Coeur Reports Continued Positive Results From Kensington’s Multi-Year Exploration Program

Coeur Mining reported positive exploration results at its Kensington gold mine in Alaska, showing promising expansions in both the Elmira and Kensington deposits. Notable drill intercepts include 10.4 feet at 1.00 ounces per ton (oz/t) gold in Elmira South and 29.6 feet at 0.41 oz/t gold in Lower Kensington. The discoveries indicate a potential mine life extension beyond five years. Elmira Main and South zones are now connected, with additional exploration drifts planned for Zone 50 in Lower Kensington by the end of 2024. CEO Mitchell J. Krebs highlighted the findings as a validation of the multi-year development program begun in mid-2022, aimed at increasing the mine’s operational flexibility and free cash flow generation.

- Elmira South Zone extended by 400 feet with notable intercepts.

- Upper Kensington Zones 30B and 30C merging into a mineable unit.

- Significant growth in Lower Kensington's Zone 50 warrants new exploration drifts.

- Potential extension of Kensington mine life beyond five years.

- Multi-year program has replaced depletion for two consecutive years.

- None.

Insights

Kensington's continued positive drilling results indicate a significant extension of mine life, which is critical for long-term strategic planning. Extending reserve estimates by over five years could translate into sustained revenue streams and improve the mine's future financial stability. Expanding deposits like Elmira and Upper Kensington means the company's operational flexibility increases, potentially reducing production costs by capitalizing on consolidated mining operations.

In the broader mining industry, such exploration success is a strong indicator of a company's potential to increase its resource base, maintaining investor confidence and justifying ongoing capital investments. However, it's essential to remain cautious as exploration results, while promising, do not guarantee future production outputs. Ongoing geological studies and structural modeling further enhance Coeur's ability to optimize its mining operations and resource extraction efficiency, which is a positive signal for investors.

Overall, this update showcases Coeur's capability in executing effective brownfield exploration programs, aligning with industry best practices.

The exploration results at Kensington could have a substantial positive impact on Coeur's future financial performance. Extending the mine life by over five years implies that the company can continue generating revenue from Kensington without the need for significant new capital expenditures to explore or develop new sites. This translates to a more predictable and sustained cash flow, which is appealing to investors looking for long-term stability.

The intercepts reported are well above average reserve grades, suggesting that future production might yield higher profit margins. If the company continues to report such high-quality drilling results, it could lead to a re-rating of its stock by analysts, potentially increasing its valuation in the market. It's also notable that the company has successfully replaced depletion for two consecutive years, indicating strong reserve management and exploration efficiency.

However, investors should consider the risks associated with mining operations, including fluctuating gold prices, operational challenges and regulatory changes. While these results are promising, the actual economic benefits will depend on the company's ability to maintain these trends and efficiently convert these resources into reserves.

The ongoing success at Kensington reflects Coeur's strategic emphasis on organic growth through brownfield exploration. This approach is cost-effective compared to greenfield exploration and can lead to quicker returns on investment. Such exploration efficiencies and continuous reserve replacement bolster investor confidence, highlighting the company's robust operational capabilities.

This strategy aligns with current market trends where investors favor companies that can demonstrate a clear path to sustainable growth without relying heavily on external acquisitions. The positive exploration results may also enhance Coeur's competitive position within the U.S. mining landscape.

However, market analysts will be keeping a close watch on the company’s ability to maintain these exploration successes and convert them into tangible financial gains. A consistent track record of reserve additions and productivity improvements will be important in differentiating Coeur from its peers.

Recent assays highlight the potential to extend its reserve based mine life to over five years by year-end

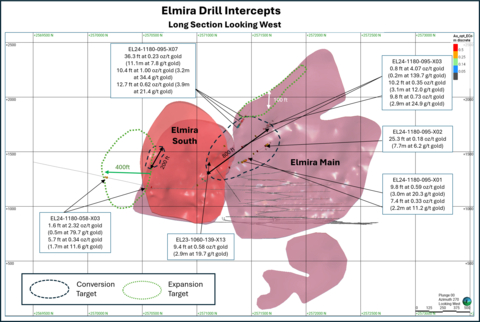

Figure 1: Long section of Elmira Main and Elmira South with recent drill intercepts (Photo: Business Wire)

Key Highlights1,2

-

Infill drilling at

Elmira is confirming continuity between Elmira Main and Elmira South with notable true width intercepts including:- Hole EL24-1180-095-X07 returned 10.4 feet at 1.00 ounces per ton (“oz/t”) gold (3.17 meters at 34.4 grams per tonne (“g/t”) gold)

-

Elmira South Zone has been extended along strike by approximately 400 feet (122 m) to date with true width intercepts including:

- Hole EL23-1060-139-X13 returned 9.4 feet at 0.58 oz/t gold (2.9 meters at 19.7 g/t gold)

- Hole EL23-1180-058-X03 returned 1.6 feet at 2.32 oz/t gold (0.5 meters at 79.6 g/t gold)

- Upper Kensington Zones 30B and 30C appear to be merging into one mineable unit. In addition, a number of potentially new sub-parallel zones are being delineated. In addition, mineralization in the Kensington Main zone has been extended 600 feet along strike since the last press release dated September 12, 2023 and 125 feet (183 meters) down dip since the year-end 2023 reserve and resource calculations

-

At Lower Kensington, the new Zone 50 has grown significantly along strike and down dip. Results have warranted the development of an additional exploration drift to allow expansion and infill drilling before year end 2024. Exciting results from Lower Kensington include the following true width intercepts:

- Hole K23-0220-147-X03 returned 29.6 feet at 0.41 oz/t gold (9.0 meters at 14.0 g/t gold)

- Hole K23-0220-091-X12 returned 11.6 feet at 0.70 oz/t gold (3.5 meters at 23.7 g/t gold)

- Hole K23-0220-091-X27 returned 7.1 feet at 1.10 oz/t gold (2.2 meters at 37.7g/t gold)

For a complete table of all year-to-date 2024 drill results, please refer to the following link: https://www.coeur.com/files/doc_downloads/2024/06/2024-

“These results validate the rationale for initiating the multi-year development program in mid-2022, which was to bolster the mine’s operational flexibility and set the stage for significant mine life additions,” said Mitchell J. Krebs, President and Chief Executive Officer. “Following the conclusion of this program in the first half of next year, we expect

Coeur’s commitment to organic growth from brownfield exploration has been a key differentiator in the sector, leading to strong reserve and resource growth with multiple new discoveries and meaningful extensions to mine lives throughout the Company’s portfolio of operations. Since the inception of Kensington’s multi-year program in mid-2022, depletion has been replaced for two consecutive years and reserves have been added at the fastest rate in the operation’s history. The

Drilling at

- Hole EL24-1180-095-X03 returned 9.8 feet at 0.73 oz/t gold (3.0 meters at 24.9 g/t gold), 10.2 feet at 0.35 oz/t gold (3.1 meters at 12.0 g/t gold), and 0.8 feet at 4.07 oz/t gold (0.2 meters at 139.7 g/t gold)

- Hole EL24-1180-095-X07 returned 36.3 feet at 0.23 oz/t gold (11.1 meters at 7.8 g/t gold), 10.4 feet at 1.00 oz/t gold (3.2 meters at 34.4 g/t gold) and 12.7 feet at 0.62 oz/t gold (3.9 meters at 21.4 g/t gold)

- Hole EL24-1180-095-X01 returned 9.8 feet at 0.59 oz/t gold (3.0 meters at 20.3 grams g/t gold) and 7.4 feet at 0.33 oz/t gold (2.2 meters at 11.2 g/t gold)

- Hole EL23-1060-139-X13 returned 9.4 feet at 0.58 oz/t gold (2.9 meters at 19.7 g/t gold)

- Hole EL24-1180-095-X02 returned 25.3 feet at 0.18 oz/t gold (7.7 meters at 6.2 g/t gold)

- Hole EL23-1180-058-X03 returned 1.6 feet at 2.32 oz/t gold (0.5 meters at 79.6 g/t gold) and 5.7 feet at 0.34 oz/t gold (1.7 meters at 11.6 g/t gold)

In Upper Kensington, drilling is showing that the recently-discovered Zone 30C appears to be merging with Zone 30B into a wider mineable unit (Figure 2). In addition, a number of potentially new, high-grade sub-parallel zones are being delineated in the hanging wall of both Kensington Main and Zones 30B and 30C.

Expansion drilling has also extended Zones 30B and 30C an additional 600 feet along strike since the previous update on September 12, 2023 and 125 feet downdip since year-end 2023 reserve and resource calculations. Notable true width intercepts in Upper Kensington include:

- Hole K23-1935-126-X12 returned 2.2 feet at 7.91 oz/t gold (0.7 meters at 271.2 g/t gold) and 13.9 feet at 0.75 oz/t gold (4.2 meters at 25.6 g/t gold)

- Hole K23-1935-126-X21 returned 17.7 feet at 0.95 oz/t gold (5.4 meters at 32.6 g/t gold)

- Hole K23-1935-126-X16 returned 0.9 feet at 15.25 oz/t gold (0.3 meters at 522.9 g/t gold)

- Hole K23-1935-126-X18 returned 14.6 feet at 0.48 oz/t gold (4.5 meters at 16.4 g/t gold)

- Hole K23-1935-126-X15 returned 17.5 feet at 0.39 oz/t gold (5.4 meters at 13.3 g/t gold)

- Hole K24-1345-074-X03 returned 16.1 feet at 0.34 oz/t gold (4.9 meters at 11.8 g/t gold)

- Hole K23-1935-126-X17 returned 15.8 feet at 0.33 oz/t gold (4.8 meters at 11.4 g/t gold)

- Hole K23-1415-048-X09 returned 1.6 feet at 2.95 oz/t gold (0.5 meters at 101.3g/t gold)

- Hole K24-1345-074-X02 returned 7.4 feet at 0.26 oz/t gold (2.3 meters at 9.0 g/t gold)

- Hole K24-1555-054-X02 returned 5.9 feet at 0.74 oz/t gold (1.8 meters at 25.5 g/t gold)

In Lower Kensington, the recently outlined Zone 50 is continuing to grow down-dip and along strike with infill and expansion drilling returning excellent results. Infill drilling over a central portion of this zone, measuring approximately 750 feet by 500 feet, has been completed, with expansion drilling completed over a similar area down-dip. Results from expansion drilling in the lower portion have been highly encouraging, warranting the development of a new exploration drift in order to complete infill at a better drill angle. This work is expected to be completed before year-end 2024 reserve and resource calculations.

The linking structures previously referred to in the Company’s

Additionally, Lower Kensington Zones 10 and Zone 10 Hanging Wall zones have continued to grow (see Figure 3). Highlighted true width results from Lower Kensington include:

- Hole K23-0220-147-X03 returned 29.6 feet at 0.41 oz/t gold (9.0 meters at 14.0 g/t gold)

- Hole K23-0220-091-X27 returned 7.1 feet at 1.10 oz/t gold (2.2 meters at 37.7 g/t gold) and 14.5 feet at 0.38 oz/t gold (4.4 meters at 13.0 g/t gold)

- Hole K23-0220-109-X02 returned 3.3 feet at 1.73 oz/t gold (1.0 meter at 59.3 g/t gold)

- Hole K23-0220-091-X01 returned 28.2 feet at 0.18 oz/t gold (8.6 meters at 6.2 g/t gold)

- Hole K24-0220-091-X02 returned 4.0 feet at 1.21 oz/t gold (1.2 meters at 41.4 g/t gold)

- Hole K23-0220-091-X23 returned 2.9 feet at 1.67 oz/t gold (0.9 meters at 57.3 g/t gold)

- Hole K24-0220-125-X03 returned 24.2 feet at 0.14 oz/t gold (7.4 meters at 4.9 g/t gold)

- Hole K24-0220-125-X01 returned 9.3 feet at 0.41 oz/t gold (2.8 meters at 14.0 g/t gold) and 13.8 feet at 0.20 oz/t gold (4.2 meters at 6.9 g/t gold)

“Results from Kensington’s multi-year exploration program continue to be very encouraging with high grades and wide intercepts encountered in Elmira South and in Upper and Lower Kensington,” said Aoife McGrath, Senior Vice President of Exploration. “Drilling also continues to outline new potential zones. After completion of a regional- and mine-scale structural modeling exercise during 2023 that put the Kensington Mine and its mineralization styles into context, detailed local scale structural modeling is almost complete for the

About Coeur

Coeur Mining, Inc. is a

Cautionary Statements

This news release contains forward-looking statements within the meaning of securities legislation in

The scientific and technical information concerning our mineral projects in this news release have been reviewed and approved by a “qualified person” under Item 1300 of SEC Regulation SK, namely our Senior Director, Technical Services, Christopher Pascoe. For a description of the key assumptions, parameters and methods used to estimate mineral reserves and mineral resources included in this news release, as well as data verification procedures and a general discussion of the extent to which the estimates may be affected by any known environmental, permitting, legal, title, taxation, sociopolitical, marketing or other relevant factors, please review the Technical Report Summaries for each of the Company’s material properties which are available at www.sec.gov.

Notes

The ranges of potential tonnage and grade (or quality) of the exploration results described in this news release are conceptual in nature. There has been insufficient exploration work to estimate a mineral resource. It is uncertain if further exploration will result in the estimation of a mineral resource. The exploration results described in this news release therefore do not represent, and should not be construed to be, an estimate of a mineral resource or mineral reserve.

For additional information regarding 2023 mineral reserves and mineral resources, see https://www.coeur.com/operations/operations/reserves-resources/.

-

For a complete table of all drill results included in this release, please refer to the following link: https://www.coeur.com/files/doc_downloads/2024/06/2024-

Kensington -exploration-update-appendix-final.pdf. - Rounding of grades, to significant figures, may result in apparent differences.

Conversion Table

1 short ton |

= |

0.907185 metric tons |

1 troy ounce |

= |

31.10348 grams |

View source version on businesswire.com: https://www.businesswire.com/news/home/20240627482552/en/

Coeur Mining, Inc.

Attention: Jeff Wilhoit, Director, Investor Relations

Phone: (312) 489-5800

www.coeur.com

Source: Coeur Mining, Inc.