Casa Minerals Options 90% of Congress Gold Mine in Arizona and Announces $2,500,000 Non-Brokered Private Placement

Casa Minerals Inc. has optioned the historic Congress Gold Mine in Arizona, allowing for a potential 90% acquisition. The agreement entails payments totaling US$100,000, issuance of 2,500,000 shares, and $2 million in exploration expenditures over three years. The mine, significant for its past production of about 500,000 ounces of gold, has been idle since 1992. Casa also announced a $2.5 million private placement. However, there are risks regarding the viability of economically-viable mineral bodies based on historic data.

- Casa Minerals has secured an option to acquire a 90% stake in the Congress Gold Mine, a historically significant site.

- The company plans to invest $2 million in exploration, potentially enhancing resource identification.

- The congress mine has a notable past production history, yielding approximately 500,000 ounces of gold.

- Uncertainty regarding the identification of economically-viable mineral bodies due to reliance on historic data.

- The mine has been inactive since 1992, raising concerns about potential operational challenges.

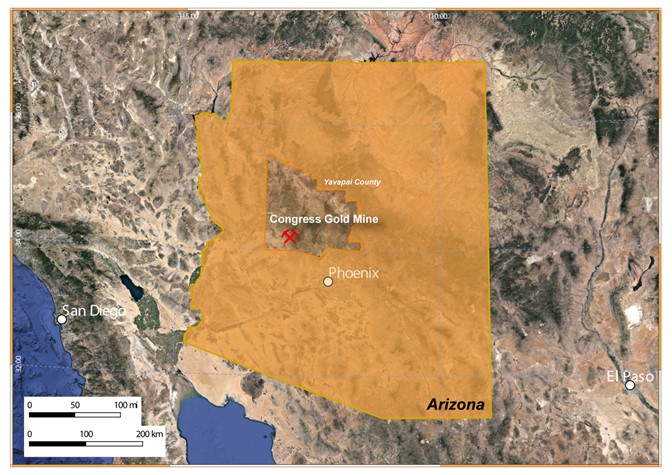

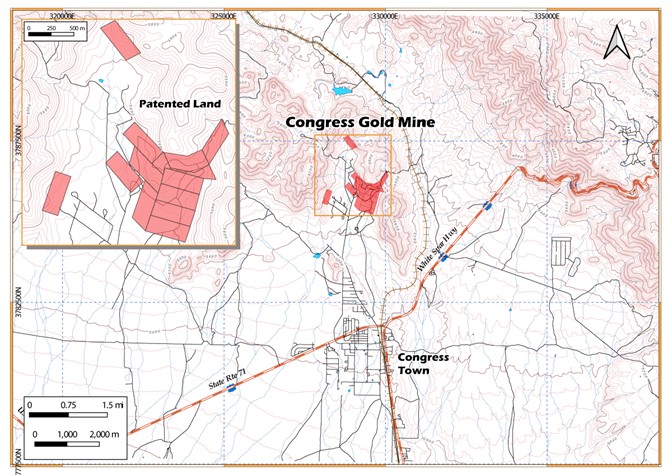

VANCOUVER, BC / ACCESSWIRE / March 3, 2021 / Casa Minerals Inc. (TSXV:CASA)(OTC PINK:CASXF)(FSE:0CM) (the "Company" or "Casa") is pleased to announce that the Company has optioned the Congress Gold Mine located in west-central Arizona, USA. The historic Congress Gold Mine is located three miles north of Congress in Martinez Mining District of Yavapai County. The property consists of 14 Patented Mineral Properties with approximately 260 acres area. Commencing in or about 1887, the Congress mine operated at intervals until 1992 and at one time supported a full scale mining and milling operation and the small town of Congress. It has the distinction of being Arizona's largest gold-silver mine with production of about 500,000 ounces of gold.

Option Agreement:

Casa entered into an option agreement with the owners of the Congress Gold Mine (the "optionors") whereby Casa Minerals may acquire a

The option agreement and the transactions contemplated there are subject to acceptance of the TSX Venture Exchange.

Brief History

Congress Gold Mine has a history of intermittent production since 1887. Several different operators produced gold-rich material from some of the 45 gold-bearing veins and structures that have been identified by surface sampling and geological mapping. Most production is reported to be from the sub-parallel Congress and Niagara Veins that occur in a northwest-southeast trend across the property. Although production records are incomplete, mineralized material with 0.7 oz gold per ton are reported from the Congress vein; overall mine-life averages were probably close to 0.3 ounces gold per ton. The Congress has been idle since 1992 when mining ceased, possibly in part due to a dispute between the then-operator and the owners. The mine has not been evaluated and explored using present day methods and economics.

Casa Minerals will conduct thorough reviews of regional and property data, with particular attention to extensions of production areas and to the many mineralized structures that never achieved production. Also, it appears as if some of the mined out parts of the mine were filled with low grade "waste" materials that were uneconomic at the time but possibly now have value. Available property maps will be evaluated and added to a new data base.

Non-brokered Private Placement

Casa Minerals is arranging a

Cautionary Note: All historic data referenced in this news release were obtained from available archives and have not been confirmed or verified by the Company or a Qualified Person. There is no assurance that work by Casa Minerals will result in identification of economically-viable mineral bodies comparable in size and/or grade to those that supported historic mining operations.

Qualified Person:

Mr. Erik Ostensoe P.Geo., a director and chief geologist of the Company, a Qualified Person as defined by National Instrument 43-101, has reviewed and approved the scientific and technical disclosure in this news release.

On Behalf of Board of Directors

Farshad Shirvani, M.Sc. Geology

President and CEO

For more information, please contact:

Casa Minerals Inc.

Farshad Shirvani, President & CEO

Phone: (604) 678-9587

Email: contact@casaminerals.com

https://www.casaminerals.com

Forward-Looking Statements

Information set forth in this news release contains forward-looking statements that are based on assumptions as of the date of this news release. These statements reflect management's current estimates, beliefs, intentions and expectations. They are not guarantees of future performance. The Company cautions that all forward-looking statements are inherently uncertain and that actual performance may be affected by a number of material factors, many of which are beyond the Company's control. Such factors include, among other things: risks and uncertainties relating to the Company's limited operating history and the need to comply with environmental and governmental regulations. Accordingly, actual and future events, conditions and results may differ materially from the estimates, beliefs, intentions and expectations expressed or implied in the forward-looking information. Except as required under applicable securities legislation, the Company undertakes no obligation to publicly update or revise forward-looking information.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

SOURCE: Casa Minerals Inc.

View source version on accesswire.com:

https://www.accesswire.com/633353/Casa-Minerals-Options-90-of-Congress-Gold-Mine-in-Arizona-and-Announces-2500000-Non-Brokered-Private-Placement

FAQ

What is the recent development for Casa Minerals regarding the Congress Gold Mine?

What are the financial implications of Casa Minerals' option agreement for the Congress Gold Mine?

What is the historical significance of the Congress Gold Mine?

What are the risks associated with Casa Minerals' acquisition of the Congress Gold Mine?