Cass Information Systems, Inc. Reports Continuing Earnings Recovery

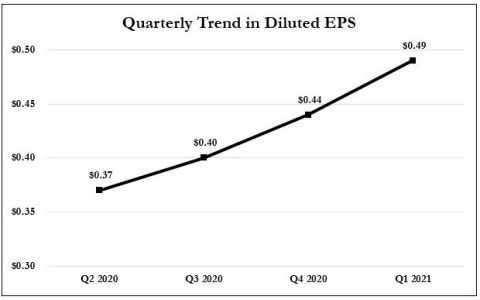

Cass Information Systems reported Q1 2021 earnings of $.49 per diluted share, a 32.4% increase from Q2 2020's $.37. Net income rose to $7.1 million from $5.4 million, despite a low interest rate environment. However, diluted EPS decreased by 5.8% compared to Q1 2020. Key metrics showed transportation invoice volume increased 6.1% and dollar volume surged 22.2%, driven by manufacturing sector performance and new clients. Revenues fell 2.7% quarter-over-quarter due to diminished gains on securities. Operating expenses declined 1.4%, showcasing cost management amid economic challenges.

- Q1 2021 earnings grew 32.4% from Q2 2020.

- Net income increased to $7.1 million compared to $5.4 million.

- Transportation dollar volume surged 22.2% year-over-year.

- Facility-related dollar volumes increased by 7.5% due to new business wins.

- Consolidated operating expenses decreased by $404,000, or 1.4%.

- Diluted EPS fell 5.8% compared to Q1 2020.

- Revenues dropped 2.7% quarter-over-quarter.

- Net interest margin declined from 3.21% to 2.32%.

Insights

Analyzing...

Cass Information Systems, Inc. (Nasdaq: CASS), the leading provider of transportation, energy, telecom, and waste invoice payment and information services, reported first quarter 2021 earnings of $.49 per diluted share, an increase of

Earnings Recovery Continues at Cass Information Systems (Graphic: Business Wire)

Net income for the period was

When compared to the first quarter of 2020, which largely transpired prior to the full impact of the pandemic, diluted earnings per share declined

|

March 31, 2021 |

March 31, 2020 |

%

|

Transportation Invoice Volume |

8.8 million |

8.3 million |

6.1 |

Transportation Dollar Volume |

|

|

22.2 |

Facility Expense Transaction Volume* |

7.0 million |

6.5 million |

7.5 |

Facility Expense Dollar Volume* |

|

|

7.5 |

Revenues |

|

|

(2.7) |

Net Income |

|

|

(6.3) |

Diluted Earnings Per Share |

$.49 |

$.52 |

(5.8) |

*Includes Energy, Telecom and Waste

Transportation invoice and dollar volumes improved

Facility-related (electricity, gas, waste and telecom expense management) invoice and dollar volumes both increased

Revenues declined

Consolidated operating expenses decreased

“Despite the pandemic and historically low interest rates, Cass has been able to steadily grow its customer base, revenue and earnings since the second quarter of 2020,” noted Eric H. Brunngraber, Cass chairman and chief executive officer. “These achievements are a testament to the ability of our team to innovate and successfully adapt when faced with an uphill challenge.”

Cash Dividend Declared

On April 20, 2021, the company’s board of directors declared a second quarter dividend of $.27 per share payable June 15, 2021 to shareholders of record June 4, 2021. Cass has continuously paid regularly scheduled cash dividends since 1934.

About Cass Information Systems

Cass Information Systems, Inc. is a leading provider of integrated information and payment management solutions. Cass enables enterprises to achieve visibility, control and efficiency in their supply chains, communications networks, facilities and other operations. Disbursing more than

Note to Investors

Certain matters set forth in this news release may contain forward-looking statements that are provided to assist in the understanding of anticipated future financial performance. However, such performance involves risks and uncertainties that may cause actual results to differ materially from those in such statements. These risks and uncertainties include the scope, duration and ultimate impact of the COVID-19 pandemic as well as economic and market conditions, risks of credit deterioration, interest rate changes, governmental actions, market volatility, security breaches and technology interruptions, energy prices and competitive factors, among others, as set forth in the Company's most recent Annual Report on Form 10-K and subsequent reports filed with the Securities and Exchange Commission. The Company has used, and intends to continue using, the Investors portion of its website to disclose material non-public information and to comply with its disclosure obligations under Regulation FD. Accordingly, investors are encouraged to monitor Cass’s website in addition to following press releases, SEC filings, and public conference calls and webcasts.

Selected Consolidated Financial Data

The following table presents selected unaudited consolidated financial data (in thousands, except per share data) for the periods ended March 31, 2021 and 2020:

|

|

Quarter

|

|

Quarter

|

|

|||

Transportation Invoice Volume |

|

8,787 |

|

|

8,280 |

|

||

Transportation Dollar Volume |

$ |

7,904,639 |

|

$ |

6,467,051 |

|

||

Facility Expense Transaction Volume |

|

6,996 |

|

|

6,509 |

|

||

Facility Expense Dollar Volume |

$ |

3,717,428 |

|

$ |

3,458,646 |

|

||

|

|

|

|

|

|

|

||

Payment and Processing Fees |

$ |

25,216 |

|

$ |

25,503 |

|

||

Net Interest Income |

|

10,345 |

|

|

11,373 |

|

||

(Release of) Provision for Credit Losses |

|

(600) |

|

|

325 |

|

||

Gains on Sales of Securities |

|

48 |

|

|

1,069 |

|

||

Other |

|

911 |

|

|

523 |

|

||

Total Revenues |

$ |

37,120 |

|

$ |

38,143 |

|

||

Personnel |

$ |

22,526 |

|

$ |

22,427 |

|

||

Occupancy |

|

947 |

|

|

941 |

|

||

Equipment |

|

1,675 |

|

|

1,635 |

|

||

Other |

|

3,377 |

|

|

3,926 |

|

||

Total Operating Expenses |

$ |

28,525 |

|

$ |

28,929 |

|

||

Income from Operations before Income Tax Expense |

$ |

8,595 |

|

$ |

9,214 |

|

||

Income Tax Expense |

|

1,524 |

|

|

1,669 |

|

||

Net Income |

$ |

7,071 |

|

$ |

7,545 |

|

||

Basic Earnings per Share |

$ |

.49 |

|

$ |

.52 |

|

||

Diluted Earnings per Share |

$ |

.49 |

|

$ |

.52 |

|

||

|

|

|

|

|

|

|

||

Average Earning Assets |

$ |

1,891,395 |

|

$ |

1,487,873 |

|

||

Net Interest Margin |

|

|

|

|

|

|

||

Allowance for Credit Losses to Loans / Allowance for Loan Losses to Loans |

|

|

|

|

|

|

||

Non-performing Loans to Total Loans |

|

— |

|

|

— |

|

||

Net Loan (Recoveries) / Charge-offs to Loans |

|

— |

|

|

— |

|

||

View source version on businesswire.com: https://www.businesswire.com/news/home/20210422005184/en/