intersect the C-West Main ("CWM") mineralized zone at the expected depth or with any significant assay results. The intended target areas for the abandoned holes were adequately covered by other infill drilling later in the program.

Detailed information for the four drill holes and the sample assay results and mineralized intercepts are provided in Table 1 and Table 2 below.

The infill drill program was completed by the end of February 2022 for a total of 30,000 m in 54 drill holes. Assay results have now been received for all 52 holes in which sampling was undertaken. The samples collected from the mineralized zone in all of those holes were submitted to the ALS Geochemistry lab in Whitehorse, YT for gold analysis. No samples were taken from the two abandoned drill holes. Drilling equipment is being stored on site ready for the start of the next drilling campaign in the summer of 2022.

Infill Holes to Upgrade Inferred Resources to Indicated Resources

The current drill program is designed primarily to in-fill drill the Inferred Resources of the CWM vein system within the currently defined resources in the PEA*. The infill drill holes range in depth from 300 to 650 m and are designed to provide greater density of drill intercepts (20 - 25 m spacing) in areas of Inferred Resources between 150 and 600 m below surface. The improved drill density will be used to upgrade parts of the Inferred Resources to Indicated Resources for inclusion in a future feasibility study.

*The New Polaris resource is contained within a preliminary economic assessment ("PEA") report which was prepared by Moose Mountain Technical Services in the format prescribed by NI43-101 Standards of Disclosure for Mineral Projects, and filed on Sedar April 18, 2019.

New Polaris Overview

Canagold's flagship asset is the

The New Polaris gold deposit is an early Tertiary, mesothermal gold-bearing vein system occupying shear zones cross-cutting late Paleozoic andesitic volcanic rocks. It was mined by underground methods from 1938 to 1942, and again from 1946 to early 1951, producing approximately 245,000 oz gold from 740,000 tonnes of ore at an average grade of 10.3 gpt gold. Three main veins ("AB, C and Y") were mined to a maximum depth of 150 m and have been traced by drilling for up to 1,000 m along strike and up to 800 m down dip, still open for expansion. The gold occurs dominantly in finely disseminated arsenopyrite within quartz-carbonate stock-work veins and altered wall-rocks. Individual mineralized zones extend up to 250 meters in length and 14 meters in width. Average widths more commonly range from 2 to 5 meters.

Qualified Person

Garry Biles, P.Eng, President & COO for Canagold Resources Ltd, is the Qualified Person who reviewed and approved the contents of this news release.

Drill Core Sampling and Quality Assurance - Quality Control Program

Drill core is geologically logged to identify the gold mineralized zones that are allocated unique sample number tickets and marked for cutting using a purpose-built diamond blade rock saw. Half core samples are collected in labelled bags and the other half remains in the original core box stored on site. Quality control (QC) samples including certified reference material standards, blanks and duplicates are inserted into the sample sequence at intervals of one in ten on a rotating basis to monitor laboratory performance and provide quality assurance (QA) of the assay results. Several sample bags are transported together in rice bags with unique numbered security tags attached and labelled with Company and lab contact information to ensure sample security and chain of custody during shipment to the lab.

The samples are submitted to the ALS Geochemistry lab in Whitehorse, YT for preparation and assaying. The entire sample is crushed to

"Scott Eldridge"

____________________

Scott Eldridge, Chief Executive Officer

CANAGOLD RESOURCES LTD.

About Canagold - Canagold Resources Ltd. is a growth-oriented gold exploration company focused on generating superior shareholder returns by discovering, exploring and developing strategic gold deposits in North America. Canagold shares trade on the TSX: CCM and the OTCQB: CRCUF.

For More Information - Please contact: Knox Henderson, VP Corporate Development

Toll Free: 1-877-684-9700 Tel: (604) 604-416-0337 Cell: (604) 551-2360

Email: knox@canagoldresources.com Website: www.canagoldresources.com

Cautionary Note Regarding Forward-Looking Statements

This news release contains "forward-looking statements" within the meaning of the United States private securities litigation reform act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities legislation. Statements contained in this news release that are not historical facts are forward-looking information that involves known and unknown risks and uncertainties. Forward-looking statements in this news release include, but are not limited to, statements with respect to the future performance of Canagold, and the Company's plans and exploration programs for its mineral properties, including the timing of such plans and programs. In certain cases, forward-looking statements can be identified by the use of words such as "plans", "has proven", "expects" or "does not expect", "is expected", "potential", "appears", "budget", "scheduled", "estimates", "forecasts", "at least", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "should", "might" or "will be taken", "occur" or "be achieved".

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such risks and other factors include, among others risks related to the uncertainties inherent in the estimation of mineral resources; commodity prices; changes in general economic conditions; market sentiment; currency exchange rates; the Company's ability to continue as a going concern; the Company's ability to raise funds through equity financings; risks inherent in mineral exploration; risks related to operations in foreign countries; future prices of metals; failure of equipment or processes to operate as anticipated; accidents, labor disputes and other risks of the mining industry; delays in obtaining governmental approvals; government regulation of mining operations; environmental risks; title disputes or claims; limitations on insurance coverage and the timing and possible outcome of litigation. Although the Company has attempted to identify important factors that could affect the Company and may cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, do not place undue reliance on forward-looking statements. All statements are made as of the date of this news release and the Company is under no obligation to update or alter any forward-looking statements except as required under applicable securities laws.

Table 1: Drill Hole Collar Information

Hole ID | Mine East (m) | Mine North (m) | Elevation (m) | Dip (°) | Azimuth (°) | Final Depth (m) |

21-1635E2* | 1635.0 | 670.0 | 21.6 | -78 | 348 | 116 |

21-1737E2* | 1744.1 | 598.7 | 18.6 | -79 | 357 | 401 |

21-1700E3 | 1700.0 | 700.0 | 21.9 | -78 | 342 | 401 |

21-1800E3 | 1800.0 | 685.0 | 20.0 | -78 | 348 | 404 |

* Abandoned.

Table 2: Drill Core Sample Results Details

Hole ID | From (m) | To (m) | Length (m) | Au (gpt) |

21-1700E3 | 362.7 | 363.7 | 1.0 | 2.64 |

21-1700E3 | 363.7 | 365.5 | 1.8 | 0.21 |

21-1700E3 | 365.5 | 366.5 | 1.0 | 0.67 |

21-1700E3 | 366.5 | 367.1 | 0.6 | 35.4 |

21-1700E3 | 367.1 | 367.4 | 0.3 | 646 |

21-1700E3 | 367.4 | 367.8 | 0.4 | 4.80 |

21-1700E3 | 367.8 | 368.0 | 0.2 | 0.15 |

21-1700E3 | 368.0 | 369.0 | 1.0 | 0.19 |

21-1700E3 | 369.0 | 369.3 | 0.3 | 21.1 |

21-1700E3 | 362.7 | 369.3 | 6.6 [4.8] | 34.4 |

21-1800E3 | 362.1 | 363.1 | 1.0 | 17.1 |

21-1800E3 | 363.1 | 364.1 | 1.0 | 43.3 |

21-1800E3 | 364.1 | 365.1 | 1.0 | 27.5 |

21-1800E3 | 365.1 | 366.1 | 1.0 | 28.9 |

21-1800E3 | 366.1 | 367.1 | 1.0 | 6.45 |

21-1800E3 | 367.1 | 368.2 | 1.1 | 25.1 |

21-1800E3 | 368.2 | 369.2 | 0.98 | 0.67 |

21-1800E3 | 369.2 | 370.2 | 1.0 | 1.90 |

21-1800E3 | 370.2 | 371.2 | 1.0 | 1.08 |

21-1800E3 | 371.2 | 372.2 | 1.0 | 0.03 |

21-1800E3 | 372.2 | 373.7 | 1.5 | 0.03 |

21-1800E3 | 373.7 | 375.1 | 1.4 | 0.03 |

21-1800E3 | 375.1 | 376.0 | 0.9 | 0.03 |

21-1800E3 | 376.0 | 377.0 | 1.0 | 0.03 |

21-1800E3 | 377.0 | 378.0 | 1.0 | 0.10 |

21-1800E3 | 378.0 | 379.0 | 1.0 | 0.03 |

21-1800E3 | 380.0 | 381.1 | 1.1 | 0.68 |

21-1800E3 | 381.1 | 382.2 | 1.1 | 0.03 |

21-1800E3 | 382.2 | 383.2 | 1.0 | 7.60 |

21-1800E3 | 383.2 | 383.8 | 0.6 | 64.6 |

21-1800E3 | 383.8 | 384.8 | 1.0 | 35.8 |

21-1800E3 | 384.8 | 385.7 | 0.9 | 102 |

21-1800E3 | 385.7 | 386.2 | 0.5 | 9.85 |

21-1800E3 | 386.2 | 387.2 | 1.0 | 3.41 |

21-1800E3 | 362.1 | 387.2 | 25.1 [19.1] | 13.6 |

Composites were calculated from length weighted Au sample interval results. Grade capping and cut-off have not been applied.

SOURCE: Canagold Resources Ltd.

View source version on accesswire.com:

https://www.accesswire.com/706770/Canagold-Drilling-Reports-Two-Highest-Grade-Drill-Results-of-54-Hole-Program-Including-136-gpt-Gold-over-251-m-Length-and-344-gpt-over-66-m-Length-at-New-Polaris-Project-BC

FAQ

What are the latest gold assay results from Canagold Resources Ltd.?

How many drill holes were included in the New Polaris Gold project results?

What does the New Polaris Gold project aim to achieve with current drilling?

When will the next drilling campaign at New Polaris start?