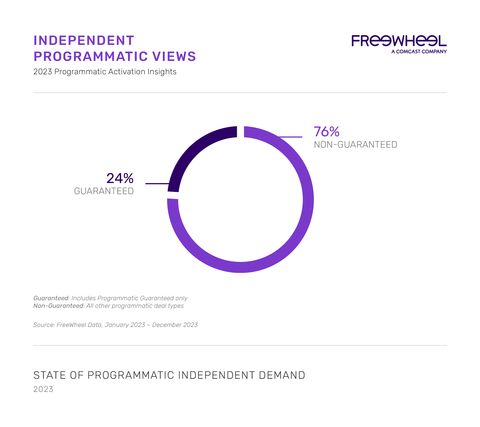

New FreeWheel Report Reveals 24% Growth in CTV Programmatic Impressions from Independent Agencies, as Advertisers of All Sizes Take on Programmatic Activation

Research shows that programmatic growth is being fueled by the democratization of access to premium CTV for more advertisers.

(Graphic: Business Wire)

“The independent market is in an era of turbo charged growth,” said Katy Loria, CRO, FreeWheel. “This growth is fueled by the increasing adoption of programmatic advertising by marketers, coupled with the expansion of premium CTV supply. Advertisers of all sizes now have powerful tools for measuring and attributing their premium video campaigns’ success, driving higher demand and better outcomes.”

The insights cover the primary forces driving the growth of programmatic impressions in the independent CTV market, with data showing a

-

The adoption of multi-publisher programmatic bundles has surged, with a +

119% increase in advertisers utilizing these bundles to find their target audiences across premium CTV platforms. - Advertiser verticals that are stronger in the independent segment, i.e. across pharma, gaming, telecom, and retail categories, are embracing programmatic at an accelerated rate due to programmatic’s ability to better prove ROI.

The data set used for the report is one of the largest available on the usage and monetization of professional, rights-managed ad-supported video content in the

“With niche first-party audiences, scale can often be an issue,” said Garrett Dale, Chief Partnership Officer and Co-Founder, Kepler Group. “Curated group deals have been integral in complementing publisher direct programmatic activations to expand reach of high-value audiences for brands, enabling Kepler to achieve and exceed client business goals from both brand awareness to performance objectives.”

Looking forward to the remainder of 2024, the report identifies an opportunity for the independent programmatic market to consider live sports inventory – which is currently not readily available at scale for buyers – for its high viewership, differentiated prestige content, and an event-like experience bringing in engaged audiences and making live sports a prime category for advertisers. Along with these benefits come the added complexity of programmatic activation, and the need to make sure the technical infrastructure on both the buy and sell side can handle the high viewership spikes.

“The biggest events – NFL Playoffs, Olympics, March Madness – are all available for streaming, which offers a huge opportunity for programmatic advertising,” said Moe Chughtai, Global Head of Advanced TV, MiQ. “If executed effectively, not only does this reduce the investment barriers to entry for marketers to gain access to this programming, it also brings a new level of addressability and accountability to live sports. By partnering with programmers and tech partners, we can make live sports the fastest-growing sector for biddable advertising.”

The report goes on to identify additional opportunities, including the transition of large advertiser commitments to programmatic and the unlocking of programmatic political spend with speed while maintaining strict creative and placement controls.

To view the full findings as outlined in FreeWheel’s State of Programmatic Independent Demand, visit here.

About FreeWheel

FreeWheel empowers all segments of The New TV Ecosystem. We are structured to provide the full breadth of solutions the advertising industry needs to achieve their goals. We provide the technology, data enablement and convergent marketplaces required to ensure buyers and sellers can transact across all screens, across all data types, and all sales channels, in order to ensure the ultimate goal – results for marketers. With offices in

View source version on businesswire.com: https://www.businesswire.com/news/home/20240516589722/en/

Media

Meredith Fitzgerald

meredith_fitzgerald@comcast.com

215-970-8504

Source: FreeWheel