Corporación América Airports S.A. Reports October 2024 Passenger Traffic

Corporación América Airports reported a 4.0% year-over-year decrease in passenger traffic for October 2024, or -1.6% excluding Natal airport operations. International passenger traffic grew 3.8% YoY, while domestic traffic declined 11.1%. Notable highlights include a 7.0% increase in Argentina's international traffic, 6.1% growth in Italy's total traffic, and a 17.4% rise in cargo volume across all operations. Key developments include JetSMART's fleet expansion in Argentina, new seasonal routes by Aerolíneas Argentinas, and route resumptions by American Airlines and Delta.

Corporación América Airports ha registrato una diminuzione del 4,0% nel traffico passeggeri rispetto allo stesso mese dell'anno precedente per ottobre 2024, ovvero -1,6% escludendo le operazioni nell'aeroporto di Natal. Il traffico passeggeri internazionale è aumentato del 3,8% anno su anno, mentre il traffico nazionale è diminuito dell'11,1%. Tra i punti salienti si nota un incremento del 7,0% nel traffico internazionale in Argentina, una crescita del 6,1% nel traffico totale in Italia e un aumento del 17,4% nel volume delle merci in tutte le operazioni. Gli sviluppi chiave includono l'espansione della flotta di JetSMART in Argentina, nuove rotte stagionali da parte di Aerolíneas Argentinas e la ripresa delle rotte da parte di American Airlines e Delta.

Corporación América Airports reportó una disminución del 4.0% en el tráfico de pasajeros en octubre de 2024 en comparación con el año anterior, o -1.6% excluyendo las operaciones del aeropuerto de Natal. El tráfico de pasajeros internacional creció un 3.8% interanual, mientras que el tráfico nacional disminuyó un 11.1%. Entre los aspectos destacados se incluye un aumento del 7.0% en el tráfico internacional de Argentina, un crecimiento del 6.1% en el tráfico total de Italia y un incremento del 17.4% en el volumen de carga en todas las operaciones. Los desarrollos clave incluyen la expansión de la flota de JetSMART en Argentina, nuevas rutas estacionales de Aerolíneas Argentinas y la reanudación de rutas por parte de American Airlines y Delta.

코르포라시온 아메리카 공항는 2024년 10월에 승객 수가 전년 대비 4.0% 감소했다고 보고했으며, 나탈 공항 운영을 제외할 경우 -1.6% 감소했습니다. 국제 승객 수는 전년 대비 3.8% 증가했지만, 국내선 승객 수는 11.1% 감소했습니다. 주요 하이라이트로는 아르헨티나의 국제 항공편이 7.0% 증가했으며, 이탈리아의 전체 항공편이 6.1% 증가하고, 모든 운영에서 화물량이 17.4% 증가한 점이 있습니다. 주요 발전으로는 아르헨티나의 JetSMART가 함대를 확장하고, Aerolíneas Argentinas가 새로운 계절 노선을 개설했으며, American Airlines와 Delta가 노선을 재개했습니다.

Corporación América Airports a annoncé une baisse de 4,0% du trafic passagers pour octobre 2024 par rapport à l'année précédente, ou -1,6% en excluant les opérations de l'aéroport de Natal. Le trafic international de passagers a augmenté de 3,8% d'une année sur l'autre, tandis que le trafic domestique a diminué de 11,1%. Parmi les faits marquants, on note une augmentation de 7,0% du trafic international en Argentine, une croissance de 6,1% du trafic total en Italie et une hausse de 17,4% du volume de fret dans toutes les opérations. Les développements clés incluent l'expansion de la flotte de JetSMART en Argentine, de nouvelles routes saisonnières d'Aerolíneas Argentinas et la reprise des routes par American Airlines et Delta.

Corporación América Airports meldete für Oktober 2024 einen Rückgang des Passagieraufkommens um 4,0% im Vergleich zum Vorjahr, oder -1,6% ohne die Betriebszahlen des Flughafens Natal. Der internationale Passagierverkehr wuchs im Jahresvergleich um 3,8%, während der Inlandsverkehr um 11,1% sank. Zu den bemerkenswerten Highlights gehören ein Anstieg des internationalen Verkehrs in Argentinien um 7,0%, ein Wachstum des gesamten Verkehrs in Italien um 6,1% und ein Anstieg des Frachtvolumens in allen Betrieben um 17,4%. Wichtige Entwicklungen umfassen die Flottenerweiterung von JetSMART in Argentinien, neue saisonale Routen von Aerolíneas Argentinas sowie die Wiederaufnahme von Routen durch American Airlines und Delta.

- International passenger traffic increased 3.8% YoY

- Cargo volume grew 17.4% YoY across all operations

- Italy's passenger traffic increased 6.1% YoY

- Argentina's international traffic rose 7.0% YoY

- Uruguay's total passenger traffic grew 2.6% YoY

- Total passenger traffic decreased 4.0% YoY

- Domestic passenger traffic declined 11.1% YoY

- Aircraft movements decreased 3.1% YoY

- Argentina's domestic traffic fell 13.3% YoY due to recession

- Ecuador's passenger traffic decreased 1.4% YoY

Insights

The October traffic data reveals mixed performance across CAAP's airport portfolio. While international traffic grew

The divergence between domestic and international traffic trends highlights shifting market dynamics. While domestic traffic faces headwinds from economic pressures and the end of stimulus programs like Argentina's "Previaje," international routes show resilience with capacity expansions from major carriers. Notable developments include British Airways'

Total passenger traffic down

International passenger traffic up

LUXEMBOURG--(BUSINESS WIRE)--

Corporación América Airports S.A. (NYSE: CAAP), (“CAAP” or the “Company”), one of the leading private airport operators in the world, reported today a

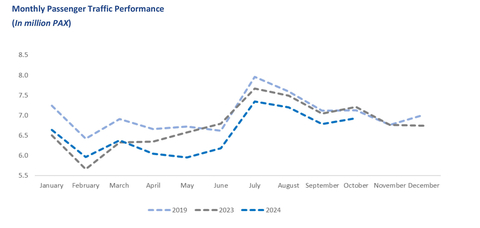

Monthly Passenger Traffic Performance (In million PAX) (Graphic: Business Wire)

Passenger Traffic, Cargo Volume and Aircraft Movements Highlights (2024 vs. 2023) |

|||||||

Statistics |

Oct'24 |

Oct'23 |

% Var. |

|

YTD’24 |

YTD'23 |

% Var. |

Domestic Passengers (thousands) |

3,596 |

4,043 |

- |

|

33,561 |

37,899 |

- |

International Passengers (thousands) |

2,684 |

2,587 |

|

|

25,848 |

23,859 |

|

Transit Passengers (thousands) |

646 |

582 |

|

|

6,030 |

5,880 |

|

Total Passengers (thousands)1 |

6,927 |

7,212 |

- |

|

65,440 |

67,638 |

- |

Cargo Volume (thousand tons) |

38.8 |

33.1 |

|

|

318.6 |

301.7 |

|

Total Aircraft Movements (thousands) |

71.7 |

74.0 |

- |

|

681.8 |

713.9 |

- |

1 Excluding Natal for comparison purposes, total passenger traffic was down |

|||||||

Total passenger traffic declined by

In

In

In

In

In

In

Cargo Volume and Aircraft Movements

Cargo volume increased by

Aircraft movements decreased by

Summary Passenger Traffic, Cargo Volume and Aircraft Movements (2024 vs. 2023) |

|||||||

|

Oct'24 |

Oct'23 |

% Var. |

|

YTD'24 |

YTD'23 |

% Var. |

Passenger Traffic (thousands) |

|

|

|

|

|

|

|

|

3,612 |

3,917 |

- |

|

34,257 |

35,927 |

- |

|

872 |

823 |

|

|

7,919 |

7,191 |

|

|

1,397 |

1,415 |

- |

|

12,907 |

14,185 |

- |

|

184 |

179 |

|

|

1,865 |

1,597 |

|

|

388 |

394 |

- |

|

3,914 |

4,067 |

- |

|

473 |

485 |

- |

|

4,577 |

4,672 |

- |

TOTAL |

6,927 |

7,212 |

- |

|

65,440 |

67,638 |

- |

(1) Following the friendly termination process concluded in February 2024, CAAP no longer operates Natal airport. Statistics for Natal are available up to February 18, 2024. |

|||||||

Cargo Volume (tons) |

|||||||

|

20,471 |

17,501 |

|

|

164,620 |

156,066 |

|

|

1,295 |

1,170 |

|

|

10,726 |

10,649 |

|

|

6,473 |

5,936 |

|

|

53,833 |

54,366 |

- |

|

2,962 |

2,324 |

|

|

25,972 |

25,667 |

|

|

3,112 |

2,775 |

|

|

30,893 |

27,106 |

|

|

4,504 |

3,366 |

|

|

32,574 |

27,840 |

|

TOTAL |

38,817 |

33,070 |

|

|

318,618 |

301,694 |

|

Aircraft Movements |

|

|

|

|

|

|

|

|

38,947 |

40,560 |

- |

|

367,152 |

383,594 |

- |

|

7,900 |

7,794 |

|

|

71,913 |

68,246 |

|

|

12,474 |

13,015 |

- |

|

119,836 |

132,419 |

- |

|

2,632 |

2,637 |

- |

|

26,191 |

25,780 |

|

|

6,320 |

6,130 |

|

|

63,240 |

65,818 |

- |

|

3,392 |

3,846 |

- |

|

33,462 |

38,066 |

- |

TOTAL |

71,665 |

73,982 |

- |

|

681,794 |

713,923 |

- |

About Corporación América Airports

Corporación América Airports acquires, develops and operates airport concessions. Currently, the Company operates 52 airports in 6 countries across

View source version on businesswire.com: https://www.businesswire.com/news/home/20241118202406/en/

Investor Relations Contact

Patricio Iñaki Esnaola

Email: patricio.esnaola@caairports.com

Phone: +5411 4899-6716

Source: Corporación América Airports