Charlie's Holdings Reports 23% Growth to Company Record $26.4 Million Revenue for Year Ended December 31, 2022

Charlie's Holdings, Inc. (OTCQB: CHUC) reported a 23% revenue growth for 2022, achieving a record $26.4 million. Despite revenue gains, the company experienced a 10% decrease in gross profit to $10.0 million and incurred an operating loss of $1.8 million, contrasting with a profit in 2021. The net loss reached $1.6 million, showing a significant drop from a net income of $4.8 million in the prior year. Charlie's has initiated investments in novel vapor products, including an alternative nicotine substitute, Metatine, and is developing patented age-gating technology to comply with FDA regulations. The company aims to expand its international market reach and enhance its product offerings in the growing alternative cannabis sector.

- Record revenue growth of 23% to $26.4 million

- Development of alternative nicotine substitute 'Metatine'

- Strategic investment in proprietary technology and age-gating systems

- Focus on expanding international market sales

- Gross profit decreased by 10% to $10.0 million

- Operating loss of $1.8 million compared to previous profit

- Net loss of $1.6 million compared to net income of $4.8 million

Insights

Analyzing...

Increased Investments for Development of Novel, New Vapor Products

COSTA MESA, CA / ACCESSWIRE / April 18, 2023 / Charlie's Holdings, Inc. (OTCQB:CHUC) ("Charlie's" or the "Company"), an industry leader in the premium vapor products space, yesterday reported results for the fourth quarter and full year ended December 31, 2022, and provided an update on recent business highlights.

Key Financial Highlights for 2022 (compared with 2021)

- Revenue increased

23% to Company record$26.4 million - Gross profit decreased

10% to$10.0 million - Operating expenses, as a perecentage of revenue, decreased from

49% to45% - Operating loss of

$1.8 million compared to operating income of$0.6 million - Including the fair value of derivative liabilities, Net loss of

$1.6 million compared to net income of$4.8 million

Key Business Highlights During and Subsequent to 2022

- The Company appointed Edward Carmines, Ph.D., accomplished scientist and Premarket Tobacco Application ("PMTA") expert, to Charlie's Board of Directors

- Identified an alternative alkaloid nicotine substitute ("Metatine™") to be used in lieu of tobacco-based and synthetically derived nicotine

- Launched PINWEEL, an alternative cannabis brand derived from

100% hemp extract - Announced a new strategic initiative to develop patented "age-gating" technology to address significant concerns raised by U.S. Food and Drug Administration ("FDA") over the use of Electronic Nicotine Delivery System ("ENDS") products by underage consumers

- Secured written consent from a majority of preferred shareholders to (i) allow automatic conversion of all "Preferred A Shares" to common stock upon the Company's common stock being up-listed on the New York Stock Exchange or NYSE American, and (ii) to increase permitted indebtedness to

$6 million

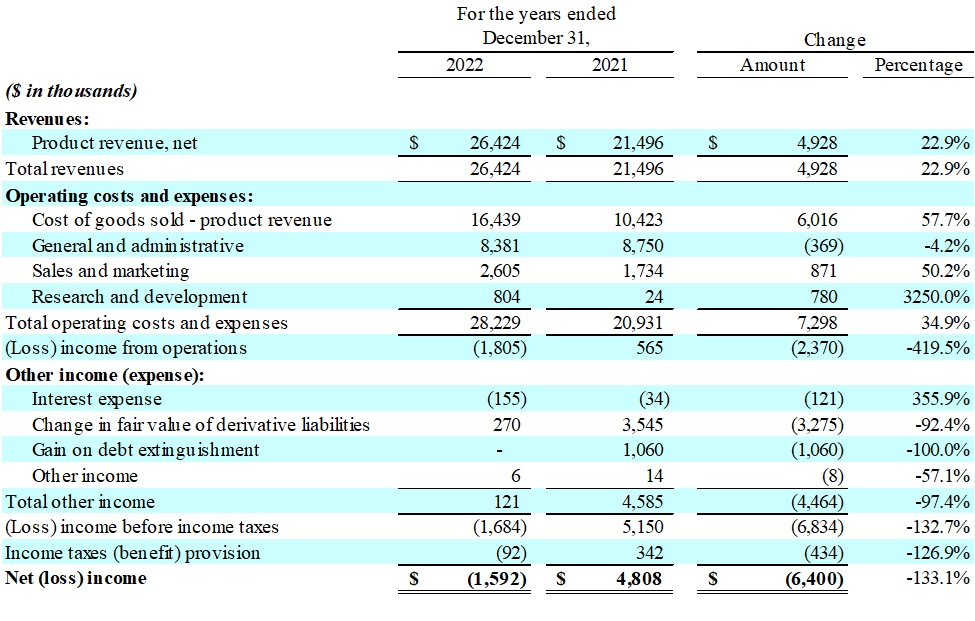

Results of Operations for the Year Ended December 31, 2022 Compared to the Year Ended December 31, 2021

Management Commentary

"2022 was a very strong year for Charlie's, as we continued our growth trajectory by increasing revenue to an all-time Company record of

Ryan Stump, Charlie's Chief Operating Officer, commented, "As of this date, Charlie's 2020 PMTA remains among the select minority of applications submitted to the FDA for a tobacco-derived nicotine ENDS product that has not received a Marketing Denial Order or Refuse-to-File designation. This fact highlights our progress toward achieving full regulatory compliance and demonstrates the emphasis our Company places on providing adult consumers with a trusted product portfolio." Mr. Stump continued, "On November 3, 2022, the FDA accepted for scientific review certain of our PMTAs for synthetic nicotine products and, on November 4, 2022, FDA refused to accept certain other PMTAs for these products, rendering the latter products subject to FDA enforcement. We submitted an administrative appeal with FDA regarding the agency's refusal to accept certain of the PMTAs, and have resubmitted PMTAs for, and continue to sell, the affected synthetic nicotine products while the administrative appeal process is pending. We remain pro-active and confident in all of our PMTA submissions."

Henry Sicignano III, Charlie's President, explained, "Our team has developed - and begun executing - a well laid-out strategic plan with focus on three broad initiatives: (i) development of proprietary technology and novel new products, (ii) expansion of the Company's hemp-derived alternative cannabis product line, and (iii) focus on top line growth. Through the course of 2023, we will continue to concentrate our resources on areas of our business in which we enjoy competitive advantages in order to increase market share, sales, and, ultimately, Charlie's marketcap. I am proud to report: Charlie's is extremely well positioned to enjoy very substantial growth over the next 12-18 months."

Strategic Priorities for Growth

Priority 1: In 2022, Charlie's initiated a plan and began to invest substantial time and resources to develop various proprietary products and new technologies in order to achieve competitive advantages in the vapor and alternative products marketplace. In conjunction with internal and external research and development resources, the Company endeavored to identify an alternative alkaloid nicotine substitute ("Metatine™") to be used in lieu of tobacco-based and synthetically derived nicotine. Charlie's believes adult consumers will enjoy Metatine vapor products in much the same way that they enjoy traditional vapor products. However, because Metatine is not made or derived from tobacco, and because Metatine does not consist of or contain nicotine from any source, the FDA's Center for Tobacco Products does not have jurisdiction to regulate Metatine. Accordingly, if the Company is successful utilizing Metatine in the development of a viable commercial product, such a product would allow Charlie's additional flexibility in offering both flavored and non-flavored vapor products to adult consumers looking to transition away from traditional combustible and smokeless tobacco products.

The Company has also begun to develop intellectual property around technologies designed to prevent youth access to nicotine vapor products. Edward Carmines, Ph.D., a member of Charlie's Board of Directors and an accomplished scientist and regulatory affairs expert, is spearheading Charlie's development of patented "age-gating technology" for both Charlie's and potential licensees of the Company. Currently, there is a need for age-gated product technologies that can satisfy or accommodate concerns the FDA has related to under-age youth access in the ENDS market. If the Company's age-gated e-cigarettes-in-development are recognized as "products of merit" by the FDA, Charlie's e-cigarettes could emerge among the select minority of flavored nicotine disposables able to be sold legally in the

Priority 2: In November 2022, Charlie's successfully launched the Company's PINWEEL brand of alternative cannabis products. In 2023, the Company plans to increase sales and marketing efforts of its PINWEEL product line, including ingestibles and disposable vapor devices. Charlie's management believes there is a significant upside in the hemp-derived products space and has begun to shift its focus in this business to the burgeoning "alternative cannabis" market for products containing live resin blends of hemp-derived cannabinoids. These product categories have grown rapidly, as they offer consumers a range of benefits across varying potencies and product formats. Alternative cannabis products contain only cannabinoids that are derived from the hemp plant, are not subject to the Controlled Substances Act and are legal throughout most of the United States. Further, alternative cannabis products are not currently subject to FDA review.

Priority 3: Charlie's will expand and refocus its sales team. Currently, the Company is increasing the number of independent contractor account executives, as well as refining the skill set of existing sales team. An expanded sales team will more effectively manage key customer relationships across a larger number of reps, mitigating concentration risks and assuring adequate coverage. The sales team is organized into two groups, each with a specific mandate for targeting customers. One group will focus on direct-to-retail (smoke shops, chain stores, adult beverage/liquor stores, gas stations, and grocery stores) with the goal of acquiring 1,000 new customer accounts in 2023. The second group will focus on satisfying the requirements of mega-distributors (McLane, Coremark, HT Hackney, Eby-Brown) in order to sell into the nation's largest chain store accounts. Additionally, to broaden the Company's footprint with customers and to minimize order size variability, sales reps will rebalance their product sales mix, placing enhanced focus on alternative cannabis and legacy e-liquid products.

Priority 4: In order to mitigate FDA regulatory risk in the domestic market and to capture what management believes is a significant commercial opportunity, Charlie's has dedicated additional resources to efforts focused on growing the Company's international business. Presently, approximately

Financial Results for the Year Ended December 31, 2022:

- Revenue: For the year ended December 31, 2022, revenue was

$26.4 million , an increase of$4.9 million , or23% , compared with$21.5 million for the year ended December 31, 2021. The increase in revenue was primarily due to a$4.0 million increase in Charlie's nicotine-based product sales, and a$0.9 million increase in sales of the Company's hemp-derived products. The increase in the Company's nicotine-based vapor product sales is directly related to the launch of its Pacha (formerly Pachamama Disposable) product line, which grew significantly during the first half of 2022 with the launch of additional size and flavor offerings.

Pacha Disposables became Charlie's first-ever entrant into the rapidly expanding, disposable e-cigarette market and offer users a variety of premium flavors containing synthetic nicotine (not derived from tobacco) in a compact, discrete format. Ongoing uncertainty surrounding the FDA's application review timeline, following the May 13, 2022 PMTA submission deadline, as well as the emergence of lower-priced competitors selling direct from China affected buying patterns of disposable nicotine products in the domestic vape market during the second half of 2022. Sales growth slowed during the quarter ended December 31, 2022 as customers reduced emphasis on offering a wide product variety and focused on low-cost, high-sales velocity offerings.

- Gross Profit: For the year ended December 31, 2022, gross profit was

$10.0 million , a decrease of$1.1 million , or10% , compared with$11.1 million for the year ended December 31, 2021. The resulting gross margin was37.8% , compared with51.5% for the year ended December 31, 2021. The decrease in gross margin is primarily due to a higher sales mix consisting of the Company's Pacha Disposable product line, which carries a lower margin per unit relative to its other vapor products. Cost of revenue was also significantly affected by a large provision for inventory obsolescence related to certain of the Company's nicotine and alternative cannabis disposable products. The increased provision for inventory obsolescence was mostly the result of compressed product lifecycles in both the nicotine disposable and alternative cannabis product categories. - Total Operating Expenses: For the year ended December 31, 2022, total operating expenses, including general and administrative, sales and marketing and research and development costs, were

$11.8 million , an increase of$1.3 million , or12% , compared with$10.5 million for the year ended December 31, 2021. Operating expenses as a percentage of revenue decreased to45% from49% for the periods compared. This was primarily due to the Company's increased participation in tradeshows during the year as Charlie's continues to believe it is the best method for directly reaching adult consumers and distributors of its products. Also, for the year ended December 31, 2022, total research and development expense increased approximately$0.8 million due to the Company filing new PMTAs for its synthetic nicotine Pacha products, investing in "age-gating technology" research and development, and investing in the development of new alternative alkaloid vapor products. - Operating Income/Loss: For the year ended December 31, 2022, operating loss was

$1.8 million , as compared with an operating income of$0.6 million for the year ended December 31, 2021. - Income Tax Expense: The Company's income tax benefit was

$92,000 , or5.5% of income before income taxes, for the year ended December 31, 2022. The Company's income tax expense was$342,000 for the year ended December 31, 2021. - Net Income/Loss: For the year ended December 31, 2022, net loss was

$1.6 million , compared with a net income of$4.8 million for the year ended December 31, 2021. Of note, net income for the year ended December 31, 2021 included a$3.5 million gain in fair value of derivative liabilities and a$1.1 million gain on debt extinguishment. - EPS: For the year ended December 31, 2022, net loss per share was (

$0.01) , compared with diluted earnings per share of of$0.02 , for the year ended December 31, 2021.

About Charlie's Holdings, Inc.

Charlie's Holdings, Inc. (OTCQB: CHUC) is an industry leader in the premium vapor products space. The Company's products are sold around the world to select distributors, specialty retailers, and third-party online resellers through subsidiary companies Charlie's Chalk Dust, LLC and Don Polly, LLC. Charlie's Chalk Dust, LLC has developed an extensive portfolio of brand styles, flavor profiles, and innovative product formats. Don Polly, LLC creates innovative hemp-derived products and brands.

For additional information, please visit Charlie's corporate website at: Chuc.com and the Company's branded online websites: CharliesChalkDust.com, Pacha.co, andPinweel.com.

Safe Harbor Statement

This press release contains "forward-looking statements" within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995, including but not limited to statements regarding the Company's overall business, existing and anticipated markets and expectations regarding future sales and expenses. Words such as "expect," "anticipate," "should," "believe," "target," "project," "goals," "estimate," "potential," "predict," "may," "will," "could," "intend," variations of these terms or the negative of these terms, and similar expressions, are intended to identify these forward-looking statements. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond the Company's control. The Company's actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors, including but not limited to: the Company's ongoing ability to quote its shares on the OTCQB; whether the Company will meet the requirements to uplist to a national securities exchange in the future; the Company's ability to successfully increase sales and enter new markets; whether the Company's PMTA's will be approved by the FDA, and the FDA's decisions with respect to the Company's future PMTA's; the Company's ability to manufacture and produce products for its customers; the Company's ability to formulate new products; the acceptance of existing and future products; the complexity, expense and time associated with compliance with government rules and regulations affecting nicotine, synthetic nicotine, and products containing cannabidiol; litigation risks from the use of the Company's products; risks of government regulations, including recent regulation of synthetic nicotine; the impact of competitive products; and the Company's ability to maintain and enhance its brand, as well as other risk factors included in the Company's most recent quarterly report on Form 10-Q, annual report on Form 10-K, and other SEC filings. These forward-looking statements are made as of the date of this press release and were based on current expectations, estimates, forecasts and projections as well as the beliefs and assumptions of management. Except as required by law, the Company undertakes no duty or obligation to update any forward-looking statements contained in this release as a result of new information, future events or changes in its expectations.

Investors Contact:

IR@charliesholdings.com

Phone: 949-570-0691

SOURCE: Charlie's Holdings

View source version on accesswire.com:

https://www.accesswire.com/749778/Charlies-Holdings-Reports-23-Growth-to-Company-Record-264-Million-Revenue-for-Year-Ended-December-31-2022