Centamin PLC Announces Positive Doropo Gold Project DFS

Centamin announced the results of a Definitive Feasibility Study (DFS) for the Doropo Gold Project in Côte d'Ivoire.

The DFS indicates:

- A 10-year mine life with Probable Mineral Reserves of 1.88 million ounces of gold at an average grade of 1.53 g/t.

- Average annual gold production of 167,000 ounces over the LOM, with 207,000 ounces in the first five years.

- All-in sustaining costs (AISC) of $1,047/oz over the LOM, dropping to $971/oz for the first five years.

- Post-tax NPV8% of $426 million and 34% IRR at a gold price of $1,900/oz.

- Total construction capex of $373 million.

Significant advantages include a decrease in community resettlement needs and early receipt of the environmental permit, facilitating the mining license application.

CEO Martin Horgan highlighted the project's strong first five years and plans for early works to mitigate completion risks and expedite timelines.

- Definitive Feasibility Study (DFS) shows robust project potential.

- High initial production: 207,000 ounces annually for the first five years.

- AISC below $1,000/oz for the first five years.

- Post-tax NPV8% of $426 million and 34% IRR.

- Significant reduction in community resettlement needs.

- Environmental permit already received.

- Increase in total construction capex to $373 million.

- Higher strip ratio and operational costs compared to PFS.

PERTH, AUSTRALIA / ACCESSWIRE / July 18, 2024 / Centamin plc ("Centamin" or "the Company") (LSE:CEY)(TSX:CEE

POSITIVE DEFINITIVE FEASIBILITY STUDY AT THE DOROPO GOLD PROJECT

Preparation for mining license application underway

Centamin is pleased to provide the outcome of the definitive feasibility study ("DFS") at its Doropo Gold Project ("Doropo") in north-eastern Côte d'Ivoire, including detailed project parameters and economics and an updated Mineral Reserves estimate.

MARTIN HORGAN, CEO,commented: "The results of the DFS demonstrate a robust project that meets Centamin's investment criteria. The project shows a strong first five years with production in excess of 200kozpa at an AISC below US

Financing options for the project are well advanced, supported by a clear roadmap for early works that will mitigate completion risks. This study underlines our confidence in Doropo's potential to become a commercially viable project, bringing substantial investment and employment opportunities to northeastern Côte d'Ivoire."

HIGHLIGHTS[1]

● | Mineral Reserve Estimate of 1.88 million ounces ("Moz") of Probable Mineral Reserves, at an average grade of 1.53 grams per tonne of gold ("g/t Au"), supporting a 10-year life of mine ("LOM") |

● | Upside opportunities identified including potential resource and reserve growth, to be explored utilising cashflow following first production |

● | Average annual gold production of 167koz over the LOM, with an average of 207koz in the first five years |

● | All-in sustaining costs ("AISC") of US |

● | Mining and processing operations remain consistent with the Pre-feasibility Study ("PFS"), utilising open-pit mining and a carbon-in-leach ("CIL") processing circuit |

● | Fulfils Centamin's hurdle rate of |

● | Robust economics with a post-tax net present value of US |

● | Total construction capital expenditure ("capex") of US |

● | A significant reduction in the need for community resettlement from estimates in the PFS of 2000 to 3000 persons, to less than 500, meaning no resettlement will be required during the construction period and the first 2 years of commercial operation |

● | The Environmental permit was received in June, following the Q1 2024 submission of the ESIA, endorsing the Company's management plans. Alongside the DFS this will support the mining license application |

● | An early works plan to be undertaken ahead of a financial investment decision will reduce project delivery risk and potentially expedite construction timelines |

● | The Company will host a webcast presentation of Doropo with the interim financial results on Thursday, 25 July at 08.30 BST (UK time) |

DEFINITIVE FEASIBILITY STUDY SUMMARY

| Units | Years 1-5 | LOM |

PHYSICALS |

|

|

|

Mine life | Years | 5 | 10 |

Total ore processed | kt | 21,662 | 38,220 |

Strip ratio | w:o | 5.0 | 4.9 |

Feed grade processed | g/t Au | 1.65 | 1.53 |

Gold recovery | % | ||

Total gold production | koz | 1,033 | 1,667 |

PRODUCTION & COSTS |

|

|

|

Annual gold production | Koz | 207 | 167 |

Cash costs | US$/oz | 817 | 892 |

AISC | US$/oz | 971 | 1047 |

PROJECT ECONOMICS (post-tax and at US |

|

|

|

Construction capital expenditure | US$m |

| 373 |

Free Cash flow | US$m |

| 810 |

NPV | US$m |

| 426 |

IRR | % |

| 34 |

Payback period | years |

| 2.1 |

POST-TAX NET PRESENT VALUE (US$M) SENSITIVITY ANALYSIS

| Gold price | |||||

Discount rate | US | US | US | US | US | US |

199 | 275 | 364 | 454 | 543 | 613 | |

175 | 247 | 332 | 416 | 501 | 568 | |

153 | 221 | 301 | 382 | 462 | 526 | |

132 | 197 | 273 | 350 | 426 | 487 | |

113 | 174 | 247 | 320 | 393 | 450 | |

95 | 154 | 223 | 293 | 362 | 417 | |

FOR FULL LIFE OF MINE SCHEDULES: (link here)

WEBCAST PRESENTATION

The Company will host a webcast presentation on Thursday, 25 July 2024 at 08.30 BST to discuss the interim results and Doropo, followed by an opportunity to ask questions.

Webcast link: https://www.lsegissuerservices.com/spark/Centamin/events/80411d15-3a8c-475a-8162-3bbcf0a2ac0e

PRINT-FRIENDLY VERSION of the announcement: www.centamin.com/media/companynews.

DOROPO GOLD PROJECT DEFINITIVE FEASIBILITY STUDY

OVERVIEW

Doropo is located in the northeast of Côte d'Ivoire, situated in the north-eastern Bounkani region between the Comoè National Park and the international border with Burkina Faso, 480km north of the capital Abidjan and 50km north of the city of Bouna.

The exploration license areas are c.1,847 km2 covering thirteen gold deposits, named Souwa, Nokpa, Chegue Main, Chegue South, Tchouahinin, Kekeda, Han, Enioda, Hinda, Nare, Kilosegui, Attire and Vako. Approximately

Geologically, Doropo lies entirely within the Tonalite-Trondhjemite-Granodiorite domain, bounded on the eastern side by the Boromo-Batie greenstone belt, in Burkina Faso, and by the Tehini-Hounde greenstone belt on the west.

MINERAL RESOURCES AND RESERVES

The DFS is based on the 2023 Mineral Resource Estimate for Doropo published in January 2024 (link to regulatory announcement here). The Mineral Reserve estimate has converted

The change in reserve tonnage is primarily due to aligning the reserve gold price applied to Doropo with the Company's long-term gold price of US

The grade improvement resulted from an improved understanding of the controls of mineralisation following infill drilling programme focused on converting Inferred Mineral Resources to Measured and Indicated Mineral Resources within the resource pit shells, confirming reserve pit depths and initial grade control drilling.

There is potential for additional resource conversion and further resource growth. Several exploration targets have been identified across the license holding which have the potential to increase the resource and reserve base.

Detailed Mineral Resource and Reserve notes can be found within the Endnotes.

| Jul-24 |

| Jun-23 |

| ||||||

| Tonnage (Mt) | Grade | Gold Content (Moz) | Tonnage (Mt) | Grade | Gold Content (Moz) | ||||

MINERAL RESERVES |

|

|

|

|

| |||||

Proven | 1.26 | 1.73 | 0.07 | - | - | - | ||||

Probable | 36.97 | 1.52 | 1.81 | 40.55 | 1.44 | 1.87 | ||||

P&P Reserves | 38.22 | 1.53 | 1.88 | 40.55 | 1.44 | 1.87 | ||||

|

|

|

|

|

|

| ||||

MINERAL RESOURCES (including reserves) |

|

|

|

| ||||||

Measured | 1.51 | 1.60 | 0.08 | - | - | - | ||||

Indicated | 75.34 | 1.25 | 3.03 | 51.51 | 1.52 | 2.52 | ||||

M+I Resources | 76.85 | 1.26 | 3.11 | 51.51 | 1.52 | 2.52 | ||||

Inferred | 7.37 | 1.23 | 0.3 | 13.67 | 1.14 | 0.5 | ||||

|

|

|

|

|

|

|

|

|

|

|

MINING

● | 10 years of mining operations, including pre-commercial works |

● | LOM 4.9:1 strip ratio (waste to ore) |

● | 28 million tonnes per annum ("Mtpa") peak total material movement |

The eight relatively shallow deposits will be mined using a conventional drill, blast, load and haul open pit operation. The basis for the DFS is a contract mining operation, mining a maximum of 28 Mtpa of material and delivering up to 4.9 Mtpa of ore to the run of mine ("ROM") pad and stockpiles annually, with variation based on the location and the combination of oxide, transition and fresh ore mined. The project plans to mine 38Mt of ore to be fed into the process plant and 188Mt of waste over the LOM. The strip ratio has increased from the PFS due to the reduction of some of the upper pit wall angles in the saprolite material near surface, a result of the increased geotechnical study work undertaken.

PROCESSING

● | Free milling gold leads to a conventional closed SAG/ball mill/crushing ("SABC") and CIL flowsheet |

● | Mill capacity 5.4Mtpa (oxide/transition ore), 4.0Mtpa (fresh ore) |

● | Averaging |

Processing at Doropo will involve primary crushing and grinding of the mined ore, using Semi-Autogenous Grinding ("SAG") mill and ball mill in closed circuit to a target grind size (P80) of 75 microns (µm) for fresh ore and 106 µm for oxide and transition ore. A gravity circuit will recover any native/free gold, before entering the CIL circuit. The gold in the loaded carbon will be recovered by an elution circuit, using electrowinning and gold smelting to produce doré. Flowsheet development was supported by extensive DFS metallurgical test work, supplemented by the PFS results. The DFS metallurgical test work demonstrated a high level of consistency resulting in only minor process design updates from the PFS. The DFS metallurgical test work allowed for extensive optimisation and further simplification of the flowsheet by removing the shear reactor and tailings thickener, while keeping the remaining flowsheet unchanged. The change in recovery was driven by a more conservative calculation method, switching from a grade recovery curve to the use of grade bins split by material type, alongside test work indicating lower recoveries in fresh material.

INFRASTRUCTURE

● | 90kV national grid for the project power supply |

● | Tailings storage facility ("TSF") will be fully geomembrane lined and the embankment will be built using the downstream construction method |

Knight Piésold Consulting carried out a DFS of the site infrastructure for Doropo includingTSF, water storage/harvest dam, airstrip and haul access road.

The TSF was designed in accordance with Global Industry Standard on Tailings Management ("GISTM") and Australian National Committee on Large Dams ("ANCOLD") guidelines. The TSF will be fully lined with a geomembrane liner, leachate collection and constructed by the downstream construction method with annual raises to suit storage requirements. The TSF is designed and will be operated as a no discharge facility. The TSF will have a final capacity of 29 million cubic meters (Mm³) or 41 Mt of dry tails. Due to an improved design, it will cover a smaller total footprint area, including the basin area, of approximately 287 hectares ("ha") for the final stage facility, compared to 346 ha in the Preliminary Feasibility Study (PFS).

Doropo will utilise the Côte d'Ivoire national grid for its power supply, offering a cost and potential carbon saving relative to other options including self-generation as the tariff benefits from a mix of renewable and thermal generation with a significantportion of hydroelectric power supply.The proposed grid power supply connection for the project is via the existing Bouna substation which is approximately 55km southeast of Doropo. There will also be standby power on-site using diesel generators, for back-up power of critical process equipment and infrastructure if required. Solar power supplementation is currently being investigated to lower grid reliability and overall carbon emissions.

ENVIRONMENTAL AND SOCIAL

The environmental permit for Doropo was granted in June, following public consultation and submission of the Environmental and Social Impact Assessment ("ESIA") in Q1 2024.

The ESIA was prepared by Earth Systems and H&B Consulting working in conjunction with Centamin. Early development of information has allowed its incorporation into the DFS design and decision-making process. The ESIA shows less than 500 people would require physical resettlement, down from 2,000 to 3,000 in the PFS. Re-alignment of the TSF, water storage dam (WSD), waste rock dumps (WRD) and plant site has reduced the total mine footprint by approximately

The project provides a valuable opportunity to boost local social and economic development with a commitment to invest

The outer extent of Doropo is 7km from the Comoé National Park, which is a UNESCO World Heritage site. Doropois being designed to avoid adverse impacts to the park and its biodiversity, including a self-imposed stand-off of 4km to further safeguard the natural area.

COSTS

Operating Costs

Operating cost estimates for mining have been prepared by Orelogy with input from Centamin. Contract mining has been selected as the basis for all the open pit mining activities managed by Centamin's operation team,mining contractor costs were prepared by Orelogy, through a competitive bid process. Cost estimates for processing and general and administration ("G&A") costs were prepared by GR Engineering Services with input from Centamin. The reduction in mining and processing costs was driven by reduced freight and logistics expenses, as well as more competitive bids from mining contractors, as we approach the final investment decision. Key input costs used are a delivered diesel price of

LOM Average Costs

Area | Unit | DFS | PFS |

Mining | US$/t mined | 3.9 | 4.1 |

Processing | US$/t processed | 12.1 | 12.9 |

G&A | US$/t processed | 3.8 | 3.5 |

Capital Costs

● | Total up-front construction capital costs of US |

● | LOM sustaining capital costs of US |

The table below presents an estimate of the initial construction CAPEX, prepared by GR Engineering Services and Knight Piésold. Centamin provided the Owner Project Cost. The DFS value represents an increase of less than

Construction Capital Estimate (US$m) | DFS | PFS |

Construction distributable | 33 | 26 |

Treatment plant costs | 109 | 99 |

Reagents & plant services | 6 | 18 |

Infrastructure | 75 | 73 |

Mining | 22 | 19 |

Management costs | 32 | 27 |

Owner project costs | 67 | 54 |

Total excl. Contingency | 344 | 315 |

Contingency | 29 | 34 |

TOTAL CONSTRUCTION CAPEX | 373 | 349 |

The table below provides an estimate of ongoing capital commitments necessary to sustain operations over the LOM, including closure and rehabilitation costs, including bond payments. These estimates incorporate input from Knight Piésold and a closure estimate developed by Earth Systems. Sustaining capital expenditure has decreased compared to the PFS due primarily to two factors. A reduction in physical resettlement requirements, which has lowered costs over the life of the mine. Alongside increased upfront TSF construction costs, which have resulted in a greater allocation of these costs to the initial construction capital estimate.

Sustaining Capital Estimate (US$m) | DFS | PFS |

Sustaining capital expenditure | 60 | 80 |

Closure and rehabilitation | 36 | 30 |

TOTAL SUSTAINING CAPEX | 96 | 110 |

OWNERSHIP, PERMITTING, TAXES AND ROYALTIES

● | Financial modelling based on current Ivorian mining code and tax regime |

● | Sliding scale royalties between |

● | Community development fund royalty of |

Doropo is contained within the current exploration permits that were granted to Centamin's

Under the current Ivorian mining code, mining permits are subject to a

The financial model has assumed the corporate tax ("CIT") rate of

Royalties are applied to gross sales revenue, after deductions for transport and refining costs and penalties on a sliding scale depending on gold price. Please refer to the table below:

Spot Gold Price (US$/oz) |

| Applicable Royalty Rate |

<1,000 |

| |

1,000 - 1,300 |

| |

1,300 - 1,600 |

| |

1,600 - 2,000 |

| |

>2,000 |

|

The project will support local community development through the payment of a social fund royalty of

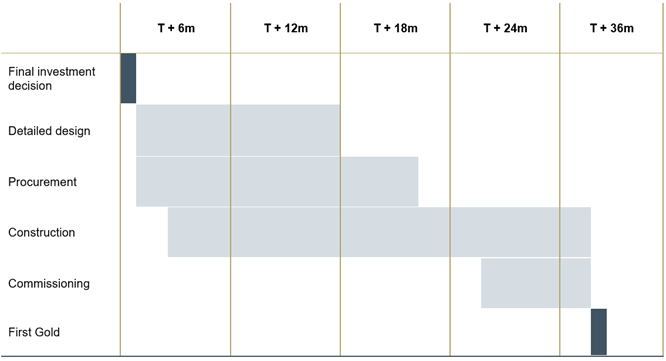

PROJECT TIMELINE

● | Submit mining license application during H2-2024 |

● | First gold 27 months from final investment decision (T=0) |

NEXT STEPS

The Company completed extensive work during the DFS stage. The DFS, together with the environmental permit will form key documents in support of our submission for a mining license to the Côte d'Ivoire Government. This application is scheduled to be submitted in Q3 2024. Following the award of the mining license and conclusion of the mining convention, we will be well positioned to make a final investment decision, with project financing options already well advanced.

There is up to US

PROJECT UPSIDE OPPORTUNITIES

There are a number of identified geological and financial opportunities with the potential to enhance to the current LOM.

● | Resource upgrade: there are Inferred Mineral Resources situated both outside and within the current pit shells. With additional drilling and metallurgical test work, these resources could support conversion of some of the material into Indicated Mineral Resources which can then be converted into reserves for evaluation and inclusion in the DFS. ○ Potential extensions to mineralisation at the Han, Kekeda and Atirre deposits within the Main Resource Cluster ○Potential at depth where the Souwa mineralised structure (which dips north-west) intersects the Nokpa mineralised structure, as well as ○Potential to convert current Inferred and Indicated mineral resources at Hinda, Nare, Sanboyoro, Solo, Tchouahinin and Vako. |

● | Additional mineralisation from target areas, systematic surface exploration work has identified multiple exploration targets (gold-in-soil/auger anomalies) across the project footprint. Some targets have been drill tested and warrant further development work, whilst others remain untested. These include south and along strike of Kilosegui, Tehini 3 and the Vako and Sanboyoro region inside the proposed mining license. ○ At Kilosegui, mineralisation remains open along strike in both directions from the mineral resource area, indicated by gold-in-soil and sample auger geochemical anomalies. In addition, there is a second short parallel structure evident from soil and auger sampling on the south side of the Kilosegui resource area. ○ Untested soil anomalies in the Vako-Sanboyoro area 10-15km west of the Main Resource Cluster ○ Untested soil anomalies to the South of the Main Resource Cluster |

● | Capital cost saving opportunities ○ Review of the usage of contractors during construction and throughout the mine life across the operation. |

● | Operating cost saving opportunities ○Further pit optimisation and evaluation of owner-mining, instead of contract-mining, given the Company's extensive operating experience at the Sukari Gold Mine in Egypt, this could be at the start of the project or during the mine life. ○ Further processing optimisation, including finalisation of reagent consumption and recovery parameters. |

ENDNOTES

Investors should be aware that the figures stated are estimates and no assurances can be given that the stated quantities of metal will be produced.

MINERAL RESOURCE AND MINERAL RESERVE NOTES

Mineral Resource Notes

● | Mineral Resource estimate is based on available data as at 31st October 2023. |

● | The gold grade estimation method is OK with Localised Uniform Conditioning. |

● | The rounding of tonnage and grade figures has resulted in some columns showing relatively minor discrepancies in sum totals. |

● | All Mineral Resource estimates have been determined and reported in accordance with NI 43-101 and the classification adopted by the CIM Definition Standards for Mineral Resources and Mineral Reserves (CIM, 2014). |

● | A cut-off grade of 0.3 g/t gold is used to account for reserves in the oxide material which are around 0.4g/t. |

● | Pit optimisations based on a US |

● | This Updated Mineral Resource estimate was prepared by Michael Millad and Flavie Isatelle of Cube Consulting Pty Ltd who are the Qualified Persons for the estimate. |

● | This Updated Mineral Resources estimate is not expected to be materially affected by environmental, permitting, legal title, taxation, socio-political, marketing or other relevant issues. |

Mineral Reserve Notes

● | The Mineral Reserve is reported according to CIM Definition Standards for Mineral Resources and Mineral Reserves (CIM, 2014). |

● | The mine design and associated Mineral Reserve estimate for Doropo is based on Mineral Resource classified as Measured and Indicated from the Cube Mineral Resource Estimate (MRE) with an effective date of 31st October 2023. |

● | Ore block grade and tonnage dilution was incorporated into the model. |

● | The Mineral Reserve was evaluated using a cut-off grade of 0.41 to 0.71 g/t Au depending on mining area and weathering profile. |

QUALIFIED PERSONS

A "Qualified Person" is as defined by the National Instrument 43-101 of the Canadian Securities Administrators. The named Qualified Person(s) have verified the data disclosed, including sampling, analytical, and test data underlying the information or opinions contained in this announcement in accordance with standards appropriate to their qualifications. Each Qualified Person consents to the inclusion of the information in this document in the form and context in which it appears.

Information of a scientific or technical nature in this document, including but not limited to the Mineral Resource estimates, was prepared by and under the supervision of the Centamin Qualified Persons, Howard Bills, Centamin Group Exploration Manager, and Craig Barker, Centamin Group Mineral Resource Manager, in addition to the below independent Qualified Persons.

The following table includes the respective independent Qualified Persons, who have the sign-off responsibilities of the final NI 43-101 Technical Report. All are experts in their relevant disciplines who fulfil the requirements of being a "Qualified Person(s)" under the CIM Definition Standards.

Author(s) | Company | Discipline |

Michael Millad | Cube Consulting | Mineral Resource estimate and geology |

Flavie Isatelle | Cube Consulting | Mineral resource estimate and geology |

Grant Harding | Independent Metallurgical Operations | Metallurgy |

Ross Cheyne | Orelogy Consulting | Mineral Reserve estimate and mining methods |

David Morgan | Knight Piesold Consulting | Project infrastructure design |

Deepak Malhotra | GR Engineering Services | Recovery Methods, CAPEX and Process OPEX |

Independent Technical Consultants

The following table includes the consultant companies that contributed to the Centamin DFS report:

Company | Discipline |

Cube Consulting | Mineral Resource estimate and geology |

Earth Systems | Environment and social studies/Closure costs |

ECG Consulting | High Voltage power supply and distribution |

Knight Piesold Consulting | Project infrastructure design |

Independent Metallurgical Operations | Metallurgy |

GR Engineering Services | Process design, capital and operating estimate |

Orelogy Consulting | Mineral Reserve estimate and mining methods |

SRK Consulting | Open pit geotechnical design |

TetraTech (Piteau Associates) | Hydrology, hydrogeology, geochemical studies |

ABOUT CENTAMIN

Centamin is an established gold producer, with premium listings on the London Stock Exchange and Toronto Stock Exchange. The Company's flagship asset is the Sukari Gold Mine ("Sukari"), Egypt's largest and first modern gold mine, as well as one of the world's largest producing mines. Since production began in 2009 Sukari has produced over 5 million ounces of gold, and today has 6.0Moz in gold Mineral Reserves. Through its large portfolio of exploration assets in Egypt and Côte d'Ivoire, Centamin is advancing an active pipeline of future growth prospects, including the Doropo project in Côte d'Ivoire, and has over 3,000km2 of highly prospective exploration ground in Egypt's Nubian Shield.

Centamin recognises its responsibility to deliver operational and financial performance and create lasting mutual benefit for all stakeholders through good corporate citizenship, including but not limited to in 2022, achieving new safety records; commissioning of the largest hybrid solar farm for a gold mine; sustaining a +

FOR MORE INFORMATION please visit the website www.centamin.com or contact:

Centamin plc | FTI Consulting |

FORWARD-LOOKING STATEMENTS

This announcement (including information incorporated by reference) contains "forward-looking statements" and "forward-looking information" under applicable securities laws (collectively, "forward-looking statements"), including statements with respect to future financial or operating performance. Such statements include "future-oriented financial information" or "financial outlook" with respect to prospective financial performance, financial position, EBITDA, cash flows and other financial metrics that are based on assumptions about future economic conditions and courses of action. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as "believes", "expects", "expected", "budgeted", "forecasts" and "anticipates" and include production outlook, operating schedules, production profiles, expansion and expansion plans, efficiency gains, production and cost guidance, capital expenditure outlook, exploration spend and other mine plans. Although Centamin believes that the expectations reflected in such forward-looking statements are reasonable, Centamin can give no assurance that such expectations will prove to be correct. Forward-looking statements are prospective in nature and are not based on historical facts, but rather on current expectations and projections of the management of Centamin about future events and are therefore subject to known and unknown risks and uncertainties which could cause actual results to differ materially from the future results expressed or implied by the forward-looking statements. In addition, there are a number of factors that could cause actual results, performance, achievements or developments to differ materially from those expressed or implied by such forward-looking statements; the risks and uncertainties associated with direct or indirect impacts of COVID-19 or other pandemic, general business, economic, competitive, political and social uncertainties; the results of exploration activities and feasibility studies; assumptions in economic evaluations which prove to be inaccurate; currency fluctuations; changes in project parameters; future prices of gold and other metals; possible variations of ore grade or recovery rates; accidents, labour disputes and other risks of the mining industry; climatic conditions; political instability; decisions and regulatory changes enacted by governmental authorities; delays in obtaining approvals or financing or completing development or construction activities; and discovery of archaeological ruins. Financial outlook and future-ordinated financial information contained in this news release is based on assumptions about future events, including economic conditions and proposed courses of action, based on management's assessment of the relevant information currently available. Readers are cautioned that any such financial outlook or future-ordinated financial information contained or referenced herein may not be appropriate and should not be used for purposes other than those for which it is disclosed herein. The Company and its management believe that the prospective financial information has been prepared on a reasonable basis, reflecting management's best estimates and judgments at the date hereof, and represent, to the best of management's knowledge and opinion, the Company's expected course of action. However, because this information is highly subjective, it should not be relied on as necessarily indicative of future results. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information or statements, particularly in light of the current economic climate and the significant volatility, the risks and uncertainties associated with the direct and indirect impacts of COVID-19. Forward-looking statements contained herein are made as of the date of this announcement and the Company disclaims any obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise. Accordingly, readers should not place undue reliance on forward-looking statements.

LEI: 213800PDI9G7OUKLPV84

Company No: 109180

[1]

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact rns@lseg.com or visit www.rns.com.

SOURCE: Centamin PLC

View the original press release on accesswire.com

FAQ

What are the key findings of the Doropo Gold Project DFS announced by Centamin (CELTF)?

What is the projected average annual gold production at the Doropo Gold Project?

What are the estimated all-in sustaining costs (AISC) for the Doropo Gold Project?

How much is the total construction capital expenditure (capex) for the Doropo Gold Project?