The Chemours Company Reports Robust Second Quarter 2022 Results

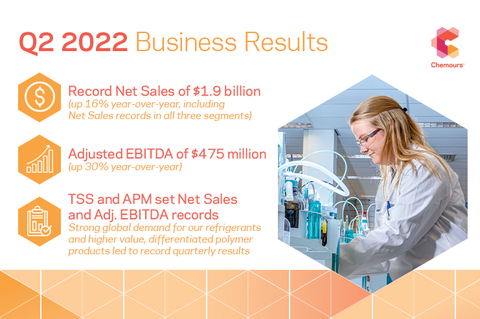

The Chemours Company (NYSE: CC) reported strong Q2 2022 results, achieving record Net Sales of $1.9 billion, up 16% year-over-year. Net Income reached $201 million, with EPS of $1.26. Adjusted EBITDA rose 30% to $475 million, driven by high demand for refrigerants and specialized products. Free Cash Flow increased by 21% to $229 million. The company is now targeting the high end of its Adjusted EBITDA guidance for 2022 and has increased its Free Cash Flow outlook to over $600 million. A plant expansion in Texas is also planned to meet growing demand for Opteon™ refrigerants.

- Net Sales of $1.9 billion, up 16% year-over-year.

- Net Income of $201 million, with EPS of $1.26.

- Adjusted EBITDA increased by 30% to $475 million.

- Free Cash Flow of $229 million, up 21% year-over-year.

- Expansion of Corpus Christi plant to support refrigerant demand.

- Lower volume headwinds of (1)% partly offset positive pricing effects.

- Currency headwinds of (2)% impacting overall performance.

- Legacy environmental remediation charge of $165 million.

Insights

Analyzing...

Strong demand drives record TSS and APM performance, now targeting the high end of Adjusted EBITDA guidance range and increasing Free Cash Flow outlook

Second Quarter 2022 Results & Highlights

-

Record

Net Sales of$1.9 billion 16% year-over-year, including recordNet Sales in all three segments -

Net Income of

$201 million $1.26 $0.87 -

Adjusted Net Income* of

$302 million $1.89 $0.69 -

Adjusted EBITDA* of

$475 million 30% year-over-year - Strong global demand for our refrigerants and higher value, differentiated polymer products led to record Adjusted EBITDA for both TSS and APM

-

Free Cash Flow of

$229 million 21% year-over-year -

Now targeting the high end of our full year Adjusted EBITDA guidance range of

$1.47 5 billion$1.57 5 billion$600 million -

Announced

Corpus Christi, Texas plant expansion to support strong demand for low GWP Opteon™ refrigerants -

On

July 27, 2022 , the Company's Board of Directors approved a third quarter dividend of$0.25

“The second quarter’s results demonstrate the strength of our highly focused portfolio,” said

Second quarter 2022 Net Sales were

Second quarter Net Income was

Titanium Technologies (TT)

Delivering high-quality Ti-Pure™ pigment through customer-centered innovation and sustainability leadership

In the second quarter, Titanium Technologies segment

Thermal & Specialized Solutions (TSS)

Driving innovation in low GWP thermal management solutions to support customer transitions to more sustainable products

The Thermal & Specialized Solutions segment delivered record-breaking second quarter financial results.

Advanced Performance Materials (APM)

Creating a clean energy and advanced electronics powerhouse

The Advanced Performance Materials segment delivered record-breaking financial results for the second consecutive quarter. Segment

Other Segment

The remaining Chemical Solutions business in Other Segment had

Corporate and Other Activities

Corporate and Other was an offset to second quarter Adjusted EBITDA of

Liquidity

As of

Cash provided by operating activities for the second quarter of 2022 was

Outlook

Adjusted EBITDA for FY 2022 is now expected to be at the high end of the previously updated guidance range of

Conference Call

As previously announced, Chemours will hold a conference call and webcast exclusively for Q&A on

About

For more information, we invite you to visit chemours.com or follow us on Twitter @Chemours or LinkedIn.

Non-GAAP Financial Measures

We prepare our financial statements in accordance with Generally Accepted Accounting Principles (GAAP). Within this press release, we may make reference to Adjusted Net Income, Adjusted EPS, Adjusted EBITDA, Adjusted EBITDA Margin, Free Cash Flow, Adjusted Effective Tax Rate, Return on

Management uses Adjusted Net Income, Adjusted EPS, Adjusted EBITDA, Adjusted EBITDA Margin, Free Cash Flow, Adjusted Effective Tax Rate, Return on

Accordingly, the company believes the presentation of these non-GAAP financial measures, when used in conjunction with GAAP financial measures, is a useful financial analysis tool that can assist investors in assessing the company's operating performance and underlying prospects. This analysis should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP. This analysis, as well as the other information in this press release, should be read in conjunction with the company's financial statements and footnotes contained in the documents that the company files with the

Forward-Looking Statements

This press release contains forward-looking statements, within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, which involve risks and uncertainties. Forward-looking statements provide current expectations of future events based on certain assumptions and include any statement that does not directly relate to a historical or current fact. The words "believe," "expect," "will," "anticipate," "plan," "estimate," "target," "project" and similar expressions, among others, generally identify "forward-looking statements," which speak only as of the date such statements were made. These forward-looking statements may address, among other things, the outcome or resolution of any pending or future environmental liabilities, the commencement, outcome or resolution of any regulatory inquiry, investigation or proceeding, the initiation, outcome or settlement of any litigation, changes in environmental regulations in the

* For information on our non-GAAP measures, please refer to the attached "Reconciliation of GAAP Financial Measures to non-GAAP Financial Measures (Unaudited)"

Interim Consolidated Statements of Operations (Unaudited) (Dollars in millions, except per share amounts) |

||||||||||||||||

|

|

Three Months Ended |

|

|

Six Months Ended |

|

||||||||||

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

||||

Net sales |

|

$ |

1,915 |

|

|

$ |

1,655 |

|

|

$ |

3,679 |

|

|

$ |

3,091 |

|

Cost of goods sold |

|

|

1,418 |

|

|

|

1,391 |

|

|

|

2,697 |

|

|

|

2,530 |

|

Gross profit |

|

|

497 |

|

|

|

264 |

|

|

|

982 |

|

|

|

561 |

|

Selling, general, and administrative expense |

|

|

254 |

|

|

|

172 |

|

|

|

395 |

|

|

|

310 |

|

Research and development expense |

|

|

25 |

|

|

|

27 |

|

|

|

55 |

|

|

|

51 |

|

Restructuring, asset-related, and other charges |

|

|

1 |

|

|

|

5 |

|

|

|

12 |

|

|

|

— |

|

Total other operating expenses |

|

|

280 |

|

|

|

204 |

|

|

|

462 |

|

|

|

361 |

|

Equity in earnings of affiliates |

|

|

16 |

|

|

|

10 |

|

|

|

28 |

|

|

|

20 |

|

Interest expense, net |

|

|

(40 |

) |

|

|

(47 |

) |

|

|

(82 |

) |

|

|

(97 |

) |

Other income, net |

|

|

38 |

|

|

|

21 |

|

|

|

44 |

|

|

|

21 |

|

Income before income taxes |

|

|

231 |

|

|

|

44 |

|

|

|

510 |

|

|

|

144 |

|

Provision for (benefit from) income taxes |

|

|

30 |

|

|

|

(22 |

) |

|

|

76 |

|

|

|

(17 |

) |

Net income |

|

|

201 |

|

|

|

66 |

|

|

|

434 |

|

|

|

161 |

|

Net income attributable to Chemours |

|

$ |

201 |

|

|

$ |

66 |

|

|

$ |

434 |

|

|

$ |

161 |

|

Per share data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per share of common stock |

|

$ |

1.29 |

|

|

$ |

0.40 |

|

|

$ |

2.75 |

|

|

$ |

0.97 |

|

Diluted earnings per share of common stock |

|

|

1.26 |

|

|

|

0.39 |

|

|

|

2.69 |

|

|

|

0.95 |

|

Interim Consolidated Balance Sheets (Unaudited) (Dollars in millions, except per share amounts) |

||||||||

|

|

|

|

|

|

|

||

Assets |

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

1,248 |

|

|

$ |

1,451 |

|

Accounts and notes receivable, net |

|

|

1,066 |

|

|

|

720 |

|

Inventories |

|

|

1,219 |

|

|

|

1,099 |

|

Prepaid expenses and other |

|

|

73 |

|

|

|

75 |

|

Total current assets |

|

|

3,606 |

|

|

|

3,345 |

|

Property, plant, and equipment |

|

|

9,264 |

|

|

|

9,232 |

|

Less: Accumulated depreciation |

|

|

(6,153 |

) |

|

|

(6,078 |

) |

Property, plant, and equipment, net |

|

|

3,111 |

|

|

|

3,154 |

|

Operating lease right-of-use assets |

|

|

220 |

|

|

|

227 |

|

|

|

|

102 |

|

|

|

102 |

|

Other intangible assets, net |

|

|

13 |

|

|

|

6 |

|

Investments in affiliates |

|

|

177 |

|

|

|

169 |

|

Restricted cash and restricted cash equivalents |

|

|

100 |

|

|

|

100 |

|

Other assets |

|

|

401 |

|

|

|

447 |

|

Total assets |

|

$ |

7,730 |

|

|

$ |

7,550 |

|

Liabilities |

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

1,249 |

|

|

$ |

1,162 |

|

Compensation and other employee-related cost |

|

|

111 |

|

|

|

173 |

|

Short-term and current maturities of long-term debt |

|

|

24 |

|

|

|

25 |

|

Current environmental remediation |

|

|

239 |

|

|

|

173 |

|

Other accrued liabilities |

|

|

263 |

|

|

|

325 |

|

Total current liabilities |

|

|

1,886 |

|

|

|

1,858 |

|

Long-term debt, net |

|

|

3,656 |

|

|

|

3,724 |

|

Operating lease liabilities |

|

|

178 |

|

|

|

179 |

|

Long-term environmental remediation |

|

|

468 |

|

|

|

389 |

|

Deferred income taxes |

|

|

54 |

|

|

|

49 |

|

Other liabilities |

|

|

273 |

|

|

|

269 |

|

Total liabilities |

|

|

6,515 |

|

|

|

6,468 |

|

Commitments and contingent liabilities |

|

|

|

|

|

|

|

|

Equity |

|

|

|

|

|

|

|

|

Common stock (par value |

|

|

2 |

|

|

|

2 |

|

|

|

|

(1,517 |

) |

|

|

(1,247 |

) |

Additional paid-in capital |

|

|

1,005 |

|

|

|

944 |

|

Retained earnings |

|

|

2,102 |

|

|

|

1,746 |

|

Accumulated other comprehensive loss |

|

|

(378 |

) |

|

|

(364 |

) |

Total Chemours stockholders’ equity |

|

|

1,214 |

|

|

|

1,081 |

|

Non-controlling interests |

|

|

1 |

|

|

|

1 |

|

Total equity |

|

|

1,215 |

|

|

|

1,082 |

|

Total liabilities and equity |

|

$ |

7,730 |

|

|

$ |

7,550 |

|

Interim Consolidated Statements of Cash Flows (Unaudited) (Dollars in millions) |

||||||||

|

|

Six Months Ended |

|

|||||

|

|

2022 |

|

|

2021 |

|

||

Cash flows from operating activities |

|

|

|

|

|

|

|

|

Net income |

|

$ |

434 |

|

|

$ |

161 |

|

Adjustments to reconcile net income to cash provided by operating activities: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

146 |

|

|

|

163 |

|

Gain on sales of assets and businesses, net |

|

|

(27 |

) |

|

|

(2 |

) |

Equity in earnings of affiliates, net |

|

|

(23 |

) |

|

|

(19 |

) |

Amortization of debt issuance costs and issue discounts |

|

|

4 |

|

|

|

4 |

|

Deferred tax benefit |

|

|

(9 |

) |

|

|

(39 |

) |

Asset-related charges |

|

|

5 |

|

|

|

— |

|

Stock-based compensation expense |

|

|

17 |

|

|

|

20 |

|

Net periodic pension cost |

|

|

4 |

|

|

|

3 |

|

Defined benefit plan contributions |

|

|

(7 |

) |

|

|

(8 |

) |

Other operating charges and credits, net |

|

|

(8 |

) |

|

|

24 |

|

Decrease (increase) in operating assets: |

|

|

|

|

|

|

|

|

Accounts and notes receivable |

|

|

(339 |

) |

|

|

(288 |

) |

Inventories and other operating assets |

|

|

(86 |

) |

|

|

(60 |

) |

(Decrease) increase in operating liabilities: |

|

|

|

|

|

|

|

|

Accounts payable and other operating liabilities |

|

|

182 |

|

|

|

336 |

|

Cash provided by operating activities |

|

|

293 |

|

|

|

295 |

|

Cash flows from investing activities |

|

|

|

|

|

|

|

|

Purchases of property, plant, and equipment |

|

|

(168 |

) |

|

|

(127 |

) |

Proceeds from sales of assets and businesses |

|

|

33 |

|

|

|

— |

|

Foreign exchange contract settlements, net |

|

|

(1 |

) |

|

|

(7 |

) |

Other investing activities |

|

|

(9 |

) |

|

|

— |

|

Cash used for investing activities |

|

|

(145 |

) |

|

|

(134 |

) |

Cash flows from financing activities |

|

|

|

|

|

|

|

|

Debt repayments |

|

|

(7 |

) |

|

|

(27 |

) |

Payments on finance leases |

|

|

(6 |

) |

|

|

(5 |

) |

Payments of debt issuance cost |

|

|

(1 |

) |

|

|

— |

|

Purchases of treasury stock, at cost |

|

|

(272 |

) |

|

|

(13 |

) |

Proceeds from exercised stock options, net |

|

|

48 |

|

|

|

11 |

|

Payments related to tax withholdings on vested stock awards |

|

|

(4 |

) |

|

|

(2 |

) |

Payments of dividends to the Company's common shareholders |

|

|

(78 |

) |

|

|

(82 |

) |

Cash used for financing activities |

|

|

(320 |

) |

|

|

(118 |

) |

Effect of exchange rate changes on cash, cash equivalents, restricted cash and restricted cash equivalents |

|

|

(31 |

) |

|

|

(9 |

) |

(Decrease) increase in cash, cash equivalents, restricted cash and restricted cash equivalents |

|

|

(203 |

) |

|

|

34 |

|

Cash, cash equivalents, restricted cash, and restricted cash equivalents at |

|

|

1,551 |

|

|

|

1,105 |

|

Cash, cash equivalents, restricted cash and restricted cash equivalents at |

|

$ |

1,348 |

|

|

$ |

1,139 |

|

|

|

|

|

|

|

|

|

|

Supplemental cash flows information |

|

|

|

|

|

|

|

|

Non-cash investing and financing activities: |

|

|

|

|

|

|

|

|

Purchases of property, plant, and equipment included in accounts payable |

|

$ |

41 |

|

|

$ |

43 |

|

Treasury Stock repurchased, not settled |

|

|

2 |

|

|

|

2 |

|

Segment Financial and Operating Data (Unaudited) (Dollars in millions) |

||||||||||||||||||||||||

Segment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

Ended |

|

|

Sequential |

|

|||||||||||||

|

Three Months Ended |

|

|

Increase / |

|

|

|

|

|

Increase / |

|

|||||||||||||

|

2022 |

|

|

2021 |

|

|

(Decrease) |

|

|

2022 |

|

|

(Decrease) |

|

||||||||||

Titanium Technologies |

$ |

|

968 |

|

|

$ |

|

859 |

|

|

$ |

|

109 |

|

|

$ |

|

928 |

|

|

$ |

|

40 |

|

Thermal & Specialized Solutions |

|

|

518 |

|

|

|

|

340 |

|

|

|

|

178 |

|

|

|

|

425 |

|

|

|

|

93 |

|

Advanced Performance Materials |

|

|

401 |

|

|

|

|

362 |

|

|

|

|

39 |

|

|

|

|

385 |

|

|

|

|

16 |

|

Other Segment |

|

|

28 |

|

|

|

|

94 |

|

|

|

|

(66 |

) |

|

|

|

26 |

|

|

|

|

2 |

|

Total |

$ |

|

1,915 |

|

|

$ |

|

1,655 |

|

|

$ |

|

260 |

|

|

$ |

|

1,764 |

|

|

$ |

|

151 |

|

Segment Adjusted EBITDA |

|

|

|

|

|

|

|

|

|

|

Three Months |

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ended |

|

|

Sequential |

|

||||

|

Three Months Ended |

|

|

Increase / |

|

|

|

|

|

Increase / |

|

|||||||||||||

|

2022 |

|

|

2021 |

|

|

(Decrease) |

|

|

2022 |

|

|

(Decrease) |

|

||||||||||

Titanium Technologies |

$ |

|

216 |

|

|

$ |

|

217 |

|

|

$ |

|

(1 |

) |

|

$ |

|

206 |

|

|

$ |

|

10 |

|

Thermal & Specialized Solutions |

|

|

213 |

|

|

|

|

115 |

|

|

|

|

98 |

|

|

|

|

174 |

|

|

|

|

39 |

|

Advanced Performance Materials |

|

|

107 |

|

|

|

|

79 |

|

|

|

|

28 |

|

|

|

|

88 |

|

|

|

|

19 |

|

Other Segment |

|

|

(2 |

) |

|

|

|

18 |

|

|

|

|

(20 |

) |

|

|

|

— |

|

|

|

|

(2 |

) |

Corporate and Other |

|

|

(59 |

) |

|

|

|

(63 |

) |

|

|

|

4 |

|

|

|

|

(65 |

) |

|

|

|

6 |

|

Total Adjusted EBITDA |

$ |

|

475 |

|

|

$ |

|

366 |

|

|

$ |

|

109 |

|

|

$ |

|

403 |

|

|

$ |

|

72 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA Margin |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Quarterly Change in |

|

|||||||||||||||||||

|

|

|

|

Percentage Change vs. |

|

Percentage Change Due To |

|

|||||||||||||

|

|

|

|

|

|

Price |

|

Volume |

|

Currency |

|

Portfolio |

|

|||||||

|

$ |

|

1,915 |

|

|

|

16 |

% |

|

23 |

% |

|

(1 |

)% |

|

(2 |

)% |

|

(4 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Titanium Technologies |

$ |

|

968 |

|

|

|

13 |

% |

|

23 |

% |

|

(8 |

)% |

|

(2 |

)% |

|

— |

% |

Thermal & Specialized Solutions |

|

|

518 |

|

|

|

52 |

% |

|

39 |

% |

|

15 |

% |

|

(2 |

)% |

|

— |

% |

Advanced Performance Materials |

|

|

401 |

|

|

|

11 |

% |

|

15 |

% |

|

(1 |

)% |

|

(3 |

)% |

|

— |

% |

Other Segment |

|

|

28 |

|

|

|

(70 |

)% |

|

3 |

% |

|

— |

% |

|

— |

% |

|

(73 |

)% |

Quarterly Change in |

|

|||||||||||||||||||

|

|

|

|

Percentage Change vs. |

|

Percentage Change Due To |

|

|||||||||||||

|

|

|

|

|

|

Price |

|

Volume |

|

Currency |

|

Portfolio |

|

|||||||

|

$ |

|

1,915 |

|

|

|

9 |

% |

|

4 |

% |

|

6 |

% |

|

(1 |

)% |

|

— |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Titanium Technologies |

$ |

|

968 |

|

|

|

4 |

% |

|

6 |

% |

|

— |

% |

|

(2 |

)% |

|

— |

% |

Thermal & Specialized Solutions |

|

|

518 |

|

|

|

22 |

% |

|

1 |

% |

|

21 |

% |

|

— |

% |

|

— |

% |

Advanced Performance Materials |

|

|

401 |

|

|

|

4 |

% |

|

2 |

% |

|

4 |

% |

|

(2 |

)% |

|

— |

% |

Other Segment |

|

|

28 |

|

|

|

8 |

% |

|

5 |

% |

|

3 |

% |

|

— |

% |

|

— |

% |

Reconciliation of GAAP Financial Measures to Non-GAAP Financial Measures (Unaudited)

(Dollars in millions)

GAAP Net Income Attributable to Chemours to Adjusted Net Income and Adjusted EBITDA Reconciliation

Adjusted earnings before interest, taxes, depreciation, and amortization (“Adjusted EBITDA”) is defined as income (loss) before income taxes, excluding the following items: interest expense, depreciation, and amortization; non-operating pension and other post-retirement employee benefit costs, which represents the components of net periodic pension (income) costs excluding the service cost component; exchange (gains) losses included in other income (expense), net; restructuring, asset-related, and other charges; (gains) losses on sales of businesses or assets; and, other items not considered indicative of the Company’s ongoing operational performance and expected to occur infrequently, including Qualified Spend reimbursable by DuPont and/or Corteva as part of the Company's cost-sharing agreement under the terms of the MOU that were previously excluded from Adjusted EBITDA. Adjusted Net Income is defined as net income (loss) attributable to Chemours, adjusted for items excluded from Adjusted EBITDA, except interest expense, depreciation, amortization, and certain provision for (benefit from) income tax amounts.

|

|

Three Months Ended |

|

|

Six Months Ended |

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2022 |

|

|

2021 |

|

||||||||||

Net income attributable to Chemours |

|

$ |

|

201 |

|

|

$ |

|

66 |

|

|

$ |

|

234 |

|

|

$ |

|

434 |

|

|

$ |

|

161 |

|

Non-operating pension and other post-retirement employee benefit income |

|

|

|

(2 |

) |

|

|

|

(2 |

) |

|

|

|

(1 |

) |

|

|

|

(3 |

) |

|

|

|

(5 |

) |

Exchange losses (gains), net |

|

|

|

3 |

|

|

|

|

(3 |

) |

|

|

|

— |

|

|

|

|

3 |

|

|

|

|

5 |

|

Restructuring, asset-related, and other charges (1) |

|

|

|

— |

|

|

|

|

5 |

|

|

|

|

16 |

|

|

|

|

16 |

|

|

|

|

— |

|

Gain on sales of assets and businesses, net (2) |

|

|

|

(26 |

) |

|

|

|

(2 |

) |

|

|

|

(1 |

) |

|

|

|

(27 |

) |

|

|

|

(2 |

) |

Natural disasters and catastrophic events (3) |

|

|

|

— |

|

|

|

|

3 |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

|

19 |

|

Transaction costs |

|

|

|

— |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

|

5 |

|

Qualified spend recovery (4) |

|

|

|

(13 |

) |

|

|

|

— |

|

|

|

|

(14 |

) |

|

|

|

(27 |

) |

|

|

|

— |

|

Legal and environmental charges (5,6) |

|

|

|

170 |

|

|

|

|

195 |

|

|

|

|

8 |

|

|

|

|

178 |

|

|

|

|

208 |

|

Adjustments made to income taxes (7) |

|

|

|

(2) |

|

|

|

(10 |

) |

|

|

|

(3 |

) |

|

|

|

(6) |

|

|

|

(10 |

) |

||

Benefit from income taxes relating to reconciling items (8) |

|

|

|

(29) |

|

|

|

(47 |

) |

|

|

|

— |

|

|

|

|

(28) |

|

|

|

(58 |

) |

||

Adjusted Net Income (9) |

|

|

|

302 |

|

|

|

|

205 |

|

|

|

|

239 |

|

|

|

|

540 |

|

|

|

|

323 |

|

Interest expense, net |

|

|

|

40 |

|

|

|

|

47 |

|

|

|

|

41 |

|

|

|

|

82 |

|

|

|

|

97 |

|

Depreciation and amortization |

|

|

|

72 |

|

|

|

|

79 |

|

|

|

|

74 |

|

|

|

|

146 |

|

|

|

|

163 |

|

All remaining provision for income taxes (9) |

|

|

|

61 |

|

|

|

|

35 |

|

|

|

|

49 |

|

|

|

|

110 |

|

|

|

|

51 |

|

Adjusted EBITDA |

|

$ |

|

475 |

|

|

$ |

|

366 |

|

|

$ |

|

403 |

|

|

$ |

|

878 |

|

|

$ |

|

634 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted effective tax rate (9) |

|

|

|

17 |

% |

|

|

|

15 |

% |

|

|

|

17 |

% |

|

|

|

17 |

% |

|

|

|

14 |

% |

(1) |

In 2022, restructuring, asset related, and other charges primarily includes asset charges and write-offs resulting from the conflict between |

||

(2) |

Refer to “Note 6 – Other Income (Expense), Net” to the Interim Consolidated Financial Statements in our Quarterly Report on Form 10-Q for the quarter ended |

||

(3) |

In 2021, natural disasters and catastrophic events pertains to the total cost of plant repairs and utility charges in excess of historical averages caused by Winter Storm Uri. | ||

(4) |

Qualified spend recovery represents costs and expenses that were previously excluded from Adjusted EBITDA, reimbursable by DuPont and/or Corteva as part of our cost-sharing agreement under the terms of the MOU which is discussed in further detail in "Note 16 – Commitments and Contingent Liabilities" to the Interim Consolidated Financial Statements in our Quarterly Report on Form 10-Q for the quarter ended |

||

(5) |

Legal charges pertains to litigation settlements, PFOA drinking water treatment accruals, and other legal charges. For the three and six months ended |

||

(6) |

Environmental charges pertains to management’s assessment of estimated liabilities associated with certain non-recurring environmental remediation expenses at various sites. In 2022, environmental charges include |

||

(7) |

Includes the removal of certain discrete income tax impacts within our provision for income taxes, such as shortfalls and windfalls on our share-based payments, certain return-to-accrual adjustments, valuation allowance adjustments, unrealized gains and losses on foreign exchange rate changes, and other discrete income tax items. | ||

(8) |

The income tax impacts included in this caption are determined using the applicable rates in the taxing jurisdictions in which income or expense occurred for each of the reconciling items and represents both current and deferred income tax expense or benefit based on the nature of the non-GAAP financial measure. | ||

(9) |

Adjusted effective tax rate is defined as all remaining provision for income taxes divided by pre-tax Adjusted Net Income. |

Reconciliation of GAAP Financial Measures to Non-GAAP Financial Measures (Unaudited)

(Dollars in millions, except per share amounts)

GAAP Earnings per Share to Adjusted Earnings per Share Reconciliation

Adjusted earnings per share (“EPS”) is calculated by dividing Adjusted Net Income by the weighted-average number of common shares outstanding. Diluted Adjusted EPS accounts for the dilutive impact of stock-based compensation awards, which includes unvested restricted shares. Diluted Adjusted EPS considers the impact of potentially-dilutive securities, except in periods in which there is a loss because the inclusion of the potentially-dilutive securities would have an anti-dilutive effect.

|

|

Three Months Ended |

|

|

Six Months Ended |

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2022 |

|

|

2021 |

|

||||||||||

Numerator: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Net income attributable to Chemours |

|

$ |

|

201 |

|

|

$ |

|

66 |

|

|

$ |

|

234 |

|

|

$ |

|

434 |

|

|

$ |

|

161 |

|

Adjusted Net Income |

|

|

|

302 |

|

|

|

|

205 |

|

|

|

|

239 |

|

|

|

|

540 |

|

|

|

|

323 |

|

Denominator: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Weighted-average number of common shares outstanding - basic |

|

|

|

156,224,802 |

|

|

|

|

166,168,550 |

|

|

|

|

159,897,673 |

|

|

|

|

158,051,092 |

|

|

|

|

165,912,089 |

|

Dilutive effect of the Company's employee compensation plans |

|

|

|

3,442,411 |

|

|

|

|

3,989,453 |

|

|

|

|

3,681,907 |

|

|

|

|

3,562,159 |

|

|

|

|

3,693,498 |

|

Weighted-average number of common shares outstanding - diluted |

|

|

|

159,667,213 |

|

|

|

|

170,158,003 |

|

|

|

|

163,579,580 |

|

|

|

|

161,613,251 |

|

|

|

|

169,605,587 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Basic earnings per share of common stock |

|

$ |

|

1.29 |

|

|

$ |

|

0.40 |

|

|

$ |

|

1.46 |

|

|

$ |

|

2.75 |

|

|

$ |

|

0.97 |

|

Diluted earnings per share of common stock |

|

|

|

1.26 |

|

|

|

|

0.39 |

|

|

|

|

1.43 |

|

|

|

|

2.69 |

|

|

|

|

0.95 |

|

Adjusted basic earnings per share of common stock |

|

|

|

1.93 |

|

|

|

|

1.23 |

|

|

|

|

1.49 |

|

|

|

|

3.42 |

|

|

|

|

1.95 |

|

Adjusted diluted earnings per share of common stock |

|

|

|

1.89 |

|

|

|

|

1.20 |

|

|

|

|

1.46 |

|

|

|

|

3.34 |

|

|

|

|

1.90 |

|

Reconciliation of GAAP Financial Measures to Non-GAAP Financial Measures (Unaudited)

(In millions, except per share amounts)

2022 Estimated GAAP Net Income Attributable to Chemours to Estimated Adjusted Net Income, Estimated Adjusted EBITDA and Estimated Adjusted EPS Reconciliation (*)

|

|

(Estimated)

|

|

|||||

|

|

Low |

|

|

High |

|

||

Net income attributable to Chemours |

|

$ |

712 |

|

|

$ |

792 |

|

Restructuring, transaction, and other costs, net (1) |

|

|

103 |

|

|

|

103 |

|

Adjusted Net Income |

|

|

815 |

|

|

|

895 |

|

Interest expense, net |

|

|

170 |

|

|

|

170 |

|

Depreciation and amortization |

|

|

300 |

|

|

|

300 |

|

All remaining provision for income taxes |

|

|

190 |

|

|

|

210 |

|

Adjusted EBITDA |

|

$ |

1,475 |

|

|

$ |

1,575 |

|

|

|

|

|

|

|

|

|

|

Weighted-average number of common shares outstanding - basic (2) |

|

|

156.6 |

|

|

|

156.6 |

|

Dilutive effect of the Company's employee compensation plans (3) |

|

|

3.5 |

|

|

|

3.5 |

|

Weighted-average number of common shares outstanding - diluted |

|

|

160.1 |

|

|

|

160.1 |

|

|

|

|

|

|

|

|

|

|

Basic earnings per share of common stock |

|

$ |

4.55 |

|

|

$ |

5.06 |

|

Diluted earnings per share of common stock (4) |

|

|

4.45 |

|

|

|

4.95 |

|

Adjusted basic earnings per share of common stock |

|

|

5.20 |

|

|

|

5.72 |

|

Adjusted diluted earnings per share of common stock (4) |

|

|

5.09 |

|

|

|

5.59 |

|

(1) |

Restructuring, transaction, and other costs, net includes the net provision for (benefit from) income taxes relating to reconciling items and adjustments made to income taxes for the removal of certain discrete income tax impacts. | ||

(2) |

The Company’s estimates for the weighted-average number of common shares outstanding - basic reflect results for the six months ended |

||

(3) |

The Company’s estimates for the dilutive effect of the Company’s employee compensation plans reflect the dilutive effect for the six months ended |

||

(4) |

Diluted earnings per share is calculated using net income available to common shareholders divided by diluted weighted-average common shares outstanding during each period, which includes unvested restricted shares. Diluted earnings per share considers the impact of potentially dilutive securities except in periods in which there is a loss because the inclusion of the potential common shares would have an anti-dilutive effect. | ||

| (*) | The Company’s estimates reflect its current visibility and expectations based on market factors, such as currency movements, macro-economic factors, and end-market demand. Actual results could differ materially from these current estimates. |

Reconciliation of GAAP Financial Measures to Non-GAAP Financial Measures (Unaudited)

(Dollars in millions)

GAAP Cash Flow Provided by Operating Activities to Free Cash Flows Reconciliation

Free Cash Flows is defined as cash flows provided by (used for) operating activities, less purchases of property, plant, and equipment as shown in the consolidated statements of cash flows.

|

|

Three Months Ended |

|

|

Six Months Ended |

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2022 |

|

|

2021 |

|

||||||||||

Cash provided by operating activities |

|

$ |

|

291 |

|

|

$ |

|

256 |

|

|

$ |

|

2 |

|

|

$ |

|

293 |

|

|

$ |

|

295 |

|

Less: Purchases of property, plant, and equipment |

|

|

|

(62 |

) |

|

|

|

(67 |

) |

|

|

|

(106 |

) |

|

|

|

(168 |

) |

|

|

|

(127 |

) |

Free Cash Flows |

|

$ |

|

229 |

|

|

$ |

|

189 |

|

|

$ |

|

(104 |

) |

|

$ |

|

125 |

|

|

$ |

|

168 |

|

2022 Estimated GAAP Cash Flow Provided by Operating Activities to Estimated Free Cash Flow Reconciliation (*)

|

|

(Estimated) |

|

|

|

Year Ended |

|

Cash flow provided by operating activities |

|

$ |

>1,000 |

Less: Purchases of property, plant, and equipment |

|

|

~(400) |

Free Cash Flows |

|

$ |

>600 |

(*) |

|

The Company’s estimates reflect its current visibility and expectations based on market factors, such as currency movements, macro-economic factors, and end-market demand. Actual results could differ materially from these current estimates. |

Return on Invested Capital Reconciliation

Return on

|

|

Twelve Months Ended |

|

|||||

|

|

2022 |

|

|

2021 |

|

||

Adjusted EBITDA (1) |

|

$ |

1,557 |

|

|

$ |

1,090 |

|

Less: Depreciation and amortization |

|

|

(300 |

) |

|

|

(321 |

) |

Adjusted EBIT |

|

$ |

1,257 |

|

|

$ |

769 |

|

|

|

|

|

|

|

|

|

|

|

|

As of |

|

|||||

|

|

2022 |

|

|

2021 |

|

||

Total debt, net (2) |

|

$ |

3,680 |

|

|

$ |

3,989 |

|

Total equity |

|

|

1,215 |

|

|

|

900 |

|

Less: Cash and cash equivalents |

|

|

(1,248 |

) |

|

|

(1,139 |

) |

Invested capital, net |

|

$ |

3,647 |

|

|

$ |

3,750 |

|

Average invested capital (3) |

|

$ |

3,667 |

|

|

$ |

3,834 |

|

|

|

|

|

|

|

|

|

|

Return on |

|

|

34 |

% |

|

|

20 |

% |

(1) |

Reconciliations of net income (loss) attributable to Chemours to Adjusted EBITDA are provided on a quarterly basis. See the preceding table for the reconciliation of net income (loss) attributable to Chemours to Adjusted EBITDA. | ||

(2) |

Total debt principal minus unamortized issue discounts of |

||

(3) |

Average invested capital is based on a five-quarter trailing average of invested capital, net. |

Reconciliation of GAAP Financial Measures to Non-GAAP Financial Measures (Unaudited)

(Dollars in millions)

Net Leverage Ratio Reconciliation

Net Leverage Ratio is defined as our total debt principal, net, or our total debt principal outstanding less cash and cash equivalents, divided by Adjusted EBITDA.

|

|

As of |

|

|||||

|

|

2022 |

|

|

2021 |

|

||

Total debt principal |

|

$ |

3,710 |

|

|

$ |

4,020 |

|

Less: Cash and cash equivalents |

|

|

(1,248 |

) |

|

|

(1,139 |

) |

Total debt principal, net |

|

$ |

2,462 |

|

|

$ |

2,881 |

|

|

|

|

|

|

|

|

|

|

|

|

Twelve Months Ended |

|

|||||

|

|

2022 |

|

|

2021 |

|

||

Adjusted EBITDA (1) |

|

$ |

1,557 |

|

|

$ |

1,090 |

|

|

|

|

|

|

|

|

|

|

Net Leverage Ratio |

|

1.6x |

|

|

2.6x |

|

||

(1) |

|

Reconciliations of net income (loss) attributable to Chemours to Adjusted EBITDA are provided on a quarterly basis. See the preceding table for the reconciliation of net income (loss) attributable to Chemours to Adjusted EBITDA. |

View source version on businesswire.com: https://www.businesswire.com/news/home/20220728005938/en/

INVESTORS

SVP, Chief Development Officer

+1.302.773.2263

investor@chemours.com

Manager, Investor Relations

+1.302.773.0026

investor@chemours.com

NEWS MEDIA

+1.302.219.7140

media@chemours.com

Source: