ConnectM Releases Preliminary Third Quarter 2024 Results & Details Significant Operational Progress

ConnectM Technology Solutions (NASDAQ: CNTM) announced preliminary Q3 2024 results, reporting revenue of $6.1 million, a 36% increase year-over-year. Nine-month revenue grew 11% to $17.3 million. The company projects FY2024 revenue to exceed $24 million, marking a 20% YoY increase. Key achievements include amending Forward Stock Purchase agreement, resulting in a $26.1 million increase in Stockholder Equity, converting $13.7 million of debt to equity at $2.00 per share, launching an AI-powered heat pump, and acquiring DeliveryCircle. The company expects to achieve operating cash flow breakeven in Q1 2025.

ConnectM Technology Solutions (NASDAQ: CNTM) ha annunciato i risultati preliminari del terzo trimestre 2024, riportando ricavi di 6,1 milioni di dollari, con un incremento del 36% rispetto all'anno precedente. I ricavi nei nove mesi sono cresciuti dell'11% raggiungendo 17,3 milioni di dollari. L'azienda prevede che i ricavi per l'intero anno 2024 supereranno 24 milioni di dollari, segnando un incremento del 20% anno su anno. Tra i traguardi chiave vi sono la modifica dell'accordo di acquisto delle azioni, che ha portato a un aumento di 26,1 milioni di dollari nel patrimonio netto degli azionisti, la conversione di 13,7 milioni di dollari di debito in azioni a 2,00 dollari per azione, il lancio di una pompa di calore alimentata da AI, e l'acquisizione di DeliveryCircle. L'azienda prevede di raggiungere il pareggio in flusso di cassa operativo nel primo trimestre del 2025.

ConnectM Technology Solutions (NASDAQ: CNTM) anunció resultados preliminares del tercer trimestre de 2024, reportando ingresos de 6.1 millones de dólares, un aumento del 36% en comparación con el año anterior. Los ingresos acumulados en los nueve meses crecieron un 11% alcanzando 17.3 millones de dólares. La compañía proyecta que los ingresos del año fiscal 2024 superen 24 millones de dólares, marcando un aumento del 20% interanual. Entre los logros clave se incluye la modificación del acuerdo de compra de acciones, lo que resultó en un aumento de 26.1 millones de dólares en el patrimonio de los accionistas, convirtiendo 13.7 millones de dólares de deuda en capital a 2.00 dólares por acción, el lanzamiento de una bomba de calor impulsada por IA, y la adquisición de DeliveryCircle. La compañía espera alcanzar el equilibrio en flujo de efectivo operativo en el primer trimestre de 2025.

ConnectM Technology Solutions (NASDAQ: CNTM)가 2024년 3분기 예비 결과를 발표했으며, 610만 달러의 수익을 보고하여 전년 대비 36% 증가했습니다. 9개월 누적 수익은 1730만 달러로 11% 성장했습니다. 회사는 2024 회계연도 수익이 2400만 달러를 초과할 것으로 전망하며, 이는 전년 대비 20% 증가하는 수치입니다. 주요 성과로는 유상증자 계약 수정, 주주 자본이 2610만 달러 증가하는 결과, 1370만 달러의 부채를 주당 2.00 달러로 자본으로 전환, AI 기반 열 펌프 출시 및 DeliveryCircle 인수 등이 있습니다. 회사는 2025년 1분기에 운영 현금 흐름 손익 분기점을 달성할 것으로 기대하고 있습니다.

ConnectM Technology Solutions (NASDAQ: CNTM) a annoncé les résultats préliminaires du troisième trimestre 2024, rapportant des revenus de 6,1 millions de dollars, soit une augmentation de 36 % par rapport à l'année précédente. Les revenus de neuf mois ont augmenté de 11 % pour atteindre 17,3 millions de dollars. L'entreprise prévoit que les revenus de l'exercice 2024 dépasseront 24 millions de dollars, marquant une augmentation de 20 % d'une année sur l'autre. Parmi les réalisations clés figurent la modification de l'accord d'achat d'actions, résultant en une augmentation de 26,1 millions de dollars du capital des actionnaires, la conversion de 13,7 millions de dollars de dettes en capitaux propres à 2,00 dollars par action, le lancement d'une pompe à chaleur alimentée par l'IA, et l'acquisition de DeliveryCircle. L'entreprise s'attend à atteindre l'équilibre du flux de trésorerie opérationnel au premier trimestre 2025.

ConnectM Technology Solutions (NASDAQ: CNTM) hat die vorläufigen Ergebnisse für das dritte Quartal 2024 bekannt gegeben und berichtet von Einnahmen von 6,1 Millionen US-Dollar, was einem Anstieg von 36 % im Vergleich zum Vorjahr entspricht. Der Umsatz über neun Monate wuchs um 11 % auf 17,3 Millionen US-Dollar. Das Unternehmen prognostiziert, dass der Umsatz für das Geschäftsjahr 2024 24 Millionen US-Dollar übersteigen wird, was einem jährlichen Anstieg von 20 % entspricht. Zu den wichtigsten Erfolgen gehören die Änderung des Aktienkaufvertrags, die zu einem Anstieg des Eigenkapitals um 26,1 Millionen US-Dollar führte, die Umwandlung von 13,7 Millionen US-Dollar Schulden in Eigenkapital zu 2,00 US-Dollar pro Aktie, die Einführung einer KI-gesteuerten Heizpumpe sowie die Übernahme von DeliveryCircle. Das Unternehmen erwartet, im ersten Quartal 2025 den operativen Cashflow-Break-Even zu erreichen.

- Q3 2024 revenue increased 36% YoY to $6.1 million

- Nine-month revenue grew 11% to $17.3 million

- Projected FY2024 revenue of $24 million, representing 20% YoY growth

- Eliminated $2 million in annual interest expense

- Secured $4.2 million in fresh capital

- Management purchased 455,000 shares showing confidence

- $26.1 million increase in Stockholder Equity

- Significant debt conversion causing shareholder dilution through $13.7 million debt-to-equity swap

Insights

ConnectM's Q3 results show promising growth with

- Balance sheet improvements through debt-to-equity conversion at

$2.00 per share and elimination of$2 million annual interest expense - Management's skin in the game with 455,000 shares purchased shows confidence

- MSA-focused growth strategy reduces acquisition risks while maintaining revenue potential

However, with a market cap of just

~ Third Quarter Revenue Increased

~ Revenues For The Nine Months Increased

~ FY2024 On-Track to Deliver Revenue of North of

~ On Track to Achieve Operating Cash Flow Breakeven in The First Quarter of 2025~

MARLBOROUGH, Mass., Nov. 19, 2024 (GLOBE NEWSWIRE) -- ConnectM Technology Solutions, Inc. (Nasdaq: CNTM) (“ConnectM” or the “Company”), a technology company focused on the electrification economy, today announced preliminary results for the quarter ended September 30, 2024.

ConnectM is an AI-powered B2B technology electrification platform working within the

- Smart Heating & Cooling with a focus on Heat Pumps (“Building Electrification”)

- Two, three, and four-wheel commercial electric vehicles; last mile delivery (“Transportation & Logistics”)

- Distributed Energy Resources including Solar, Battery and EV Charging (“Distributed Energy”)

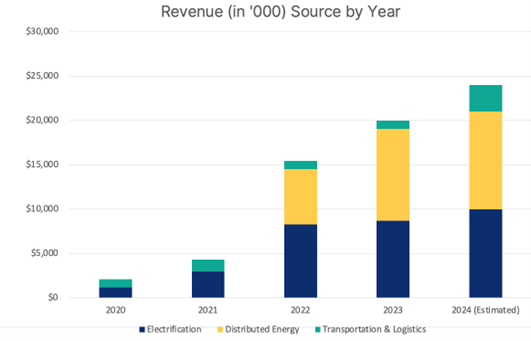

The table below sets forth sustainable Growth over the Last Five Years

Key Company Highlights

- Revenue in Q3 2024 was

$6.1 million , compared to$4.45 million in Q3 2023. Revenue in the first nine months of 2024 increased11% to$17.3 million , compared to$15.6 million in the same period last year. - Successfully amended Forward Stock Purchase agreement to remove future settlement liability at maturity, resulting in a

$26.1 million increase in Stockholder Equity. - Company continues to eliminate overhang from go public event, successfully converting

$13.7 million of debt with debt-to-equity swap at$2.00 per share. - As part of the Company's ongoing efforts to make advanced heating technology accessible, ConnectM launched its AI-powered heat pump, for residential and light commercial use. Integrated with ConnectM's Energy Intelligence Network, the heat pump is optimized for performance, energy efficiency and reduces customer energy costs.

- Completed its first acquisition since go public event, entering into an agreement to acquire a controlling interest in DeliveryCircle, a nationwide tech-enabled delivery company which connects businesses looking for a last-mile delivery solution. This strategic acquisition expands ConnectM’s Transportation & Logistics segment in the United States.

Bhaskar Panigrahi, CEO and Chairman of ConnectM, commented, “I am thrilled to report preliminary top line growth while completing significant milestones early on. We recorded revenue of

We have much to be proud of since our July 2024 public debut. The management team quickly prioritized balance sheet optimization – deleveraging the balance sheet and eliminating

Operationally, we have reduced our operating expenses, strategically prioritizing the growth of our business through Managed Services Agreements (“MSAs”) and new product introductions, such as our AI-powered heat pump, and continued to grow through accretive acquisitions such as DeliveryCircle and Green Energy Gains. MSAs are a preferred risk adjusted growth play where we earn a high percentage of MSA partner revenue via our electrification platform subscription service. This strategic structure reduces our acquisition risk by giving the Company the option to acquire an MSA partner based on their performance and transformation post adoption of our platform.

Lastly, I have strong conviction that the future is bright for ConnectM. My team and I are focused on continuing to grow revenue and taking category leadership positions across our three operating segments. As you can see by our aligned investment interest, we are committed to creating meaningful catalysts for growth with the goal of increasing long-term value for all shareholders.”

Outlook

For the fourth quarter and full year 2024, the Company expects revenues of approximately

About ConnectM Technology Solutions, Inc.

ConnectM is a technology company focused on advancing the electrification economy by integrating electrified energy assets with its AI-powered technology solutions platform. The Company provides residential and light commercial buildings and all-electric original equipment manufacturers with a proprietary Energy Intelligence Network platform to accelerate the transition to all-electric heating, cooling, and transportation. Leveraging technology, data, artificial intelligence, contemporary design, and behavioral economics, ConnectM aims to make electrification more user-friendly, affordable, precise, and socially impactful. As a vertically integrated company with wholly owned service networks and a comprehensive technology stack, ConnectM empowers customers to reduce their reliance on fossil fuels, lower overall energy costs, and minimize their carbon footprint.

For more information, please visit: https://www.connectm.com/

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We have based these forward-looking statements on our current expectations and projections about future events. All statements, other than statements of present or historical fact included in this press release, regarding our future financial performance and our strategy, expansion plans, future operations, future operating results, estimated revenues, losses, projected costs, prospects, plans and objectives of management are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may,” “should,” “could,” “would,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “continue,” “project” or the negative of such terms or other similar expressions. These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions about us that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Except as otherwise required by applicable law, we disclaim any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this press release. We caution you that the forward-looking statements contained herein are subject to numerous risks and uncertainties, most of which are difficult to predict and many of which are beyond our control.

In addition, we caution you that the forward-looking statements regarding the Company contained in this press release are subject to the risks and uncertainties described in the “Cautionary Note Regarding Forward-Looking Statements” section of the Current Report on Form 8-K filed with the Securities and Exchange Commission on July 18, 2024. Such filing identifies and addresses other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and ConnectM is under no obligation to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise.

Contact:

MZ North America

(203) 741-8811