Corporación América Airports S.A. Reports September 2024 Passenger Traffic

Corporación América Airports S.A. (NYSE: CAAP) reported a 3.6% year-on-year decrease in passenger traffic for September 2024. Excluding Natal airport, the decrease was 1.2% YoY. Key highlights include:

- Domestic passengers decreased by 12.2% YoY

- International passengers increased by 5.4% YoY

- Transit passengers rose by 12.6% YoY

- Cargo volume increased by 9.7% YoY

- Total aircraft movements declined by 3.7% YoY

Performance varied across countries, with Uruguay showing strong growth (+15.7% YoY), Italy increasing (+5.9% YoY), while Argentina (-7.2% YoY), Brazil (-2.4% YoY), Ecuador (-5.1% YoY), and Armenia (-2.5% YoY) experienced declines. The report highlights ongoing challenges in some markets, including recession impacts in Argentina and aviation constraints in Brazil.

Corporación América Airports S.A. (NYSE: CAAP) ha riportato un declino del 3,6% anno su anno nel traffico passeggeri per settembre 2024. Escludendo l'aeroporto di Natal, il declino è stato di 1,2% anno su anno. I punti salienti includono:

- I passeggeri nazionali sono diminuiti del 12,2% anno su anno

- I passeggeri internazionali sono aumentati del 5,4% anno su anno

- I passeggeri in transito sono aumentati del 12,6% anno su anno

- Il volume di cargo è aumentato del 9,7% anno su anno

- I movimenti aerei totali sono diminuiti del 3,7% anno su anno

Le performance variano tra i diversi paesi, con l'Uruguay che mostra una forte crescita (+15,7% anno su anno), l'Italia in aumento (+5,9% anno su anno), mentre l'Argentina (-7,2% anno su anno), il Brasile (-2,4% anno su anno), l'Ecuador (-5,1% anno su anno) e l'Armenia (-2,5% anno su anno) hanno registrato dei cali. Il report evidenzia le sfide in corso in alcuni mercati, compresi gli impatti della recessione in Argentina e le restrizioni aviatriche in Brasile.

Corporación América Airports S.A. (NYSE: CAAP) reportó una reducción del 3,6% interanual en el tráfico de pasajeros durante septiembre de 2024. Excluyendo el aeropuerto de Natal, la disminución fue del 1,2% interanual. Los aspectos destacados incluyen:

- Los pasajeros nacionales disminuyeron un 12,2% interanual

- Los pasajeros internacionales aumentaron un 5,4% interanual

- Los pasajeros en tránsito crecieron un 12,6% interanual

- El volumen de carga aumentó un 9,7% interanual

- Los movimientos aéreos totales disminuyeron un 3,7% interanual

El desempeño varió entre países, con Uruguay mostrando un fuerte crecimiento (+15,7% interanual), Italia aumentando (+5,9% interanual), mientras que Argentina (-7,2% interanual), Brasil (-2,4% interanual), Ecuador (-5,1% interanual) y Armenia (-2,5% interanual) experimentaron descensos. El informe destaca los desafíos en curso en algunos mercados, incluidos los impactos de la recesión en Argentina y las restricciones en la aviación en Brasil.

Corporación América Airports S.A. (NYSE: CAAP)는 2024년 9월 승객 교통이 전년 대비 3.6% 감소했다고 보고했습니다. 나탈 공항을 제외하면 감소폭은 전년 대비 1.2%였습니다. 주요 하이라이트는 다음과 같습니다:

- 국내 승객은 전년 대비 12.2% 감소했습니다.

- 국제 승객은 전년 대비 5.4% 증가했습니다.

- 환승 승객은 전년 대비 12.6% 증가했습니다.

- 화물량은 전년 대비 9.7% 증가했습니다.

- 총 항공기 이동 수는 전년 대비 3.7% 감소했습니다.

성능은 국가별로 다르게 나타났으며, 우루과이는 (+15.7% 전년 대비) 강력한 성장을 보였고, 이탈리아도 증가세를 보였습니다 (+5.9% 전년 대비), 반면 아르헨티나 (-7.2% 전년 대비), 브라질 (-2.4% 전년 대비), 에콰도르 (-5.1% 전년 대비) 및 아르메니아 (-2.5% 전년 대비)는 감소를 경험했습니다. 보고서는 아르헨티나의 경기 침체 영향과 브라질의 항공 제한 등 일부 시장에서의 지속적인 도전을 강조합니다.

Corporación América Airports S.A. (NYSE: CAAP) a rapporté une diminution de 3,6% d'une année sur l'autre du trafic passagers pour septembre 2024. En excluant l'aéroport de Natal, la diminution était de 1,2% d'une année sur l'autre. Les faits marquants incluent :

- Les passagers domestiques ont diminué de 12,2% d'une année sur l'autre

- Les passagers internationaux ont augmenté de 5,4% d'une année sur l'autre

- Les passagers en transit ont augmenté de 12,6% d'une année sur l'autre

- Le volume de fret a augmenté de 9,7% d'une année sur l'autre

- Les mouvements d'avions totaux ont diminué de 3,7% d'une année sur l'autre

Les performances variaient selon les pays, l'Uruguay montrant une forte croissance (+15,7% d'une année sur l'autre), l'Italie en hausse (+5,9% d'une année sur l'autre), tandis que l'Argentine (-7,2% d'une année sur l'autre), le Brésil (-2,4% d'une année sur l'autre), l'Équateur (-5,1% d'une année sur l'autre) et l'Arménie (-2,5% d'une année sur l'autre) ont connu des diminutions. Le rapport met en évidence les défis persistants sur certains marchés, y compris les impacts de la récession en Argentine et les contraintes aériennes au Brésil.

Die Corporación América Airports S.A. (NYSE: CAAP) berichtete von einem rückgang von 3,6% im Vergleich zum Vorjahr im Passagierverkehr für September 2024. Ohne den Flughafen Natal betrug der Rückgang 1,2% im Jahresvergleich. Wichtige Höhepunkte sind:

- Die Inlandsreisenden sanken um 12,2% im Jahresvergleich

- Die Internationalen Reisenden stiegen um 5,4% im Jahresvergleich

- Die Transferreisenden nahmen um 12,6% im Jahresvergleich zu

- Das Frachtvolumen stieg um 9,7% im Jahresvergleich

- Die Gesamtbewegungen von Flugzeugen sanken um 3,7% im Jahresvergleich

Die Leistung variierte in verschiedenen Ländern, wobei Uruguay ein starkes Wachstum (+15,7% im Jahresvergleich) zeigte, Italien auch anstieg (+5,9% im Jahresvergleich), während Argentinien (-7,2% im Jahresvergleich), Brasilien (-2,4% im Jahresvergleich), Ecuador (-5,1% im Jahresvergleich) und Armenien (-2,5% im Jahresvergleich) Rückgänge erlebten. Der Bericht hebt bestehende Herausforderungen in einigen Märkten hervor, einschließlich der Auswirkungen der Rezession in Argentinien und der Luftverkehrsbeschränkungen in Brasilien.

- International passenger traffic increased by 5.4% YoY

- Cargo volume grew by 9.7% YoY

- Uruguay's passenger traffic rose by 15.7% YoY

- Italy's passenger traffic increased by 5.9% YoY

- Brazil's adjusted passenger traffic (excluding Natal) grew by 11.3% YoY

- Overall passenger traffic decreased by 3.6% YoY

- Domestic passenger traffic declined by 12.2% YoY

- Total aircraft movements decreased by 3.7% YoY

- Argentina's total passenger traffic fell by 7.2% YoY

- Ecuador's passenger traffic decreased by 5.1% YoY

Insights

The September 2024 passenger traffic report for Corporación América Airports (CAAP) presents a mixed picture. The overall 3.6% YoY decrease in total passenger traffic (or 1.2% YoY decrease excluding Natal) indicates some challenges, but there are positive signs in certain segments and markets.

Key points to consider:

- International passenger traffic increased by

5.4% YoY, showing resilience in cross-border travel. - Cargo volume grew by

9.7% YoY, a positive indicator for trade and economic activity. - Performance varied across markets: Italy (+

5.9% ) and Uruguay (+15.7% ) showed strong growth, while Argentina (-7.2% ) and Ecuador (-5.1% ) faced challenges. - Domestic traffic in Argentina declined

12.1% YoY, impacted by economic recession and the absence of government incentives.

For investors, the mixed results suggest CAAP is navigating a complex operating environment. The growth in international traffic and cargo volume are positive signs, potentially offsetting domestic weaknesses. However, the overall decline in passenger numbers and aircraft movements may pressure short-term financial performance.

The airport traffic data provides valuable insights into travel trends and economic conditions across CAAP's markets:

- The

5.4% growth in international traffic suggests a continued recovery in global travel, particularly benefiting markets like Italy and Uruguay. - Argentina's

12.1% domestic traffic decline reflects the country's economic challenges and highlights the impact of government policies on travel demand. - Brazil's performance (

11.3% growth excluding Natal) indicates resilience despite industry challenges, potentially benefiting from competitor airport closures. - The

9.7% increase in cargo volume, particularly strong in Argentina (+11.7% ) and Uruguay (+20.1% ), suggests improving trade activity.

These trends have broader implications for tourism, trade and economic recovery in the regions CAAP serves. The divergence between international and domestic performance in some markets may indicate shifting travel patterns and economic priorities. For investors, this data provides a nuanced view of CAAP's market positioning and potential growth areas, such as international routes and cargo services.

Total passenger traffic down

International passenger traffic up

LUXEMBOURG--(BUSINESS WIRE)--

Corporación América Airports S.A. (NYSE: CAAP), (“CAAP” or the “Company”), one of the leading private airport operators in the world, reported today a

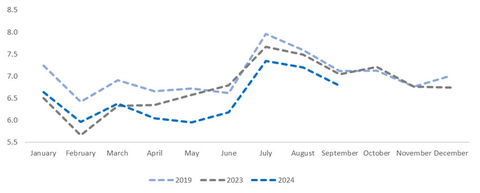

Monthly Passenger Traffic Performance (In million PAX) (Graphic: Business Wire)

Passenger Traffic, Cargo Volume and Aircraft Movements Highlights (2024 vs. 2023) |

|

||||||||

Statistics |

Sep'24 |

Sep'23 |

% Var. |

|

YTD’24 |

YTD'23 |

% Var. |

||

Domestic Passengers (thousands) |

3,376 |

3,844 |

-12.2 |

% |

|

29,965 |

33,856 |

-11.5 |

% |

International Passengers (thousands) |

2,752 |

2,612 |

5.4 |

% |

|

23,164 |

21,273 |

8.9 |

% |

Transit Passengers (thousands) |

659 |

585 |

12.6 |

% |

|

5,384 |

5,298 |

1.6 |

% |

Total Passengers (thousands)1 |

6,787 |

7,042 |

-3.6 |

% |

|

58,513 |

60,426 |

-3.2 |

% |

Cargo Volume (thousand tons) |

33.9 |

30.9 |

9.7 |

% |

|

279.8 |

268.6 |

4.2 |

% |

Total Aircraft Movements (thousands) |

69.3 |

71.9 |

-3.7 |

% |

|

610.1 |

639.9 |

-4.7 |

% |

1 Excluding Natal for comparison purposes, total passenger traffic was down |

|||||||||

Passenger Traffic Overview

Total passenger traffic declined by

In

In

In

In

In

In

Cargo Volume and Aircraft Movements

Cargo volume increased by

Aircraft movements decreased by

Summary Passenger Traffic, Cargo Volume and Aircraft Movements (2024 vs. 2023) |

|||||||||

|

Sep'24 |

Sep'23 |

% Var. |

|

YTD'24 |

YTD'23 |

% Var. |

||

Passenger Traffic (thousands) |

|

|

|

|

|

|

|

||

|

3,419 |

3,684 |

-7.2 |

% |

|

30,645 |

32,010 |

-4.3 |

% |

|

928 |

876 |

5.9 |

% |

|

7,046 |

6,368 |

10.6 |

% |

|

1,345 |

1,378 |

-2.4 |

% |

|

11,510 |

12,770 |

-9.9 |

% |

|

191 |

165 |

15.7 |

% |

|

1,681 |

1,418 |

18.5 |

% |

|

377 |

398 |

-5.1 |

% |

|

3,526 |

3,673 |

-4.0 |

% |

|

527 |

540 |

-2.5 |

% |

|

4,104 |

4,187 |

-2.0 |

% |

TOTAL |

6,787 |

7,042 |

-3.6 |

% |

|

58,513 |

60,426 |

-3.2 |

% |

(1) Following the friendly termination process concluded in February 2024, CAAP no longer operates Natal airport. Statistics for Natal are available up to February 18, 2024. |

|||||||||

Cargo Volume (tons) |

|||||||||

|

17,966 |

16,078 |

11.7 |

% |

|

144,149 |

138,565 |

4.0 |

% |

|

1,075 |

856 |

25.6 |

% |

|

9,431 |

9,479 |

-0.5 |

% |

|

5,376 |

5,443 |

-1.2 |

% |

|

47,360 |

48,430 |

-2.2 |

% |

|

2,897 |

2,413 |

20.1 |

% |

|

23,010 |

23,343 |

-1.4 |

% |

|

2,420 |

2,591 |

-6.6 |

% |

|

27,781 |

24,331 |

14.2 |

% |

|

4,158 |

3,526 |

17.9 |

% |

|

28,070 |

24,475 |

14.7 |

% |

TOTAL |

33,892 |

30,907 |

9.7 |

% |

|

279,801 |

268,623 |

4.2 |

% |

Aircraft Movements |

|||||||||

|

36,559 |

38,091 |

-4.0 |

% |

|

328,205 |

343,034 |

-4.3 |

% |

|

8,175 |

7,965 |

2.6 |

% |

|

64,013 |

60,452 |

5.9 |

% |

|

12,348 |

12,860 |

-4.0 |

% |

|

107,362 |

119,404 |

-10.1 |

% |

|

2,441 |

2,148 |

13.6 |

% |

|

23,559 |

23,143 |

1.8 |

% |

|

5,957 |

6,581 |

-9.5 |

% |

|

56,920 |

59,688 |

-4.6 |

% |

|

3,805 |

4,272 |

-10.9 |

% |

|

30,070 |

34,220 |

-12.1 |

% |

TOTAL |

69,285 |

71,917 |

-3.7 |

% |

|

610,129 |

639,941 |

-4.7 |

% |

About Corporación América Airports

Corporación América Airports acquires, develops and operates airport concessions. Currently, the Company operates 52 airports in 6 countries across

View source version on businesswire.com: https://www.businesswire.com/news/home/20241016585699/en/

Investor Relations Contact

Patricio Iñaki Esnaola

Email: patricio.esnaola@caairports.com

Phone: +5411 4899-6716

Source: Corporación América Airports